Bet Spread Definition

🔞 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Bet Spread Definition

Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security. The investor does not own the underlying security in spread betting, they simply speculate on its price movement. It is promoted as a tax free, commission free activity that allows investors to speculate in both bull and bear markets.

Sponsored

Compete Risk Free with $100,000 in Virtual Cash

Put your trading skills to the test with our

FREE Stock Simulator.

Compete with thousands of Investopedia traders and trade your way to the top! Submit trades in a virtual environment before you start risking your own money.

Practice trading strategies

so that when you're ready to enter the real market, you've had the practice you need.

Try our Stock Simulator today >>

Futures are financial contracts obligating the buyer to purchase an asset or the seller to sell an asset at a predetermined future date and price.

Forex spread betting allows speculation on the movements of the selected currency without actually transacting in the foreign exchange market.

A contract for differences (CFD) is a marginable financial derivative that can be used to speculate on very short-term price movements for a variety of underlying instruments.

A derivative is a securitized contract between two or more parties whose value is dependent upon or derived from one or more underlying assets. Its price is determined by fluctuations in that asset, which can be stocks, bonds, currencies, commodities, or market indexes.

An options contract allows the holder to buy or sell an underlying security at the strike price or given price. The two notable types of options are put options and call options.

An equity derivative is a trading instrument which is based on the price movements of an underlying asset's equity.

#

A

B

C

D

E

F

G

H

I

J

K

L

M

N

O

P

Q

R

S

T

U

V

W

X

Y

Z

Investopedia is part of the Dotdash publishing family.

Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security. It involves placing a bet on the price movement of a security. A spread betting company quotes two prices, the bid and ask price (also called the spread), and investors bet whether the price of the underlying security will be lower than the bid or higher than the ask. The investor does not own the underlying security in spread betting, they simply speculate on its price movement.

Spread betting allows investors to speculate on the price movement of a wide variety of financial instruments, such as stocks , forex , commodities and fixed income securities . In other words, an investor makes a bet based on whether they think the market will rise or fall from the time their bet is accepted. They also get to choose how much they want to risk on their bet. It is promoted as a tax free, commission free activity that allows investors to speculate in both bull and bear markets.

Spread betting is a leveraged product which means investors only need to deposit a small percentage of the position's value. For example, if the value of a position is $50,000 and the margin requirement is 10%, a deposit of just $5,000 is required. This magnifies both gains and losses which means investors can lose more than their initial investment. (To learn more, see: Margin )

Let’s assume that the price of ABC stock is $201.50 and a spread-betting company, with a fixed spread, is quoting the bid/ask at $200 / $203 for investors to transact on it. The investor is bearish and believes that ABC is going to fall below $200 so they hit the bid to sell at $200. They decide to bet $20 for every point the stock falls below their transacted price of $200. If ABC falls to where the bid/ask is $185/$188, the investor can close their trade with a profit of {($200 - $188) * $20 = $240}. If the price rises to $212/$215, and they choose to close their trade, then they will lose {($200 - $215) * $20 = -$300}.

The spread betting firm requires a 20% margin, which means the investor needs to deposit 20% of the value of the position at its inception, {($200 * $20) * 20% = $800, into their account to cover the bet. The position value is derived by multiplying the bet size by the stock’s bid price ($20 x $200 = $4,000).

SPREAD BET | definition in the Cambridge English Dictionary

Spread Betting Definition | What Does Spread Betting Mean | IG UK

Spread Betting ( Definition , Features) | Explained with Examples

Spread betting definition and meaning | Collins English Dictionary

Spread Betting Definition

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. High volatility increases the risk of sudden, large or rapid losses.

To prioritise the service we give our existing clients, IG is not currently allowing any new positions on GameStop and AMC Entertainment.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. High volatility increases the risk of sudden, large or rapid losses.

To prioritise the service we give our existing clients, IG is not currently allowing any new positions on GameStop and AMC Entertainment.

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies. You can view our cookie policy and edit your settings here , or by following the link at the bottom of any page on our site.

