Best Spread Betting Companies Uk

👉🏻👉🏻👉🏻 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Home » UK Brokers » Best Spread Betting Platforms UK

Spread Betting in the United Kingdom requires a good platform (MT4/MT5) and the top UK spread betting broker. The 2021 UK best spreads betting platform was based on features, fees and the range of financial markets offered.

Justin Grossbard has been investing for the past 20 years and writing for the past 10. He co-founded Compare Forex Brokers in 2014 after working with the foreign exchange trading industry for several years. He also founded a number of FinTech and digital startups including Innovate Online and SMS Comparison. Justin holds a Masters Degree and an Honours in Commerce from Monash University. He and his wife Paula live in Melbourne, Australia with his son and Siberian cat. In his spare time, he watches Australian Rules Football and invests on global markets.

Each month we update average spreads data published by the brokers the retail brokers lose %

We double-check broker fee details each month which is made possible through partner paid advertising. Learn more this here.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

The top UK spread betting platforms in 2021 are the following.

78.2% of retail CFD accounts lose money

73% of retail investor accounts lose money when trading CFDs with this provider

77% of retail investor accounts lose money when trading CFDs with this provider.

73% of retail CFD accounts lose money

76.14% of retail CFD accounts lose money

$50 depending on payment method) Standard Account

$25,000 Active traders

Commission rebates for active traders

Excellent performance and

slippage metrics supplied

Spread betting and CFD trading are similar in the sense that investors are trading leveraged products and speculating on the direction a financial market will move.

The main difference is that when spread betting, a trader is not buying and selling a derivative contract. Rather, traders bet on price movements, deciding on the amount to bet per point of price movement. Spread betters decide the ‘stake’ per price movement they wish to trade, with profits being made when the market moves in favour of the bet.

When compared to CFD trading, spread betting is more tax efficient. UK tax laws mean any gains made from CFD trading are subject to Capital Gains Tax (CGT). As spread betting involves no contracts, profits avoid both stamp duty and Capital Gains Tax, which means it can be considered a tax-free trading strategy.

Pepperstone is a no dealing desk (NDD) broker that offers spread betting on a range of asset classes with competitive pricing. As well as spread betting with currency pairs, Pepperstone clients gain access to thousands of index, commodity, treasury and stock markets.

While cryptocurrencies were available in the past, recent changes to FCA regulation have restricted the ability of retail traders to access crypto markets such as Bitcoin or Bitcoin cash.

Pepperstone gained its reputation as one of the best brokers for ultra-tight forex spreads due to its NDD execution and top-tier liquidity providers. Although they don’t offer specific investment advice, the brokers offer educational resources suited to both beginner and experienced traders.

When spread betting forex, traders do not pay any flat-rate commission and therefore bet on spreads available to those using Pepperstone Standard account.

With the Standard account, Pepperstone offers minimum spreads as low as 1.0 pips on major currency pairs such as the EUR/GBP, AUD/JPY, AUD/USD, CHF/JPY, CHF/SGD and EUR/USD. The table below shows the average spreads for major currencies available to spread bet with Pepperstone. Compared to brokers such as CMC Markets and FxPro, Pepperstone offers tighter average spreads on a wider range of fx pairs than its competitors.

Spread Betting: Standard Account, No Commission Spreads

Data taken from broker website. Accurate as at 02/07/2021

When spread betting with Pepperstone, customers can choose between MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. Both platforms offer a good range of financial instruments as well as various technical analysis tools to develop spread betting trading strategies. Trading tools and features available on both MT4 and MT5 include:

MT4 and MT5 are available as desktop platforms, web trader platforms or mobile and tablet spread betting apps that are compatible with iOS and Android devices.

Before spread betting with real money, traders can sign up for Pepperstone’s demo account that is available with both MetaTrader 4 and MetaTrader 5. To start trading with real money, a Pepperstone spread betting account can easily be opened online with no initial minimum deposit, although the broker recommends depositing at least £200. To deposit and withdraw funds from a trading account, customers can make bank transfers and use a credit card (Mastercard and Visa).

As a spread betting and CFD broker, Pepperstone is overseen by the Financial Conduct Authority in the United Kingdom. The FCA ensures brokers follow UK regulation and that retail investor accounts are receiving a fair brokerage service. While Pepperstone’s Australian subsidiary is regulated by the Australian Securities and Investments Commission (ASIC), spread betting is not permitted in Australia and even outside the UK.

The overall rating is based on review by our experts

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investors lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing money.

FXCM is one of the largest brokers to offer spread betting. Choosing FXCM comes with a number of strengths. These include

FXCM gives you a choice of two trading accounts for spread betting. The first is the retail spread betting account, the second is the active trader account.

