Betting Against The Spread Tips

⚡ ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Betting Against The Spread Tips

Best spread betting strategies and tips

Becca Cattlin | Financial writer , London

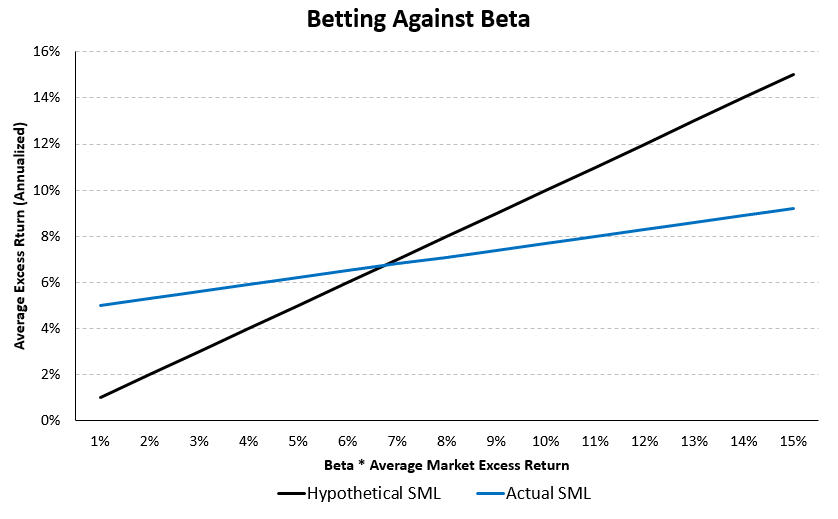

What is the number one mistake traders make?

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. High volatility increases the risk of sudden, large or rapid losses.

To prioritise the service we give our existing clients, IG is not currently allowing any new positions on GameStop and AMC Entertainment.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. High volatility increases the risk of sudden, large or rapid losses.

To prioritise the service we give our existing clients, IG is not currently allowing any new positions on GameStop and AMC Entertainment.

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies. You can view our cookie policy and edit your settings here , or by following the link at the bottom of any page on our site.

Spread betting enables you to execute a range of trading strategies, thanks to the range of benefits it offers traders. Discover some of the most popular spread betting strategies and some tips for getting started.

A trading strategy is nothing more than a predefined methodology for how a trader will enter and exit the market. It will identify specific market circumstances and price points during which a trader will look to execute and close their trade.

We’ve taken a look at some top-level strategies, and the way they would be carried out using spread bets .

This is by no means a full list of all of the trading strategies that can utilise spread bets. In fact, as long as the platform you are using has the appropriate technical analysis tools, most strategies are suited to using this popular derivative product.

A trending market is one that is reaching higher highs or lower lows. Trading with a trend is usually the practice of those who adapt the ‘ position trading ’ style, and is considered a medium-term strategy.

A trend trader’s strategy would use charts and technical analysis to identify the beginning and end of market movements. This often includes the use of indicators such as moving averages and the moving average convergence/divergence (MACD) to identify where to open and close their spread betting positions.

Trend trading is a popular strategy among spread betters, as they can follow the market momentum regardless of whether they are going long or short.

For example, if the price of soybeans was thought to be in an uptrend, with higher peaks and troughs, a trader might open a long spread betting position. They’d do this by opening a spread bet to buy soybeans. Once the trader has reached their profit target or acceptable loss, or analysis has shown the trend will soon be reversing, they would close their position by selling soybeans.

On the other hand, if the soybean market was in a downtrend, meeting lower highs and lower lows, a trader might decide to open a short spread betting position. They would do so by opening a position to sell soybeans.

Consolidating markets are range bound – so instead of reaching price extremes like trending markets, they remain within lines of support and resistance . This is why consolidating market strategies require traders to use indicators to identify entry and exit points within the range bound market, such as the relative strength index (RSI) .

An important part of a consolidating market strategy is volume analysis. When a market is trading within a range, the volume of trades is usually low and flat, but if the range is about to break there will usually be a rise in volume. This can be a clear indication that it is time for traders to think about closing their positions and, potentially, switching to a different strategy.

Although consolidating markets don’t provide the opportunity for running profits, they can create plenty of opportunities for short-term traders, such as scalpers.

Scalping is a trading style that is designed to profit from small and frequent price changes. Although traders might not make the large, long-term gains you’d see with other styles, they enter and exit far more trades, with the aim of taking smaller profits more often.

Many believe taking such short-term positions might not produce the same results as longer-term strategies but spread betting can help capital to go much further. This is because spread betting is a leveraged product, which means that traders can open positions that are much larger than their initial deposit. It is important to remember that while leverage can magnify your profits, it can also magnify your losses. This makes it crucial to have a suitable risk management strategy in place.

