Binary Spread Betting

🔞 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Binary Spread Betting

Copyright © 2021 Bestfxbrokers.com | All Rights Reserved

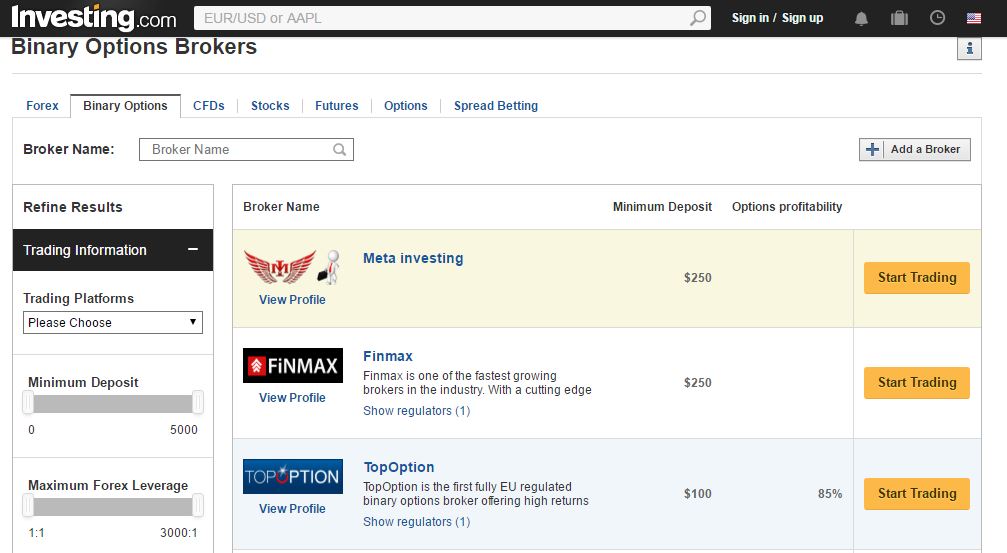

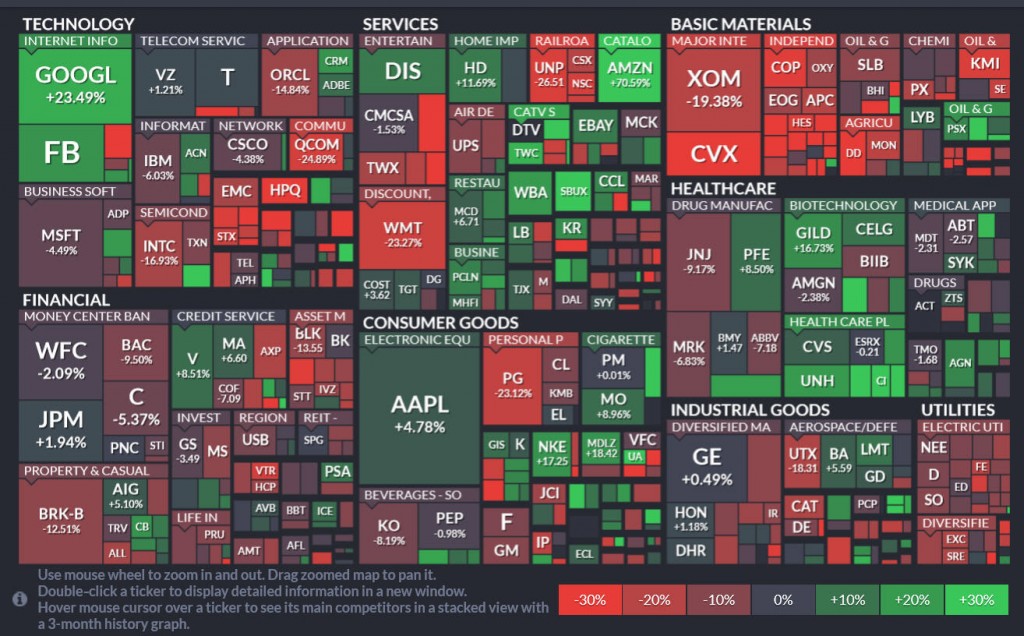

Binary options trading is a trend that is taking off around the globe. If you are familiar with financial markets or a forex trader then you have certainly heard of spread betting. Or, if happen to be in the UK, you probably are already somewhat familiar with financial spread betting because of how common they are in the bookies. You can place financial spread bets at your local betting shops and bookmakers.

