Bitcoin Is Not Dead – It’s Beating Stocks, Bonds, Currencies and Commodities.

Crypto Klondike

“We have very deep conviction on a long-term basis. And if you look at the fundamentals, the 24-hour transaction volume on the Bitcoin network is about $4.6 billion as of lately, and the market cap is $74 billion. So that’s about a 16-times multiple of transaction volume for market cap. That’s very similar to Mastercard which does about $11 billion worth of transactions and is valued at about $180 billion. So from a value perspective, it’s right there on par with Mastercard.”

Pompliano says that despite Bitcoin’s relative youth as a payment rail, with 10 years on the tech scene – compared to Mastercard which was founded in 1966 – it’s beaten stocks, bonds, currencies and commodities in terms of performance. Over the next 10 years, his research forecasts that public equity performance will be relatively “bleak” compared to that of cryptocurrencies.

When challenged about the true value of Bitcoin and cryptocurrencies, and what the fundamentals really support – BTC trading between $1,000 – $3,000 – Pompliano says they look at transaction volumes.

“I think that all of this has been driven by retail investors. There’s been very few institutional investors in the space pre-2018. And we tend to think that the work done today is going to lay the groundwork for the price movements moving forward over the next two to three years.”

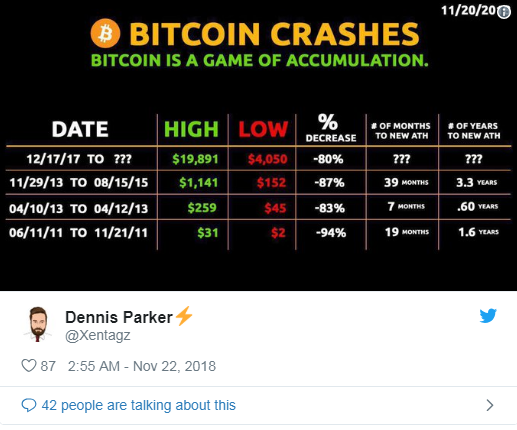

Since Bitcoin’s slide from an all-time high of nearly $20,000 late last year to its current price around $4,385, crypto naysayers such as Warren Buffett, Jamie Dimon and Nouriel Roubinireiterate their position that the crypto markets will end poorly, while crypto bulls point to Bitcoin’s previous crashes and multiple comebacks.