Spread betting is a leveraged financial derivative, which enables traders to speculate on the future direction of a market’s price. You take a position based on whether you think the asset will rise or fall in value, and the accuracy of your bet determines the profit or loss when the position is closed.

To define spread betting, we first need to acknowledge the 'the spread' : this is the term used to describe the difference between a buy and a sell price. Long positions return a profit if the price of the market moves high enough to cover the spread, while short positions return a profit if the price of the market drops enough to cover the spread.

When opening a spread betting position, you decide how much you would like to bet for each point of movement in an asset’s price. Your profit or loss at the close of the trade is calculated as:

Profit or loss = (£ bet per point x points moved) - charges to open and maintain position

Find out more about spread betting, including what the spread is and how leverage works.

A - B - C - D - E - F - G - H - I - L - M - N - O - P - Q - R - S - T - U - V - W - Y

Get answers about your account or our services.

Or ask about opening an account on 0800 195 3100 or newaccounts.uk@ig.com .

We're here 24hrs a day from 8am Saturday to 10pm Friday.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

The value of shares, ETFs and ETCs bought through a share dealing account, a stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting back less than you originally put in. Past performance is no guarantee of future results.

CFD, share dealing and stocks and shares ISA accounts provided by IG Markets Ltd, spread betting provided by IG Index Ltd. IG is a trading name of IG Markets Ltd (a company registered in England and Wales under number 04008957) and IG Index Ltd (a company registered in England and Wales under number 01190902). Registered address at Cannon Bridge House, 25 Dowgate Hill, London EC4R 2YA. Both IG Markets Ltd (Register number 195355) and IG Index Ltd (Register number 114059) are authorised and regulated by the Financial Conduct Authority.

