Can I Prepare My Service Disruption Case By Myself?

Organization Interruption Insurance Coverage Lawsuit Covid Insurance Legal Action Organization losses due to COVID-19 might be covered under a service's insurance policy, even if the insurance company denies the claim. Despite the ideal protection, policyholders often deal with disputes with their insurance policy supplier. Understanding these typical friction points can aid you prepare a stronger insurance claim from the outset. McAllen Storm Damage Lawyer Do Not Throw Away Damaged Product Can you file a claim against a business after they go out of business?

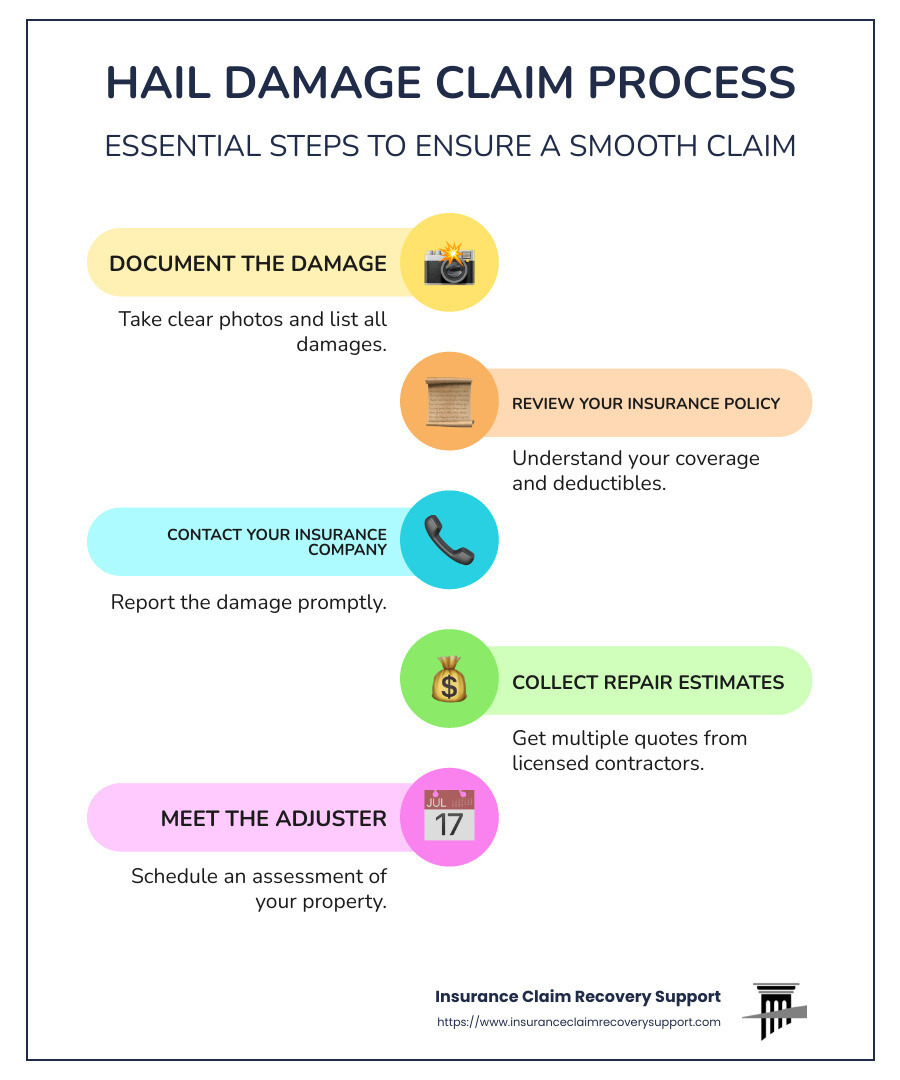

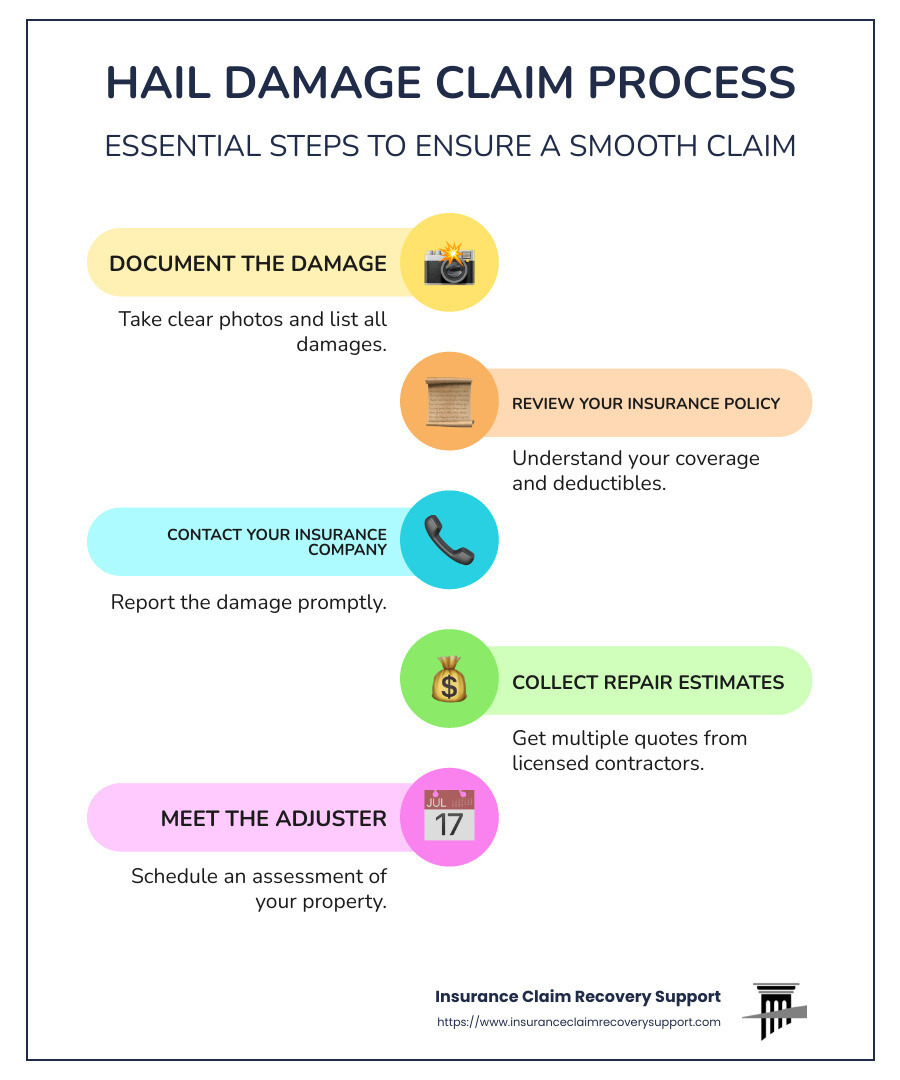

of loss reduction efforts, and complete the amount of the loss. You may be qualified to payment for economic losses caused by sabotage. This settlement can include lost revenues, damage to your business's reputation, or expenses connected to repairing the damage done by your partner's actions. You have to offer unbiased proof of the losses via your monetary statements, basic ledger, income tax return, consumer orders, vendor document, and information regarding the physical remediation of the home. For instance, if your company suffers a fire, your commercial building insurance policy would certainly cover the physical problems and the business disruption insurance would certainly cover the lost earnings. Besides a fire, various other examples of covered occasions consist of wind, hail storm, vandalism or damages to your structure or tools. General obligation and professional obligation insurance coverage do not cover damages to your business's residential or commercial property, such as stock, furniture and fixtures, and equipment and tools(consisting of computer systems and various other digital information processing devices )or any type of personal property possessed by you that is utilized in your organization. Company Disturbance Insurance Coverage Remediation Duration There is normally a 24 -to 72-hour waiting duration associated with this duration. Some insurance provider might provide an extensive restoration period, yet this will certainly require to be defined when the policy is bought. A healing receivable should be acknowledged right into earnings when the straight and step-by-step losses are incurred if the entity ends that receipt of the recovery earnings is possible.