Breakout trading involves entering a trend as early as possible, ready for the market price to ‘break out’ from a consolidating or trending range. Breakout strategies are based on the idea that key price points are the start of a major movement, or expansions in volatility – so by entering the market at the correct level, a trader can ride the trend from start to finish.

Typically, traders looking to take advantage of a breakout will need to identify support or resistance levels – as once these have been met or surpassed, they will need to enter the market. Most breakout trading strategies will utilise volume trading indicators , and RSI or MACD technical indicators to find these levels.

One strategy used to spread bet breakouts is to place limit-entry orders at key price points, so that if the market moves through the support or resistance level, the order is executed automatically.

For example, let’s say you wanted to open a spread betting position on gold, which is currently trading at $1255. Although the market has been trading in a range for two weeks, you believe it is due to breakout into a downward trend. Looking at historic levels of support, you can see that $1250 is a key price point. So, you decide to place an entry order to open a short spread betting position if the price of gold falls below $1249. If the market did fall below this price, your spread bet would be executed, and you could ride the breakout until your analysis indicated the downtrend was over. If the market didn’t fall to this price, your trade would never be executed.

Reversal trading strategies are based on identifying areas in which trends are going to change direction. Reversals can be both bullish or bearish, giving a signal that the market is either at the top of an uptrend, or at the bottom of a downtrend. Traders using this strategy would open a spread betting position in the opposite direction to the current market trend, ready to take advantage of the reversal. This can also be known as ‘contrarian trading’.

When trading reversals, it is important to ensure that the market is not simply experiencing a retracement – a more temporary move. Retracement levels are commonly identified using the Fibonacci retracement tool. If the price goes beyond the levels identified by the tool, it is taken as a sign the market is reversing.

Although reversals can be a complicated spread betting strategy, with the use of indicators, there can be a wealth of opportunities. In order to execute a reversal strategy, a trader will need to utilise a confirmation tool. These can include:

For example, let’s say you wanted to create a FTSE 100 spread betting strategy and decided to focus on reversal trading. Although FTSE 100 has been in a downtrend for the last week, you believe that following positive earnings announcements for major FTSE constituents, the trend will reverse. You decide to enter a position if you identify the double bottom candlestick pattern, in the hopes of taking advantage of the upcoming price increase. If the market did reverse, you would be in a position to profit from the upswing. However, if the market continued to decline, you would suffer a loss.

There are a few key things every trader needs to know before they implement a spread betting strategy. It is important to:

Before you start to spread bet, it is crucial to have an understanding of what spread betting is and how it works .

When you spread bet, you can speculate on the future price movements of a range of global markets, such as forex, commodities, indices and shares. And because you don’t own the asset, you won’t have to pay tax on any profits you make. 1 These are just some of the benefits of spread betting , others include hedging, out-of-hours trading and no commission.

Prior to even thinking about which strategy you are going to implement, you should create a trading plan that will give your time on the markets clear direction and purpose. Your plan should always be unique to you, but most plans include:

When you’re building your trading plan and spread betting strategy, you might already have a market in mind. But if you don’t, it’s important to choose which assets you want to focus on before you start spread betting.

Most people will choose to trade a market that they already have an interest in, so they have prior knowledge that they can fall back on. With IG, you can trade over 16,000 markets, including indices, forex, shares, commodities and many more.

Before you open any spread betting position, it is important to be aware of exactly how much you could stand to lose if the market turned against you. Especially as spread bets are leveraged, you could stand to lose – or win – much more than your initial deposit. It is always wise to think about your trade in terms of its full value, rather than the amount you pay to open it.

One way of mitigating risk and locking in profits is by setting an automatic stop or limit, which will define the level you’d like to close your trade at. Stop-losses will close a trade if the market moves against you, while limit-close orders will close your position once it has reached a certain amount of profit.

Footnote

1 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

Publication date : Friday 24 May 2019 15:11

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary .

Explore the range of markets you can trade – and learn how they work – with IG Academy's free ’introducing the financial markets’ course.

We reveal the top potential pitfall and how to avoid it. Discover how to increase your chances of trading success, with data gleaned from over 100,00 IG accounts.

For more info on how we might use your data, see our privacy notice and access policy and privacy webpage .

Find out what charges your trades could incur with our transparent fee structure.

Discover why so many clients choose us, and what makes us a world-leading provider of spread betting and CFDs.

Stay on top of upcoming market-moving events with our customisable economic calendar.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

The value of shares, ETFs and ETCs bought through a share dealing account, a stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting back less than you originally put in. Past performance is no guarantee of future results.

