Betting Second Spread

🔞 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Betting Second Spread

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. High volatility increases the risk of sudden, large or rapid losses.

To prioritise the service we give our existing clients, IG is not currently allowing any new positions on GameStop and AMC Entertainment.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. High volatility increases the risk of sudden, large or rapid losses.

To prioritise the service we give our existing clients, IG is not currently allowing any new positions on GameStop and AMC Entertainment.

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies. You can view our cookie policy and edit your settings here , or by following the link at the bottom of any page on our site.

Speculate on whether an asset’s price will rise or fall with spread bets. Discover everything you need to know about what spread betting is and how it works.

Start trading today. Call 0800 195 3100 or email newaccounts.uk@ig.com . We’re here 24 hours a day, from 8am Saturday to 10pm Friday.

Spread betting is a popular derivative product you can use to speculate on financial markets – such as forex, indices, commodities or shares – without taking ownership of the underlying asset. Instead, you’d be placing a bet on whether you think the price will rise or fall.

We invented financial spread betting in 1974, and today we enable you to take advantage of over 17,000+ markets, whether they are rising or falling in price. This gives you a much wider range of opportunities than traditional buy-and-hold investing . Plus, as you won’t be taking ownership of the asset, spread betting is tax-free.*

Ready to start spread betting? Open an account

Spread betting works by tracking the value of an asset, so that you can take a position on the underlying market price – without taking ownership of the asset. There are a few key concepts about spread betting you need to know, including:

Going long is the term used to describe placing a bet that the market price will increase over a certain timeframe. Going short or ‘shorting’ a market is the reverse – placing a bet that the market will decline.

So spread betting enables you to speculate on both rising and falling markets. You would buy the market to go long, or sell the market to go short.

Let’s say you thought the price of gold was going to decline. You could open a spread bet to ‘sell’ the underlying market. The loss or gain to your position would depend on the extent to which your prediction was correct. If the market did decline, your spread bet would profit. But if the price of gold increased instead, your position would make a loss.

Leverage enables you to gain full market exposure for a fraction of the underlying market cost.

Say you wanted to open a position on Facebook shares. As an investor that would mean paying the full cost of the shares upfront. But by spread betting on Facebook shares instead, you might only have to put down a deposit worth 20% of the cost.

It’s important to note that leverage magnifies both profits and losses as these are calculated based on the full value of the position, not just the initial deposit. To manage your exposure, you should create a suitable risk management strategy and to consider how much capital you can afford to put at risk.

When you spread bet, you put down a small initial deposit – known as the margin – to open a position. This is why leveraged trading is sometimes referred to as ‘trading on margin’.

There are two types of margin to consider when spread betting:

Spread betting has three main features: the spread, bet size and bet duration. The spread is the charge you’ll pay for a position, the bet size is the amount of money you want to put up per point of market movement, and the bet duration is how long your position will remain open before it expires.

The spread is the difference between the buy and sell prices, which are wrapped around the underlying market price. They’re also known as the offer and bid. The costs of any given trade are factored into these two prices, so you’ll always buy slightly higher than the market price and sell slightly below it.

For example, if the FTSE 100 is trading at 5885.5 and has a one-point spread, it would have an offer price of 5886 and a bid price of 5885.

The bet size is the amount you want to bet per unit of movement of the underlying market. You can choose your bet size, as long as it meets the minimum we accept for that market. Your profit or loss is calculated as the difference between the opening price and the closing price of the market, multiplied by the value of your bet.

We measure the price movements of the underlying market in points. Depending on the liquidity and volatility of your chosen market, a point of movement can represent a pound, a penny, or even a one hundredth of a penny. You can find out what a point means for your chosen market on the deal ticket.

If you open a £2 per point bet on the FTSE 100 and it moves 60 points in your favour, your profit would be £120 (£2 x 60). If it moved 60 points against you, your loss would be £120.

The bet duration is the length of time before your position expires. All spread bets have a fixed timescale that can range from a day to several months away. You’re free to close them at any point before the designated expiry time, assuming the spread bet is open for trading.

Ready to start spread betting? Open an account

Say Apple is trading with a sell price of 11550 ($115.50) and a buy price of 11560 ($115.60). You anticipate that Apple shares are going to rise in the next few days, so decide to go long on (buy) Apple shares for £10 per point of movement at 11560.

If Apple shares did rise in price, you might decide to close your trade when the sell price hits 11590. As the market has increased by 30 points (11590 – 11560), you’d be coming out with a profit of £300 (30 x £10), excluding any additional costs.

