Best Spread Betting Offers

⚡ ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Best Spread Betting Offers

Last Update : Sep 17, 2020 08:37 AM GMT

At FX Empire, we stick to strict standards of a review process. Learn about our review process. FX Empire may receive compensation. Here’s how we make money.

Pro Tip: Most of these brokers offer free demo accounts so you can test the brokers and their platforms with virtual money. Give it a try with some play money before using your own cash.

Here’s a list of The Best Spread Betting Brokers

Note: Not all Forex brokers accept US clients. For your convenience we specified those that accept US Forex traders as clients.

The content provided on the website includes general news and publications, our personal analysis and opinions, and contents provided by third parties, which are intended for educational and research purposes only. It does not constitute, and should not be read as, any recommendation or advice to take any action whatsoever, including to make any investment or buy any product. When making any financial decision, you should perform your own due diligence checks, apply your own discretion and consult your competent advisors. The content of the website is not personally directed to you, and we does not take into account your financial situation or needs.The information contained in this website is not necessarily provided in real-time nor is it necessarily accurate. Prices provided herein may be provided by market makers and not by exchanges. Any trading or other financial decision you make shall be at your full responsibility, and you must not rely on any information provided through the website. FX Empire does not provide any warranty regarding any of the information contained in the website, and shall bear no responsibility for any trading losses you might incur as a result of using any information contained in the website. The website may include advertisements and other promotional contents, and FX Empire may receive compensation from third parties in connection with the content. FX Empire does not endorse any third party or recommends using any third party's services, and does not assume responsibility for your use of any such third party's website or services. FX Empire and its employees, officers, subsidiaries and associates, are not liable nor shall they be held liable for any loss or damage resulting from your use of the website or reliance on the information provided on this website.

This website includes information about cryptocurrencies, contracts for difference (CFDs) and other financial instruments, and about brokers, exchanges and other entities trading in such instruments. Both cryptocurrencies and CFDs are complex instruments and come with a high risk of losing money. You should carefully consider whether you understand how these instruments work and whether you can afford to take the high risk of losing your money. FX Empire encourages you to perform your own research before making any investment decision, and to avoid investing in any financial instrument which you do not fully understand how it works and what are the risks involved.

The following article is an informative overview of the lucrative investment practice of spread betting. We have conducted thorough research into all aspects of spread betting, laying everything out for your analysis. In this article, you will discover what exactly spread betting is, the accounts involved, and how it really works.

As well, you will learn of the pros and cons spread betting has to offer, why it is so popular among investors, and whether spread betting is right for you. So, delve into this informative article, and learn everything there is to know about spread betting.

The brokers below represent the best Spread Betting brokers.

CFDs carry risk. 73% of traders lose

CFDs carry risk. 73% of traders lose

74.74% of retail investor accounts lose money

74.74% of retail investor accounts lose money

82% of retail CFD accounts lose money

82% of retail CFD accounts lose money

Regulated By: ASIC, CySEC, FCA, FSCA

Headquarters : Safecap is located at 148 Strovolos Avenue, 2048, Strovolos, P.O.Box 28132, Nicosia, Cyprus.

CFDs carry risk. 73% of traders lose

Markets.com was founded in 2008 and was rebranded in 2019 to MarketsX, alongside the introduction of Marketsi in 2020 to invest in real stocks and shares. The broker is part of the TradeTech Group which is a constituent of Playtech PLC, a FTSE 250 company listed on the London Stock Exchange.

The Markets.com group offers regulation from the Cyprus Securities and Exchange Commission (CySEC), the British Virgin Islands Financial Services Commission (FSC), the UK Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC) and the Financial Sector Conduct Authority of South Africa (FSCA).

With MarketsX users can trade commission-free on more than 2,200+ CFD instruments covering Shares, Indices, Bonds, Blends, Commodities, Currencies, ETFs and Cryptos. Users can also invest in real stocks and shares via a Marketsi account which comes with an innovative Investment Strategy Builder tool.

