CRYPTOCOIN INSURANCE - The first option exchange with insurance

mhizbam

Dear reader, Just as my usual practice of bringing valuable and profitable information across your way, let me quickly give you information about this great innovation known as “CRYPTOCOIN INSURANCE”. Please sit down and relax your nerves as you read. Also, I encourage you not only to read, but also to take an important step as part of this great innovation.

Trading on the crypto-currency market has already gone through several stages of development: from the first centralized exchanges, where there were practically no volumes, to several hundred exchanges where the leaders turnover exceeds a billion dollars a day. Recently, the Securities and Exchange Commission (SEC) allowed trading futures for bitcoins on the largest US stock exchanges.

The market is becoming more like ordinary stock and commodity markets. However, one of the segments, which many players and especially hedgers can not bypass, is completely unavailable today. It's about options.

In the familiar world, options are traded on exchanges that have a huge turnover. Usually one side of the deal is represented by speculators who want to make a profit, and the other side is companies that want to insure their risks (for example, from a sharp drop in prices).

Why such an exchange is not yet established on the crypto-currency market? There are a number of reasons that will be considered below. Few people understand what options are. Therefore, it seems to me that the demand for this service is low.

In fact, it is huge. Simply the players who form this requirement can not find the appropriate tool they need, primarily for risk insurance.

For example, the customer pays insurance in the amount of 0.1 Bitcoin and for a deposit of 3 Bitcoins. If the price decreases by 15% within 3 days, he gets the right to receive insurance in the amount of a deposit drop of 0.45 Bitcoin.

IDEA

In the event of an insured event, CRYPTOCOIN INSURANCE pays the client insurance against previously received insurance. If the insured event was not, then the insurance paid by the client will be the company's income.

In fact, this is the option mentioned above. However, in order not to embarrass a huge number of clients who do not understand and do not want to deal with options, CRYPTOCOIN INSURANCE has created a two-in-one solution:

CRYPTOCOIN INSURANCE launches the world's first option crypto exchange.

CRYPTOCOIN INSURANCE creates an insurance company, places options in insurance that are clear to everyone, and hedges its risks on the stock exchange of options.

In most cases, the company that first enters the market, as you know, becomes a leader and always takes the largest share. Today CRYPTOCOIN INSURANCE has no competitors and occupies the entire market.

DESCRIPTION OF PROBLEMS

- There is no solution to insure a deposit in Bitcoin or Ethereum from falling.

- At the same time, there is increased volatility in this market, which causes people to be afraid to store large amounts of money in the crypto currency. On the other hand, large companies are slow to enter the market (for example, they do not accept payments in the crypto currency) for the same reason.

- There is no special crypto exchange, where you can buy / sell options.

- The main fear of creating such an exchange is increased volatility. To everyone who deals with stock options, oil or wheat, it seems that the risks are huge.

- In the market of crypto currency, there is still no possibility of short sales.

- Nobody can sell the crypto currency, which is physically absent on the account for a short period of time. This reduces the ability of speculators to smoothen price fluctuations in other markets. In turn, this leads to an increase in volatility and the consequences listed in paragraphs 1 and 2 above.

SOLUTIONS

- CRYPTOCOIN INSURANCE allows you to insure risks of growth or fall in prices for major crypto-currencies.

The exchange will start working with 5 crypto-currencies, which have the maximum market. In addition, as the demand and turnover increase, other crypto-currencies will be added.

CRYPTOCOIN INSURANCE sells insurance, both to Bitcoin and to the Ether. Thus, hedging the risk. The absence of competition in the market allows maintaining a significant margin of 20%. CRYPTOCOIN INSURANCE repacks and sells / purchases its own risk as options on its own stock exchange.

- CRYPTOCOIN INSURANCE creates the first crypto-currency, option exchange.

- The main fear of options on the crypto-currency market is increased volatility. But is it really so?

Let's consider an example with the usual stock market. For example, a client sold an option to a share of ZZZ. Today is Saturday, and the market is closed. There are unexpected good news and stocks are growing at the opening of the market on Monday at 2-10 times. In turn, the seller of the option bears huge losses.

The advantage of the crypto currency market, unlike the stock or commodity, is that it operates 24 hours a day. And for the entire period of its existence (about 10 years), there was not one news that would quickly shift the price of Bitcoin or Etherium by at least 30-50%. In fact, if we are talking only about blue chips, the crypto currency market is much safer for option sellers than other markets we are used to.

- Options allow short sales.

- Not having physical Bitcoin or Etherium, you can get an option to drop them, but actually implement an uncovered sale.