If the market had fallen in value instead – down to a sell price of 11,510 – you would have ended up with a loss. As the market had moved by 50 points (11,560 – 11,510), you would have made a loss of £500 (50 x £10). Again, not including any additional charges.

Yes, if your prediction of whether the market will rise or fall is correct, you’ll profit and if it’s incorrect, you’ll lose.

It is important to remember that all forms of trading carry risk. So, although spread betting provides opportunities for profit, you should never risk more than you can afford to lose.

When you hedge using a spread bet, you open a position that will offset negative price movement in an existing position. This could be trading the same asset in the opposite direction, or on an asset that moves in a different direction to your existing trade.

For example, if you were worried that inflation might impact the value of your share portfolio, you might decide to take a long position on gold – an asset that typically has an inverse correlation with the dollar and can protect portfolios from inflation. If your shareholdings did decline, the profits from your spread bet on gold could offset any losses. But if your shareholdings rose in value instead, this profit could offset any potential loss to your gold spread bet.

Spread bets are not taxed.* Traditionally, when you buy and sell shares you have to pay stamp duty and capital gains tax on any profits that you make, but spread bets are tax-free. And because you don’t take ownership of the underlying asset, you won’t have to pay stamp duty either.

Spread betting is a bet on the future direction of a market, while a CFD is an agreement to exchange the difference in the price of an asset from when the contract is opened to when it is closed. There are a range of similarities and differences between these two derivative products.

Leverage is an inherent part of spread betting, so you can’t open a position without it. Before you start trading on leverage, it’s a good idea to build up your knowledge on the subject and create a risk management strategy.

Dividend payments have no impact on your spread betting position. If you hold a spread bet open on an equity or index when a dividend payment takes place, we’ll make an adjustment to your position. This means that capital will either be credited or debited to your account if a dividend is paid, depending on whether you have incurred additional running loss/profit.

Find out more about spread betting and test yourself with IG Academy’s range of online courses.

Discover the differences between spread betting and CFD trading

Learn about risk management tools including stops and limits

Browser-based desktop trading and native apps for all devices

* Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

The value of shares, ETFs and ETCs bought through a share dealing account, a stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting back less than you originally put in. Past performance is no guarantee of future results.

CFD, share dealing and stocks and shares ISA accounts provided by IG Markets Ltd, spread betting provided by IG Index Ltd. IG is a trading name of IG Markets Ltd (a company registered in England and Wales under number 04008957) and IG Index Ltd (a company registered in England and Wales under number 01190902). Registered address at Cannon Bridge House, 25 Dowgate Hill, London EC4R 2YA. Both IG Markets Ltd (Register number 195355) and IG Index Ltd (Register number 114059) are authorised and regulated by the Financial Conduct Authority.

The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

What Is Spread Betting ?

What is Spread Betting and How Does it Work? | IG UK

Spread Betting For Maximum PROFIT! - Learn 2 Trade January 2021

What is Spread Betting and How Does it Work? | CMC Markets

What is spread betting ? | Capital.com

Learn 2 Trade 2021 Guide On Spread Betting!

Note: Although spread betting sites allow you to trade with more than you have in your account through a margin system, this also means that you will lose your entire stake if your trade is liquidated.