Headquarters : 20 Gresham Street, 4th Floor, London EC2V 7JE, United Kingdom

74.74% of retail investor accounts lose money

Founded in 1999, FXCM Group is an international online forex and CFD brokerage brand. In the UK, the FXCM brand is managed by FXCM Ltd. The company is based in the UK and its head office is located at 20 Gresham Street, 4th Floor, London EC2V 7JE, United Kingdom.

Now FXCM offers the trading of currencies (majors and exotics), indices, cryptocurrencies and commodities. They have a selection of platforms as well as algo trading, in depth education and market research.

Headquarters : 30 Churchill Place, London, E14 5EU, UK

82% of retail CFD accounts lose money

This company was established in 2011 and is now present in many regions. It is regulated by FCA in the UK and by CySEC in Cyprus and offers over 250 assets including 50 currencies, 5 metals, 3 commodities, 180 share CFD’s, 5 indices and 3 cryptocurrencies. The broker gives traders access to both the MT4 and MT5 platforms.

Spread betting is an investing method based on the speculation of price movements in a financial market. Instead of actually buying and trading a financial instrument, the investor speculates on whether the price will go up or down in a determined amount of time. The spread betting broker quotes two prices, a bid and an offer/asking price, (the spread is between these two prices). An investor then speculates on which way the price will go and places a bet on the direction the assets price will move. So, an investor places the bet on whether the price will go above or below the spread.

In forex spread betting, for every pip the currency moves, you gain or lose the amount you bet per pip, depending on which direction you speculate it would go. Depending on how much the price moves determines your profit or loss. For example, if the price moves 10 points (pips) up, and you bet $5 per pip, you would then gain $50, or say it moves 5 pips down, you then lose $25.

A spread betting account enables an investor to participate in the practice of spread betting. Most brokers allow spread betting; however, they may require the investor to reside under the same jurisdiction as their regulation. It is highly recommended you go with a brokerage who is highly reputable and regulated. Most accounts are free to open, but require a minimum deposit to begin spread betting.

There are a variety of accounts to choose from for spread betting. Not all of them offer the same financial instruments, there is a wide range of markets they might offer. As well, many have different rules, fees, and structures. See the account types below.

Spread betting is really, quite simple. In a way, it’s like gambling with 50-50 percent odds of coming out on top. However, it is more calculated and analytical than gambling, hence being viewed as a viable investment strategy rather than gambling. So, how does spread betting work?

First, when opening a spread betting position on the market, you are given two prices; a bid (buy) and an offer (sell) price. These prices are on either side of the underlying market- this is called a spread. Depending on what you think the market will do, you place your bet accordingly. If you believe the market will rise, you bet at the buying price. If you believe it will fall, you bet at the sell price. The more the market moves in your favor, the greater you profit. Every point or pip moved in the direction you bet, results in profit, and vice versa for losses.

Spread betting is very popular among investors of all levels. Investors see the opportunities it presents and the numerous benefits spread betting provides. See below, the key factors that make spread betting so popular among investors.

Spread betting does not have any additional commissions. Brokerages make their money through the spread, meaning all trading costs are built in. The brokerage calculates the commission cost into the spread, so what you see is what you get. There are no unexpected fees or charges for using a spread betting account or conducting trades on the account.

Spread betting offers investors numerous benefits, which is why it is so popular among investors. In addition to the list of why spread betting is so popular, see the pros and cons of spread betting below.

Now that we have displayed the numerous benefits of spread trading, what are the disadvantages or risks involved?

Spread betting is a popular option among traders and there’s a good chance it’s right for you too. As an investor, you might want to partake in this lucrative investment endeavour for the following reasons:

The types of investors who enjoy spread betting follow a variety of trading methodologies. Spread betting is something that can attract anyone. Some common investor types who delve into spread betting are; market enthusiasts, day traders, short to medium term traders, long term investors, and diversifiers. So, as you can see, spread betting can really be for anyone. The only factor that may cause spread betting to be unsuitable for someone, is if they reside in a country which spread betting is illegal, such as America.

CySEC, FSC, FCSA, FCA and ASIC regulated.

Commission-free CFD trading on 2,200+ instruments.