This page looks to compare and contrast binary options trading and financial spread betting.

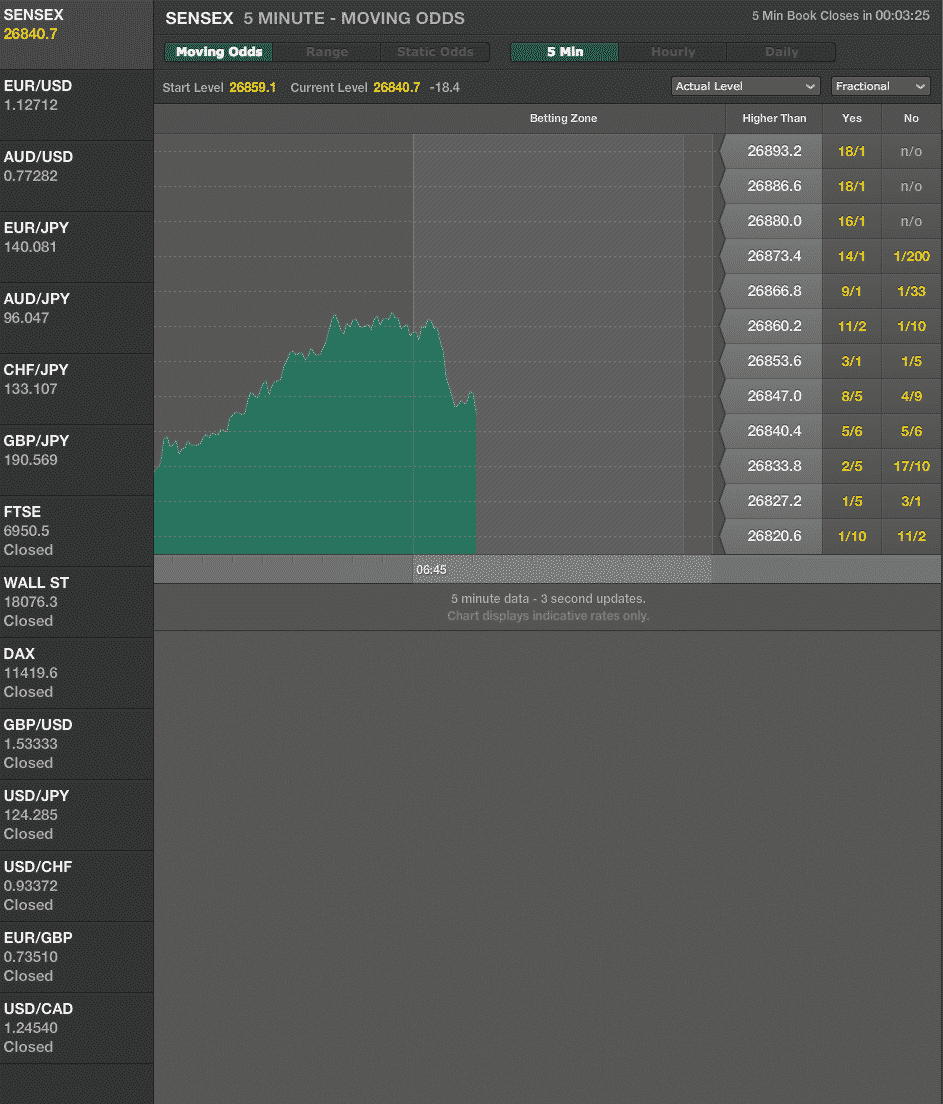

Interest in spread betting (red) and binary trading (blue) over time.

As you can see, binary trading is just recently coming into favor and has just now started to reach the levels of spread betting. Binary options are new, exciting and simplified way to trade.

Binary options and spread bets are similar in many aspects. They both allow traders to predict the price movements of a wide variety of underlying assets and risk money on those predictions. Neither binary options or spread bets actually purchase the underlying asset in question, they both just allow the trader a way to bet on the price movement.