The FXCM retail spread betting account works the same as their CFD trading account. This means you get the same spreads you would if you were trading CFD financial instruments such as Forex, Shares, Indices, and other products FXCM offer.

FXCM does not charge commissions which means the markup is included as part of the spread. Spreads for the FXCM account are as follows:

FXCM Spread Betting: Standard Account, No Commission Spreads

Data taken from broker website. Accurate as at 02/07/2021

If you are after the tightest spreads for spread betting, then you should consider the Active Trader account. Active Traders is only for the serious trader who is prepared to bet in high volumes.

To qualify for an active trader account you will need to bet or trade a monthly notional volume of at least 150 million and maintain equity above $25,000. While spreads are tighter there are commission costs you will have to pay (which is unusual for a spread betting account).

For every $1 million you bet, you will pay $25 in commission when you open and close your bet.

Other benefits of the Active trader account include:

The following table lists the average spreads FXCM offer for Active Traders:

FXCM Active Trader: Standard Account, No Commission Spreads

Data taken from broker website. Accurate as at 02/07/2021

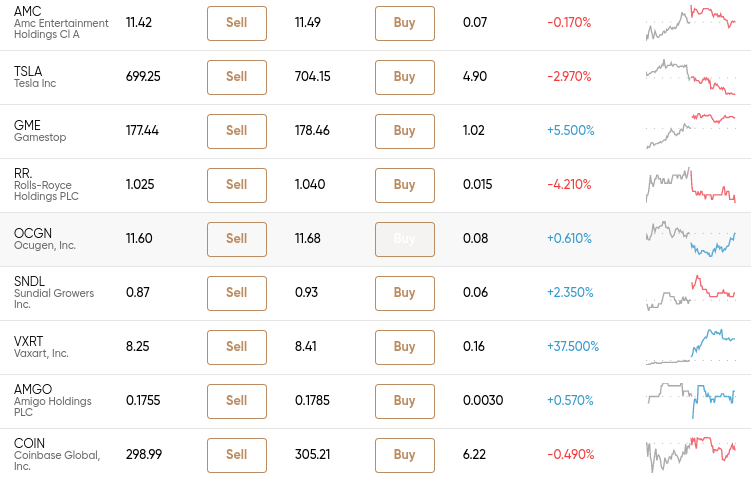

Choosing FXCM means you get a large and diverse range of financial instruments you can use for trading. Products include:

One of the major features is the range of shares FXCM. Spread betters are not restricted to shares from the US NASDAQ or NYSE like many other brokers only offer but shares across multiple markets. This means you not only can bet on popular shares based in the US like Facebook, Zoom, Microsoft, Alphabet (Google), and Tesla but also shares in other markets such as AstraZeneca and BP.

In addition to shares, FXCM also offers trading baskets. Available baskets include forex baskets and stock baskets. Trading baskets are a compilation of common assets grouped to form a kind of index.

There are 3 Forex Baskets available. These are The Dow Jones Dollar Index Basket (US Dollar), The JPY Basket which is called the YES index, and the EM Basket or Emerging Markets Index.

The difference between each index is the number of currencies that make up the index.

The other trading baskets consist of stocks ground by a particular theme. Examples include FAANG which compiles stocks of the 5 biggest I.T. companies on the US Stock exchange and US Automotive (US.AUTO) which consists of 5 of the largest automobile companies on the US stock exchange.

