Betting On The Spread Example 1

👉🏻👉🏻👉🏻 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

https://www.cmcmarkets.com/en-ie/learn-spread-betting/spreadbetting-examples

Перевести · 15.08.2020 · Spread betting example 1: buying ABC Company shares. In this example, ABC Company is trading at 100/102 (where 100 is the sell price and 102 is the buy price). The spread is 2. . Let's assume that you want to open a buy position (go long) at £2 per point because you think the price of ABC Company will go up. Let's say that our margin rate for ...

https://mytradingskills.com/spread-betting-guide/spread-betting-examples

Перевести · For example, if you wanted to place a spread bet on the FTSE 100 index (called the UK 100 in spread betting) for £1 a point, and the price was 6300, you could place a spread bet with a margin deposit of …

Spread Betting Example: Trading the FTSE 100

How to spread bet | How to trade with IG

Spread Betting Strategies that Work

How Financial Spread Betting Works: Spread Trading Examples

www.apvconstructeurs.com/2019/11/27/spread-betting-example-learn-to-spread-bet-cmc-markets

27.11.2019 · Employing the UK 100 and shares spread betting for instance, see how you can go long or short on the financial markets, based on whether you expect prices to fall or rise. Spread betting example 1 In this instance, ABC Company is trading at 100/102 (where 100 is the sell price and 102 is the buy price). The spread …

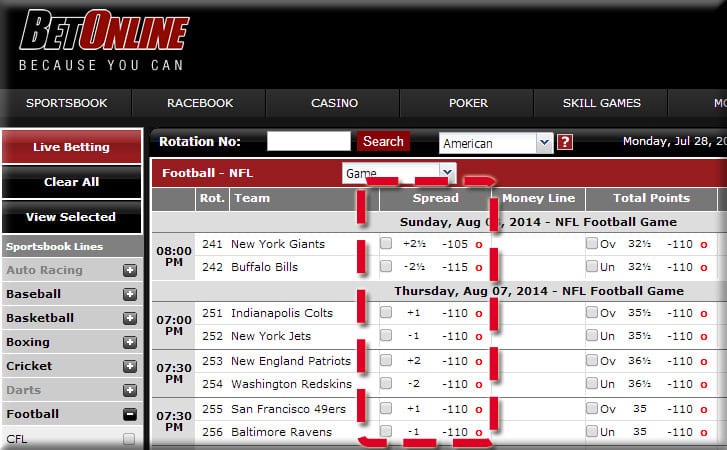

https://www.actionnetwork.com/education/point-spread

Перевести · 02.02.2021 · “Covering the spread” is another way to say that a team won a point spread bet. In the above example, Ohio State winning by 7 points or more as a -6.5 favorite means they covered the spread. If Penn State lost by 6 points or fewer, or won the game, they covered the spread.

https://www.inplaylive.com/tips/betting-on-the-spread

Перевести · 22.04.2021 · Sports Betting How To, is our how does sports betting work series — this section covers What is Bet Spread and Lines for sports betting. Specifically, what is a spread in sports betting and what does a point spread mean — when it comes to strategy for sports betting. These bet tips cover betting on the spread, what is a points spread …

Which is a side bet in spread betting?

Which is a side bet in spread betting?