Binary options are fixed risk contracts. This means when you place a binary option trade your profit and loss is fixed and can only turn out one of two ways. You can only win a certain amount or you can only lose a certain amount. This differs from financial spread betting wins and losses can be theoretically unlimited. If you do not set stop losses points to take profit with spread betting then you can win or lose based on the magnitude of price movement. You can learn more about them here . Actually, most of the content on this site is related to trading binaries in some form or fashion.

With binary options your risk and profit are limited. With spread betting you can win or lose depending on the magnitude of movement. With binary trading, magnitude of movement does not determine the payout amount. If you finish in the money by one pip, it is the same as finishing in the money by 50 pips. With spread betting, you would make considerably more money by earning a 50 pip move and considerably less with a 1 pip move as with spread betting you are usually betting a certain amount on each point move in your direction.

Binary options trading and financial spread betting are quite similar but operate somewhat differently. The main differences arise from the way that trades themselves functions. Both binary options and financial spread betting allow you to make a prediction about an underlying financial instrument and then win or lose money based off of what happens.

Let’s look at binary options first.

Binary options are known as fixed options because you risk a certain set amount of money and when you win, the payoff will be fixed at a certain percentage of your wager. If you lose, the amount of money you get back will also be fixed at a certain percentage. So say you are looking at the price of gold and you think it will go up during the expiry period. You choose High, or Up, or Call (they all mean the same thing) on your binary options trading platform and wager $100.00. If you win the trade and the payout percentage is 75%, you’ll win $75.00 If you lose, and the refund guarantee is fixed at 15%, you’ll get back $15.00 and lose $85.00.

Now consider how financial spread betting works.

