Butterfly Spread

🛑 👉🏻👉🏻👉🏻 INFORMATION AVAILABLE CLICK HERE👈🏻👈🏻👈🏻

РекламаКупите Brauberg Butterfly (228830) в ЭЛЬДОРАДО. · круглосуточно

РекламаСобранные ракетки для настольного тенниса. Основание + накладки + сборка. · ежедневно 10:00-21:00

www.investopedia.com/terms/b/butterfly…

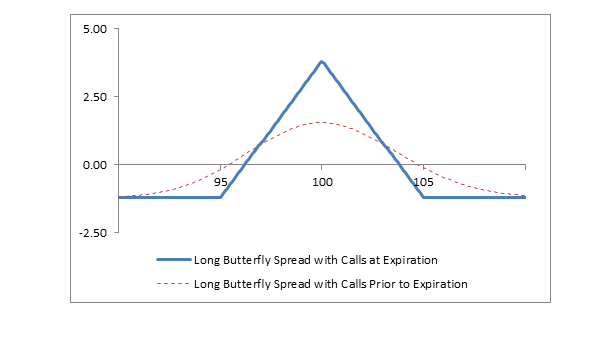

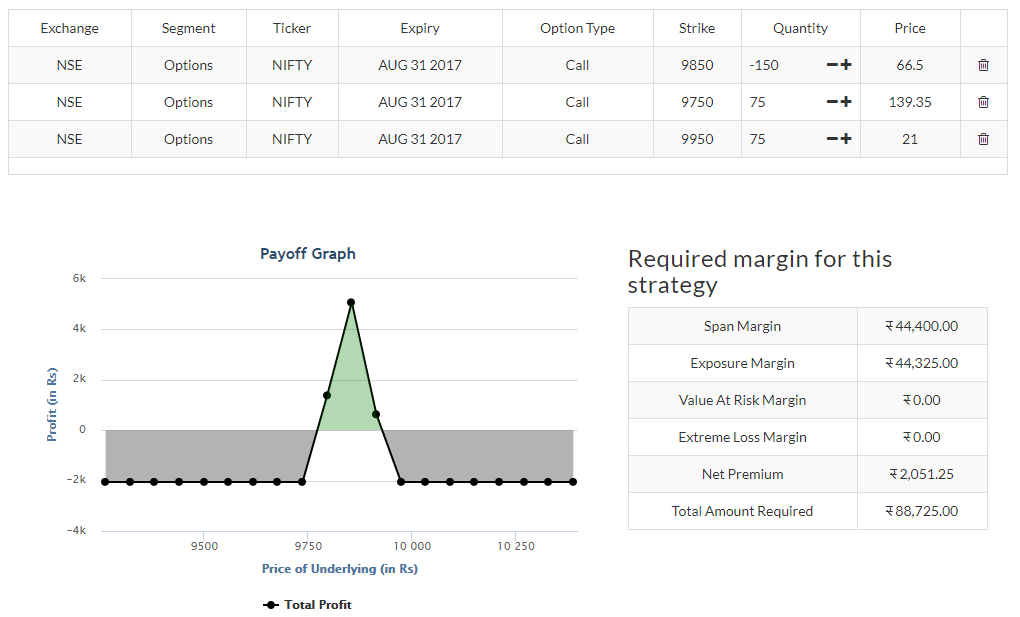

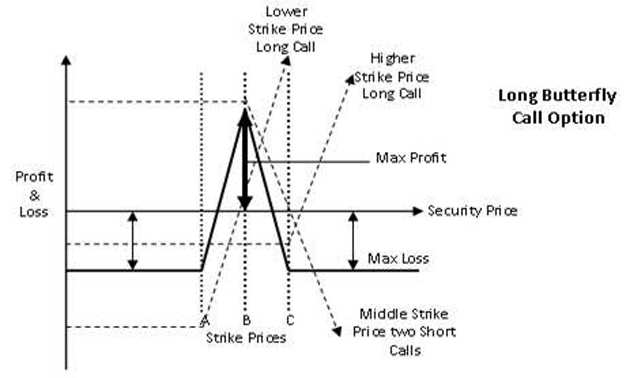

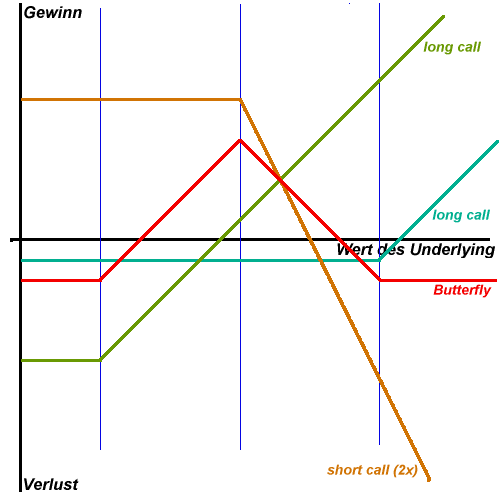

Long butterfly spreads are entered when the investor thinks that the underlying stock will not rise or fall much by expiration. Using calls, the long butterfly can be constructed by buying one lower striking in-the-money call, writing two at-the-money calls and buying another higher striking out-of-the-money call.

www.theoptionsguide.com/butterfly-spread…

The iron butterfly spread is created by buying an out-of-the-money put option with a lower strike price, writing an at-the-money put option, writing an at-the-money call option, and buying an out-of-the-money call option with a higher strike price.

www.investopedia.com/terms/b/butterflys…

How do you view a butterfly spread?

How do you view a butterfly spread?

One way to view the butterfly spread using calls is the purchase of a bull call spread with the sale of a bull call spread. The same can be said for a butterfly spread using puts. For example: Suppose that a trader is bullish on stock BBB, which is currently trading at $40 per share.

epsilonoptions.com/butterfly-spread/

What is the profit potential of a butterfly spread?

What is the profit potential of a butterfly spread?