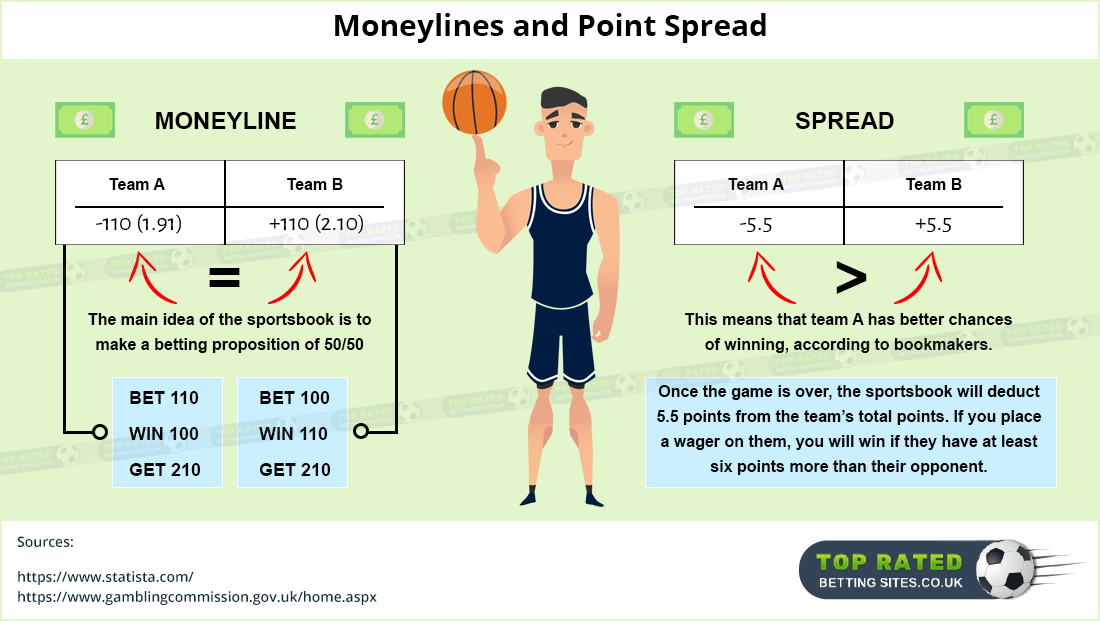

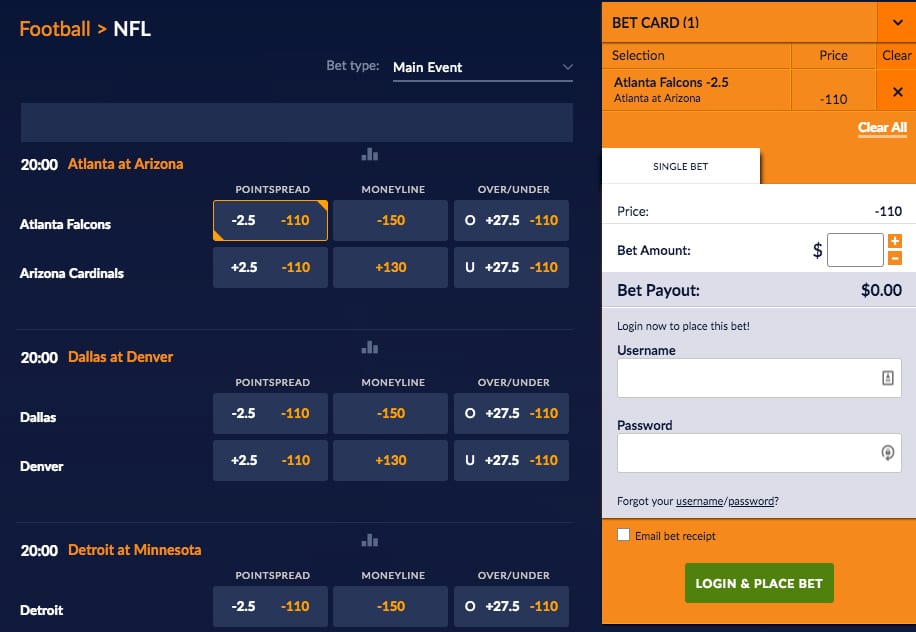

In addition to the spread bet, a very common "side bet" on an event is the total (commonly called the over/under or O/U) bet. This is a bet on the total number of points scored by both teams. Suppose team A is playing team B and the total is set at 44.5 points.

en.m.wikipedia.org/wiki/Spread_betting

What's the best spread to bet on NBA?

What's the best spread to bet on NBA?

