Checklist for Entrepreneurs: See if You`re Ready to Raise Funds

Maria SparkFundraising is the fuel of startups that pushes them forwards. Without investments, even the most brilliant idea can end up abandoned. The cold statistics shows that nearly a third of enterprise shut down due to the lack of cash flows. However, to successfully raise funds, you have to go through a number of challenges — from setting a business strategy to building a powerful team.

Whatever stage your project is now at, there is always a possibility to persuade investors and gain money. If you want to assess your chances of fundraising, take advantage of our checklist. At the end, you`ll see how likely your project is to convince investors. On top of that, we`ll share practical recommendations on how to increase your chances.

Fundraising Pitfalls

You must have been well aware of the basic questions from investors. Now let`s look through the aspects you probably haven`t covered yet. Answer the following questions to assess your startup`s investment attractiveness.

- How big is your TAM?

This stands for total addressable market, that is the maximum size of the opportunity for a particular solution. TAM is a crucial metric for investors to evaluate the project`s financial prospects as it reveals how large market share you can actually occupy. Typically, they want to see a market size of more than $1 billion. If it is significantly smaller, you will have to develop without venture capital money, or think about entering new market segments, pivoting the business model, etc.

- Is your startup region-based?

In case your project is limited to a single region, it might put investors off. Unfortunately, there are few business angels and venture investors who are ready to fund local stories now. If this is your case, focus on novice investors, or those who possess with local connections. They are most likely to provide funding.

- Do you plan to scale up internationally?

If you are planning to enter the international market, but haven`t done anything for this yet, it`s a red flag for investors. As a rule, they do not really want to take on the risk of entering a new market, but there are some exceptions. As long as you have a strong team or received an invitation to a big-name accelerator, investors may be ready to venture.

- How high is the competition?

In case you operate in a highly competitive market, investors might be scared off. The problem is especially pressing if your competitors have already raised a lot of funds and held a large market share. This risk can be reduced by shifting to a more specific niche, building a great team, and showing impressive financial results.

- How low is entry level?

If the entry level for your sector is really low, your solution can be cloned quickly. As soon as you show that your business model works, there will be a bunch of people craving to repeat your success. As a result, advertising costs increase and lead to poor sales.

- Why is it now time for your project?

Frequently, emerging startups look like they could have been launched five years ago. Therefore, investors must be wondering why this did not happen earlier. Usually, business drivers and the market situation had to change. In this regard, you have to prepare some foundation beforehand.

- How strong is your team?

Other things being equal, preference is given to more experienced entrepreneurs who have previously raised money, managed companies, and are industry experts. If your team is "raw", you will have to demonstrate other bargaining chips like high revenue or thought-out business model.

- Is your product easy to sell?

When it comes to long sales cycles (six months-a year), it is difficult to deliver the value of your solution. This may result in a considerable outflow of customers, since they will be well tempted switch to alternatives.

- How innovative is your solution?

Sometimes what seems innovative to you might have been created before. So make sure your product does have brand-new features for at least several regions.

Test Yourself!

Now it`s time to check how well your project is prepared for being presented to investors. There are 10 questions, for each answer "a" you gain 2 points, for each answer "b" – 4 points, for each "c" and "d" – 6 and 8 points respectively. Select one of the options, note it down, summarize the points, and see your result at the end.

1. What stage is your project at?

a. I`m still working on the idea.

b. I have already developed a prototype/MVP, but have not tested it on users.

c. I have built an MVP with a limited number of users.

d. I have launched a ready-to-use product with a growing number of customers.

2. Do you have an portrait of your target audience?

a. Not yet.

b. I have formulated hypotheses about the target audience but haven`t validated them yet.

c. I have conducted a series of interviews and set a value proposition for the target audience.

d. The product has already been successfully used by the target audience.

3. What stage are the sales of your product at?

a. There are no sales yet, and there are no plans to launch in the next six months.

b. There are no sales yet, but I plan to launch them in the nearest future.

c. There are single/unstable sales.

d. There are regular sales, revenue is steadily growing.

4. Are you planning to enter the international market?

a. Maybe, I haven't decided yet.

b. No, the product is designed only for the local market.

c. Yes, I am planning for several months.

d. My project already has customers abroad.

5. What specialists are there in the project team?

a. The team has not yet been built.

b. There is a product developer in the team.

c. The team has a product developer and marketer.

d. The team includes developers, marketers, and sales specialists.

6. Do you have experience in the selected niche?

a. No.

b. Yes, I have experience working in companies in the same market.

c. Yes, I have worked in a large company or set up my own successful entreprise in the same market.

7. Does the project have a marketing strategy?

a. Not yet.

b. There is a preliminary marketing strategy, but it needs to be tested and refined.

c. There is a working marketing strategy, the main channels are clear and tested, there is an understanding of the unit economy for each channel.

8. Have you decided on the business model of your project?

a. Not yet, I`m still thinking about it.

b. I have identified the main options, now we are testing hypotheses and choosing the optimal one.

c. Yes, I have tested several hypotheses and confirmed the optimal business model.

