Bull Put Spread

⚡ ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Bull Put Spread

Customer Service

Profile

Open an Account

Refer a Friend

Log In

Customer Service

Profile

Open an Account

Refer a Friend

Log Out

Home »

Research »

Learning Center »

Investment Products »

Options »

Options Strategy Guide »

Locate an Investor Center by ZIP Code

Careers

News Releases

About Fidelity

International

Copyright 1998-2021 FMR LLC. All Rights Reserved.

Terms of Use

Privacy

Security

Site Map

Accessibility

Contact Us

Share Your Screen

Disclosures

This is for persons in the U.S. only.

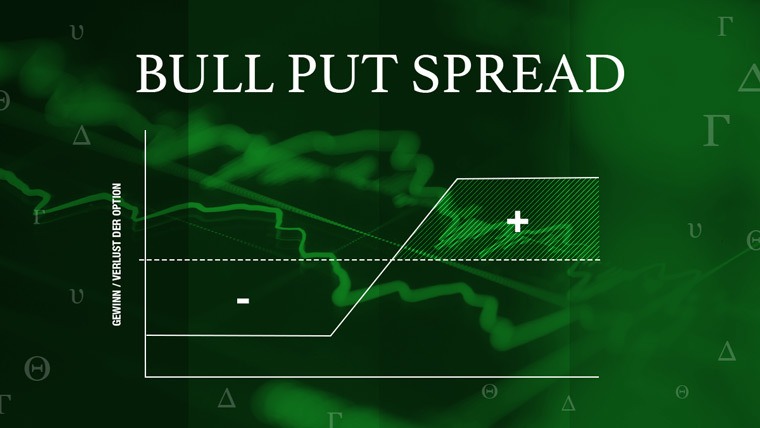

To profit from neutral to bullish price action in the underlying stock.

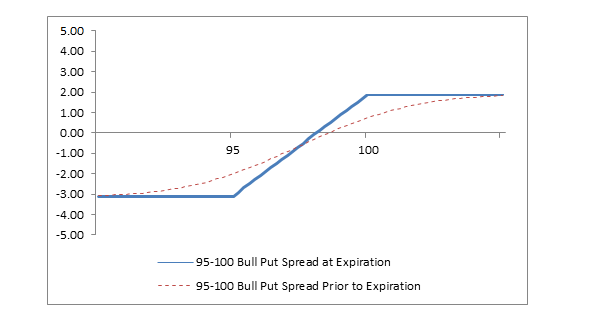

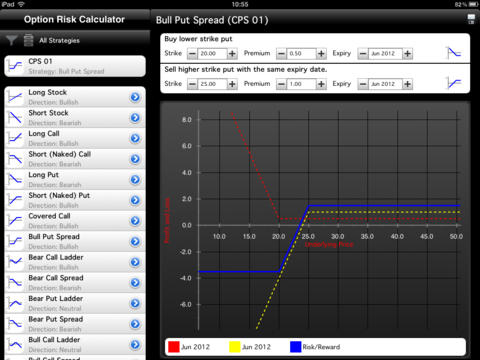

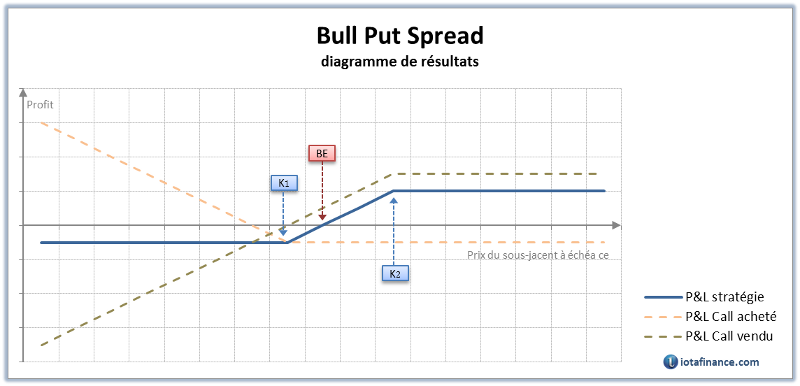

A bull put spread consists of one short put with a higher strike price and one long put with a lower strike price. Both puts have the same underlying stock and the same expiration date. A bull put spread is established for a net credit (or net amount received) and profits from either a rising stock price or from time erosion or from both. Potential profit is limited to the net premium received less commissions and potential loss is limited if the stock price falls below the strike price of the long put.