The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Teen Pee Porn

Massage Salon From Bogdan Sensual Massage

Wow Private Servers

That School Girl Pussy

Oral Sex Foto

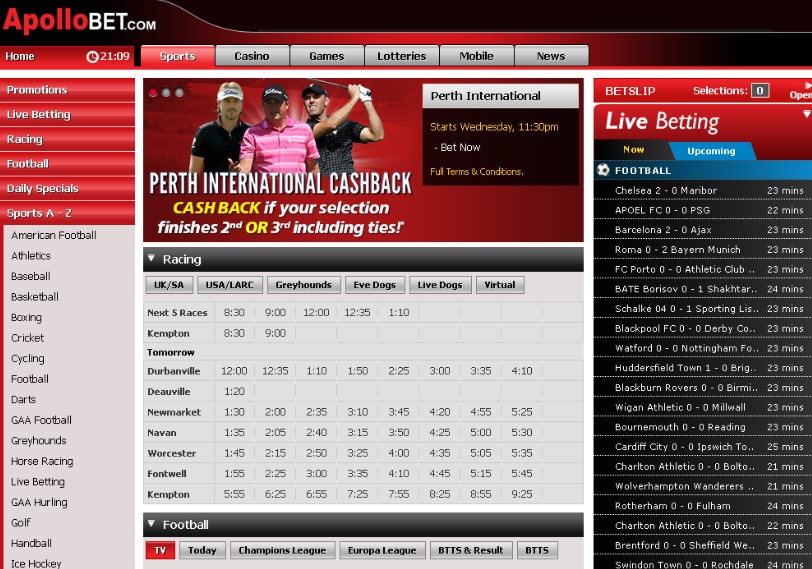

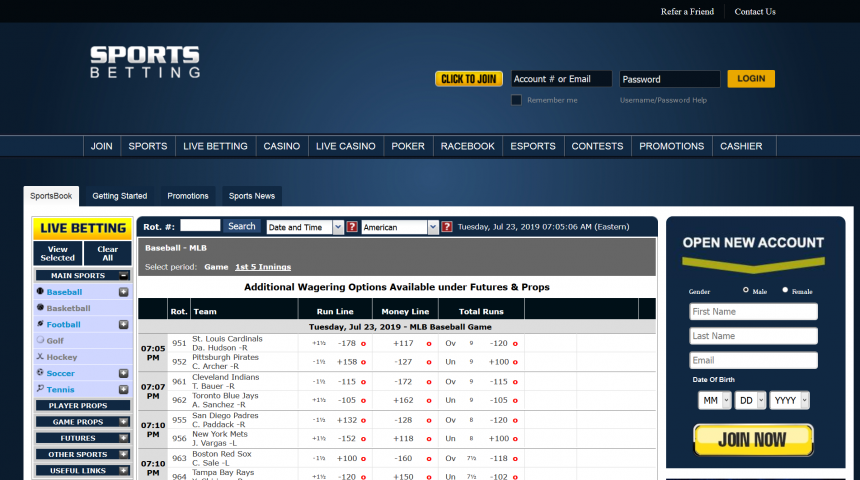

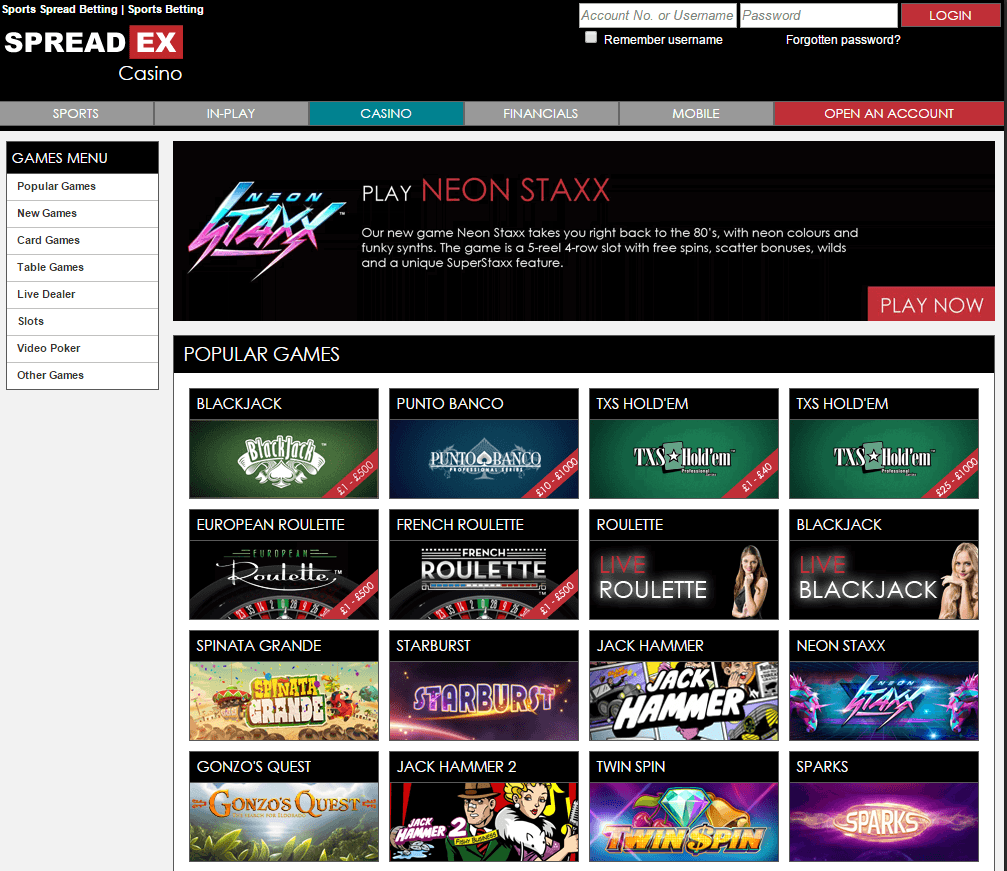

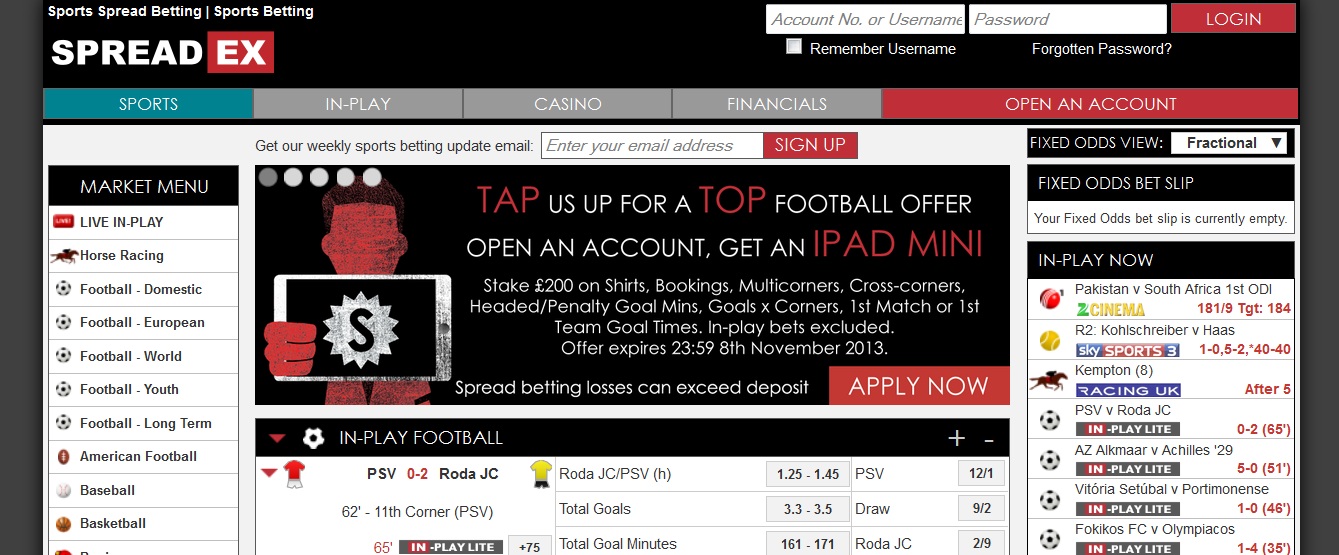

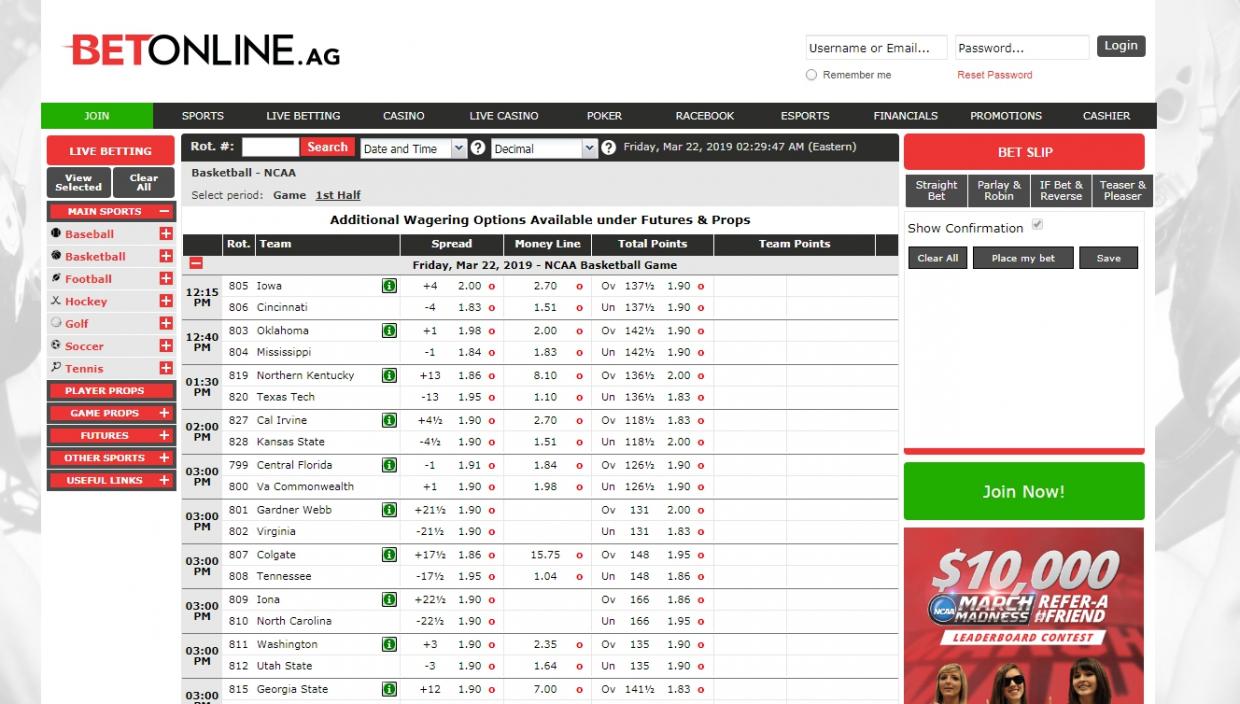