When you play the point spread, you are not betting whether an NBA team is going to win or lose a game, you are betting how many points they will win or lose by. If you think Philadelphia are a decent chance to beat Chicago in the above example, taking a spread of +8.0 would be a great bet.

themidfield.com/nba-betting/nba-point-spre…

How big is spread betting market in UK?

How big is spread betting market in UK?

A point spread is a range of outcomes and the bet is whether the outcome will be above or below the spread. Spread betting has been a major growth market in the UK in recent years, with the number of gamblers heading towards one million.

en.m.wikipedia.org/wiki/Spread_betting

How to understand hockey point spread betting better?

How to understand hockey point spread betting better?

To understand hockey point spread betting better, let us first look at the money line, which is something everyone should be familiar with in order to better enjoy their bets, regardless of the hockey bet type. Let us provide you with a little example for a better picture.

www.onlinebetting.com/hockey-betting/nhl …

https://www.betshoot.com/betting-guides/spread-betting

Перевести · 21.04.2020 · Spread betting is essentially a handicap towards the underdog, so the favourite needs to cover it and the bet becomes a question: "Will the favourite cover the points spread?". Since the method has the intention to create the first spread (handicap) correct, the probability to win these bets …

https://www.shiftingshares.com/what-is-spread-betting

Перевести · 23.04.2020 · Knowing how much one needs to trade spread bets is dependent on the financial market one intends to trade. For example, betting £1 per point on the FTSE 100 would give exposure to the price of the FTSE 100. If the index was at 6,589, then buying £1 per point would give us £6,589 of exposure.

https://en.m.wikipedia.org/wiki/Spread_betting

Ориентировочное время чтения: 11 мин

Опубликовано: 22.05.2002

By far the largest part of the official market in the UK concerns financial instruments; the leading spread-betting companies make most of their revenues from financial markets, their sports operations being much less significant. Financial spread betting in the United Kingdom closely resembles the futures and options markets, the major differences being

• the "charge" occurs through a wider bid–offer spread;

• spread betting has a different tax regime compared with securities and futures exchanges (see below);

By far the largest part of the official market in the UK concerns financial instruments; the leading spread-betting companies make most of their revenues from financial markets, their sports operations being much less significant. Financial spread betting in the United Kingdom closely resembles the futures and options markets, the major differences being

• the "charge" occurs through a wider bid–offer spread;

• spread betting has a different tax regime compared with securities and futures exchanges (see below);

• spread betting is more flexible since it is not limited to exchange hours or definitions, can create new instruments relatively easily (e.g. individual stock futures), and may have guaranteed stop losses (see below); and

• the trading is off-exchange, with the contract existing directly between the market-making company and the client, rather than exchange-cleared, and is thus subject to a lower level of regulation.

Financial spread betting is a way to speculate on financial markets in the same way as trading a number of derivatives. In particular, the financial derivative contract for difference (CFD) mirrors the spread bet in many ways. In fact, a number of financial derivative trading companies offer both financial spread bets and CFDs in parallel using the same trading platform.

Unlike fixed-odds betting, the amount won or lost can be unlimited as there is no single stake to limit any loss. However, it is usually possible to negotiate limits with the bookmaker:

• A stop loss or stop automatically closes the bet if the spread moves against the gambler by a specified amount.

• A stop win, limit or take profit closes the bet when the spread moves in a gambler's favor by a specified amount.

Spread betting has moved outside the ambit of sport and financial markets (that is, those dealing solely with share, bonds and derivatives), to cover a wide range of markets, such as house prices. By paying attention to the external factors, such as weather and time of day, those who are betting using a point spread can be better prepared when it comes to obtaining a favorable outcome. Additionally, by avoiding the favourite-longshot bias, where the expected returns on bets placed at shorter odds exceed that of bets placed at the longer odds, and not betting with one's favorite team, but rather with the team that has been shown to be better when playing in a specific weather condition and time of day, the possibility of arriving at a positive outcome is increased.