Deposit as little as $10 to start trading

Super-low commissions and tight spreads

Trade forex, crypto, commodities, and indices

Fully supported by MetaTrader 4

1. IG –Best All-Round Spread Betting Broker

75% of retail investors lose money when trading CFDs with this provider

2. Spreadex – Spread Betting on Financial Markets & Sports

You will need to pass a credit check if applying leverage

No support for e-wallets

75% of retail investors lose money when trading CFDs with this provider

3. City Index – Best Spread Betting Trading Platform

75% of retail investors lose money when trading CFDs with this provider

4. CMC Markets - Spread Betting Broker With Risk Management Tools

Thousands of financial markets supported

Risk-free demo accounts

Listed on the London Stock Exchange

75% of retail investors lose money when trading CFDs with this provider

5. FXCM– Best Low Stakes Spread Betting Broker

Spreads from just 0.6 pips

Leverage of between 2:1 and 30:1

Low stakes of just 7p per point

Selection of markets is quite small

75% of retail investors lose money when trading CFDs with this provider

Deposit as little as $10 to start trading

Super-low commissions and tight spreads

Trade forex, crypto, commodities, and indices

Fully supported by MetaTrader 4

Learn 2 Trade is a trading name of Gadget Geek Online Ltd

+44 (0) 203 146 8423

support@learn2.trade

20-22 Wenlock Road, London N1 7GU Registered Company Number: 11746374

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it. Ok Privacy policy

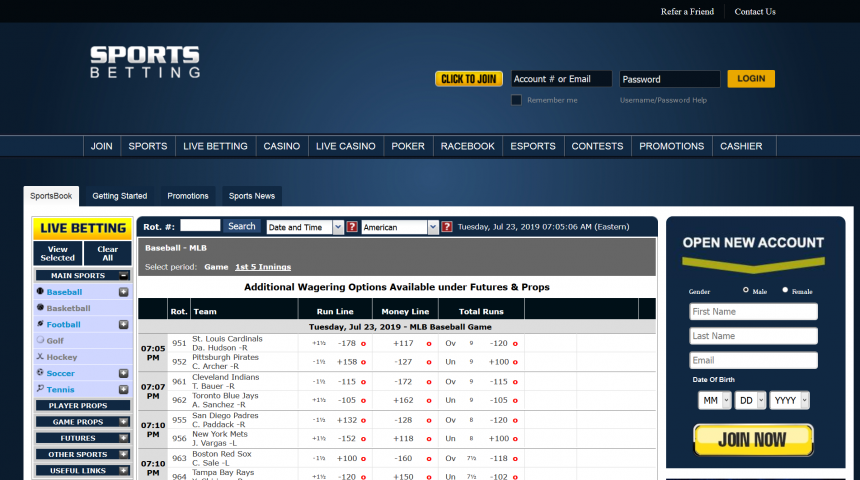

Spread betting platforms allows you to speculate on the future price of a financial instrument without you owning the underlying asset. This includes everything from gold, oil, natural gas, stocks, indices, and cryptocurrencies.

The overarching concept is that you need to determine whether you think the asset will go up or down in relation to its current price. If you’re correct, your profit is calculated by taking your stake-per-point, by the number of points the asset increased by.

Traders often opt for spread betting brokers because in most jurisdictions – gains are tax-free. Moreover, not only can you trade without paying any commissions, but spreads are usually much more competitive than traditional investment avenues.

With that said, spread betting can appear somewhat confusing at first glance if you’ve never dabbled in the space. As such, we would suggest reading our Learn 2 Trade 2021 Guide On Spread Betting – where we explain everything you need to know.

LonghornFX – Best Forex Trading Platform

Spread betting is a form of trading – similar to that of CFDs. This is because you will have access to thousands of financial instruments, which you can trade without taking ownership of the asset. The main concept is that you need to speculate on whether you think the asset will increase or decrease in value – in relation to its current market price.

For example, if the FTSE 100 is trading at 2,700 points – a ‘long’ order would indicate that you think the index will increase in value. Alternatively, if you placed a ‘short’ order, you think the opposite. Before you place your respective order, you also need to enter a stake.

In the world of spread betting, your trade size is expressed as a ‘stake-per-point’. Then, for each point that you are correct or incorrect by, is multiplied by your stake. For example, if you staked £1 per point on the FTSE 100, and you closed the trade at 2,800 points, this would mean that you won £100.

This is because the FTSE 100 ended up 100 points higher (2,800 – 2,700), and your stake-per-point was £1. At the other end of the spectrum, if you went short – your total loss would have also stood at £100 – as you were wrong by 100 points.

Spread betting operates on a points system, where your profits or losses are based on the number of points you were over or under on the trade. Confused? Well, let’s say that you were trading Nike stocks at $85.50. In spread betting terms, $85.50 would translate to 85.5 points. Then, let’s say that you went ‘long’, which means you think Nike stocks will increase in value.

If you then closed your trade when Nike was priced at 87.0 points (or $87.00), your spread betting trade was successful by 15 points. This is because in this example – each point was based on every $0.10 that the stock went up by. So, if we staked £1 per point, we would have walked away with a profit of £15 (15 points x £1).

Similarly, if you staked £5 per point, your successful Nike stock trade would have netted £75 in profit (15 points x £5). There is, of course, the possibility that your spread betting trades will sometimes go against you. In other words, had the value of Nike stocks gone down , you would have lost money.

For example, let’s say you cashed out your trade when Nike was priced at $82.50. As this translates to a loss of 30 points (85.5 – 82.5), a £1 stake would have lost you £30. In fact, there is no limit to the amount you can lose in spread betting – as trades are based on margin.

Let’s look at a couple of other examples to clear the spread betting mist.