9. What channels of project promotion do you use?

a. I haven`t reached this stage yet.

b. My team and I participate in exhibitions and startup competitions, there are publications in the media.

c. The media, including foreign ones, are actively writing about us.

10. What is the project development strategy for the next 2-3 years?

a. There is no development strategy yet.

b. There is a common vision of possible directions of development.

c. I have developed a step-by-step plan.

Results

Now let`s see how well your startup is doing!

The stage of your startup can be described as preseed. It means you have an idea but lack clear understanding of how to develop it. Probably, it is too early to delve into fundraising from business angels or venture funds because they are interested in projects with a ready-made MVP, a professional team and, ideally, first sales. To increase your chances of fundaraiding, we recommend refining the idea, improving the team, and applying for our weekly competition.

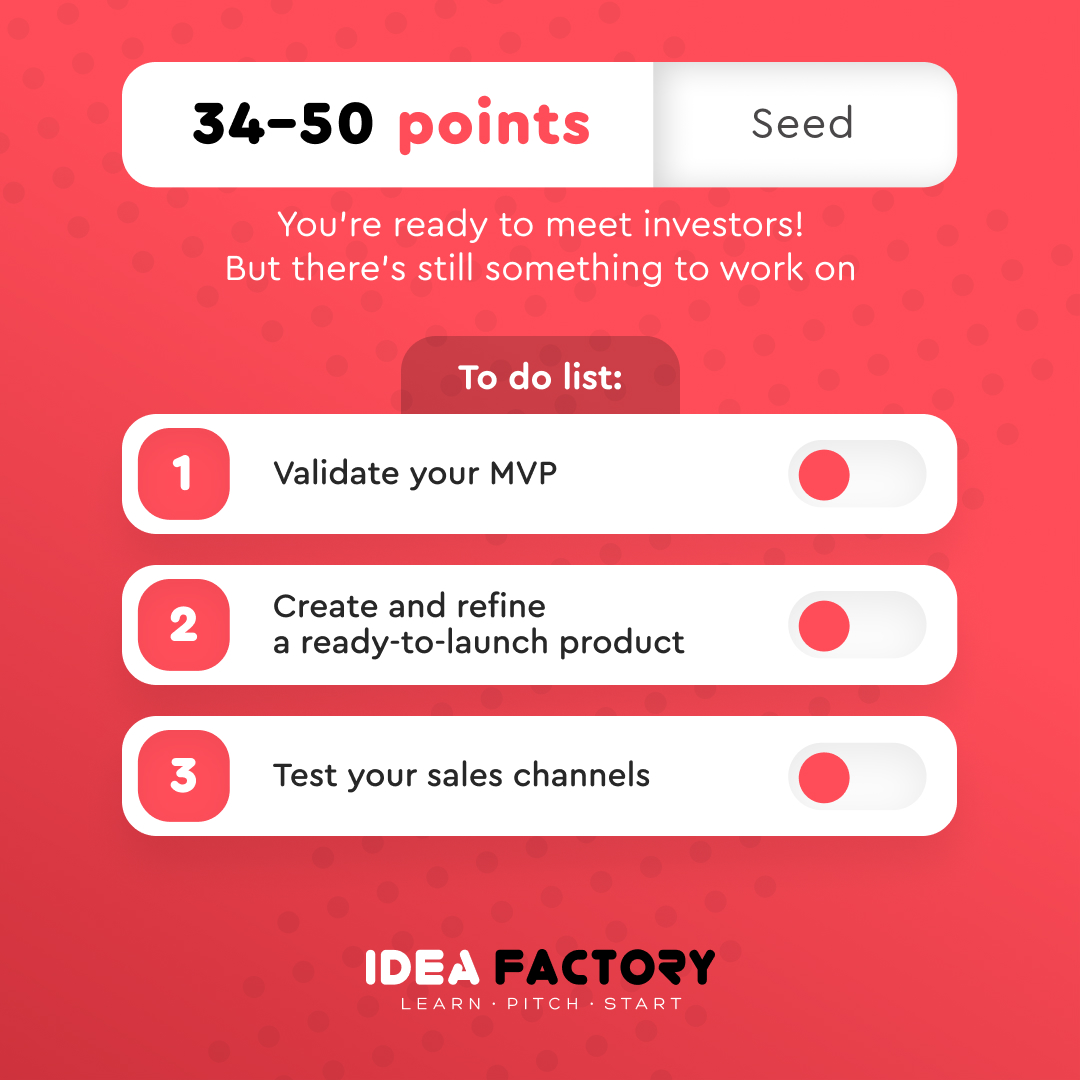

Wow! It seems you`ve gone really far. The stage of your startup can be referred to as seed. Apparently, you already have an MPV or even ready-to-launch product you have actually validated. Now you need external investments to finalize the product, test new sales channels, and growth hypotheses. Although you have good chances of raising funds, we advise to refine your product. Afterwards, don`t hesitate to address business angels and seed venture funds.

Well, well, well, we see you are an upcoming unicorn! Keep it up! You seem to be at the Round A or higher. This stage is characterized by a professional team and a product with proven sales channels ready to scale. Investors at this stage are classic venture funds you definitely should address. However, sky is the limit! So keep working on your product in terms partnerships and advertising.