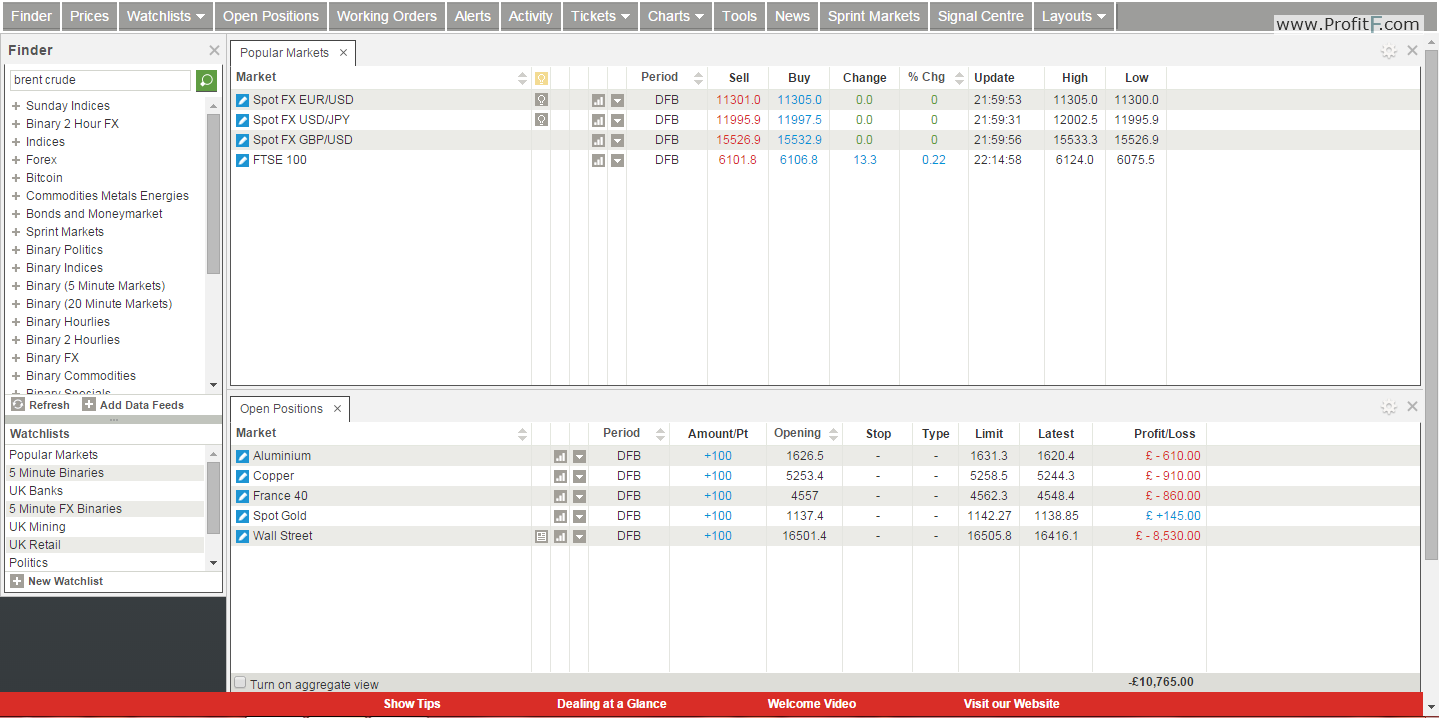

With financial spread betting you are betting on what a financial instrument will do. You can place a similar high or low trade. If you think the price is going up, you buy, if you think the price is going down you sell. The big difference is you do not fix your risk when you select how much money you’re wagering on an outcome with financial spread betting. Instead, your losses or wins can both theoretically be unbounded. This is very much like trading in other markets such as Forex. You place an entry, and your winnings or losses pile up according to a formula as the market moves in your direction or against your trade.

Spread betting takes another level of traders psychology in order to properly let your winning trades ‘run’ and stop your losing trades as fast as possible. With binaries it is a bit different because you can place this trade and walk away until the expiry and see if you won or lost. Your risk is automatically fixed with binaries, you have to fix your risk when spread betting with stop losses.

There are ways you can fix your risk and your rewards spread betting. You can set a stop loss, which will automatically close your position should it move against you by a certain amount. If you place a take profit, this will automatically close out a winning position once it has moved in your favor by a particular amount. In this way, you can prevent unlimited wins and losses.

This is why the notion that binary options are superior because “your risk is fixed” is a bit misleading. You can technically fix your risk while doing spread betting or some other trading activity as well.

