Bull Spread

🔞 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Bull Spread

Credit Risk Modeling Course 4.6 (319 ratings) 1 Course | 3+ Hours | Full Lifetime Access | Certificate of Completion

Practical Application Based Example

Credit Risk Modeling Course

1 Course

3+ Hours

Full Lifetime Access

Certificate of Completion

LEARN MORE >>

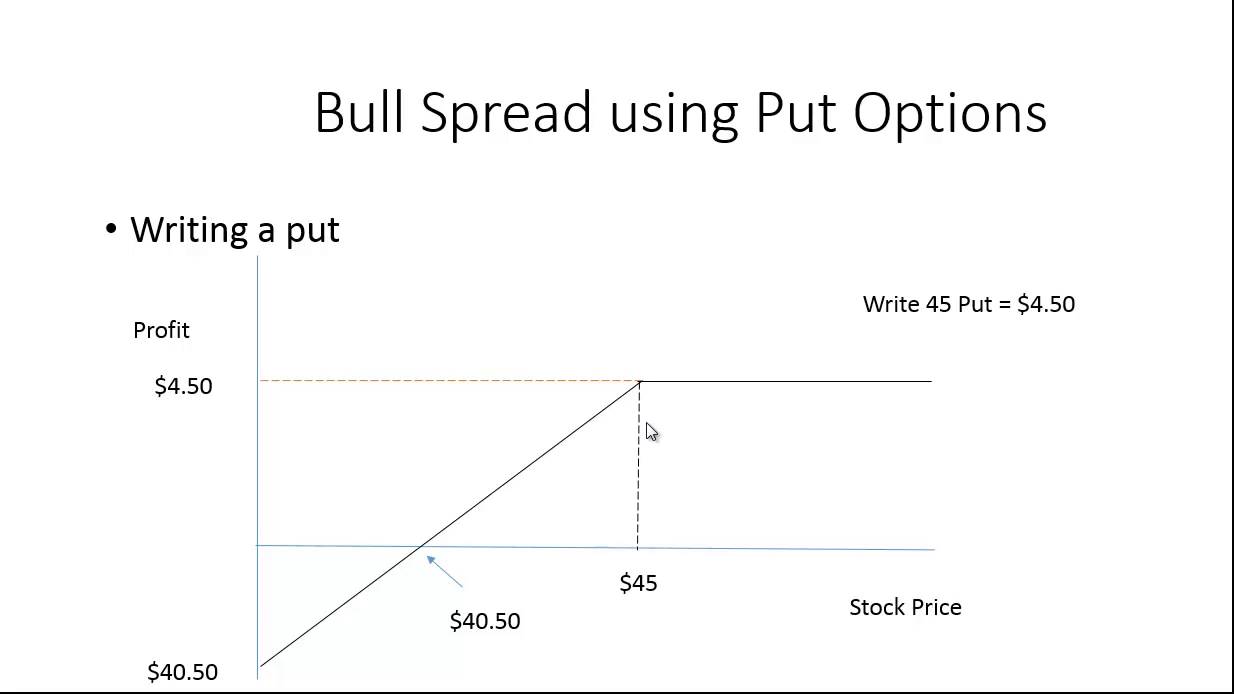