Potential profit is limited to the net premium received less commissions, and this profit is realized if the stock price is at or above the strike price of the short put (higher strike) at expiration and both puts expire worthless.

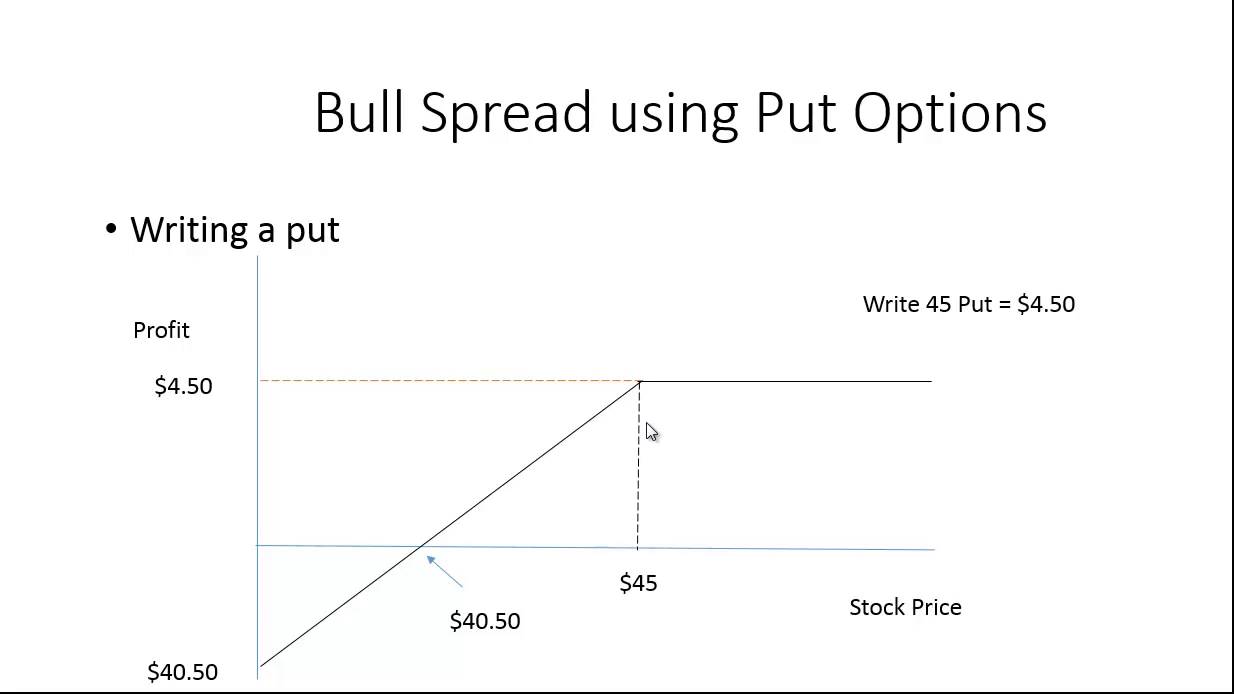

The maximum risk is equal to the difference between the strike prices minus the net credit received including commissions. In the example above, the difference between the strike prices is 5.00 (100.00 – 95.00 = 5.00), and the net credit is 1.90 (3.20 – 1.30 = 1.90). The maximum risk, therefore, is 3.10 (5.00 – 1.90 = 3.10) per share less commissions. This maximum risk is realized if the stock price is at or below the strike price of the long put at expiration.

Short puts are generally assigned at expiration when the stock price is below the strike price. However, there is a possibility of early assignment. See below.

Strike price of short put (higher strike) minus net premium received.

In this example: 100.00 – 1.90 = 98.10

A bull put spread earns the maximum profit when the price of the underlying stock is above the strike price of the short put (higher strike price) at expiration. Therefore, the ideal forecast is “neutral to bullish price action.”

The bull put spreads is a strategy that “collects option premium and limits risk at the same time.” They profit from both time decay and rising stock prices. A bull put spread is the strategy of choice when the forecast is for neutral to rising prices and there is a desire to limit risk.