Can invest in real stocks and shares with Marketsi.

Feature-rich MarketsX trading platform.

Unique and insightful sentiment trader tools.

Limited trader education.

Spreads are a little higher than others in the industry.

Regulated Broker

Multiple choices of trading platforms

Numerous free trading tools provided

Low minimum deposit requirement

Comprehensive educational section

Limited product portfolio

No longer accepts US clients after losing US regulatory license

Highly regulated by leading regulators FCA and CySEC

Access to both MT4 and MT5

An amazing selection of analysis and news

A solid educational offering

Both ECN and standard accounts available

Not the lowest spreads on the standard account

15 Best Spread Betting Brokers 2021 - Comparebrokers.co

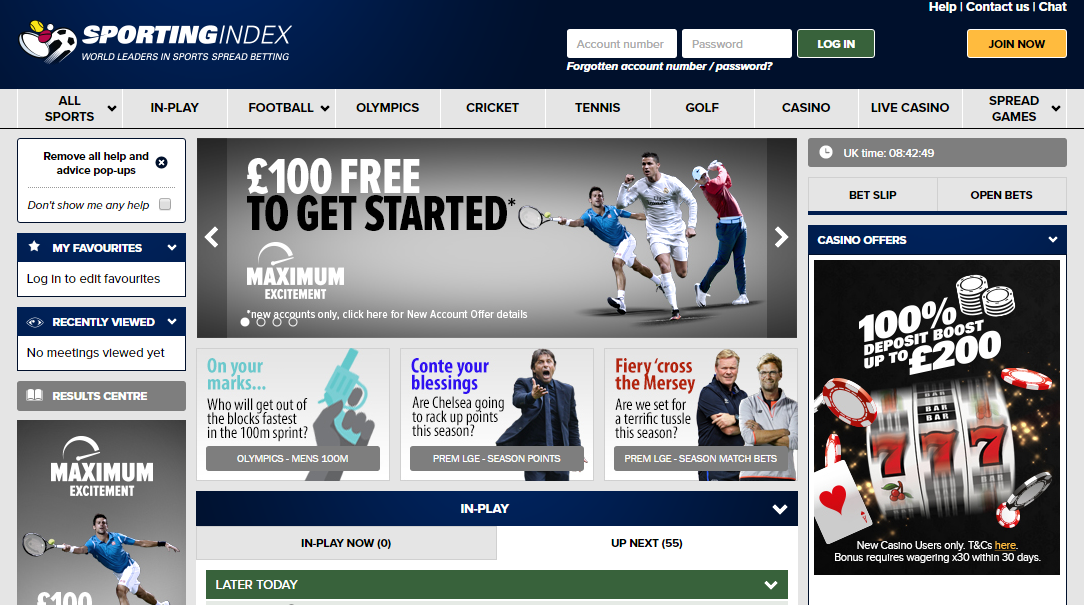

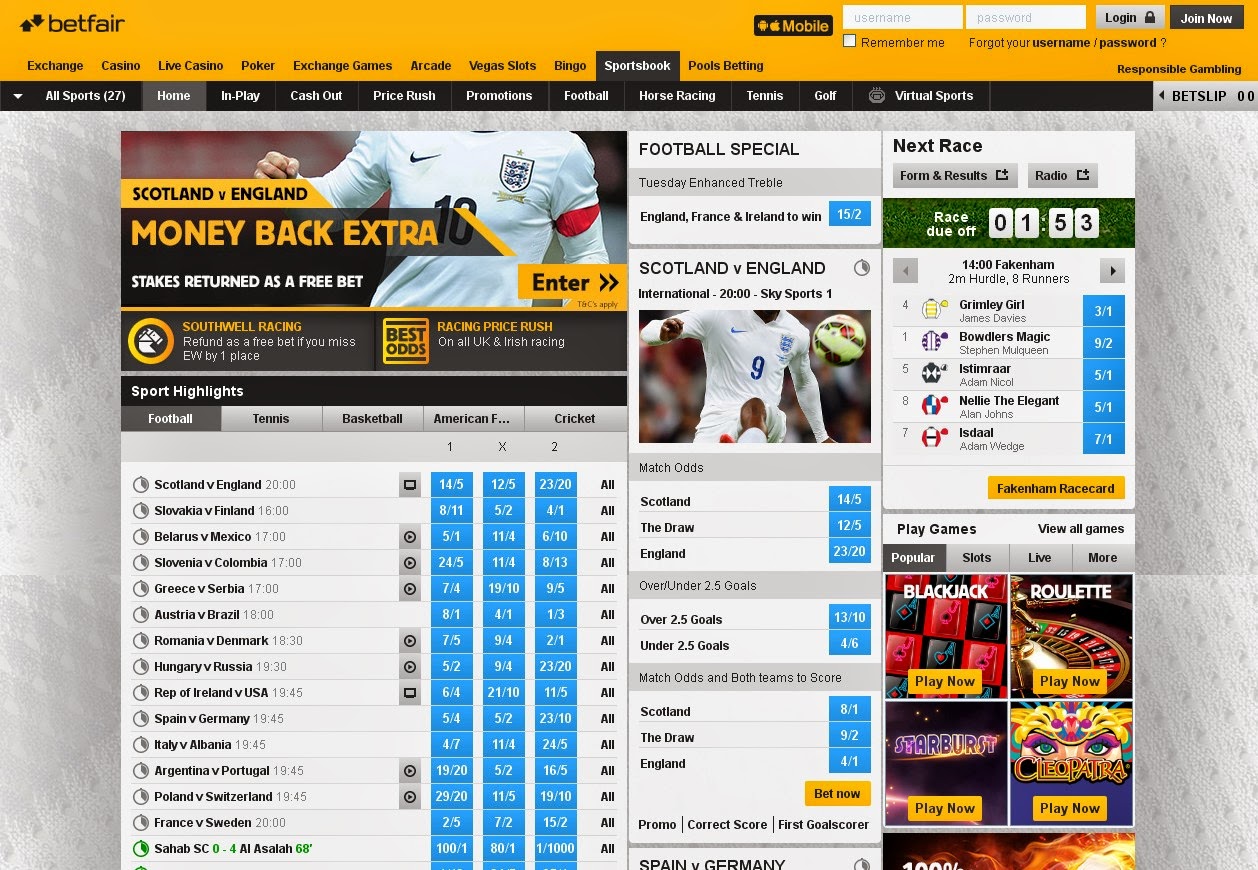

Best Spread Betting Sites - UK Sports Companies & Offers

Best Spread Betting Company 2021 - FXEmpire.com

Best Spread Betting Strategies and Tips for 2021 | IG UK

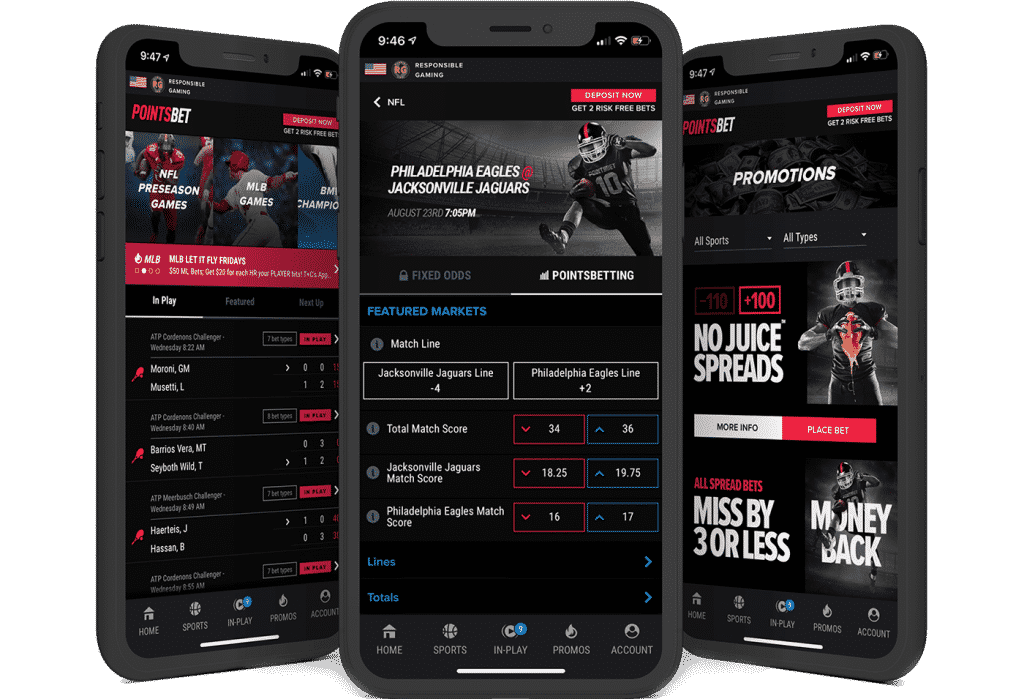

Best spread betting brokers that offer MT4

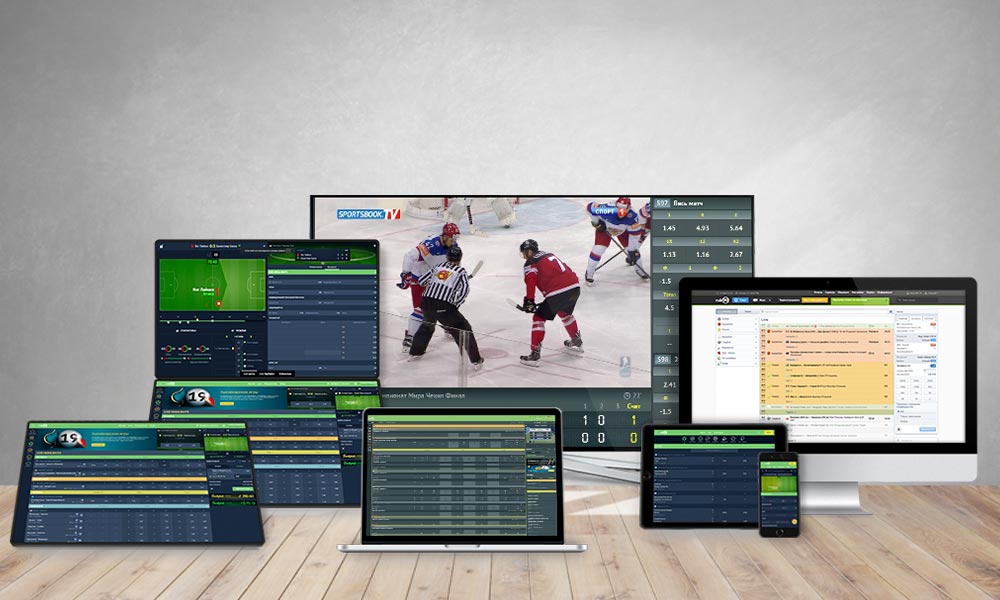

Спред Беттинг – независимый рейтинг лучших брокеров для работы на форекс.

Best Sports Spread Betting Sites | Compare The Top Bookies

Top 10 Best Lowest Spread Forex Brokers 2021 [Tight Spread Brokers]

What Is Spread Betting ?

Spread betting - Wikipedia

UK Best Spread Betting Platforms: The Complete List (2021)

Best Spread Betting Brokers 2020 - TradingBrokers.com

Спред - беттинг ( Spread - betting ) — один из видов торговли деривативами...

Financial & Sports Spread Betting | Spreadex

Spread Betting Brokers - Find The Best With 6 Powerful Tips...

Best spread betting strategies and tips

Becca Cattlin | Financial writer , London

What is the number one mistake traders make?

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. High volatility increases the risk of sudden, large or rapid losses.

To prioritise the service we give our existing clients, IG is not currently allowing any new positions on GameStop and AMC Entertainment.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. High volatility increases the risk of sudden, large or rapid losses.