This opportunity brings to the market many new traders, investors and speculators, as well as hedge funds that invest not only in growth but also in the fall of markets.

CCIN TOKEN

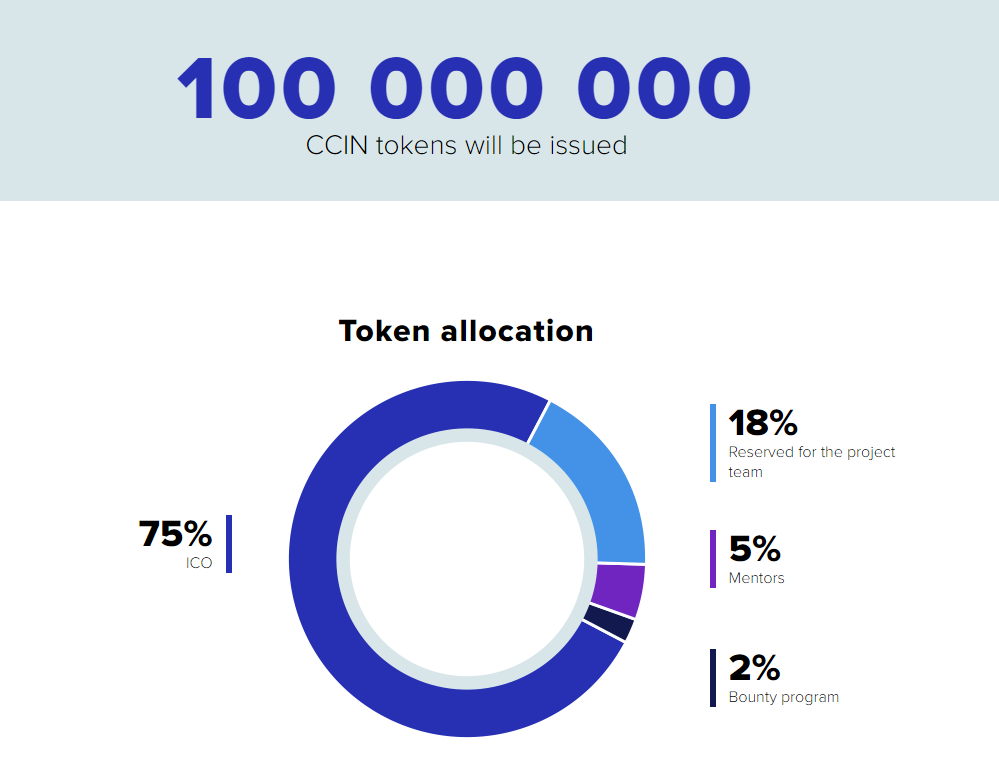

CCIN tokens will be placed during the ICO. Their total number is strictly fixed. All tokens that will not be redeemed during placement will be destroyed. They will never be issued additionally. They will be posted using the Ethereum smart contract. The fixed number of CCIN tokens guarantees buyers an increase in their value as the exchange proceeds grow. Tokens will be introduced to the crypto-exchange exchanges within 30 days after the end of the ICO.

Distribution of tokens

Growth potential

CRYPTOCOIN INSURANCE has developed a simple and understandable model for increasing the cost of the CCIN token. 30% of each commission received by the stock exchange will be channeled to the liquidity fund. Within the next month CRYPTOCOIN INSURANCE sends these funds to buy CCIN tokens from the market and burns them.

This business model is adopted solely in the interests of investors. The promise to buy tokens from future profits cannot be transparent. Moreover, a stock exchange or platform can never profit physically. In the case of CRYPTOCOIN INSURANCE, investors know exactly what each option purchase/sell transaction generates the cash flow used to purchase tokens.

This allows you to constantly shift the balance of the market and increase the demand for CCIN tokens.

If the turnover is $ 50 million per day, then the commission for both sides of the transaction will be $ 500,000 or $ 15 million per month. 30% of this amount or $ 5 million monthly are sent to buy CCIN tokens from the market.

For more information:

WEBSITE: http://ccin.io/

WHITE PAPER: http://ccin.io/doc/Whitepapereng.pdf

ANN: https://bitcointalk.org/index.php?topic=4948618

TWITTER: https://twitter.com/ccin_official

FACEBOOK: https://www.facebook.com/ccinofficial/

TELEGRAM: https://t.me/ccin_official

MEDIUM: https://medium.com/@ccin_official

Author : mhizbam

My bitcoin profile link: https://bitcointalk.org/index.php?action=profile;u=2103401