Realistically, the only way to achieve this level of profit would be if the underlying security closed at exactly $190 a share on the day of option expiration. The profit potential is $518 at any stock price above $195—26% in six weeks' time. The three key criteria to look at when considering a modified butterfly spread are:

www.investopedia.com/articles/optioninve…

https://www.investopedia.com/terms/b/butterflyspread.asp

Перевести · Butterfly Spread Understanding Butterfly Spread. Butterfly spreads use four option contracts with the same expiration but three different... Long Call Butterfly Spread. The long butterfly call spread is created by buying one in-the-money call option with a low... Short Call Butterfly Spread. The ...

https://investments_en_ru.academic.ru/439/butterfly_spread

спред бабочка Одновременная продажа или покупка на одном или нескольких рынках трех фьючерсных контрактов. Например, покупается 10 фьючерсных контрактов …

https://epsilonoptions.com/butterfly-spread

Description of The Strategy

When to Put It on

Pros of Strategy

Cons of Strategy

Risk Management

Possible Adjustments

The butterfly spreadcan use either calls or puts, and is really two spreads combined into one. A butterfly spread using calls would entail the purchase of a call, the sale of two calls further away and then the purchase of another call even farther away. A butterfly spread using puts would consist of the purchase of a put, the sale of two puts further away and th…

https://www.investopedia.com/articles/optioninvestor/10/modified-butterfly-spread.asp

Перевести · 29.10.2020 · One strategy that is quite popular among experienced options traders is known as the butterfly spread. This strategy allows a trader to enter into a trade with a high probability of profit,...

