Candle patterns with three candles

@DavidTraderSignalsCandle patterns with three candles

These models include the Evening and Morning Stars. They usually appear at the end of trends. They belong to the reversal patterns and you can recognize them by three main features:

1. The first candle is bullish and it refers to the previous trend, that is, it is like a continuation of it.

2. The second candle has a small body, which indicates market uncertainty. This candle can be either bullish or bearish.

3. The third candle acts as a confirmation that a reversal is starting. It closes below the middle of the first candle.

The Morning Star is characterized by the same signs, only in a mirror image.

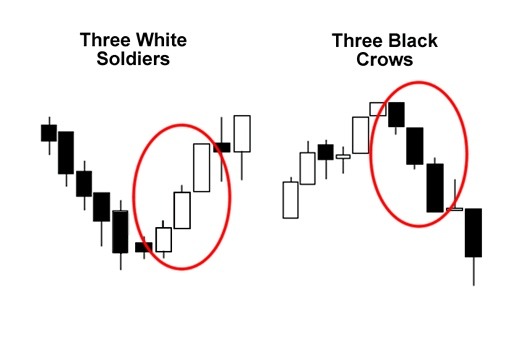

Three White soldiers and Three black crows

This pattern appears when three long white candles can be seen on the chart after a downward trend. They're talking about a market reversal.

This type of pattern is considered one of the most reliable in candlestick analysis, especially after it appears as a result of a long downtrend and short consolidation.

The first of the three soldiers is called a reversal candle. Such a candle completes a downtrend or indicates that the consolidation period after the downtrend is over.

The second candle should close near its maximum value with a small or missing upper shadow.

As for the third candle, it should be the same size as the second and have almost no shadows.

The Three Black Crows pattern is the opposite of the Three White Soldiers pattern. It appears when three bearish candles are formed on the chart after a strong upward trend. Moreover, the second bearish candle should be larger than the first, and the third one should be the same size as the second one and practically have no shadows.

Inner bar up and inner bar down

The internal up bar is a pattern that forms at the bottom after a downward trend. It includes three candlesticks that indicate that the downtrend is ending and a new uptrend is beginning.

High-quality patterns of this kind have the following important features:

1. The first candle should be at the bottom of the downtrend and is a long bearish candle.

2. The second candle should reach at least the middle of the first candle.

3. The third candle should close above the first candle, confirming that buyers were able to overcome the resistance of sellers.

As for the Inner down bar, it is formed at the top of an upward trend.

This means that the uptrend is gradually ending and a downward trend is emerging. This pattern has the following characteristics:

1. The first candle should be at the top of an uptrend and is a long bullish one.

2. The second candle should reach at least the middle of the first one.

3. The third candle should close below the first one, which will mean the victory of sellers over buyers.