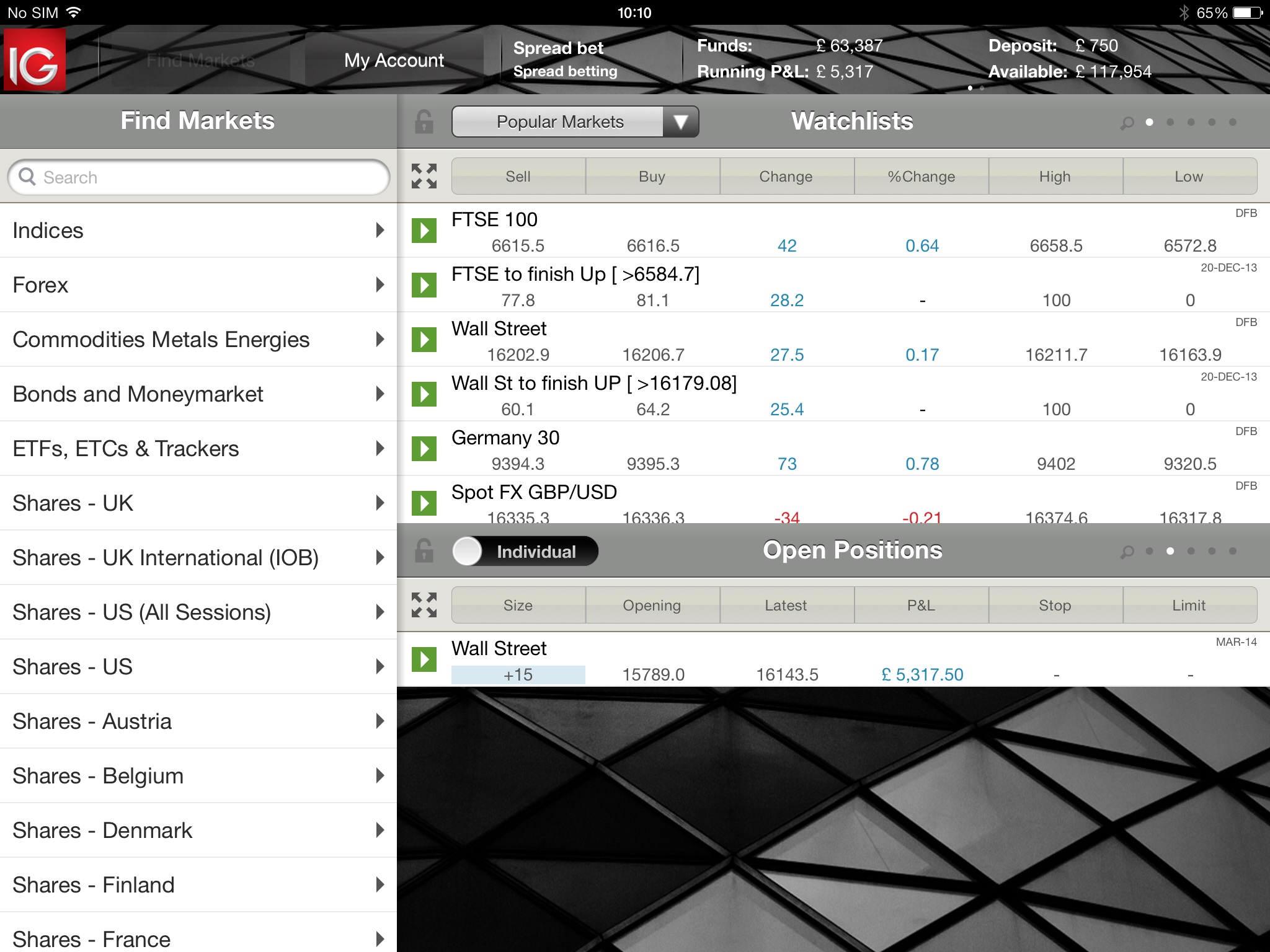

Which is better, financial spread betting or binary options? The real answer is it is up to you and your psychology. I like to say that binary options are simple, not easy. Simple to trade, but not easy to win.

Spread betting is more complicated. It is not as simple. It requires you to make more decisions about your trade because even a small trade can turn into a big trade if the price really starts moving. Which is better for you is the question you should ultimately be asking yourself.

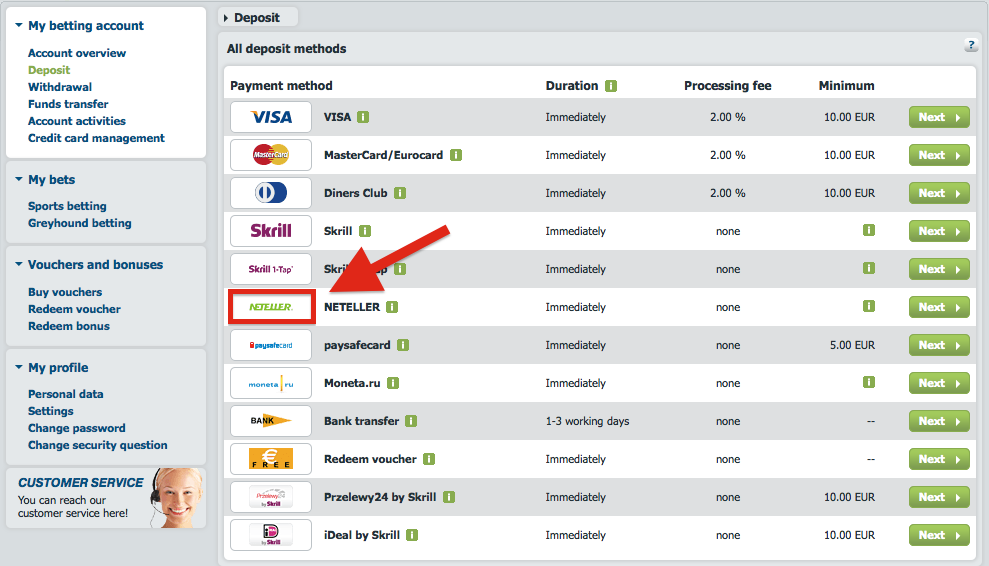

Both present traders with relatively simple concepts to comprehend, so you shouldn’t have a problem learning either. As a trader, you have your own unique trading personality, and that may be a determining factor in whether you trade binary options or do spread betting instead. There are other factors too which may drive your decision, including deposit requirements, minimum and maximum trade sizes, and so on. Every broker (whether they offer binary options or spread betting) has unique rules for every aspect of trading, so it may also be a question of which broker is best for you. Do some research, test some trades, and figure out for yourself what type of trading you like to do—it may even be a combination.