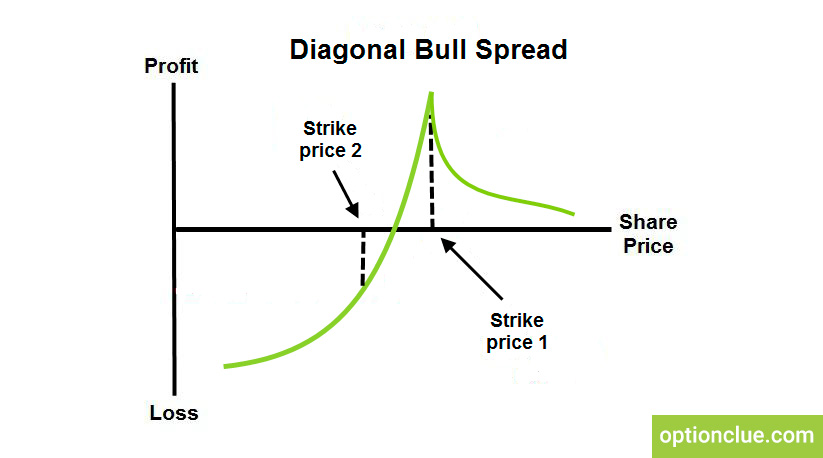

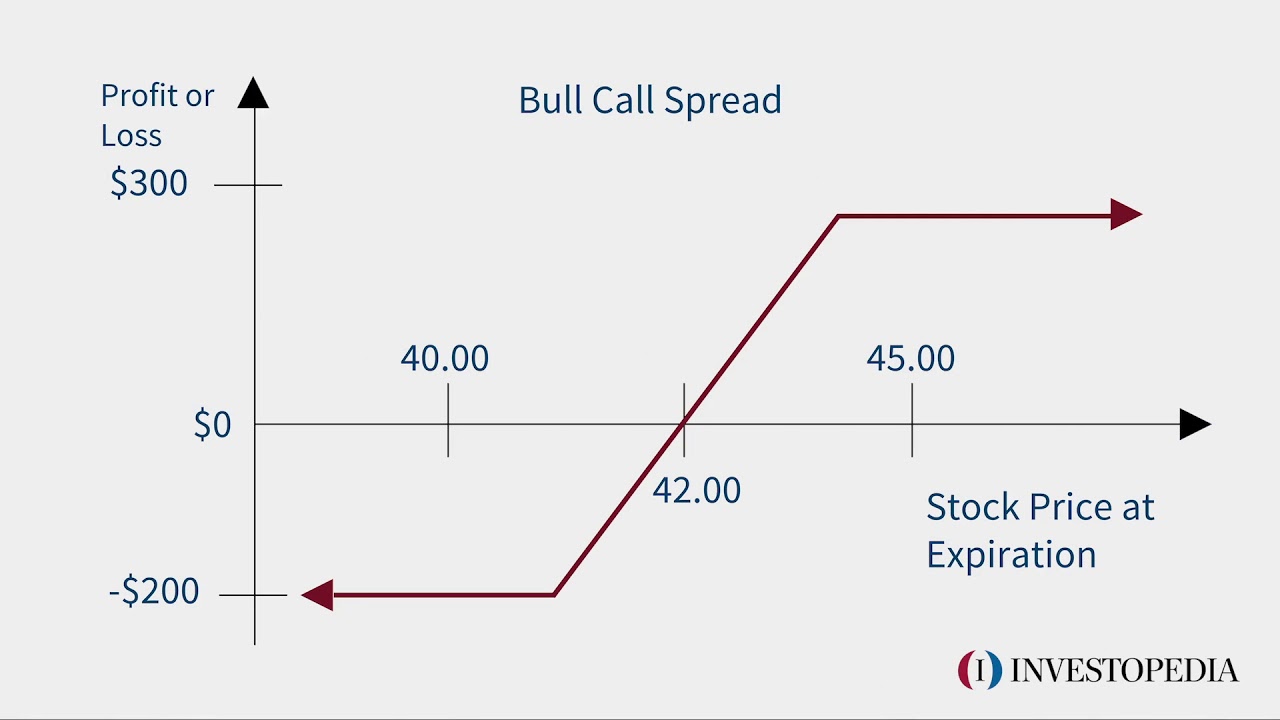

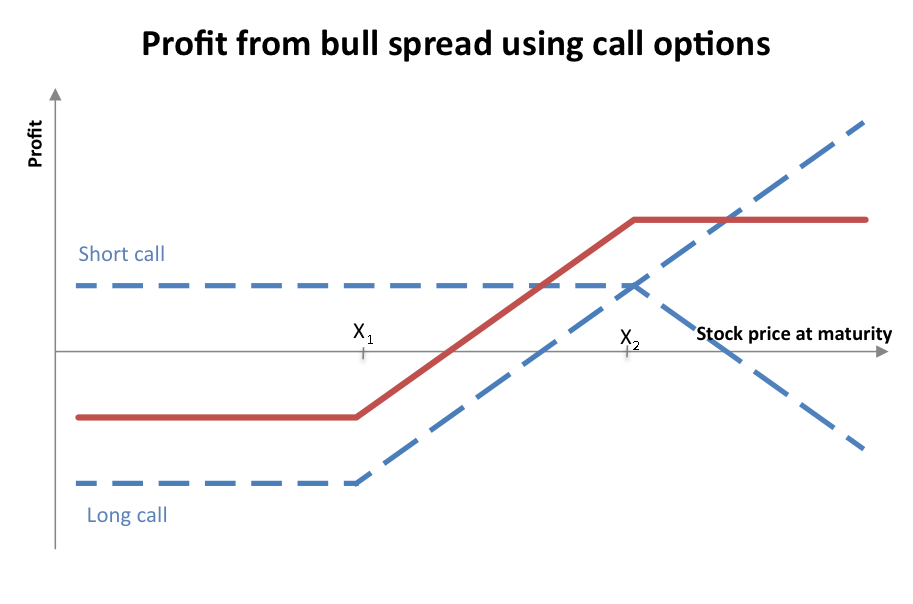

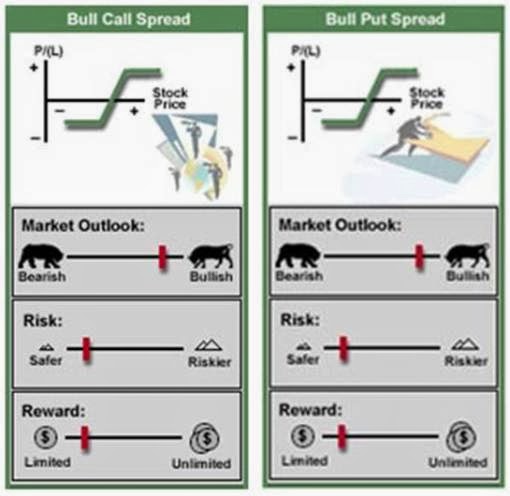

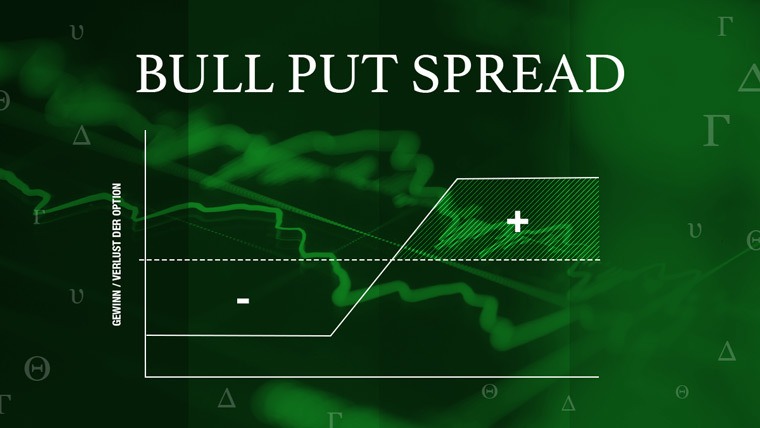

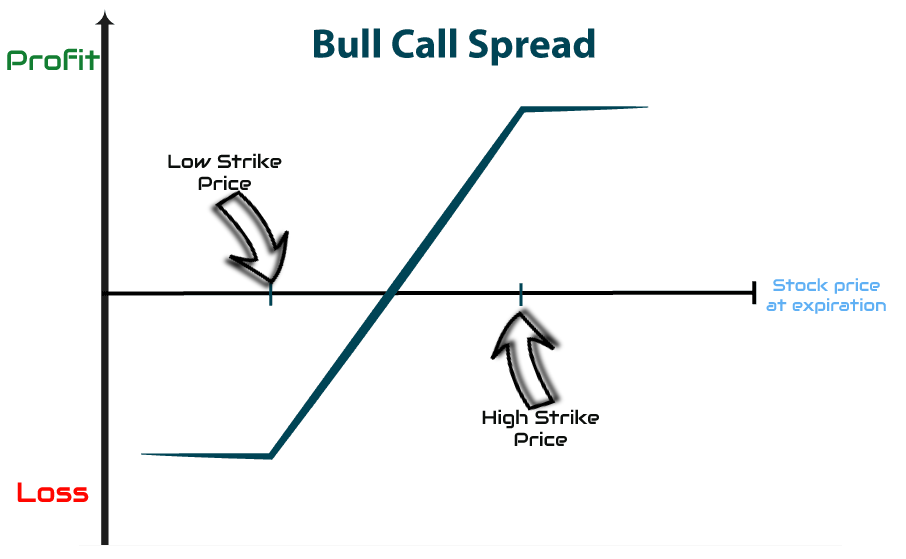

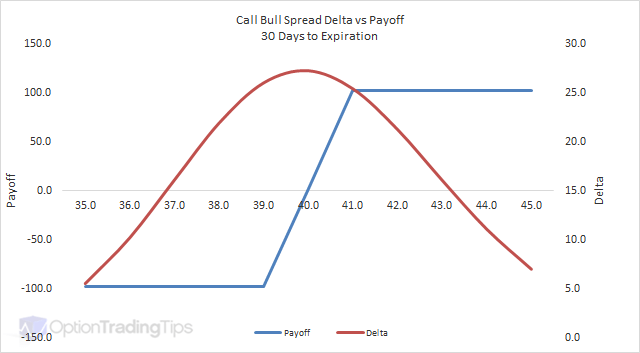

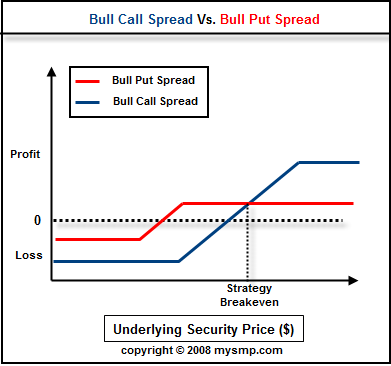

