Candles

FaDIn my trade, everything is banal and simple. This is what I have been striving for years. It's time to lift the veil of mystery. This series of posts will cover some points of my trading system. I will start with candlesticks. We all know all sorts of marbiosa, pin bar, doji and other things.

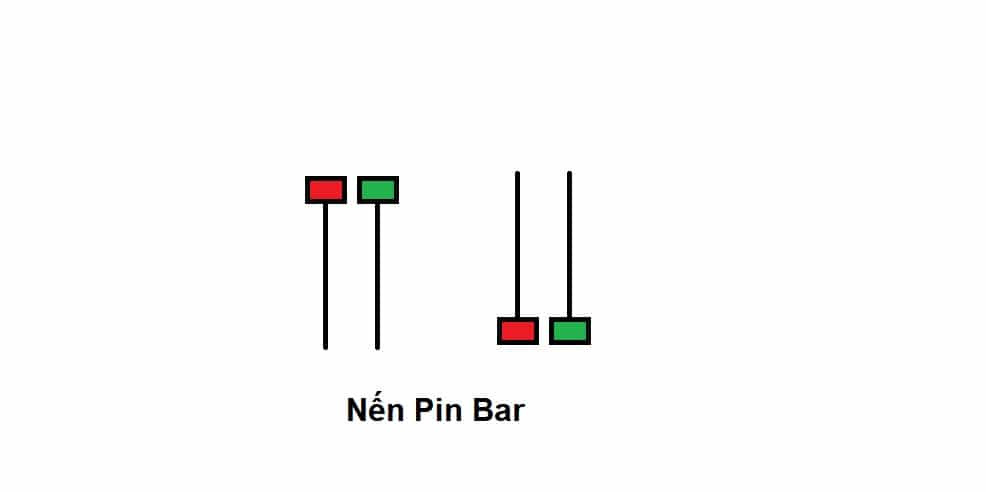

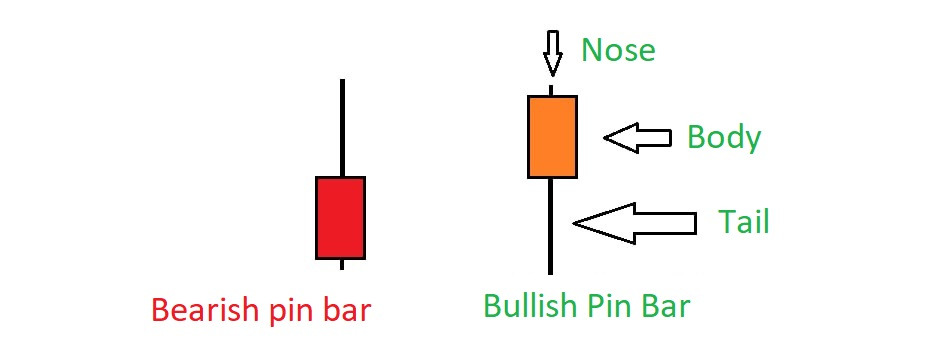

If we are talking about pin bars, most often we are talking about tailed candlesticks. The main sign is the predominance of the tail to one side or the other

The body of the pin bar. I'll talk about that later. So, in my TS everything is much simpler. The candlesticks are divided into:

a) Right.

b) Incorrect.

The correct candlestick speaks for itself, they are okay with the structure. There are only two types, the pin bar and the maribozoo.

You've already heard these concepts everywhere, I just made some changes in these concepts. So, the pin bar:

The concept of a pin bar was born for more than three years, until I came to simple rules:

1. The body of the pin bar corresponds to the intended movement (long - bull pin, short - bear)

2. The nose of a pin bar is minimal or should not exceed 50% of its body size

3. The tail of the pin bar is 2 or more times larger than the body.

It's as simple as possible. It has been experimentally determined that there is only a 4% difference between the commonly used pins and the pins shown above, meaning that this pin is only 4% more effective. Hehehe, and for that for 3 years? Here and there, a couple of percent here, a little there, we end up with a hefty over-performance in working out system situations.

