Chainlink: The Google of Crypto?

CryptoTalk-ET

Discover why Chainlink is revolutionizing the industry, driving institutional adoption, and shaping the decentralized future.

1. Overview

2. Use Case

3. Adoption

4. Revenue

5. Tokenomics

6. Treasury

7. Governance

8. Team & Investors

9. Competitors

10. Risks & Audits

11. Summary

Let's dive in directly into our analysis.

1. Overview

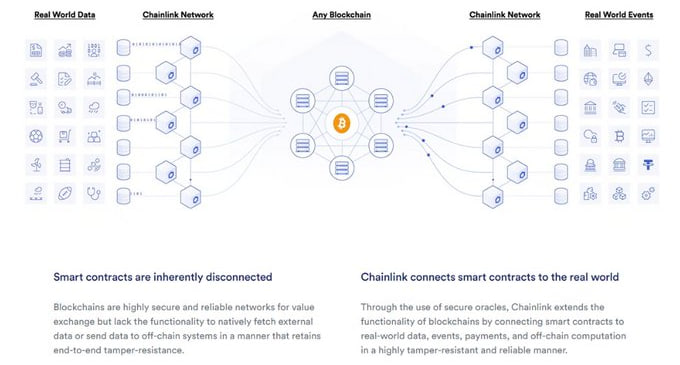

Chainlink is a decentralised oracle network that connects smart contracts to the real world.

It's infrastructure is widely adopted and used for:

• Price feeds

• Data feeds

• Proof of reserves

• Smart contract automation

• Verifiable on-chain randomness (VRF)

2. Use Case

Chainlink is widely utilized across various industries, including:

• Financial services

• DeFi

• Gaming

• NFT collectibles

• Climate markets

• Enterprise

• Insurance

It is among a handful of crypto projects that are critical for a robust and decentralized future.

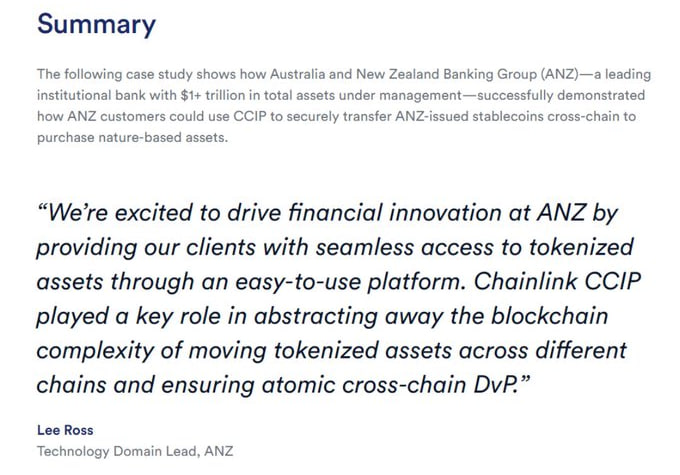

The launch of CCIP has been a game-changer for Chainlink, enabling seamless transfer of data and value between existing systems and both public and private blockchains.

The adoption of CCIP continues to surge:

• Base chain

• ANZ/ SWIFT

• Vodafone

• DTCC

• Affine Pass NFTs

3. Adoption

The current Total Value Secured (TVS) using Chainlink oracles stands at $18.52b (across 353 protocols).

Chainlink is the dominant and most widely used oracle, capturing over 48% of the market share.

Other notable oracles in the space include WINkLink, Chronical, Pyth, and TWAP.

4. Revenue

Chainlink accrues fees and rewards through several methods:

• CCIP

• Keepers

• Requests

• VRF V1

• VRF V2

In December only, Chainlink has generated:

• $289.5k in fees

• $40.85k in revenue

This places it at the top among other oracles and 89th overall according to DeFiLlama.

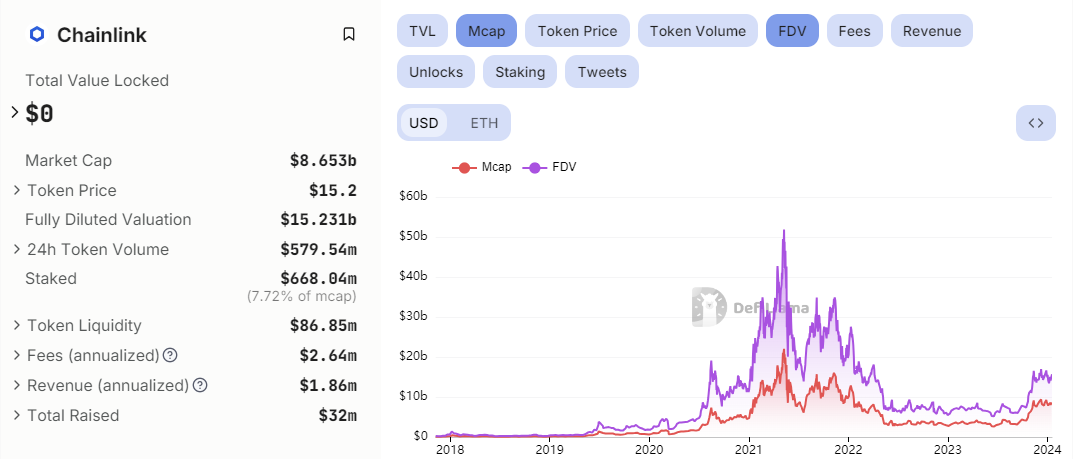

5. Tokenomics

The $LINK token is used within the network for the following components:

• Node operator fees

• Implicit staking

• Explicit staking

The recently released Chainlink 2.0 aims to create a new era of growth through:

• Chainlink Staking

• BUILD Program

• SCALE Program

These are the current supply stats:

• Circulating supply = 568m

• Max supply = 1b

• Market cap = $8.65b

• FDV = $15.23b

• Market cap/ FDV = 0.56

6. Treasury

Chainlink has allocated team tokens, which make up 17% of the total supply, to fund development.

Based on current prices:

• $150.4m $LINK

According to DefiLlama, this would position it as one of the largest tokens in terms of Treasury value.

A substantial war chest.

7. Governance

Governance is facilitated through validation, which monitors on-chain Oracle behavior and helps users choose oracles.

Chainlink products are also widely used by other DeFi projects to assist in their own decentralised governance.

8. Team & Investors

The project was founded in 2014 by @SergeyNazarov

and Steve Ellis.

Chainlink Labs has since expanded to employ over 400 individuals.

To date, the project has successfully raised $32M in funding through four rounds.

9. Competitors

Chainlink is the market-leading oracle solution, enjoying a significant first-mover advantage and dominant market share (46% of TVS).

Considering the team's continuous growth and ecosystem development, I don't anticipate this changing anytime soon.

10. Risks & Audits

The codebase and smart contracts have undergone multiple audits throughout the years.

As per the CRC, Chainlink has been assigned a 2/5 rating in its securities framework.

A score of 1/5 indicates that it is least likely to be considered a security under the Howey test.

Overall, $LINK seems to be comfortably bullish for the ALT season coming and the Chainlink protocol do hold a really positive outlooks in the mid to long term.

There are a number of upcoming bullish catalysts:

• CCIP

• Chainlink staking

• Economics 2.0

• Institutional adoption

• Ecosystem expanding

• Market conditions improving

Overall weighted score = 8.78

Follow our social media outlets on : https://www.linktr.ee/cryptotalket