Bitcoin Fixes Hungary - B is for Billions

@weimartifacts

In the book "When Money Dies," Fergusson tells the story of Hungary. It was a story about the first fiat currency that was used in Hungary in the 20th century.

Between 1913 and the end of 1921, the currency in circulation increased by 64 times. An average number of domestic articles purchased in 1914 for 100 korona now cost 8,260. Before the war, in the area which constituted the new Hungary, State revenue had been about one tenth greater than expenditure: three years after the Armistice, expenditure was one-third higher than revenue. By 1921 the dislocation of normal monetary standards resulting from war, revolution, counter-revolution, Red Terror then White Terror, and at last Admiral Horthy's regency had brought about so great a feeling of despondency that the usual thought of anyone with money was to convert it into more stable assets — foreign currency, industrial stock, antiques or jewellery. As in Germany and Austria, speculation on the Stock Exchange was rife in every class, with all categories of share bought and sold, and the rate of various currencies eagerly watched from day to day.

Besides the Korona, Hungarian governments have had the Pengő and the Forint. Earlier, in the 19th century, the official currency had been the silver-based Austrian Florin. On 1 January 1900, the "gold" Korona (Crown) replaced the former currency, and this moment marked Hungary's transition to the pure gold standard.

However, we tell this story not about the sound moneys but rather opposite things. Pengő highlights the most dramatic episode of the most challenging national history in the world in terms of numbers. The Hungarians experienced the largest hyperinflation in history, when the conversion rate from the old currency to the new one was

while in the German hyperinflation of 1914–1923, the rate reached "only" 1 : 10¹² (Hegedus, 1986).

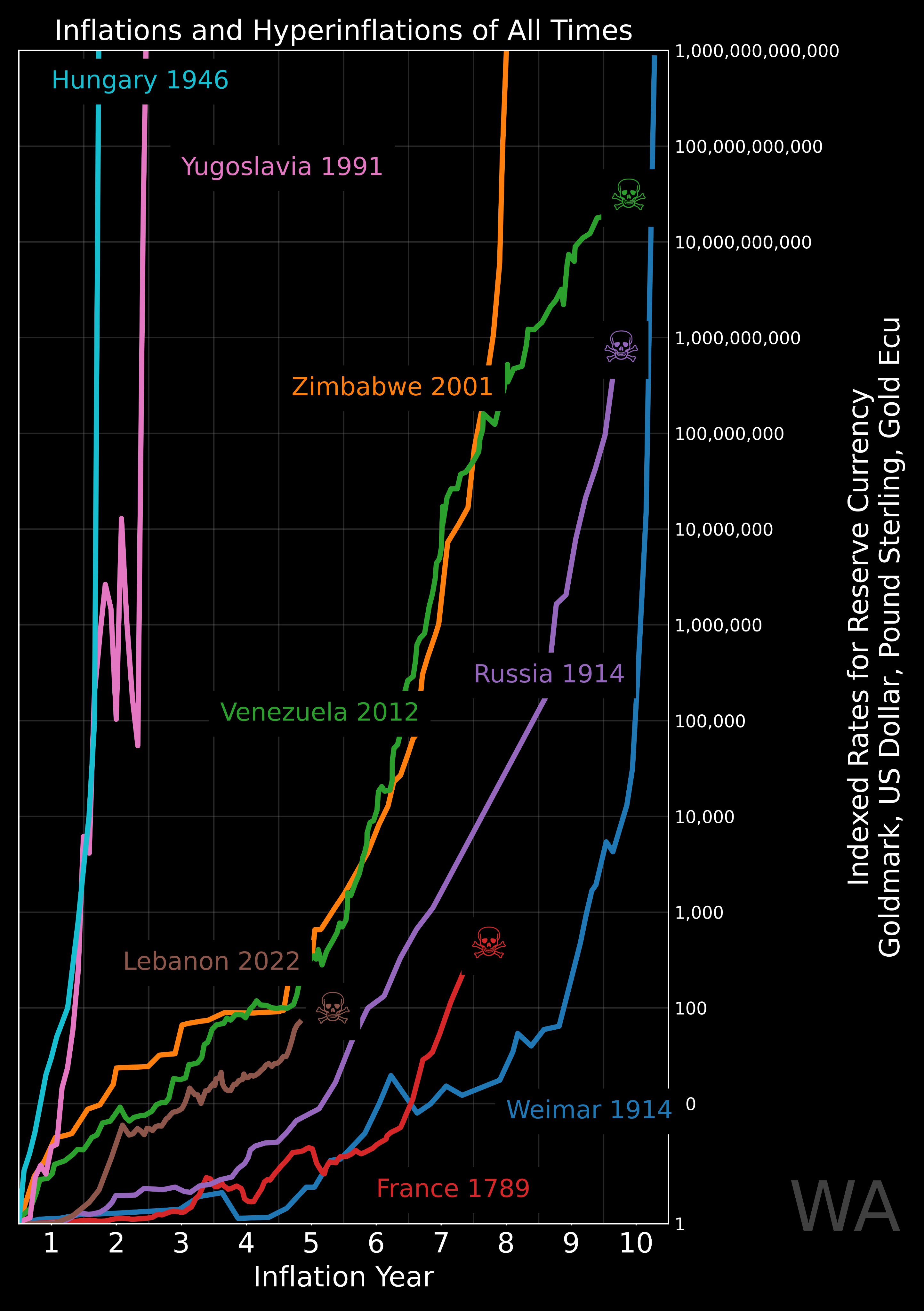

While other hyperinflations took 8-12 years to develop fully, Hungary's lasted only from 1945 to 31 July 1946. On our infographic, we have placed Weimar's hyperinflation as the longest one to develop. Although some commentators remind us that the "hyperinflationary" phase took only a couple of years, we tend to consider major "depeg" events as the starting point. Examples such as Hungary or Russia demonstrate vividly that there are always plenty of hyperinflationary regimes that are less explicit in rampant money printing than others — regimes that could hide their exploitative nature under slow devaluation of the national currency and creeping wealth extraction.