In our first example, we are going to be trading oil. We think that at $28.0 per barrel, the commodity is heavily undervalued. With rumours of a reduction in production output by OPEC and Russia, you decide to go long. This means you think the price of oil will increase against its current price of $28.0 – or 28.0 points.

As we noted earlier, spread betting trades won’t always go in your favour – so we now need to look at an unsuccessful example.

To keep things simple, we’ll stick with the same example as above, where oil is priced at $28.0 or 28.0 points. Only this time, things don’t go to plan.

This is a prime example of how easy it is to lose money when you engage with spread betting. On the flip side, you can easily mitigate your risks by installing a sensible stop-loss order. As we cover in more detail later, this allows you to automatically exit your trade when the markets go against you by a pre-defined percentage.

In a similar nature to CFDs, spread betting brokers give you access to thousands of financial markets. This ensures that you are able to create a diversified portfolio of holdings – 24 hours per day.

Below we have listed some of the most popular asset classes that you can trade at a spread betting site.

Stocks: You can spread bet thousands of blue-chip equities across dozens of marketplaces. Think along the lines of the LSE, NASDAQ, and NYSE.

Indices: If you want to trade the wider stock markets, spread betting platforms also host indices. This includes the S&P 500, Dow Jones, FTSE 100, and NASDAQ 100.

Energies: You can also trade energies. This includes the main oil and natural gas markets.

Hard Metals: The hard metals space includes everything from gold, oil, and copper.

Agriculture: If you want to gain exposure to agriculture products like wheat, crops, sugar, and grain – spread betting platforms typically support these markets.

ETFs: Further highlighting just how extensive spread betting platforms are – you can also trade ETFs.

Currencies: In a similar nature to forex trading sites, spread betting brokers also allow you to speculate on the future direction of popular currency pairs like GBP/USD and EUR/USD.

Cryptocurrencies: Some spread betting sites also allow you to trade the future value of popular cryptocurrencies like Bitcoin and Ethereum.

So now that you know the basics of spread betting, we now need to look at some of the key terms that you are all-but-certain to come across.

First and foremost – make sure that you know your longs from your shorts. As we briefly covered earlier, going long on a market means that you think the asset will increase in price. This is the same as placing a ‘buy’ order when trading CFDs, or a ‘call option’ when investing in an options contract.

If you went short on a spread betting market, this means that you think the asset will go down in value. Once again, this would equate to a ‘sell’ order when trading CFDs, or a ‘put option’ in the options trading space.

Spread betting platforms allow you to trade with more money than you actually have in your account. For example, let’s say that you wanted to buy £1,000 worth of Disney stocks. Ordinarily, if you bought £1,000 worth of shares with an online stockbroker, you would get £1,000 worth of shares.

However, spread betting sites allow you to apply leverage to your trades – so your £1,000 balance would allow you to trade with significantly more.

Crucially, trading on margin can go one of the two ways. You either win your spread betting trade and amplify your winnings, or you get liquidated and lose your margin.

For example, if you went long on Disney stocks and the price increased by 20%, you would have made a total profit of £200 (20% of £1,000). However, as you applied leverage of 10:1, your profit was actually £2,000 (£200 x 10).

If the markets went the other way, and Disney stocks went down by 10%, you would have lost your margin. As such, the trade would have been liquidated and the broker would have kept your £1,000 margin.

Much like any other investment channel in the financial markets, you must have a firm grasp of the ‘spread’ when spread betting online. For those unaware, this is the difference between the buy and sell price of an asset. In the case of spread betting, it’s the difference between the ‘long’ and ‘short’ entry price – and it’s always expressed in points.

For example, let’s say that you are trading oil.

As per the above example, this means that you need to make gains of at least 30 points(1.11%) on your spread betting trade just to break even. This is expensive.

The good news is that the spread betting brokers recommended on this page offer spreads that are significantly more competitive than this.

You also need to assess the ‘bet duration’ before placing a spread betting trade. As the name suggests, this merely refers to the duration of your bet. This usually comes in one of two forms – a daily funded bet or a quarterly bet.

The greatest risk that you face when spread betting is having your trade liquidated. Although we briefly covered how this works earlier, it’s important for us to expand. After all, a liquidated trade will result in you losing your entire margin.

So, the first thing that we need to do is assess how much margin we are actually required to put up in percentage terms.

On the one hand, it’s great that you are able to trade £5,000 worth of Apple stocks by putting a deposit of just £500 down. However, if the markets go against you, that £500 is at risk of being lost in its entirety. In fact, this would happen if the price of Apple went down by 10%, as this would amount to a real-world reduction of £500.

