Binance Coin (BNB) fundamental analysis

What are the fundamentals of BNB?BNB is the native token of the Binance chain. Mainly used as a means of payment for transactions, it is also used in validating the network to obtain rewards from staking and discounts on the Binance Exchange.

BNB: introduction and history

BNB is the native coin of the Binance Chain and allows the Binance ecosystem to function. If we wanted to see Binance and its equipment as a machine, BNB would be the fuel.

Let's go through the history of Binance's coin quickly to understand how the use cases of this token have evolved over time:

It was born in 2017 as an ERC-20 token, with the aim of reducing trading fees on the Binance Exchange for BNB holders. It was launched with a total supply of 200,000 million of which 100,000 distributed through ICOs.

Only later, with the launch of the Binance chain in 2018, the asset was traded in a 1: 1 ratio on the BEP-2 (Binance Chain) network, becoming the native asset of the network.

Finally, in 2020, Binance launched an EVM-compatible chain, the Binance Smart Chain, a network that operates in parallel to the Binance Chain where smart contracts are powered by BNB.

We can therefore find the token in different formats, which allows BNB to also be an excellent means of transferring value from one chain to another, the formats are ERC-20 therefore EVM compatible: BEP-2 on Binance Chain and BEP- 20 instead for BSC.

Now that we have seen the evolution of this coin over time, let's go into its specific use cases.

Index

What are the use cases for BNB?

Tokenomics and supply

Auto-Burn

Conclusions

What are the use cases for BNB?

BNB is the reference coin of the Binance ecosystem, mainly used to access advantages on trading fees, it has also been accepted as a form of payment at third-party sites, thanks to the speed and low transaction costs, but let's make a list of what are the use cases:

Used to pay fees on the Binance Exchange;

Means of payment for trading fees on Binance DEX (Decentralized Exchange);

Used to pay for transaction costs on the Binance Chain;

Used to pay for transaction costs on the Binance Smart Chain;

A means of payment for goods or services through payment gateways (e.g., using Binance Card or Binance Pay);

Book hotels and flights on Travala.com;

IT holds the role of utility token on various platforms in the BSC (Games and DApps);

Allows you to participate in token sales reserved for the Binance community (Binance Launchpad);

You can donate through Binance Charity;

Used to provide liquidity with Binance Liquid Swap.

Once the Binance Chain was introduced, BNB became the scarce element with which to secure the network, both in the validation phase and in the delegation phase.

Tokenomics and supply

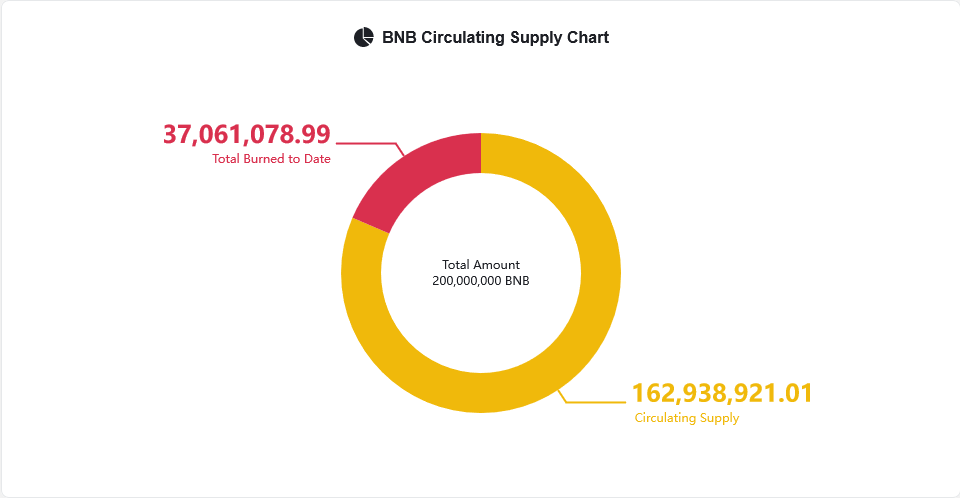

The total supply of BNB was set by the whitepaper at 200 million tokens, however planning a progressive reduction of the supply up to a maximum of 100 million tokens.

This supply reduction took place as a function of the revenue generated by Binance, causing a gradual decrease of the supply and increasing the scarcity of the asset. To date, a new mechanism has been introduced that we will see later.

As of today, these are the data avaible for us on coinmarketcap.

This reduction occurs approximately every quarter, following a procedure called Auto-Burn: a mechanism by which a defined number of tokens are subtracted from circulation, sending them to an address without private keys and thus making them permanently inaccessible.

On the Binance chain, BNB is used as a means of paying fees, including those associated with the Binance DEX and asset transfer fees. Furthermore, it is central to the security of the Network through the delegated proof of stake consensus mechanism.

Within the Binance Smart Chain, BNB plays a role similar to that of ETH in Ethereum:

It is used to develop and interact with smart contracts

It allows you to transfer crosschain assets, for example between the Binance Smart Chain and the Binance Chain

Furthermore, it is the means by which the delegators share the power of securing the network with the validators, sharing the rewards generated.

It has practically the same functions on both chains, except that the BSC (now named BNB-chain) is natively open to interoperability, while the Binance Smart Chain is a more specialized layer.

