Bitfinex Alpha #170 - Community Summary

BY BITFINEX COMMUNITYBitfinex Alpha | BTC Slips, ALTs Stagnate

📄 Read the full Bitfinex Alpha report in English here:

https://go.bitfinex.com/BFXAlpha170

Or explore the key highlights from this edition below:

BTC Drops Below Key Levels as Market Nears Possible Cyclical Floor

Bitcoin has dropped below $110,000, slipping past its January 2025 peak of $109,590 and extending losses to over 13% from its $123,640 ATH. While the technical breakdown is notable, historical patterns and seasonality suggest the market may be nearing the end of its correction, with $93K–$95K emerging as the likely cyclical floor. On-chain data backs this up, with the current Short-Term Holder Realised Price at $108,900 acting as a key pivot. A sustained drop below this level could signal more downside. Spot market sentiment has also neutralised, as indicated by Cumulative Volume Delta metrics, suggesting buyers are cautious and awaiting clearer catalysts.

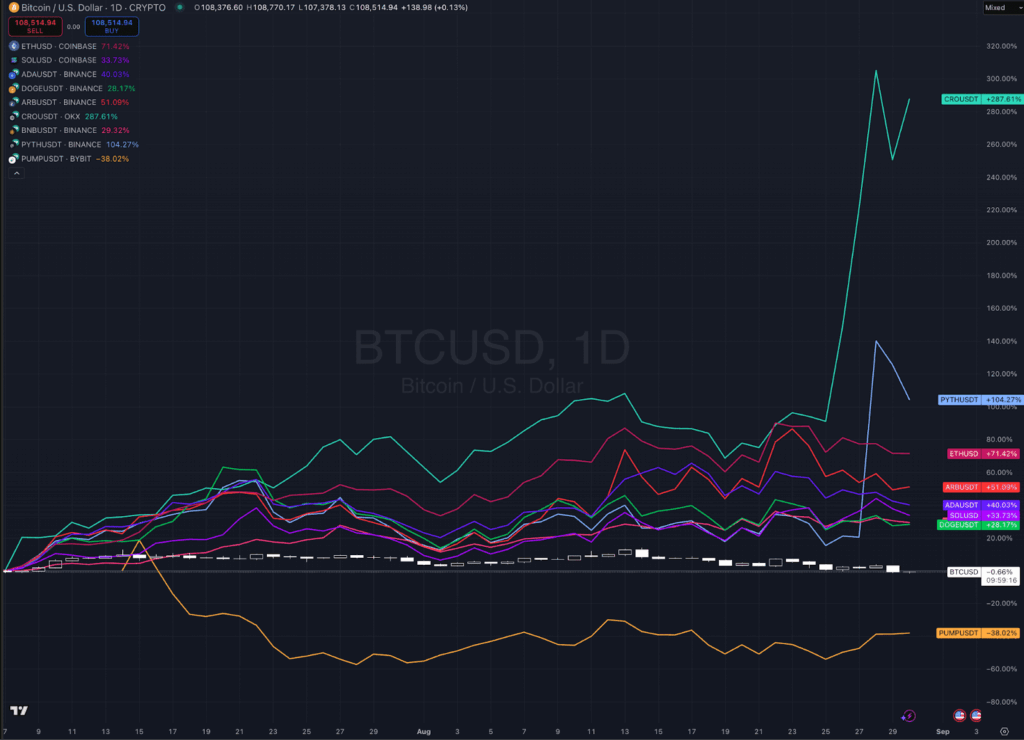

Altcoins have underperformed further, echoing the broad risk-off mood. $ETH dropped 14% after briefly hitting new highs, while $XRP, $ADA, and $DOGE suffered double-digit losses. Still, institutional interest remains intact, with $ETH treasuries and corporate buyers continuing to accumulate. Some mid-cap tokens like $CRO and $PUMP managed to rally on specific narratives, but this came through capital rotation, not new inflows.