Before you get to the point of liquidation, the spread betting broker will give you the option of adding more money to your margin account. For example, if you added a further £200, this would require the price of Apple stocks to decline by an additional £200 before your trade is closed.

On the flip side, if you opted against adding more funds to your margin, and your Apple trade hit that 10% liquidation trigger price, the broker would close your trade and retain your £500 margin.

The good news is that you can install a stop-loss order to ensure you never get liquidated. Instead, you can opt to exit your spread betting trade when the asset goes against you by a smaller amount. For example, instead of having your trade closed at the liquidation rate of 10%, you could put your stop-loss order in at 2%.

Here’s how a stop-loss order works in practice when spread betting:

As per the above, a ‘worst-case-scenario’ would be Apple stocks going down in value by 2%. If it did, you would lose £200 and the trade would be closed (2% of £10,000 trade size). Although you still lost money, if the stop-loss order wasn’t in place, you could have potentially lost your entire margin – which is £1,000.

Unlike traditional stocks, CFDs, or forex – spread betting profits are usually exempt from tax. This is because the industry is viewed as gambling, as opposed to conventional trading.

As such, if you live in a country where gambling winnings are tax-free, this is hopefully the case with spread betting, too. However, you are strongly advised to check this with a tax specialist in your respective country.

If you’ve read our guide up to this point, and you think that spread betting is right for long-term investment goals – we are now going to show you what you need to do to get started today.

If you want to spread bet online, you will need to find a suitable broker. Most spread betting platforms also support CFDs, so you’ll likely be using a hybrid site.

Nevertheless, with dozens of spread betting sites active in the online arena, you need to ensure that the platform is right for you. This should include metrics like regulation, payment methods, tradable instruments, fees, and customer support.

To help you along the way, we’ve listed our top five spread betting brokers of 2021 towards the bottom of this page.

Once you have found a spread betting platform that meets your needs, you will then need to open an account. Much like any other investment site, the process will require some personal information from you.

As spread betting is a sophisticated investment arena, the broker will likely ask you some multiple-choice questions to gauge your prior experience. This is to ensure you fully understand the risks associated with spread betting.

Before you can place your first spread betting trade, you will need to verify your identity. In most cases, you can do this by quickly uploading a clear copy of your passport or driver’s license.

Some brokers will also ask for a proof of address. If they do, you can upload a recent bank account statement or utility bill.

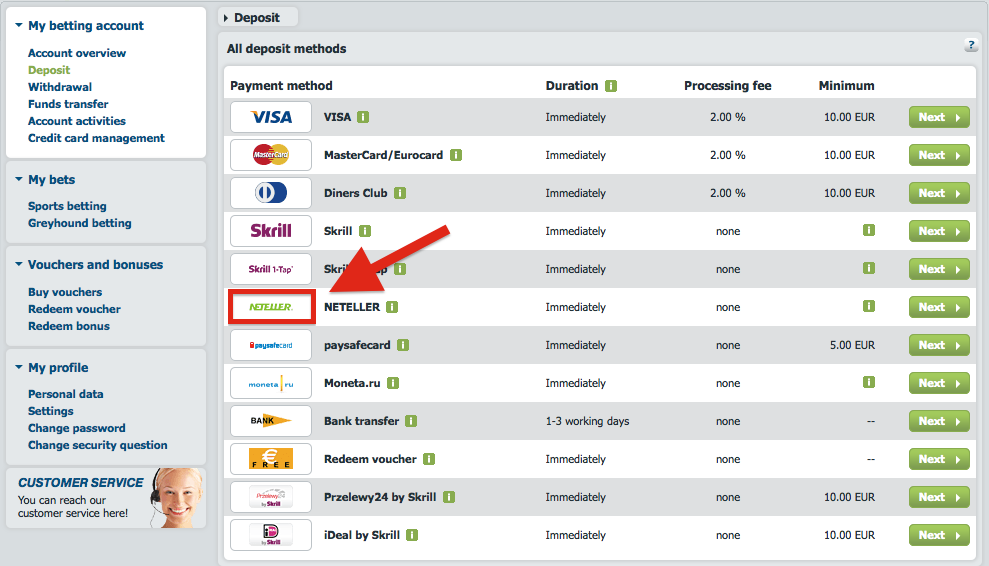

You will now be asked to fund your spread betting account. Most platforms will ask you to meet a minimum deposit amount – which is usually in the £50-£150 range.

In terms of deposit options, this often includes the following:

Apart from the bank account transfer option, deposits are usually credited to your spread betting account instantly.