Most visited Forex reviews in 2021

Hotforex review

FBS review

EasyMarkets review

Binary betting - Wikipedia

Binary Options vs. Spread Betting - What's the Difference & Which Is Best?

What Is Spread Betting ?

BINARY BETTING

What is Spread Betting and How Does it Work? | CMC Markets

Spread betting allows traders to bet on the direction of a financial market without actually owning the underlying security. Spread betting is sometimes promoted as a tax-free, commission-free activity that allows investors to speculate in both bull and bear markets, but this remains banned in the U.S. Like stock trades, spread bet risks can be mitigated using stop loss and take profit orders.

Sponsored

Compete Risk Free with $100,000 in Virtual Cash

Put your trading skills to the test with our

FREE Stock Simulator.

Compete with thousands of Investopedia traders and trade your way to the top! Submit trades in a virtual environment before you start risking your own money.

Practice trading strategies

so that when you're ready to enter the real market, you've had the practice you need.

Try our Stock Simulator today >>

Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security.

Forex (FX) is the market where currencies are traded and is a portmanteau of "foreign" and "exchange." Forex also refers to the currencies traded there.

A bear put spread is a bearish options strategy used to profit from a moderate decline in the price of an asset. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling.

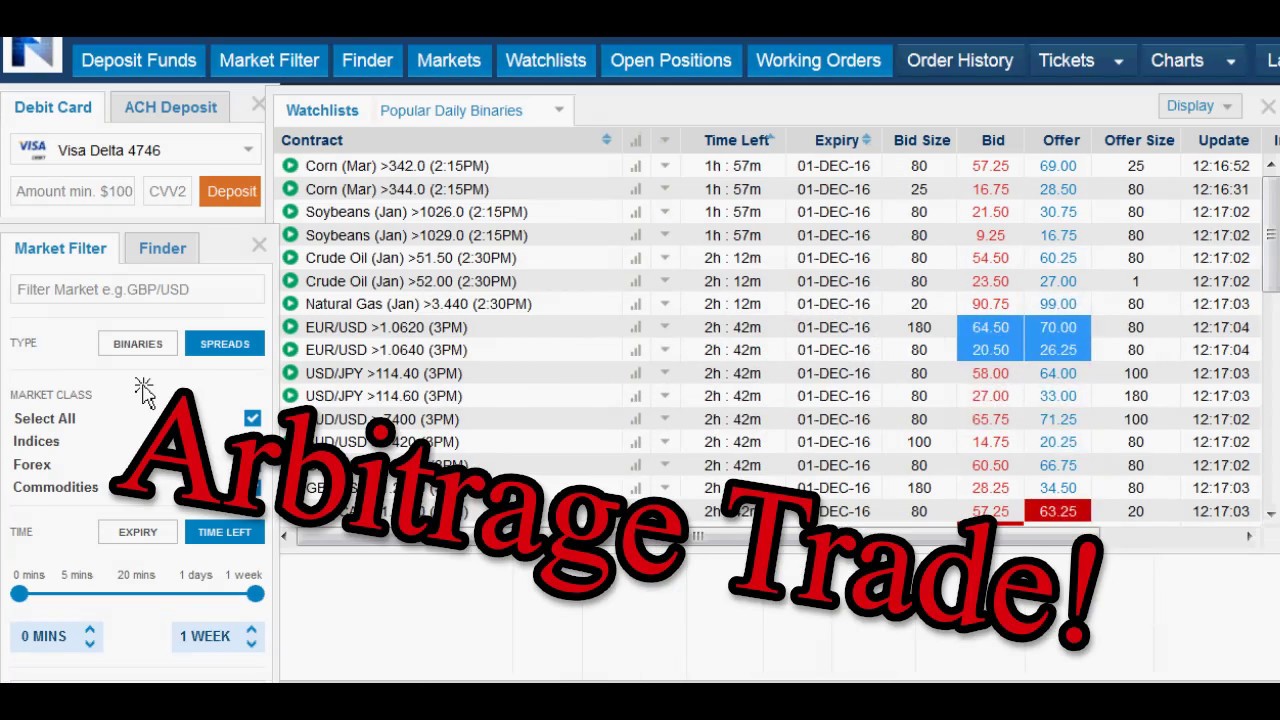

A cash-and-carry trade is an arbitrage strategy that exploits the mispricing between the underlying asset and its corresponding derivative.

Covered interest arbitrage is a strategy where an investor uses a forward contract to hedge against exchange rate risk. Returns are typically small but it can prove effective.

A bull spread is a bullish options strategy using either two puts or two calls with the same underlying asset and expiration.

#

A

B

C

D

E

F

G

H

I

J

K

L

M

N

O

P

Q

R

S

T

U

V

W

X

Y

Z

Investopedia is part of the Dotdash publishing family.

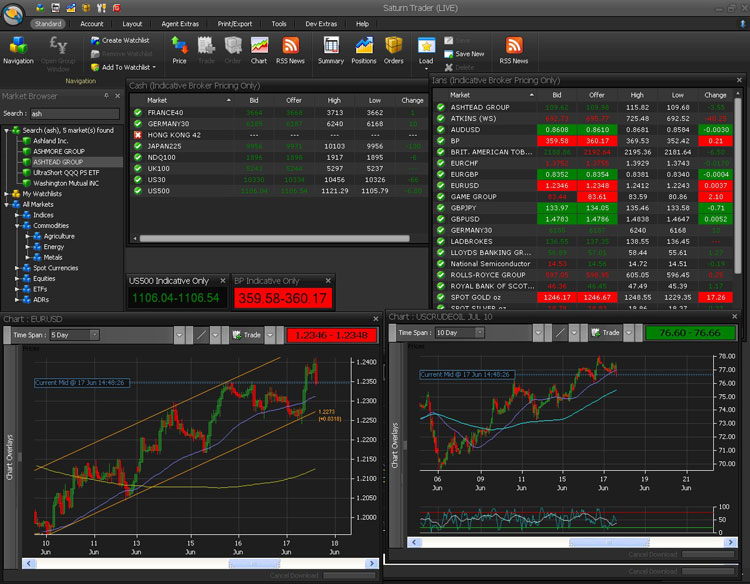

Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity. Rather, spread bettors simply speculate on whether the asset's price will rise or fall, using the prices offered to them by a broker.