Investopedia Video: Butterfly Spread

How a butterfly spread strategy works

Option Butterfly Strategy – What is a Butterfly Spread

Put Butterfly Spread Management (Plus 2 Other Spreads)

Butterfly Option Spread Trade Explained - Classic Butterfly Spread

https://www.theoptionsguide.com/butterfly-spread.aspx

Перевести · Butterfly Spread Long Call Butterfly. Long butterfly spreads are entered when the investor thinks that the underlying stock will not rise... Limited Profit. …

https://economy_en_ru.academic.ru/9121/butterfly_spread

бирж. спред бабочка (опционный спред, в котором используется четыре опциона с разными ценами исполнения или разными сроками истечения; характеризуются …

https://finance_and_debt.academic.ru/1471/butterfly_(call)_spread

фр. écart en papillon исп. margen «mariposa» спред «бабочка» по опциону «колл» Стратегия при работе с опционами, которая предполагает одновременые продажу и …

РекламаКупите Brauberg Butterfly (228830) в ЭЛЬДОРАДО. · круглосуточно

РекламаСобранные ракетки для настольного тенниса. Основание + накладки + сборка. · ежедневно 10:00-21:00

Не удается получить доступ к вашему текущему расположению. Для получения лучших результатов предоставьте Bing доступ к данным о расположении или введите расположение.

Не удается получить доступ к расположению вашего устройства. Для получения лучших результатов введите расположение.

Gordon Scott has been an active investor and technical analyst of securities, futures, forex, and penny stocks for 20+ years. He is a member of the Investopedia Financial Review Board and the co-author of Investing to Win. Gordon is a Chartered Market Technician (CMT). He is also a member of ASTD, ISPI, STC, and MTA.