Once you have deposited funds, you can then place your first spread betting trade. You can browse the many spread betting markets offered by the broker, or simply enter the financial instrument into the search box.

Once you’ve found the asset you wish to trade, you’ll need to set up an order.

Once your trade is live, you can close it at any point by placing an opposite order. For example, if you went long, place a short order to close the trade – and visa versa.

Want to start spread betting right now, but not sure which platform to use? Below you will find our top five spread betting sites of 2021. All of our top-picks are heavily regulated, give you access to thousands of financial instruments, and allow you to easily deposit funds with a debit/credit card.

Our top pick goes to IG. launched in 1974 - the UK-based broker offers CFDs, forex, and spread betting trading. In fact, you'll have access to over 17,000 individual markets, which is huge.

As such, whether you're looking to spread bet currencies, stocks, indices, and gold - IG likely has a market for you. Minimum deposits start at £250, and you can fund your account with a debit/credit card or bank account. The platform is regulated by licensing bodies in the UK, Singapore, and Australia.

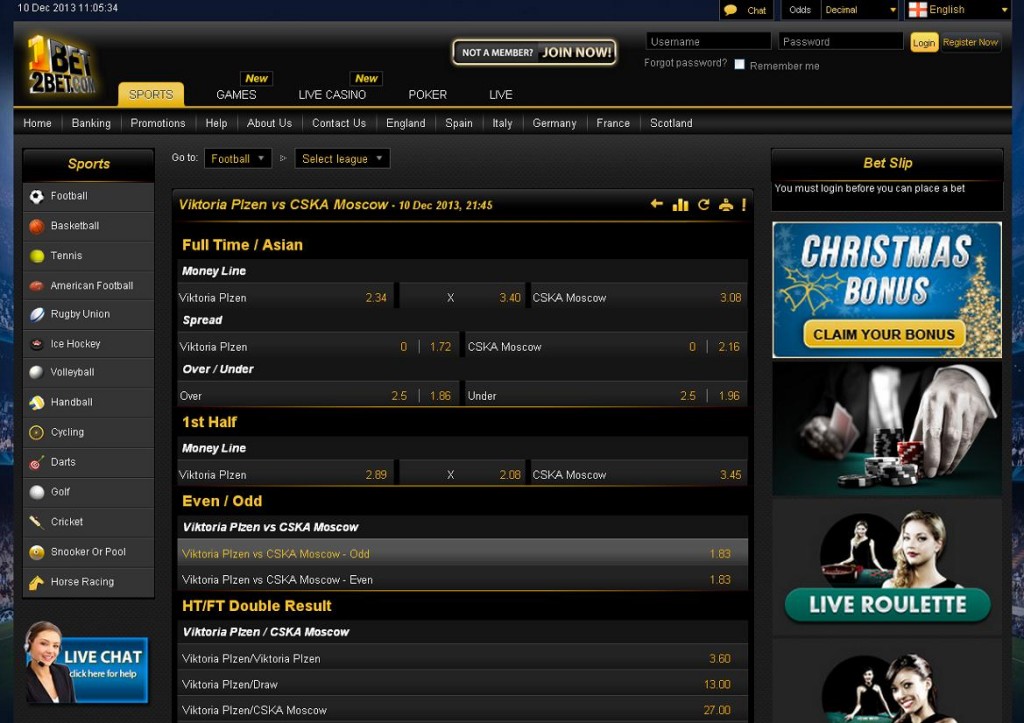

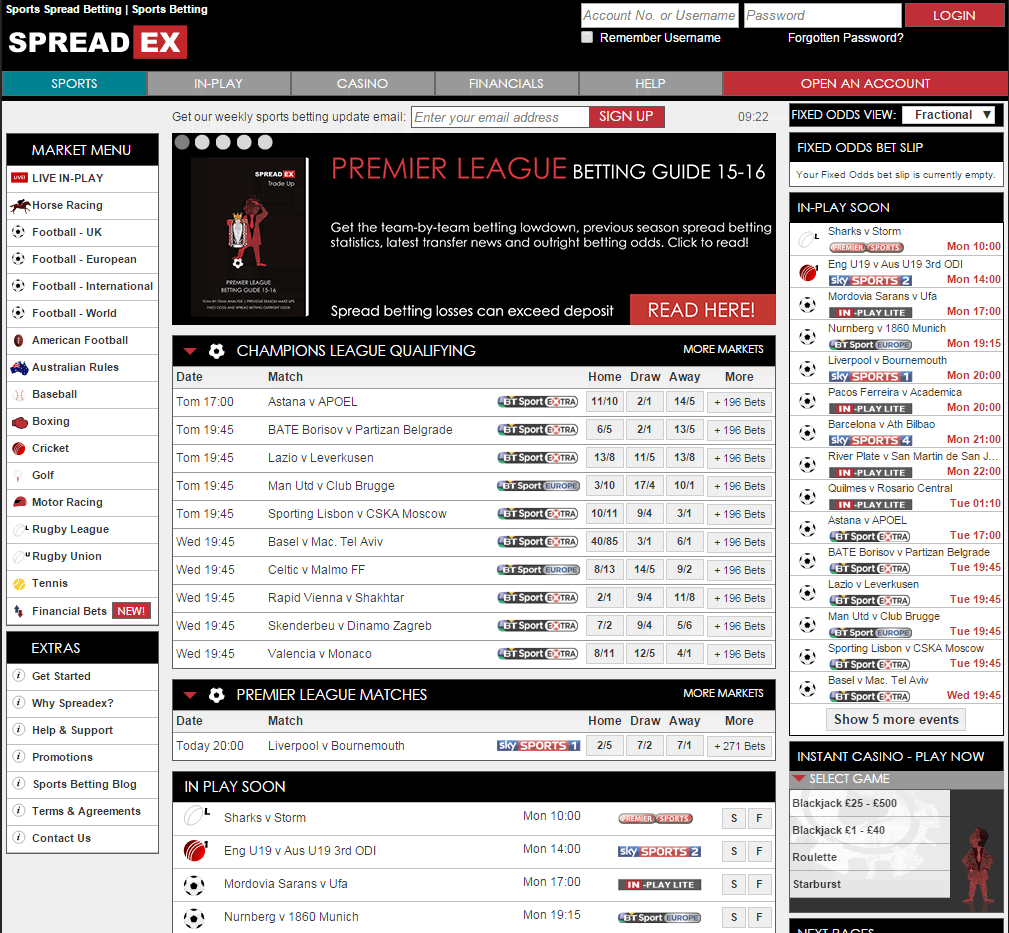

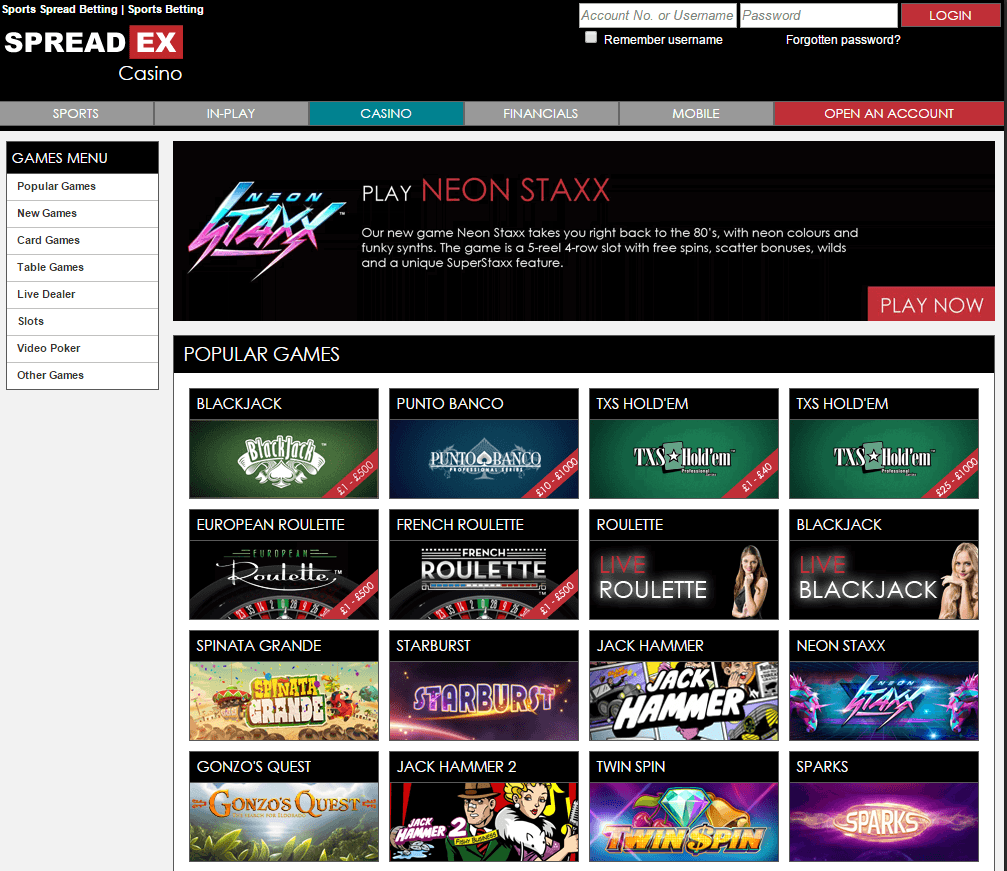

Spreadex is a specialist spread betting platform that covers traditional financial markets and sports.