To prioritise the service we give our existing clients, IG is not currently allowing any new positions on GameStop and AMC Entertainment.

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies. You can view our cookie policy and edit your settings here , or by following the link at the bottom of any page on our site.

Spread betting enables you to execute a range of trading strategies, thanks to the range of benefits it offers traders. Discover some of the most popular spread betting strategies and some tips for getting started.

A trading strategy is nothing more than a predefined methodology for how a trader will enter and exit the market. It will identify specific market circumstances and price points during which a trader will look to execute and close their trade.

We’ve taken a look at some top-level strategies, and the way they would be carried out using spread bets .

This is by no means a full list of all of the trading strategies that can utilise spread bets. In fact, as long as the platform you are using has the appropriate technical analysis tools, most strategies are suited to using this popular derivative product.

A trending market is one that is reaching higher highs or lower lows. Trading with a trend is usually the practice of those who adapt the ‘ position trading ’ style, and is considered a medium-term strategy.

A trend trader’s strategy would use charts and technical analysis to identify the beginning and end of market movements. This often includes the use of indicators such as moving averages and the moving average convergence/divergence (MACD) to identify where to open and close their spread betting positions.

Trend trading is a popular strategy among spread betters, as they can follow the market momentum regardless of whether they are going long or short.

For example, if the price of soybeans was thought to be in an uptrend, with higher peaks and troughs, a trader might open a long spread betting position. They’d do this by opening a spread bet to buy soybeans. Once the trader has reached their profit target or acceptable loss, or analysis has shown the trend will soon be reversing, they would close their position by selling soybeans.

On the other hand, if the soybean market was in a downtrend, meeting lower highs and lower lows, a trader might decide to open a short spread betting position. They would do so by opening a position to sell soybeans.

Consolidating markets are range bound – so instead of reaching price extremes like trending markets, they remain within lines of support and resistance . This is why consolidating market strategies require traders to use indicators to identify entry and exit points within the range bound market, such as the relative strength index (RSI) .

An important part of a consolidating market strategy is volume analysis. When a market is trading within a range, the volume of trades is usually low and flat, but if the range is about to break there will usually be a rise in volume. This can be a clear indication that it is time for traders to think about closing their positions and, potentially, switching to a different strategy.

Although consolidating markets don’t provide the opportunity for running profits, they can create plenty of opportunities for short-term traders, such as scalpers.

Scalping is a trading style that is designed to profit from small and frequent price changes. Although traders might not make the large, long-term gains you’d see with other styles, they enter and exit far more trades, with the aim of taking smaller profits more often.

Many believe taking such short-term positions might not produce the same results as longer-term strategies but spread betting can help capital to go much further. This is because spread betting is a leveraged product, which means that traders can open positions that are much larger than their initial deposit. It is important to remember that while leverage can magnify your profits, it can also magnify your losses. This makes it crucial to have a suitable risk management strategy in place.

Breakout trading involves entering a trend as early as possible, ready for the market price to ‘break out’ from a consolidating or trending range. Breakout strategies are based on the idea that key price points are the start of a major movement, or expansions in volatility – so by entering the market at the correct level, a trader can ride the trend from start to finish.

Typically, traders looking to take advantage of a breakout will need to identify support or resistance levels – as once these have been met or surpassed, they will need to enter the market. Most breakout trading strategies will utilise volume trading indicators , and RSI or MACD technical indicators to find these levels.

One strategy used to spread bet breakouts is to place limit-entry orders at key price points, so that if the market moves through the support or resistance level, the order is executed automatically.

For example, let’s say you wanted to open a spread betting position on gold, which is currently trading at $1255. Although the market has been trading in a range for two weeks, you believe it is due to breakout into a downward trend. Looking at historic levels of support, you can see that $1250 is a key price point. So, you decide to place an entry order to open a short spread betting position if the price of gold falls below $1249. If the market did fall below this price, your spread bet would be executed, and you could ride the breakout until your analysis indicated the downtrend was over. If the market didn’t fall to this price, your trade would never be executed.