Article Reviewed on November 07, 2020

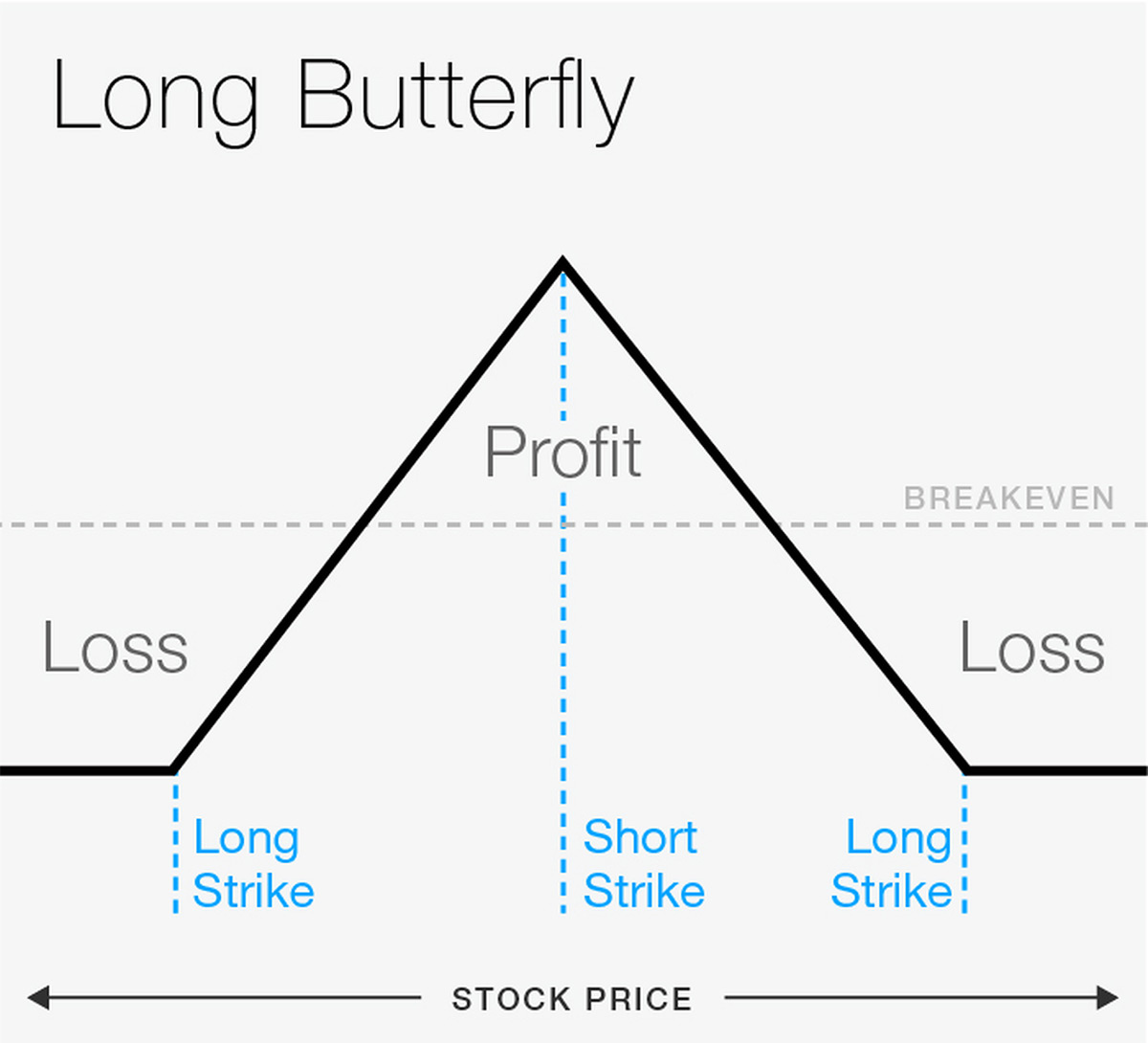

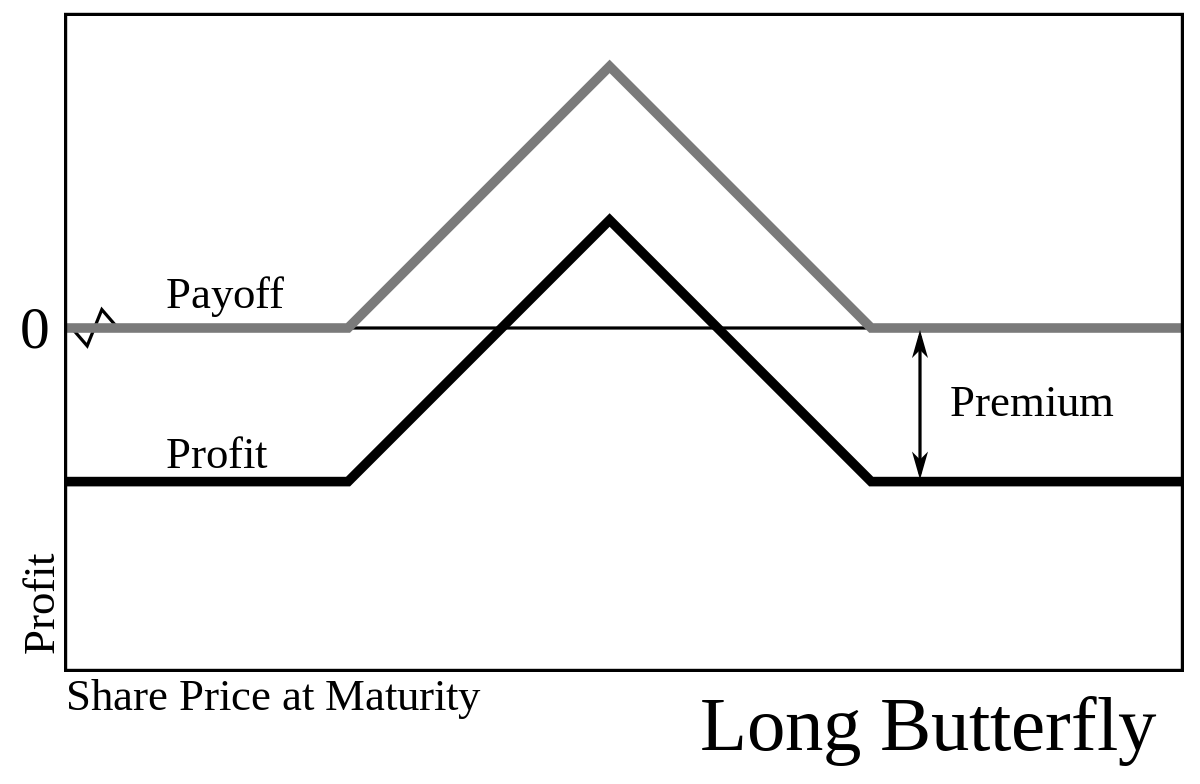

A butterfly spread is an options strategy combining bull and bear spreads, with a fixed risk and capped profit. These spreads, involving either four calls, four puts or a combination, are intended as a market-neutral strategy and pay off the most if the underlying does not move prior to option expiration.

There are multiple butterfly spreads, all using four options.

All butterfly spreads use three different strike prices.

The upper and lower strike prices are equal distance from the middle, or at-the-money, strike price.

Each type of butterfly has a maximum profit and a maximum loss.

Butterfly spreads use four option contracts with the same expiration but three different strike prices. A higher strike price, an at-the-money strike price, and a lower strike price. The options with the higher and lower strike prices are the same distance from the at-the-money options. If the at-the-money options have a strike price of $60, the upper and lower options should have strike prices equal dollar amounts above and below $60. At $55 and $65, for example, as these strikes are both $5 away from $60.

Puts or calls can be used for a butterfly spread. Combining the options in various ways will create different types of butterfly spreads, each designed to either profit from volatility or low volatility.

The long butterfly call spread is created by buying one in-the-money call option with a low strike price, writing two at-the-money call options, and buying one out-of-the-money call option with a higher strike price. Net debt is created when entering the trade.

The maximum profit is achieved if the price of the underlying at expiration is the same as the written calls. The max profit is equal to the strike of the written option, less the strike of the lower call, premiums, and commissions paid. The maximum loss is the initial cost of the premiums paid, plus commissions.

The short butterfly spread is created by selling one in-the-money call option with a lower strike price, buying two at-the-money call options, and selling an out-of-the-money call option at a higher strike price. A net credit is created when entering the position. This position maximizes its profit if the price of the underlying is above or the upper strike or below the lower strike at expiry.