Tax treatment

In the UK and some other European countries the profit from spread betting is free from tax. The tax authorities of these countries designate financial spread betting as gambling and not investing, meaning it is free from capital gains tax and stamp duty, despite the fact that it is regulated as a financial product by the Financial Conduct Authority in the UK. Most traders are also not liable for income tax unless they rely solely on their profits from financial spread betting to support themselves. The popularity of financial spread betting in the UK and some other European countries, compared to trading other speculative financial instruments such as CFDs and futures is partly due to this tax advantage. However, this also means any losses cannot be offset against future earnings for tax calculations.

Conversely, in most other countries financial spread betting income is considered taxable. For example, the Australian Tax Office issued a decision in March 2010 saying "Yes, the gains from financial spread betting are assessable income under section 6-5 or section 15-15 of the ITAA 1997". Similarly, any losses on the spread betting contracts are deductible. This has resulted in a much lower interest in financial spread betting in those countries.

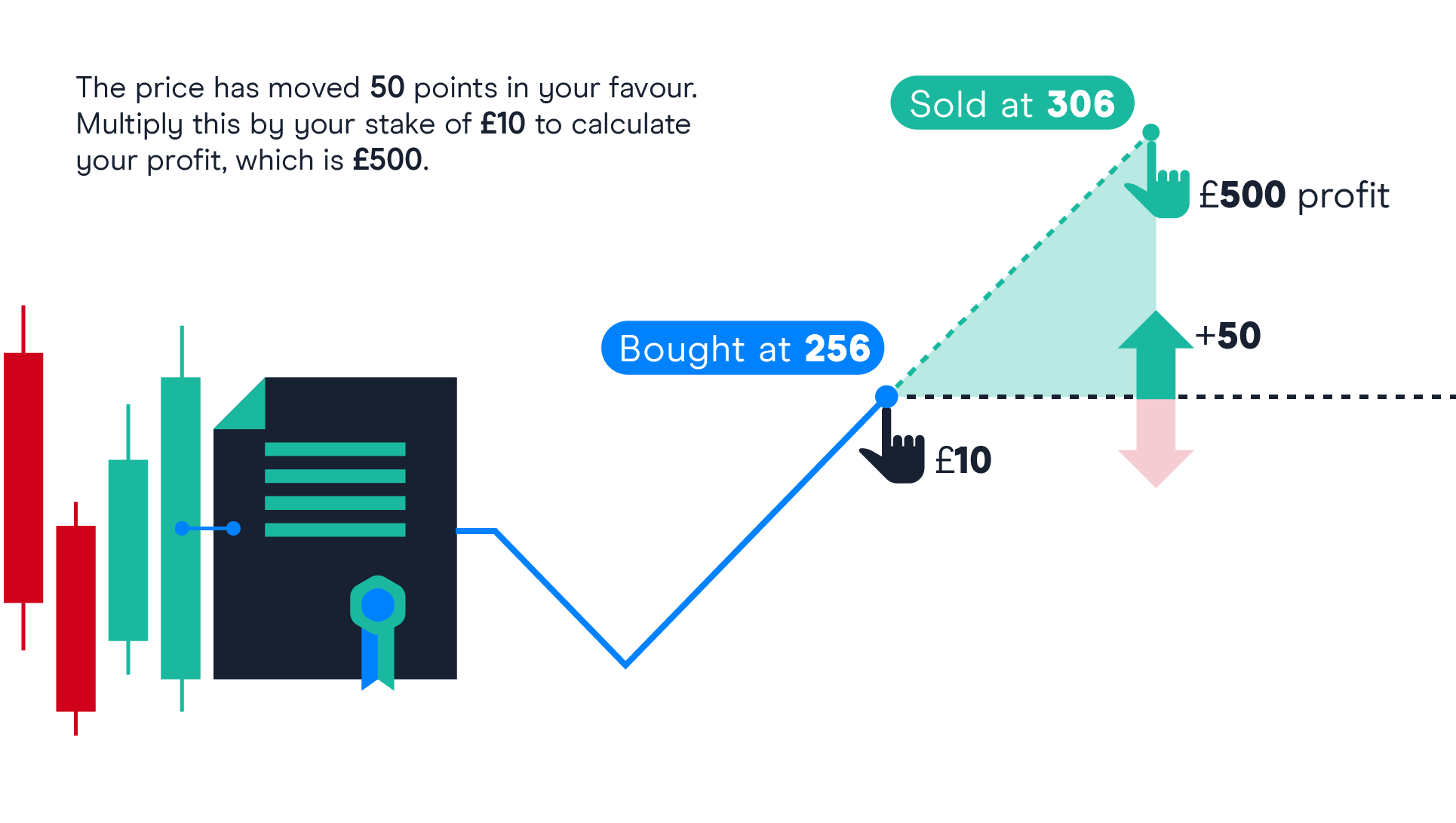

Financial spread bet example

Suppose Lloyds Bank is trading on the market at 410p bid, and 411p offer. A spread-betting company is also offering 410-411p. We use cash bets with no definite expiry, or "rolling daily bets" as they are referred to by the spread betting companies.

If I think the share price is going to go up, I might bet £10 a point (i.e., £10 per penny the shares moves) at 411p. We use the offer price since I am "buying" the share (betting on its increase). Note that my total loss (if Lloyds Bank went to 0p) could be up to £4110, so this is as risky as buying 1000 of the shares normally.

If a bet goes overnight, the bettor is charged a financing cost (or receives it, if the bettor is shorting the stock). This might be set at LIBOR + a certain percentage, usually around 2-3%.

Thus, in the example, if Lloyds Bank are trading at 411p, then for every day I keep the bet open I am charged [taking finance cost to be 7%] ((411p x 10) * 7% / 365 ) = £0.78821 (or 78.8p)