Reversal trading strategies are based on identifying areas in which trends are going to change direction. Reversals can be both bullish or bearish, giving a signal that the market is either at the top of an uptrend, or at the bottom of a downtrend. Traders using this strategy would open a spread betting position in the opposite direction to the current market trend, ready to take advantage of the reversal. This can also be known as ‘contrarian trading’.

When trading reversals, it is important to ensure that the market is not simply experiencing a retracement – a more temporary move. Retracement levels are commonly identified using the Fibonacci retracement tool. If the price goes beyond the levels identified by the tool, it is taken as a sign the market is reversing.

Although reversals can be a complicated spread betting strategy, with the use of indicators, there can be a wealth of opportunities. In order to execute a reversal strategy, a trader will need to utilise a confirmation tool. These can include:

For example, let’s say you wanted to create a FTSE 100 spread betting strategy and decided to focus on reversal trading. Although FTSE 100 has been in a downtrend for the last week, you believe that following positive earnings announcements for major FTSE constituents, the trend will reverse. You decide to enter a position if you identify the double bottom candlestick pattern, in the hopes of taking advantage of the upcoming price increase. If the market did reverse, you would be in a position to profit from the upswing. However, if the market continued to decline, you would suffer a loss.

There are a few key things every trader needs to know before they implement a spread betting strategy. It is important to:

Before you start to spread bet, it is crucial to have an understanding of what spread betting is and how it works .

When you spread bet, you can speculate on the future price movements of a range of global markets, such as forex, commodities, indices and shares. And because you don’t own the asset, you won’t have to pay tax on any profits you make. 1 These are just some of the benefits of spread betting , others include hedging, out-of-hours trading and no commission.

Prior to even thinking about which strategy you are going to implement, you should create a trading plan that will give your time on the markets clear direction and purpose. Your plan should always be unique to you, but most plans include:

When you’re building your trading plan and spread betting strategy, you might already have a market in mind. But if you don’t, it’s important to choose which assets you want to focus on before you start spread betting.

Most people will choose to trade a market that they already have an interest in, so they have prior knowledge that they can fall back on. With IG, you can trade over 16,000 markets, including indices, forex, shares, commodities and many more.

Before you open any spread betting position, it is important to be aware of exactly how much you could stand to lose if the market turned against you. Especially as spread bets are leveraged, you could stand to lose – or win – much more than your initial deposit. It is always wise to think about your trade in terms of its full value, rather than the amount you pay to open it.

One way of mitigating risk and locking in profits is by setting an automatic stop or limit, which will define the level you’d like to close your trade at. Stop-losses will close a trade if the market moves against you, while limit-close orders will close your position once it has reached a certain amount of profit.

Footnote

1 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

Publication date : Friday 24 May 2019 15:11

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary .

Explore the range of markets you can trade – and learn how they work – with IG Academy's free ’introducing the financial markets’ course.

We reveal the top potential pitfall and how to avoid it. Discover how to increase your chances of trading success, with data gleaned from over 100,00 IG accounts.

For more info on how we might use your data, see our privacy notice and access policy and privacy webpage .

Find out what charges your trades could incur with our transparent fee structure.

Discover why so many clients choose us, and what makes us a world-leading provider of spread betting and CFDs.

Stay on top of upcoming market-moving events with our customisable economic calendar.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

The value of shares, ETFs and ETCs bought through a share dealing account, a stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting back less than you originally put in. Past performance is no guarantee of future results.

CFD, share dealing and stocks and shares ISA accounts provided by IG Markets Ltd, spread betting provided by IG Index Ltd. IG is a trading name of IG Markets Ltd (a company registered in England and Wales under number 04008957) and IG Index Ltd (a company registered in England and Wales under number 01190902). Registered address at Cannon Bridge House, 25 Dowgate Hill, London EC4R 2YA. Both IG Markets Ltd (Register number 195355) and IG Index Ltd (Register number 114059) are authorised and regulated by the Financial Conduct Authority.

The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Jailbait Lingerie

Hardcore Double Penetration Threesome

Porn Babe Masturbating

Free Porn Outdoor

Wife Is A High School Girl