The maximum profit is equal to the initial premium received, less the price of commissions. The maximum loss is the strike price of the bought call minus the lower strike price, less the premiums received.

The long put butterfly spread is created by buying one put with a lower strike price, selling two at-the-money puts, and buying a put with a higher strike price. Net debt is created when entering the position. Like the long call butterfly, this position has a maximum profit when the underlying stays at the strike price of the middle options.

The maximum profit is equal to the higher strike price minus the strike of the sold put, less the premium paid. The maximum loss of the trade is limited to the initial premiums and commissions paid.

The short put butterfly spread is created by writing one out-of-the-money put option with a low strike price, buying two at-the-money puts, and writing an in-the-money put option at a higher strike price. This strategy realizes its maximum profit if the price of the underlying is above the upper strike or below the lower strike price at expiration.

The maximum profit for the strategy is the premiums received. The maximum loss is the higher strike price minus the strike of the bought put, less the premiums received.

The iron butterfly spread is created by buying an out-of-the-money put option with a lower strike price, writing an at-the-money put option, writing an at-the-money call option, and buying an out-of-the-money call option with a higher strike price. The result is a trade with a net credit that's best suited for lower volatility scenarios. The maximum profit occurs if the underlying stays at the middle strike price.

The maximum profit is the premiums received. The maximum loss is the strike price of the bought call minus the strike price of the written call, less the premiums received.

The reverse iron butterfly spread is created by writing an out-of-the-money put at a lower strike price, buying an at-the-money put, buying an at-the-money call, and writing an out-of-the-money call at a higher strike price. This creates a net debit trade that's best suited for high-volatility scenarios. Maximum profit occurs when the price of the underlying moves above or below the upper or lower strike prices.