On top of this, the bettor needs an amount as collateral in the spread-betting account to cover potential losses. Usually this is either 5 or 10% of the total exposure you are taking on but can go up to 100% on illiquid stocks. In this case £4110 * 0.1 or 0.05 = £411.00 or £205.50

If at the end of the bet Lloyds Bank traded at 400-401p, I need to cover that £4110 – £400*10 (£4000) = £110 difference by putting extra deposit (or collateral) into the account.

The punter usually receives all dividends and other corporate adjustments in the financing charge each night. For example, suppose Lloyds Bank goes ex-dividend with dividend of 23.5p. The bettor receives that amount. The exact amount received varies depending on the rules and policies of the spread betting company, and the taxes that are normally charged in the home tax country of the shares.

https://themidfield.com/nba-betting/nba-point-spread-betting

Перевести · 29.06.2017 · Both outcomes should be of equal odds roughly -105 to -110 or $1.91. The above example would be listed by the bookmaker as: Chicago -8.0 @-110 | Philadelphia +8.0 @-110. When you play the point spread, you are not betting whether an NBA team is going to win or lose a game, you are betting how many points they will win or lose by.

РекламаАбсолютно реальные цены! Экспресс доставка! · Москва · пн-сб 10:00-19:00, вс 10:00-18:00

РекламаКурсы по программированию, маркетингу, дизайну. Смените профессию. Трудоустройство.

Не удается получить доступ к вашему текущему расположению. Для получения лучших результатов предоставьте Bing доступ к данным о расположении или введите расположение.

Не удается получить доступ к расположению вашего устройства. Для получения лучших результатов введите расположение.

The requested URL /2019/11/27/spread-betting-example-learn-to-spread-bet-cmc-markets/ was not found on this server.

Private The Matador Series 06

Aria Alexander Xxx Full Hd 1080

Shemale Tranny In The Bathroom Xxx Video

Teens Lesbian Group Orgasm Squirt Xxx Video

Russian German Relations

Helpful Financial Spread Betting Examples - My Trading Skills

Spread Betting Example | Learn To Spread Bet | CMC Markets ...

Sports Betting How To: Betting on the Spread — inplayLIVE

Spread betting guide - Point spreads explained | Betshoot.com

Spread betting - Wikipedia

Betting On The Spread Example 1