As in stock market trading, two prices are quoted for spread bets—a price at which you can buy (bid price) and a price at which you can sell (ask price). The difference between the buy and sell price is referred to as the spread. The spread-betting broker profits from this spread, and this allows spread bets to be made without commissions, unlike most securities trades.

Investors align with the bid price if they believe the market will rise and go with the ask if they believe it will fall. Key characteristics of spread betting include the use of leverage, the ability to go both long and short, the wide variety of markets available, and tax benefits.

If spread betting sounds like something you might do in a sports bar, you're not far off. Charles K. McNeil, a mathematics teacher who became a securities analyst—and later a bookmaker—in Chicago during the 1940s has been widely credited with inventing the spread-betting concept. But its origins as an activity for professional financial-industry traders happened roughly 30 years later, on the other side of the Atlantic. A City of London investment banker, Stuart Wheeler, founded a firm named IG Index in 1974, offering spread betting on gold. At the time, the gold market was prohibitively difficult to participate in for many, and spread betting provided an easier way to speculate on it.

Despite its American roots, spread betting is illegal in the United States.

Let's use a practical example to illustrate the pros and cons of this derivative market and the mechanics of placing a bet. First, we'll take an example in the stock market, and then we'll look at an equivalent spread bet.

For our stock market trade, let's assume a purchase of 1,000 shares of Vodafone (LSE: VOD ) at £193.00. The price goes up to £195.00 and the position is closed, capturing a gross profit of £2,000 and having made £2 per share on 1,000 shares. Note here several important points. Without the use of margin, this transaction would have required a large capital outlay of £193k. Also, normally commissions would be charged to enter and exit the stock market trade. Finally, the profit may be subject to capital gains tax and stamp duty.