CFD, share dealing and stocks and shares ISA accounts provided by IG Markets Ltd, spread betting provided by IG Index Ltd. IG is a trading name of IG Markets Ltd (a company registered in England and Wales under number 04008957) and IG Index Ltd (a company registered in England and Wales under number 01190902). Registered address at Cannon Bridge House, 25 Dowgate Hill, London EC4R 2YA. Both IG Markets Ltd (Register number 195355) and IG Index Ltd (Register number 114059) are authorised and regulated by the Financial Conduct Authority.

The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Spread betting - Wikipedia

Best Spread Betting Strategies and Tips for 2021 | IG UK

What is Against the Spread (ATS)? Betting Against The Spread Explained

Spread Betting Tips | Finspreads

NFL Betting Advice: Week 15, 2018 - Against the Spread ... - YouTube

ATS » Introduction to Sports Betting » What is Against the Spread

What if I win my bet against the point spread?

What if the result of the point spread bet is a loss?

What if the result of the point spread is a tie?

What does it mean to pick against the spread?

Here are some wagering examples of bets Against the Spread

Bonus: 100% Match upto $500

T&C Apply

Bonus: Up to $500 Free Bets

T&C Apply

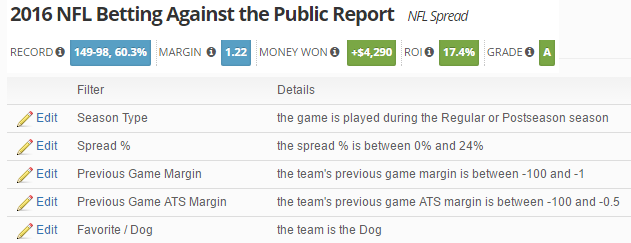

One of the most popular types of sports betting is betting against the point spread also known as ATS . The point spread is a number aka the “betting line” set by bookmakers at the sportsbook which is intended to even the playing field between two teams and give a reason for bettors to bet on either side of the game. The betting Favorite is considered the better team and listed with a Minus (-) sign while the Underdog is listed with a Plus (+) sign. A bettor wins his bet on the “Favorite” if the team wins the game by more points then the “spread or line”, the opposite is true for the “Underdog” where the bettor wins if the team loses by less then the spread or wins the game outright! There are two types of spread betting, the first is betting with the spread and the second is betting against the spread .

When you bet with the spread it means you are taking the favorite to win and cover the spread . For example in the NFL the Dallas Cowboys are Favored at -3 over the Philadelphia Eagles. Taking the Dallas Cowboys -3 means you are betting with the spread and want the Cowboys to win by MORE then 3 points.

Betting against the spread means you are taking the Underdog and the points in a game. To win you want the “underdog” to either win the game outright OR lose by less then the “ Point Spread ” you are given. A example of this we will use the following. The New England Patriots -7 vs NY Jets +7. In this example we are taking the underdog the NY Jets and +7 points. In order for us to win our bet one of two things must happen. First the Jets win the game OR the Jets lose the game but the final score has the Jets losing by LESS then 7 points. Should the final score be exactly 7 points this is a push and your bet is refunded.

ATS is short for Against The Spread! Its a term used to track how well one team does against the spread meaning their won/loss record based on the spread rather then their regular wins and losses.

You get your original bet back plus your winnings. For example if you bet $110 to win $100 you would receive $210 back.

You lose your entire original bet. For example if you bet $110 to win $100 you would lose $110.

This is considered a “push” and you are refunded your original bet back. For example if you bet $110 to win $100 you would get the $110 back.

This is called a straight bet. A straight bet is the most common type of bet for betting on the NFL, NBA, College Football & Basketball. It uses the the point spread : When betting a straight bet you are betting on the team to “cover the spread the point spread”. Referring to our examples above you are either Betting with the spread or Betting against the spread .

This is same as betting against the spread however it may be used in NFL Pickem type pools rather the placing a straight bet.

Final Score: NY Giants 28 – Dallas Cowboys 20

If you took the NY Giants as your pick at the sportsbook against the spread you would have won your bet! 28-7=21 Final score against the Spread is 21-20 Giants win!

Final Score: Golden State 99 – Denver 90

If you took the Golden State Warriors as your pick at the sportsbook against the spread you would have lost your bet! 99-10=891 Final score against the Spread is 89-90 Denver Wins and covers against the spread, you would have needed to take the Nuggets +10 to win this bet ATS at a Vegas Sportsbook.

ATS in sports betting means – Against the Spread. Most sports bettors and handicappers use the acronym when referring to a teams won loss record against the spread AKA ATS.

Bet with your head, not over it. Call 1-800-GAMBLER if you have a gambling problem.

Small Teen Double Penetration

Private Solutions

Ass Download

Overwatch Big Ass

Secretary Porn Vk

/cdn.vox-cdn.com/uploads/chorus_image/image/52927673/usa_today_9775367.0.jpg)

/cdn.vox-cdn.com/uploads/chorus_image/image/58065669/usa_today_10478297.0.jpg)