"Breakout of level" algorithm

ApitradeThe "Breakout of level" algo in the "Hurricane" futures gdid-bot allows you to automatically open a position using the first stop market order when a certain price level is broken and start trading with the bot in the usual mode immediately after that.

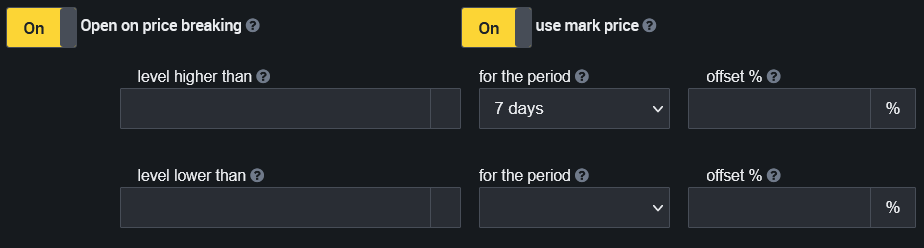

You can manually specify the price at which to place a stop market order both when launching a long bot, short bot, and a bot "without a strategy" (in this case, you need to specify a price below the current price, upon breaking of which a short stop will be executed) market order, and the price above the current price, upon the breakdown of which a long stop market order will be executed, when one of the orders is executed, the second one is cancelled). In addition, the algorithm can automatically determine the highs or lows for all coins, depending on the selected time frame (24 hours - 7 days). Thus, when the low is broken, a short stop market order will be executed and a short bot will be launched, when the high is broken, a long stop market order will be executed and a long bot will be launched. The user only needs to select a time frame without specifying the price of a stop market order. Over time, the high or low will change and the stop market order will be rearranged automatically.

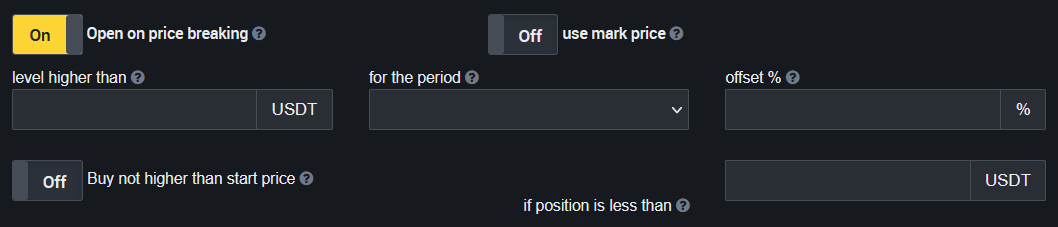

After launching the bot, it is recommended to enable the additional option "Buy no higher than the open price" (for longs) or "Buy no lower than the open price" for shorts, and also indicate in the "if the position is less" field a value from a quarter to a half of the size of your first order.

After enabling this option, trading will be performed not only lower (when long), but also slightly higher than the opening price of the first order, but when a small position remains, opening orders above the opening price will be canceled so as not to greatly worsen the average entry price.

When running this bot, it is recommended to use stop losses behind the last low, and/or stop losses at the maximum loss, and/or stop loss with a specific price, as well as stop loss at breakeven, stop loss at the maximum loss. This is due to the fact that a false breakout is possible, and if the loss is not fixed in time, the position size may become too large.