Auto-Burn

At the base of BNB's economy is the concept of Burn, a mechanism through which the total supply is programmatically reduced, removing a variable number of tokens from circulation approximately every quarter, until reaching a reduction of 50% and reaching the goal of a total supply of 100 million tokens.

The burn is the mechanism by which a number of BNBs are sent to an address in a definitive and irreversible manner in order to reduce the total offer. This was done quarterly following the trading volume generated on the Binance Exchange. With the introduction of Auto-Burn, the number of BNB to burn is established according to the price of BNB and the number of blocks generated during the quarter.

When BNB ran on the Ethereum network as an ERC-20 token, the burn was called via a smart contract; with the transition to the Binance Chain and subsequently to the BSC, the burn is performed automatically on the Binance Chain via the Auto-Burn command.

To date, 19 BNB burn events have been carried out, reducing the total supply by 37.061.078,99 BNB, thus bringing it to 162.938.921,01 BNB, a decrease of over 18.5%.

Conclusions

Binance is now a global reality. It counts, at the end of 2021, about 2 million active users and 7 million daily transactions: this is due to the ease of use of the system and the numerous applications. There are about 402 dapps across the network that make the user experience affordable for everyone, and its TVL is the 2nd larger in all Defi.

Best 20 Dapps per TVL

2nd largest TVL share Chain

The future of Binance is infact not only linked to the exchange: the BSC has grown dramatically last years, bringing huge innovations in the DeFi, NFT and gaming fields and allowing the entire Binance system to rest on another pillar. BNB in all this is the token used for exchanges and validation of all transactions.

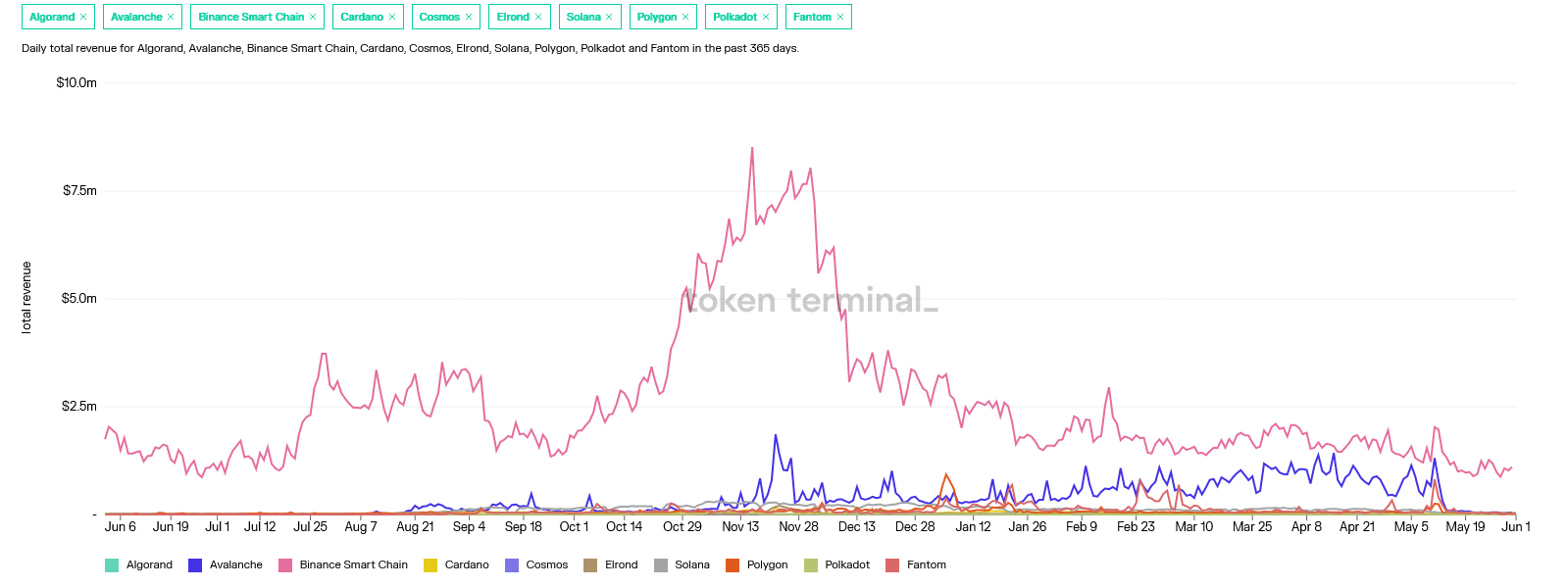

As of today, Ethereum excluded, BNB chain is still the biggest asset for total revenue on the chain compared to other L1s.

Once we have obtained BNB we have many possibilities suitable for every investor profile: it can be held and brought to cold storage, it can be staking to earn rewards directly in BNB or in partner tokens, in addition to this it can be exchanged against hundreds of other tokens. in different exchanges. Finally, like all other digital assets, it can be sent, donated or used to be spent on third-party sites. A token for every need, within the most solid ecosystem of the crypto sector.

Let us remember, however, that although Binance is not properly centralized, having shown that it also wants to bring decentralized products to the market that do not rely on third parties for network security, network validators are few and often, behind large international companies, there are interests hidden from most users. The rewards generated by the network are often shared among the most influential stakeholders, while small investors have to share what remains.