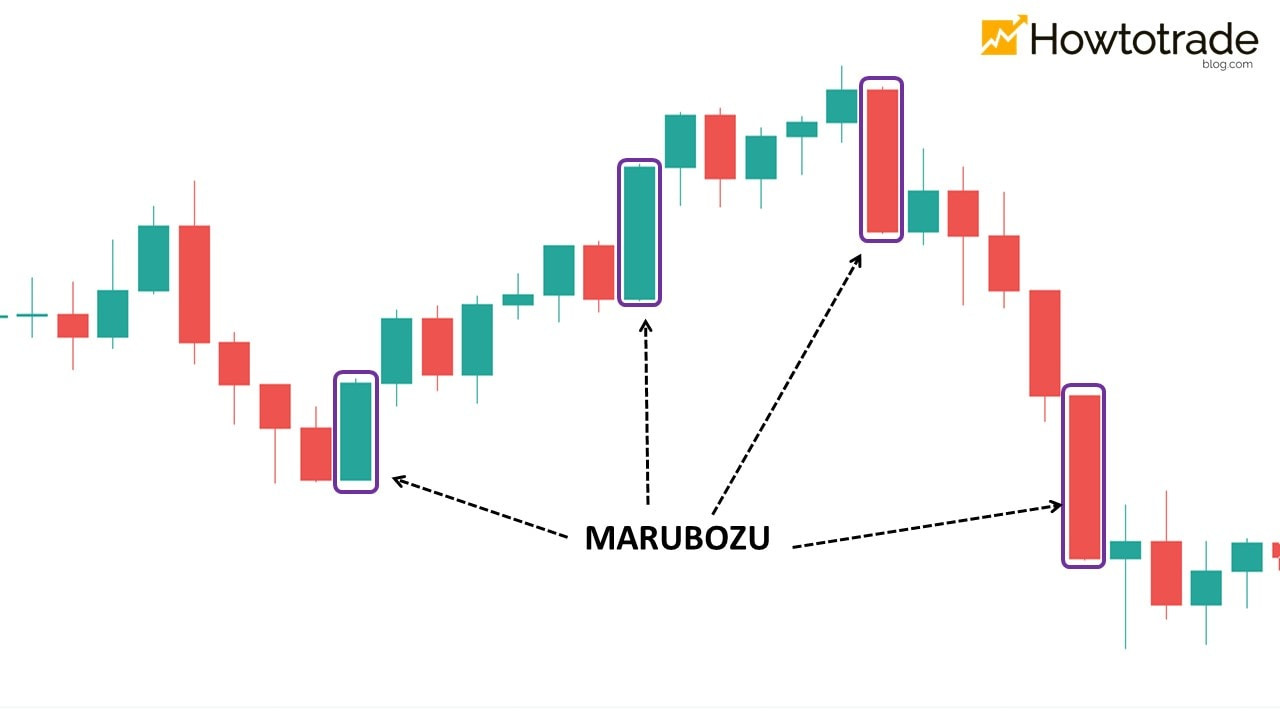

The next candle is mariboza. I'm sure you've heard of it, some have even seen it. Just a reminder:

In general, in the Internet are found the options that I took for myself. The logic is exactly the same as in the pin, but with minor refinements:

1. The nose is either absent or minimal.

2. The shadow is half the size of the body.

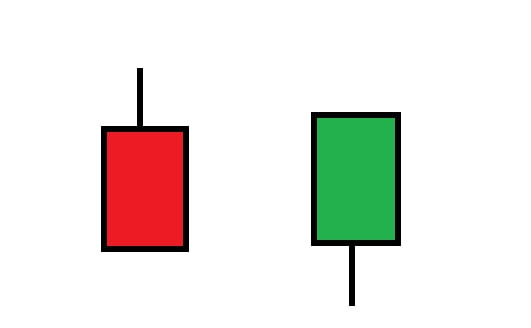

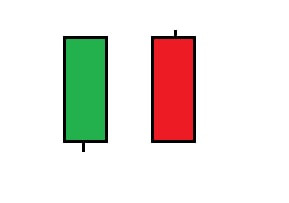

It looks as follows:

Or we can take a very small tail, then there should be no nose:

All of the above maribozoos, as well as pins, obey the body rule: a bullish maribozo is a presumed bullish movement, a bearish one is a presumed bearish movement.

Graphic examples of pin bars and maribozoos:

The right candles are all. What to do with the rest? Actually, nothing. Their name is either "wrong candles" or the down-to-earth "dodge. Regardless of the body, shadows, etc., if the conditions above are not met, then you have a dodge. Again, compare with the picture at the beginning of the article, there are also more advanced variants:

But I have it easier, dodge candlesticks can have completely different bodies, shadows, in short 98% of candlesticks on the chart - garbage, which is not worth attention. Next, I will highlight the correct candles on the chart, the rest are dodges:

It's easier than it looks.

This guide is intended to help in making a decision, especially for those who use a clean chart in their trading. Perhaps it will change established stereotypes about candlestick charts. Take it and your trading will be easier and better. Thanks for reading, your FaD!!! https://t.me/dnfad