With more than 10,000 indicidual spread betting instruments, most asset classes are covered. You can place a spread bet from just 10p per point, and minimum deposits start at £1. Multiple payment methods are supported, and the broker holda a license with the UKs FCA.

Much like IG, City Index is a multi-purpose broker that covers CFDs, forex, and spread betting. You'll have access to just over 8,000 markets, and spreads are super-competitive.

The UK-based broker is regulated on multiple fronts, and it has a long-standing reputation that dates back to 1983. You can open an account in minutes, deposits start at £100, and supported payment methods include a debit/credit card or bank transfer.

CMC Markets offers a highly comprehensive spread betting facility. This includes thousands of market across stocks, indices, ETFs, energies, hard metals, and even cryptocurrencies. Launched in 1989, CMC Markets is heavily regulated.

On top of super-low commissions and fees, CMC Markets offers a number of risk management tools. This will ensure that you keep your spread betting losses to a minimum.

FXCM is a low-cost spread betting broker that allows you to place trades at just 7p per stake. This is perfect if you are just started out in the space and wish to begin with smaller stakes.

The broker holds multiple regulatory licenses, and it also supports CFD and forex trading. Several payment options are offers, and account applications are usually approved on the spot.

We hope that by reading our guide in full you now have a 360-degree view of how spread betting works. We’ve covered everything from how you can win and lose money when spread betting, the many financial instruments that you can trade, and what risk management tools you can install to mitigate your potential losses.

Ultimately, while spread betting won’t be for everyone, it does offer a number of benefits over traditional investment channels. At the forefront of this is commission-free trades that are often exempt from tax – and spreads that remain unrivaled in other investment arenas.

Crucially, just make sure that you understand the underlying risks of spread betting before taking the plunge. After all, most newbie traders lose money when they first start out, so do tread with caution.

LonghornFX – Best Forex Trading Platform

Spread betting platforms usually give you access to same assets that you would trade via CFDs. This will include everything from stocks, indices, commodities, interest rates, ETFs, and cryptocurrencies.

The overarching concept is to assess whether an asset will increase or decrease in value against its current market price. For each 'point' that you are correct, you win an amount proportionate to your stake.

This is the difference between the 'long' and 'short' price of the asset - and it's stated in points. For example, if the difference is 5 points, you need to make at least 5 points just to break even.

Yes, spread betting is regulated much in the same way as the CFD or forex space. Key regulators include the FCA (UK), ASIC (Australia), and CySEC (Cyprus).

Profits are based on your initial 'stake-per-point', and the number of points your trade gained. For example, if you sold Apple stocks at 200 points higher than you originally paid, and you staked £5 per point, you would have made £1,000.

If your trade goes against you by a percentage equal to your margin, your trade will be liquidated. For example, if your margin is 5%, and the value of your trade goes down by 5%, your trade will be closed and the broker will keep your margin deposit.

At a minimum, spread betting sites usually give you the option of depositing funds with a debit/credit card or bank account. Some also permit e-wallets like Paypal and Skrill.

Samantha is a UK-based researcher and writer that specializes in all-things finance. This covers everything from traditional equity and fund investments, to forex and CFD trading.

Samantha has been writing financial-based content for several years and has a variety of publications in the online domain. Crucially, she is able to explain complex financial subjects in a newbie-friendly manner.

Any news,messages, opinions, charts, prices, analyses, or other info on this website shouldn’t be taken as a piece of investment advice but provided as general information for entertainment and educational purposes. The site should not be wholly relied on for extensive research before making personal trading decisions. Any content on this website is subject to change without notice. Learn 2 Trade won’t accept liability for any damage, loss, or profit loss as a result of the use or relying directly or indirectly on such information. We don’t recommend only the use of technical analysis for making trading decisions. Neither do we recommend hurried trading decisions. Always understand that past performance doesn’t guarantee future results.

Amateur Double Penetration Compilation

Realitykings Photo

Evil Angel Coming

Young Leg Spreading

Private Person Ru