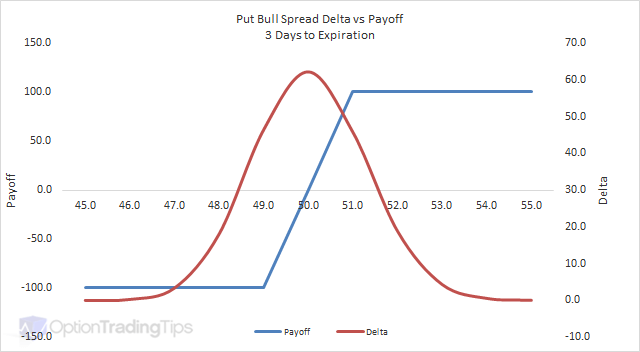

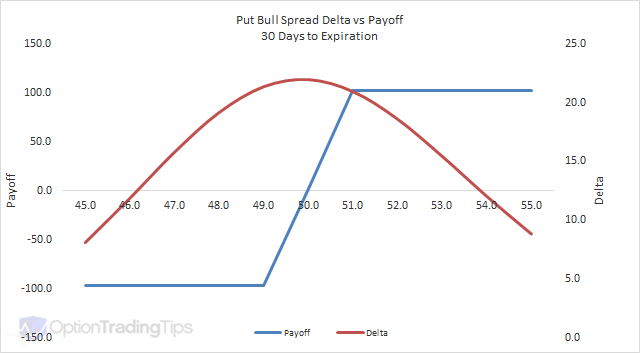

A bull put spread benefits when the underlying price rises and is hurt when it falls. This means that the position has a “net positive delta.” Delta estimates how much an option price will change as the stock price changes, and the change in option price is generally less than dollar-for-dollar with the change in stock price. Also, because a bull put spread consists of one short put and one long put, the net delta changes very little as the stock price changes and time to expiration is unchanged. In the language of options, this is a “near-zero gamma.” Gamma estimates how much the delta of a position changes as the stock price changes.

Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. Since a bull put spread consists of one short put and one long put, the price of a bull put spread changes very little when volatility changes and other factors remain constant. In the language of options, this is a “near-zero vega.” Vega estimates how much an option price changes as the level of volatility changes and other factors are unchanged.

The time value portion of an option’s total price decreases as expiration approaches. This is known as time erosion. Since a bull put spread consists of one short put and one long put, the sensitivity to time erosion depends on the relationship of the stock price to the strike prices of the spread. If the stock price is “close to” or above the strike price of the short put (higher strike price), then the price of the bull put spread decreases (and makes money) with passing of time. This happens because the short put is closest to the money and erodes faster than the long put. However, if the stock price is “close to” or below the strike price of the long put (lower strike price), then the price of the bull put spread increases (and loses money) with passing time. This happens because the long put is now closer to the money and erodes faster than the short put. If the stock price is half-way between the strike prices, then time erosion has little effect on the price of a bull put spread, because both the short put and the long put erode at approximately the same rate.

Stock options in the United States can be exercised on any business day, and holders of a short stock option position have no control over when they will be required to fulfill the obligation. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options.

While the long put (lower strike) in a bull put spread has no risk of early assignment, the short put (higher strike) does have such risk. Early assignment of stock options is generally related to dividends, and short puts that are assigned early are generally assigned on the ex-dividend date. In-the-money puts whose time value is less than the dividend have a high likelihood of being assigned. Therefore, if the stock price is below the strike price of the short put in a bull put spread (the higher strike), an assessment must be made if early assignment is likely. If assignment is deemed likely and if a long stock position is not wanted, then appropriate action must be taken. Before assignment occurs, the risk of assignment can be eliminated in two ways. First, the entire spread can be closed by buying the short put to close and selling the long put to close. Alternatively, the short put can be purchased to close and the long put open can be kept open.

If early assignment of a short put does occur, stock is purchased. If a long stock position is not wanted, the stock can be sold either by selling it in the marketplace or by exercising the long put. Note, however, that whichever method is chosen, the date of the stock sale will be one day later than the date of the stock purchase. This difference will result in additional fees, including interest charges and commissions. Assignment of a short put might also trigger a margin call if there is not sufficient account equity to support the stock position.