Now, let's look at a comparable spread bet. Making a spread bet on Vodafone, we'll assume with the bid-offer spread you can buy the bet at £193.00. In making this spread bet, the next step is to decide what amount to commit per "point," the variable that reflects the price move. The value of a point can vary.

In this case, we will assume that one point equals a one pence change, up or down, in the Vodaphone share price. We'll now assume a buy or "up bet" is taken on Vodaphone at a value of £10 per point. The share price of Vodaphone rises from £193.00 to £195.00, as in the stock market example. In this case, the bet captured 200 points, meaning a profit of 200 x £10, or £2,000.

While the gross profit of £2,000 is the same in the two examples, the spread bet differs in that there are usually no commissions incurred to open or close the bet and no stamp duty or capital gains tax due. In the U.K. and some other European countries, the profit from spread betting is free from tax.

However, while spread bettors do not pay commissions, they may suffer from the bid-offer spread, which may be substantially wider than the spread in other markets. Keep in mind also that the bettor has to overcome the spread just to break even on a trade. Generally, the more popular the security traded, the tighter the spread, lowering the entry cost .

In addition to the absence of commissions and taxes, the other major benefit of spread betting is that the required capital outlay is dramatically lower. In the stock market trade, a deposit of as much as £193,000 may have been required to enter the trade. In spread betting, the required deposit amount varies, but for the purpose of this example, we will assume a required 5% deposit. This would have meant that a much smaller £9,650 deposit was required to take on the same amount of market exposure as in the stock market trade.

The use of leverage works both ways, of course, and herein lies the danger of spread betting. As the market moves in your favor, higher returns will be realized; on the other hand, as the market moves against you, you will incur greater losses. While you can quickly make a large amount of money on a relatively small deposit, you can lose it just as fast.

If the price of Vodaphone fell in the above example, the bettor may eventually have been asked to increase the deposit or even have had the position closed out automatically. In such a situation, stock market traders have the advantage of being able to wait out a down move in the market, if they still believe the price is eventually heading higher.

Despite the risk that comes with the use of high leverage, spread betting offers effective tools to limit losses .

Risk can also be mitigated by the use of arbitrage, betting two ways simultaneously.

Arbitrage opportunities arise when the prices of identical financial instruments vary in different markets or among different companies. As a result, the financial instrument can be bought low and sold high simultaneously. An arbitrage transaction takes advantage of these market inefficiencies to gain risk-free returns.

Due to widespread access to information and increased communication, opportunities for arbitrage in spread betting and other financial instruments have been limited. However, spread betting arbitrage can still occur when two companies take separate stances on the market while setting their own spreads.

At the expense of the market maker, an arbitrageur bets on spreads from two different companies. When the top end of a spread offered by one company is below the bottom end of another’s spread, the arbitrageur profits from the gap between the two. Simply put, the trader buys low from one company and sells high in another. Whether the market increases or decreases does not dictate the amount of return.

Many different types of arbitrage exist, allowing for the exploitation of differences in interest rates, currencies, bonds, and stocks, among other securities. While arbitrage is typically associated with risk-less profit, there are in fact risks associated with the practice, including execution , counterparty, and liquidity risks. Failure to complete transactions smoothly can lead to significant losses for the arbitrageur. Likewise, counterparty and liquidity risks can come from the markets or a company’s failure to fulfill a transaction.

Continually developing in sophistication with the advent of electronic markets, spread betting has successfully lowered the barriers to entry and created a vast and varied alternative marketplace.

Arbitrage, in particular, lets investors exploit the difference in prices between two markets, specifically when two companies offer different spreads on identical assets.

The temptation and perils of being overleveraged continue to be a major pitfall in spread betting. However, the low capital outlay necessary, risk management tools available, and tax benefits make spread betting a compelling opportunity for speculators.

Options Trading Strategy & Education

Outdoor Basketball

Russian Teen Anal Outdoor

Booty Penetration Tube

Porno Realitykings Hg

Neiva Mara Private