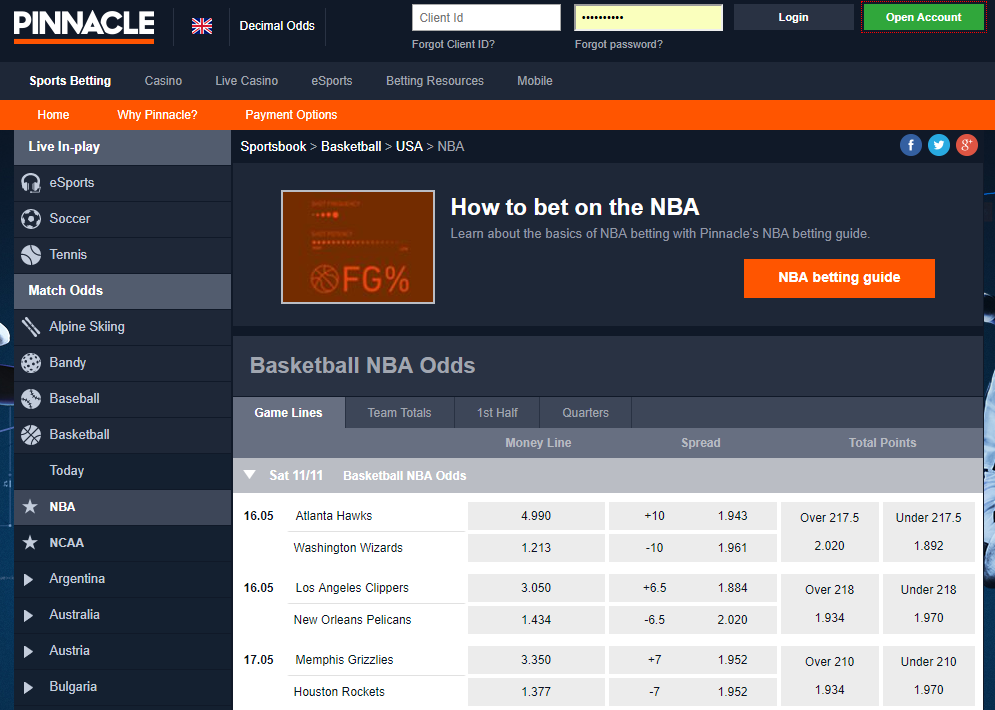

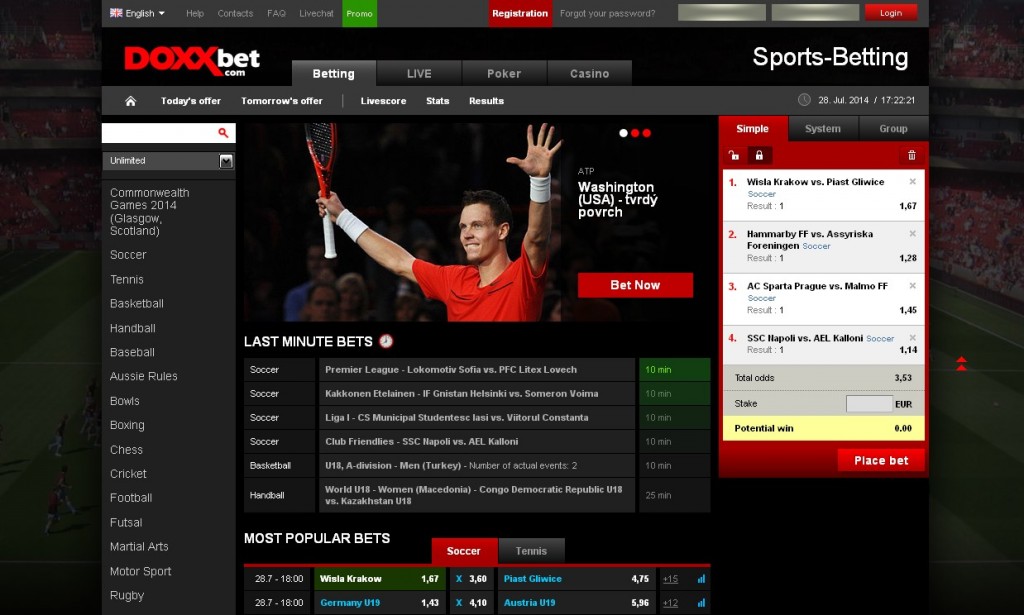

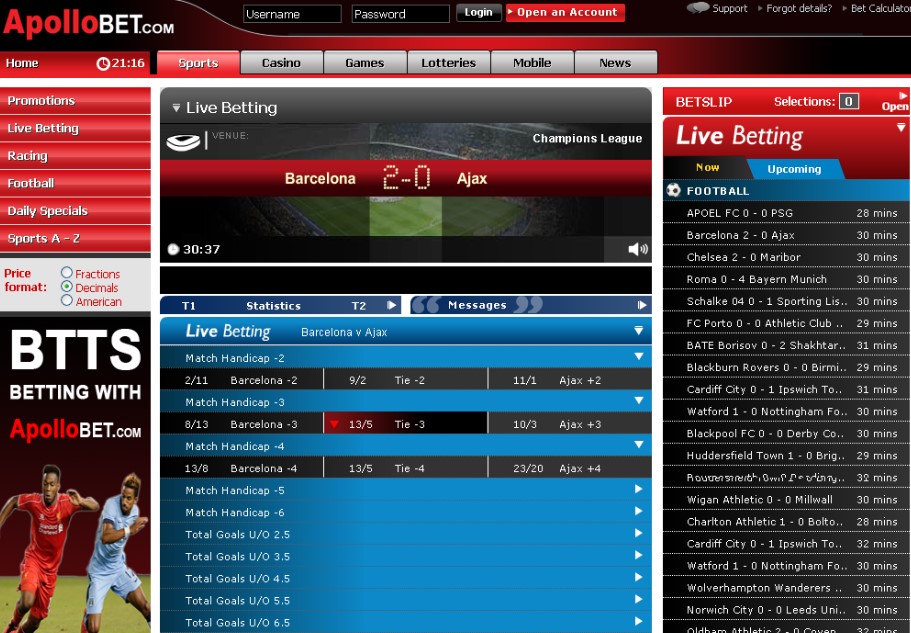

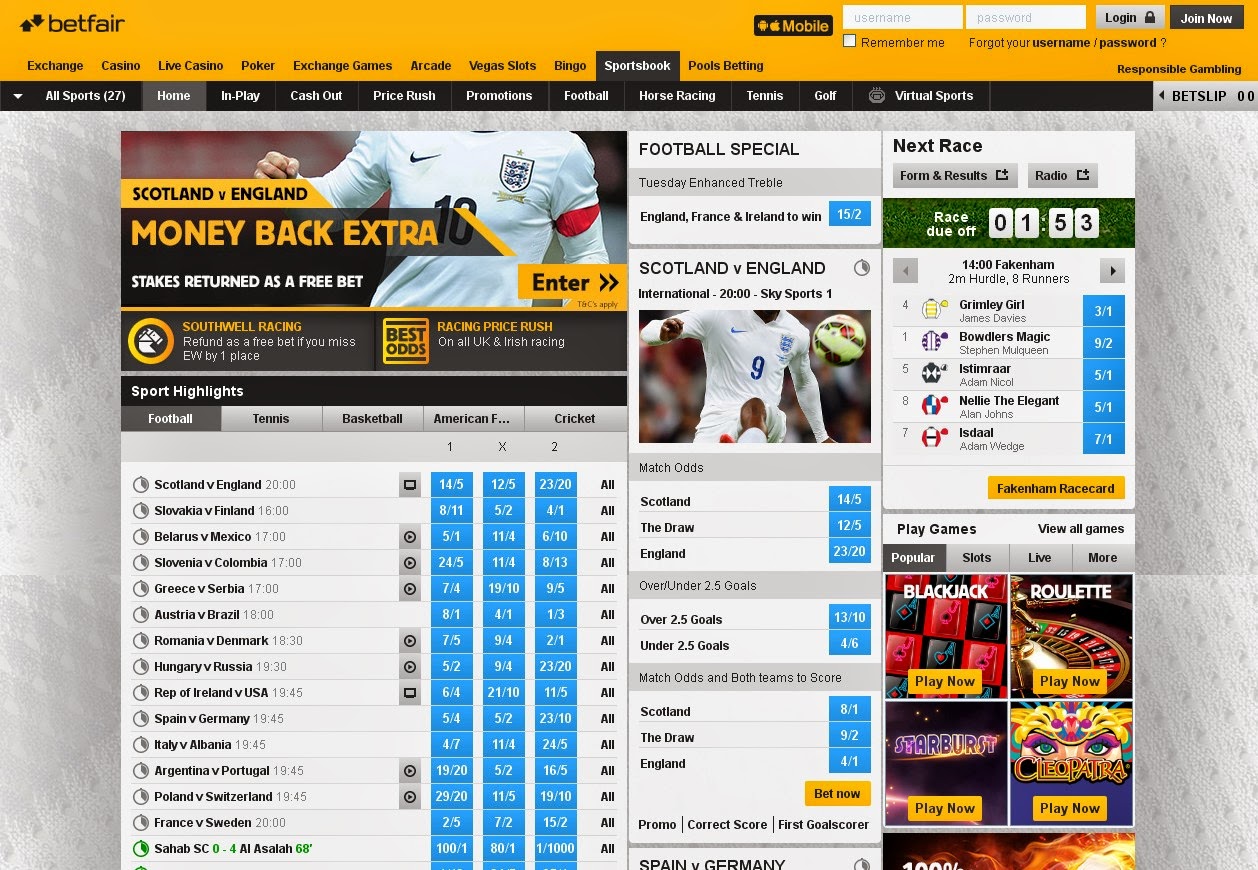

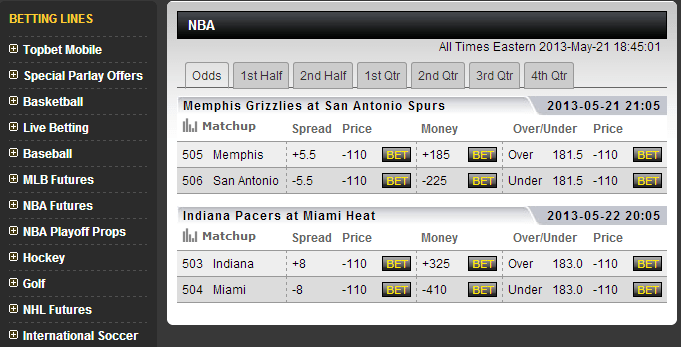

f_auto/p/86b91e40-a4e8-11e6-89db-00163ed833e7/4383828/sports-betting-platform-screenshot.png" width="550" alt="Bet Spread Definition" title="Bet Spread Definition">

f_auto/p/86b91e40-a4e8-11e6-89db-00163ed833e7/4383828/sports-betting-platform-screenshot.png" width="550" alt="Bet Spread Definition" title="Bet Spread Definition">