There are three possible outcomes at expiration. The stock price can be at or above the higher strike price, below the higher strike price but not below the lower strike price or below the lower strike price. If the stock price is at or above the higher strike price, then both puts in a bull put spread expire worthless and no stock position is created. If the stock price is below the higher strike price but not below the lower strike price, then the short put is assigned and a long stock position is created. If the stock price is below the lower strike price, then the short put is assigned and the long put is exercised. The result is that stock is purchased at the higher strike price and sold at the lower strike price and the result is no stock position.

The “bull put spread” strategy has other names. It is also known as a “credit put spread” and as a “short put spread.” The term “bull” refers to the fact that the strategy profits with bullish, or rising, stock prices. The term “credit” refers to the fact that the strategy is created for a net credit, or net amount received. Finally, the term “short” refers to the fact that this strategy involves the net selling of options, which is another way of saying that it is established for a net credit.

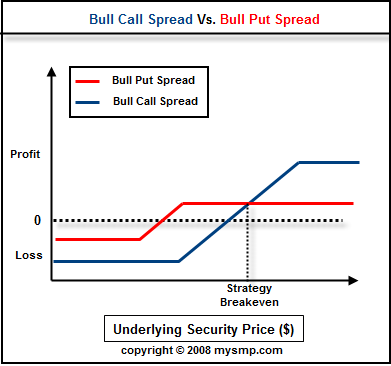

A bear put spread consists of one long put with a higher strike price and one short put with a lower strike price.

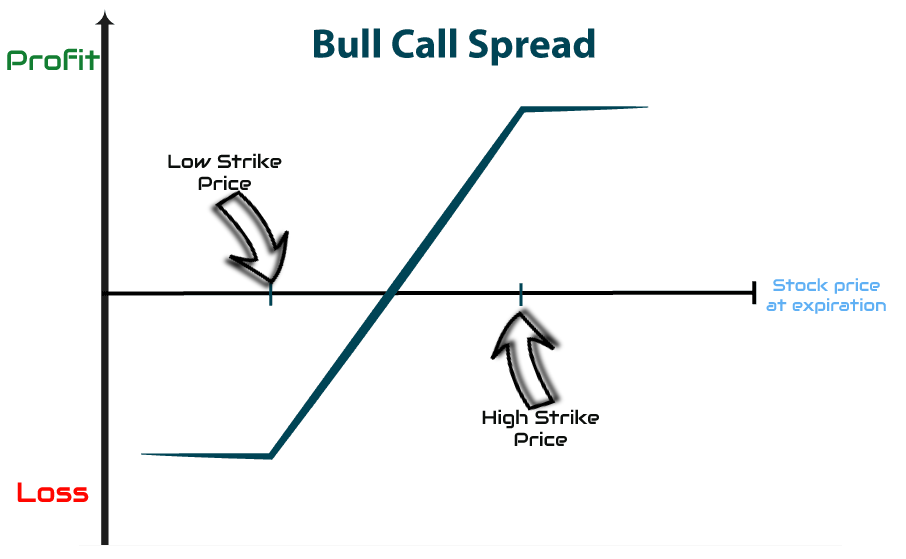

A bull call spread consists of one long call with a lower strike price and one short call with a higher strike price.

Article copyright 2013 by Chicago Board Options Exchange, Inc (CBOE). Reprinted with permission from CBOE. The statements and opinions expressed in this article are those of the author. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data.

Options trading entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Options . Supporting documentation for any claims, if applicable, will be furnished upon request.

Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes only.

Bull spread - Wikipedia

Bull Put Spread - Fidelity

Bull Put Spread Explained | Online Option Trading Guide

Bull Put Spreads - The Ultimate Guide

Bull Put Spread Explained (Best Guide w/ Examples) | projectoption

Toggle navigation

The Options Guide

Outlook on Underlying:

Arbitrage

Bearish

Bullish

Neutral - Bearish on Volatility

Neutral - Bullish on Volatility

Profit Potential:

Limited

Unlimited

Loss Potential:

Limited

Unlimited

Credit/Debit:

Credit

Debit

No. Legs:

1

2

3

4

The bull put spread option trading strategy is employed when the options trader thinks that the price of

the underlying asset will go up moderately in the near term. The bull put spread options strategy is also known as the bull put credit spread as a credit is received

upon entering the trade.

Bull put spreads can be implemented by

selling a higher striking

in-the-money put option and buying a lower striking

out-of-the-money put option on the same underlying

stock with the same expiration date .