The strategy's risk is limited to the premium paid to attain the position. The maximum profit is the strike price of the written call minus the strike of the bought call, less the premiums paid.

An investor believes that Verizon stock, currently trading at $60 will not move significantly over the next several months. They choose to implement a long call butterfly spread to potentially profit if the price stays where it is.

An investor writes two call options on Verizon at a strike price of $60, and also buys two additional calls at $55 and $65.

In this scenario, an investor would make the maximum profit if Verizon stock is priced at $60 at expiration. If Verizon is below $55 at expiration, or above $65, the investor would realize their maximum loss, which would be the cost of buying the two wing call options (the higher and lower strike) reduced by the proceeds of selling the two middle strike options.

If the underlying asset is priced between $55 and $65, a loss or profit may occur. The amount of premium paid to enter the position is key. Assume that it costs $2.50 to enter the position. Based on that, if Verizon is priced anywhere below $60 minus $2.50, the position would experience a loss. The same holds true if the underlying asset were priced at $60 plus $2.50 at expiration. In this scenario, the position would profit if the underlying asset is priced anywhere between $57.50 and $62.50 at expiration.

This scenario does not include the cost of commissions, which can add up when trading multiple options.

A butterfly spread is an options strategy combining bull and bear spreads, with a fixed risk and capped profit. These spreads, involving either four calls, four puts or a combination, are intended as a market-neutral strategy and pay off the most if the underlying does not move prior to option expiration. Combining the options in various ways will create different types of butterfly spreads, each designed to either profit from volatility or low volatility.

Butterfly spreads use four option contracts with the same expiration but three different strike prices. A higher strike price, an at-the-money strike price, and a lower strike price. The options with the higher and lower strike prices are the same distance from the at-the-money options. Each type of butterfly has a maximum profit and a maximum loss.

The long call butterfly spread is created by buying one in-the-money call option with a low strike price, writing (selling) two at-the-money call options, and buying one out-of-the-money call option with a higher strike price. Net debt is created when entering the trade.

The maximum profit is achieved if the price of the underlying at expiration is the same as the written calls. The max profit is equal to the strike of the written option, less the strike of the lower call, premiums, and commissions paid. The maximum loss is the initial cost of the premiums paid, plus commissions.

The long put butterfly spread is created by buying one out-of-the-money put option with a low strike price, selling (writing) two at-the-money put options, and buying one in-the-money put option with a higher strike price. Net debt is created when entering the position. Like the long call butterfly, this position has a maximum profit when the underlying stays at the strike price of the middle options.

The maximum profit is equal to the higher strike price minus the strike of the sold put, less the premium paid. The maximum loss of the trade is limited to the initial premiums and commissions paid.

The offers that appear in this table are from partnerships from which Investopedia receives compensation.

An iron condor involves buying and selling calls and puts with different strike prices when a trader expects low volatility.

A bull put spread is an income-generating options strategy that is used when the investor expects a moderate rise in the price of the underlying asset.

A bull call spread is an options strategy designed to benefit from a stock's limited increase in price.

A Christmas tree is a complex options trading strategy achieved by buying and selling six call options with different strikes for a neutral to bullish forecast.

A bull vertical spread is used by investors who feel that the market price of a commodity will appreciate but wish to limit the downside potential associated with an incorrect prediction.

A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk.

Options Trading Strategy & Education

Options Trading Strategy & Education

Options Trading Strategy & Education

Options Trading Strategy & Education

Investopedia is part of the Dotdash publishing family.

Porno Bukkake Asian

Zoo Porn Public

Nasty Salt Bad Blood

Female Prime Minister

Mickey Avalon My Dick

butterfly spread - это... Что такое butterfly spread?

Butterfly Spread: Learn This Options Trading Strategy Here

Butterfly Spread Explained | Online Option Trading Guide

butterfly spread - это... Что такое butterfly spread?

butterfly (call) spread - это... Что такое butterfly (call ...

Butterfly Spread