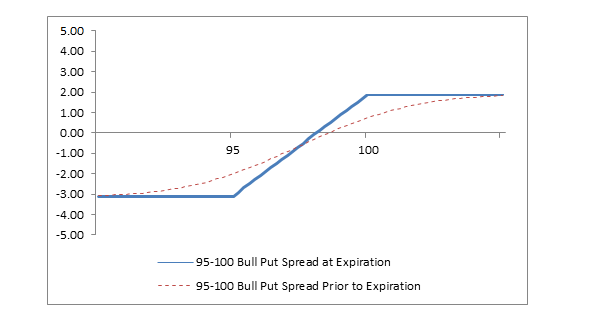

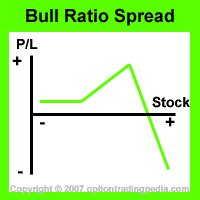

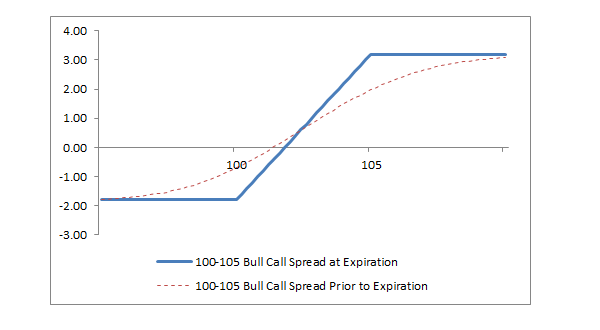

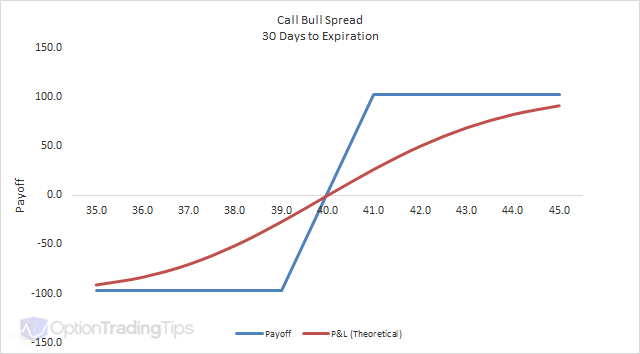

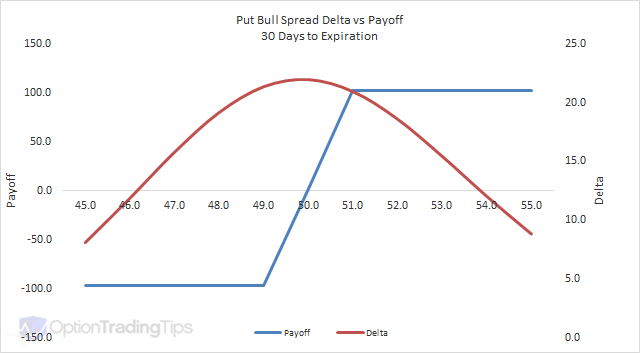

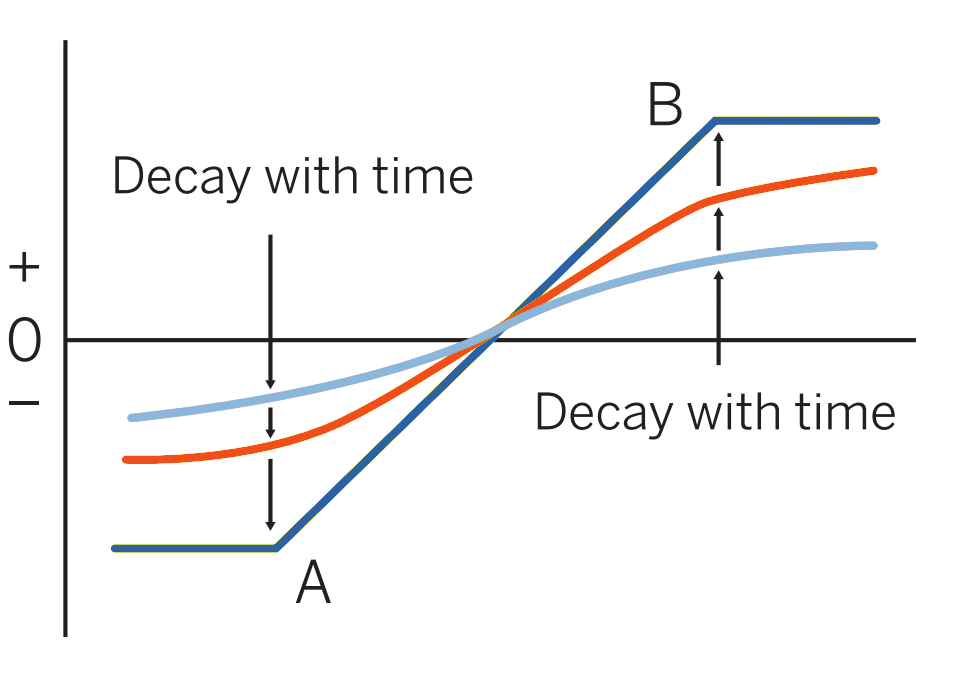

A bull spread is a widely used two leg option trading strategy that involves buying and selling the option contracts of equal quantity of any financial asset having the same expiration but different strikes such that the strategy delivers positive P&L when the underlying has a bullish movement, hence its name.

There are primarily two types which depend on if Calls are used, or Puts are used to implement the strategy

This strategy is deployed by buying ATM (at the money) call options while selling an equal number of OTM ( out of the money ) call options of the same underlying and same expiry. While deploying this strategy, a net debit of the Premium will occur, or a cost will be involved in setting up this strategy.

Bull Call Spread Formula (Where: X1Asses In Public Charley Chase Porn

Preteen Lingerie

Https Www Spankwire Com

Real Sex Sleeping Mom

Sexy Secretaries 2021