Fortunately is that if an insurance provider is acting in bad belief, it is liable to pay for the additional problems because of this. While not legally needed, working with a lawyer can dramatically raise your chances of success, especially when handling a complicated case or a denial. Insurer have groups of adjusters, accounting professionals, and lawyers functioning to reduce payouts. Without skilled legal aid, you might be leaving money on the table. In most cases, the response will certainly rely on the precise language of your plan, along with the specific situations of your distinct circumstance. We urge you to reach out to a skilled lawyer for assistance understanding your policy and your civil liberties regarding service interruption insurance coverage. When we take care of building insurance coverage claim conflicts, we employ one of the most knowledgeable and qualified professional witnesses to review your insurance coverage case and affirm in your place. Typically, we work with specialists such as engineers, specialists, independent roof specialists and various other experts to carry out a thorough assessment on all possible causes of damages. Any type of losses proceeding beyond the factor would be addressed by the "Extended Healing Duration" stipulation in the policy not by the Remediation Duration clause.Navigating an organization disruption insurance coverage claim can be a difficult challenge, and tackling it alone commonly leads to choosing less than what is reasonable.CBI insurance coverage can reimburse the policyholder in each of these situations, covering the disruption in the insured's business brought on by a risk defined in the plan creating physical damages or loss somewhere else.Backed by substantial experience in customer and industrial lawsuits, we focus on understanding your special situation and straightening our strategies as necessary.All this need to be done while maintaining positive professional relationships with all that are involved.The specifics can differ, however generally consist of revenues that would have been gained, dealt with prices, momentary moving costs, and appointing of rebuilding or fixing physical damage. What Is The Difference Between Ale And Bi Coverage? In the aftermath of a disruption occasion, services usually need to replace damaged equipment or tools and retrain their personnel to utilize brand-new tools. Company disruption insurance policy might cover additional expenses incurred to minimize the impact of the disturbance and maintain the business running. This coverage acts as a safeguard for scenarios in which your organization relies on various other entities to preserve smooth procedures. That's where service interruption insurance comes in-- an important type of protection that many local business owner forget till it's far too late. While company disruption insurance policy can cover the earnings loss and extra expenditures incurred due to a short-lived closure or disturbance, it typically does not include losses directly brought on by flooding or earthquake events. Promptly after a loss, your company will be introduced to the complexity of recovering your service and the included complexity of documenting an insurance policy case. Insurance claim paperwork is crucial to getting a fast and fair settlement. Injured? Obtaining The Payment You Deserve Starts Here This is a practical device when new players come on board or agreements require to be revisited. This paperwork helps develop that a covered hazard directly created physical damages that stopped regular organization procedures. The initial steps include notifying your insurance company immediately, documenting the damages thoroughly, and maintaining accurate records of lost income and additional expenditures sustained as a result of the interruption. A Company Disruption insurance claim is made to an insurance company to cover losses incurred when a company is compelled to stop or decrease procedures because of a protected occasion. Unlike residential property insurance, which covers physical damages, BI insurance policy compensates for lost revenue and added costs sustained throughout the period of interruption. Founded in 1985, our law practice continues to be dedicated to standing for insurance policy policyholders throughout the USA. The particular strategy will depend on your individual situations and the arrangements laid out in your insurance coverage. Remember, if you are disappointed with the first settlement deal, there are numerous courses you can discover to seek a resolution that lines up with your needs and the real extent of the problems. It may be practical to look for an independent analysis from a specialist. Consulting an insurance claim specialist or a lawyer can also be useful at this stage. They can ensure that you are dealt with rather and assist you in protecting the appropriate settlement you deserve. Remember, do not be reluctant to defend your legal rights and go after a resolution that lines up with the real degree of the damages. The insurance coverage claim process is complex and it's not constantly evident if you are getting ample settlement for the disruption to your company. Preserving a professional can aid you navigate this process and ensure you receive ideal settlement. Service interruption insurance policy works when a covered occasion impacts your procedures.