So where is the "B" comes from? A mathematician John D. Cook explains large numbers in his post and uses Pengő for illustration:

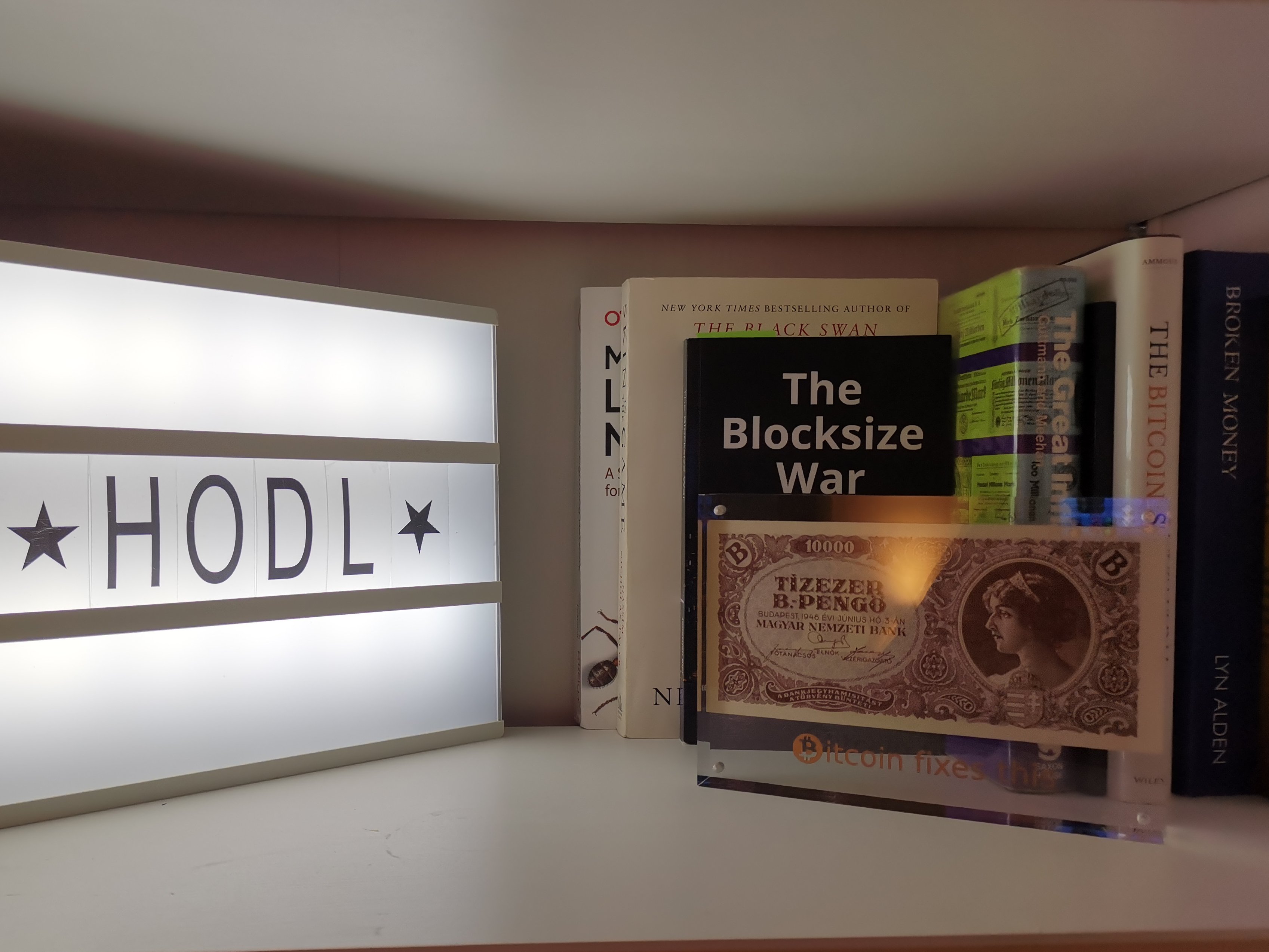

Speaking of massive inflation, the largest bank note denomination ever printed was the one sextillion pengő note printed by Hungary. This note is not as familiar as the 100 trillion dollar note from Zimbabwe because Hungary did not explicitly write out all the zeros in its note while Zimbabwe did.

Therefore, Pengő notes couldn't be used other than with a special multiplier: whereas in Europe it is common to use one milliard for 10⁹ instead of billion in the Anglo-Saxon world, the Hungarian billion, like the French and German, was meant to be a 10¹² multiplier. Much like the Russian hyperinflation, the Hungarian was due to over-expansion of credit and a simultaneous absence of real assets, i.e., gold.

For the major reform of the dead Pengő currency (August 1946), the Hungarian government recovered $32 million in gold reserves from the United States. The gold had been earlier removed to Germany by the Nazi government. It was returned to Budapest on 6 August via Hitler's private train, amid great press publicity (Bomberger, 1983). This measure backed the new Forint currency substantially, albeit later the government removed credit and issuance ceilings and in fact began devaluing the new paper currency too.