The overall altcoin market cap is stagnating, with most movements reflecting shifts between tokens rather than fresh demand. With ETF inflows slowing seasonally and speculation cooling off, September may mark a cyclical bottom before stronger drivers return for a potential Q4 recovery.

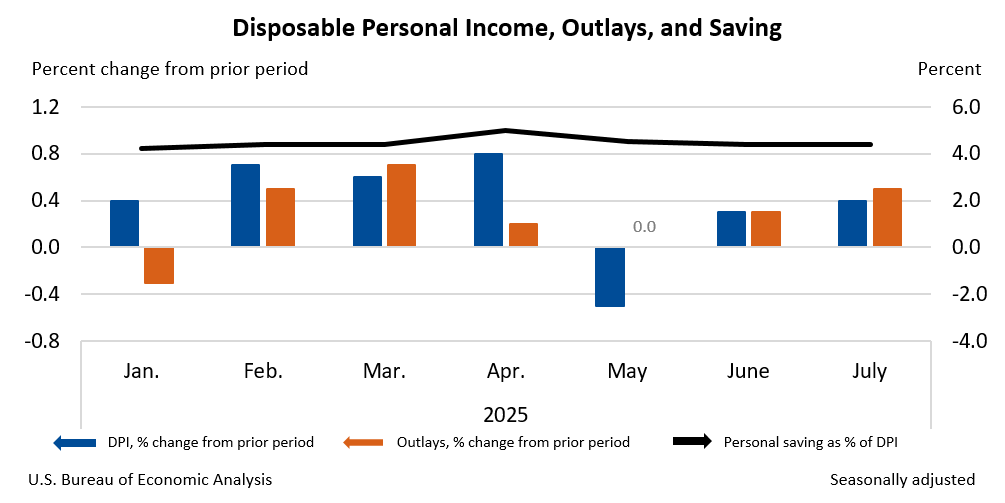

Mixed Economic Signals Fuel Expectations for Rate Cut

In the final week of August, US economic data gave policymakers a complex backdrop ahead of the Fed’s September meeting. Consumer spending rose 0.5% in July (the strongest in four months) but inflation remained sticky, with core PCE up 2.9% year over year. Meanwhile, job creation slowed to 35,000 per month. However, updated benchmarks from the St. Louis Fed now indicate that fewer new jobs are needed to sustain labour market equilibrium, effectively lowering the bar for rate cuts. Despite inflation remaining above target, this shift has tilted expectations towards potential easing in September.

GDP figures added further nuance, with Q2 growth revised up to 3.3%, driven by strong intellectual property and equipment investment. Still, regional indicators like the Chicago Business Barometer revealed weakening business activity due to tariffs and fading business confidence.

On the crypto-regulatory front, key developments signal broader financial support for digital assets. The CFTC reaffirmed its Foreign Board of Trade framework, enabling offshore exchanges to return to the US under defined rules, an update expected to boost liquidity and reduce fragmentation. Meanwhile, corporate adoption surged as BitMine Immersion Technologies solidified its position as the largest $ETH treasury firm, now holding $8.82B in crypto and cash, with plans to eventually own 5% of Ethereum’s total supply.

In sovereign crypto strategy, El Salvador enhanced the security of its $BTC reserves by spreading its $682M holdings across multiple wallets and launching a public dashboard to promote transparency. This move reinforces the country's leadership in nation-state crypto adoption and highlights a growing emphasis on responsible governance.

📊 Read the full Bitfinex Alpha report:

https://go.bitfinex.com/BFXAlpha170

🔥 Start your trading journey:

https://www.bitfinex.com/sign-up/

📣 Stay updated on future Community Summaries of Bitfinex Alpha by following our official announcement channels:

English: https://t.me/bfxannouncements

Spanish: https://t.me/BFXAnnouncementsES

Portuguese: https://t.me/BFXAnnouncementsPT

Vietnamese: https://t.me/bitfinexVNann

Chinese: https://t.me/BFXAnnouncementsCN

You can also join the discussion on our Telegram groups or Discord: https://discord.gg/bitfinex