If the stock price closes above the higher strike price on expiration date, both options expire worthless and the bull put spread option strategy earns the maximum profit which

is equal to the credit taken in when entering the position.

The formula for calculating maximum profit is given below:

If the stock price drops below the lower strike price on expiration date, then the bull put spread strategy incurs a maximum loss equal to the difference between the strike prices of the two puts minus the net credit received when putting on the trade.

The formula for calculating maximum loss is given below:

The underlier price at which break-even is achieved for the bull put spread position can be calculated using the following formula.

An options trader believes that XYZ stock trading at $43 is going to rally soon

and enters a bull put spread by buying a JUL 40 put for $100 and writing a JUL 45

put for $300. Thus, the trader receives a net credit of $200 when entering the spread

position.

The stock price of XYZ begins to rise and closes at $46 on expiration date. Both

options expire worthless and the options trader keeps the entire credit of $200

as

profit, which is also the maximum profit possible.

If the price of XYZ had declined to $38 instead, both options expire in-the-money

with the JUL 40 call having an intrinsic

value of $200 and the JUL 45 call having

an intrinsic value of $700. This means that the spread is now worth $500 at expiration.

Since the trader had received a credit of $200 when he entered the spread, his net

loss comes to $300. This is also his maximum possible loss.

Note: While we have covered the use of this strategy with reference to stock options, the bull put spread is equally applicable using ETF options, index options as well as options on futures .

For ease of understanding, the calculations depicted in the above examples did not take into account commission charges as they are relatively small amounts (typically around $10 to $20) and varies across option brokerages .

However, for active traders, commissions can eat up a sizable portion of their profits in the long run. If you trade options actively, it is wise to look for a low commissions broker. Traders who trade large number of contracts in each trade should check out OptionsHouse.com as they offer a low fee of only $0.15 per contract (+$4.95 per trade).

The following strategies are similar to the bull put spread in that they are also bullish strategies that have limited profit potential and limited risk.

The bull put spread is a credit spread as the difference between the sale and purchase of the two options results in a net credit. For a bullish spread position that is entered with a net debit, see bull call spread.

Buying straddles is a great way to play earnings.

Many a times, stock price gap up or down following the quarterly earnings report

but often, the direction of the movement can be unpredictable. For instance, a sell

off can occur even though the earnings report is good if investors had expected

great results.... [Read on...]

If you are very bullish on a particular stock for the long term and is looking to

purchase the stock but feels that it is slightly overvalued at the moment, then

you may want to consider writing put options on the

stock as a means to acquire it at a discount.... [Read on...]

Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time..... [Read on...]

If you are investing the Peter Lynch style, trying to predict the next multi-bagger,

then you would want to find out more about LEAPS® and why I consider them to be a great option for investing in the next Microsoft®....

[Read on...]

Cash dividends issued by stocks have big impact on their option prices. This is

because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date.... [Read on...]

As an alternative to writing covered calls, one can enter a bull call spread for

a similar profit potential but with significantly less capital requirement. In

place of holding the underlying stock in the covered call strategy, the alternative.... [Read on...]

Some stocks pay generous dividends every quarter. You qualify for the dividend if

you are holding on the shares before the ex-dividend date.... [Read on...]

To achieve higher returns in the stock market, besides doing more homework on the

companies you wish to buy, it is often necessary to

take on higher risk. A most common way to do that is to buy stocks on margin.... [Read on...]

Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading.... [Read on...]

Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator.... [Read on...]

Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in 1969. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa.... [Read on...]

In options trading, you may notice the use of certain greek alphabets like delta

or gamma when describing risks associated with various positions. They are known as "the greeks".... [Read on...]

Since the value of stock options depends on the price of the underlying stock, it

is useful to calculate the fair value of the stock by using a technique known as

discounted cash flow....

[Read on...]

Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. You should not risk more than you afford to lose. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience.

Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. TheOptionsGuide.com shall not be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon.

General Risk Warning:

The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. You should never invest money that you cannot afford to lose.

Tranny Shemale Xhamster

Czech Mature Porn

Sensual Cumshots

Porn Public Fingering

First Public Sex

:max_bytes(150000):strip_icc()/dotdash_Final_Seagull_Option_Apr_2020-01-ddc8d06ec2ee477d95c15ea16722887d.jpg)