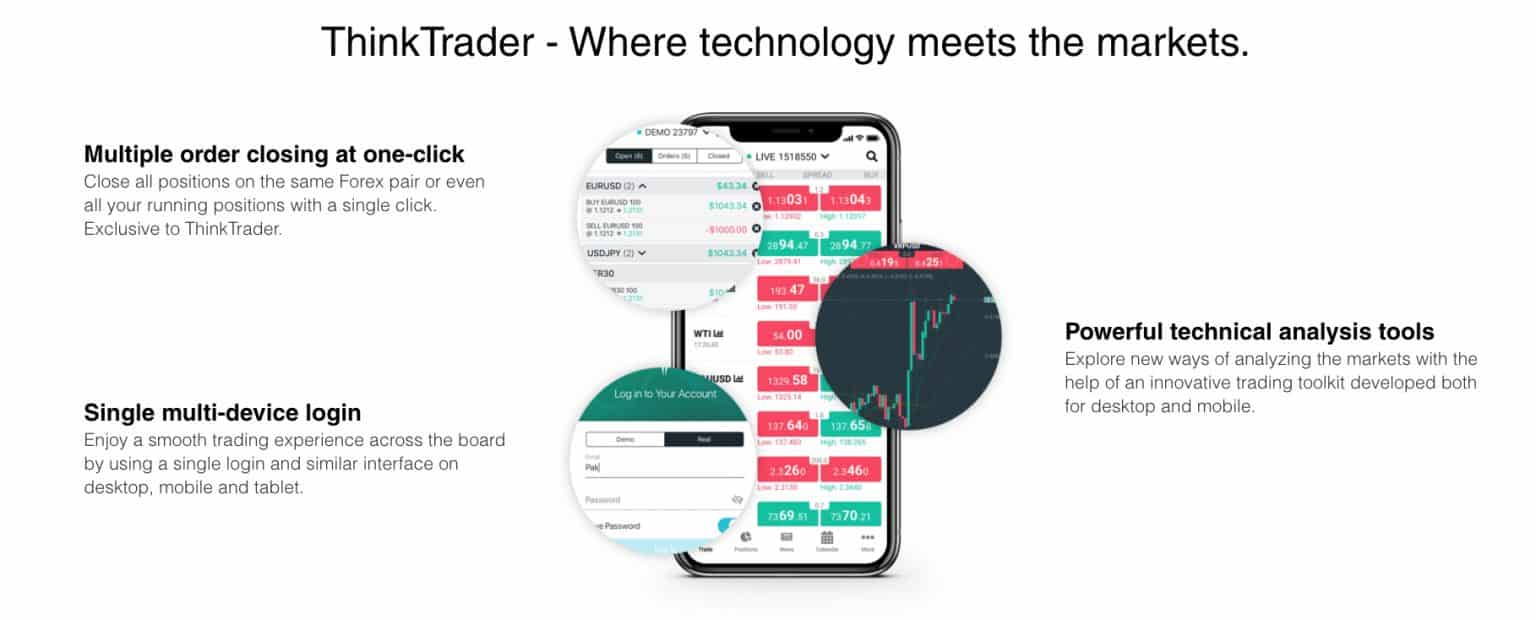

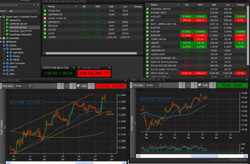

FXCM gives you a choice of 2 trading platforms for Spread betting. These are Trading Station Web and MetaTrader 4.

Trading Station Web is FXCM’s in-house developed trading platform built following feedback from FXCM clients. The platform was recently updated using HTML5 making it suitable for Windows and Mac browsers and is also available for Android and iOS mobiles.

Features of Trading Station include:

1As per FXCM’s Spread Report (Q1 2021)

²FXCM can be compensated in several ways, which include but are not limited to adding a mark-up to the spreads it receives from its liquidity providers, adding a mark-up rollover, etc. Commission-based pricing is applicable to Active Trader account types

3Cryptocurrency Products are currently not available to retail clients residing in the UK

4Leverage: Leverage is a double-edged sword and can dramatically amplify your profits. It can also just as dramatically amplify your losses. Trading foreign exchange/CFDs with any level of leverage may not be suitable for all investors.

Markets.com is one of the best brokers that is regulated by the FCA (Financial Conduct Authority) which allows you to spread bet. They have a wide range of platforms to offer including their top-tier proprietary platform Marketsx and the most popular MetaTrader 4 & 5 available.

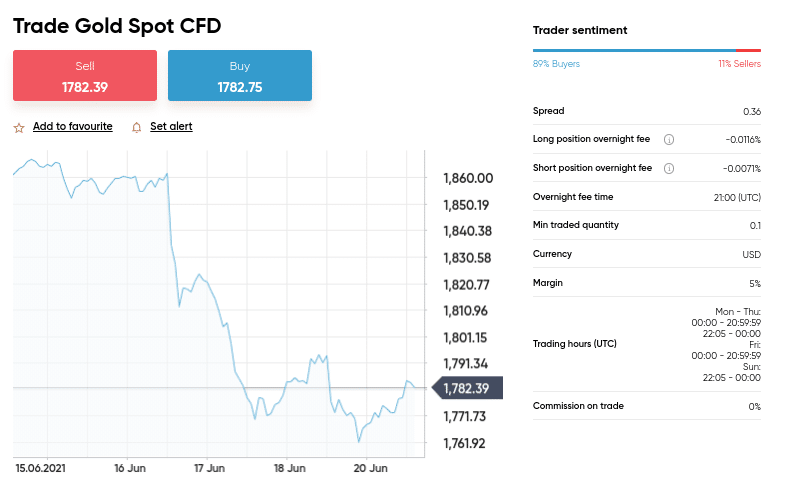

Markets.com offers you some of the most competitive spreads compared to a lot of the brokers on the market. While they do not display their average spreads on their website like the majority of other brokers, we had our skilled analysts look at some of their live spreads. As can be seen below, their live spreads are some of the lowest in the industry with EUR/USD being 0.60 pips and EUR/JPY being 0.70. This can be compared to FXCM’s spreads of 1.30 & 2.10 for the same pairs.

Markets.com has the widest range of platforms that offer spread betting for their UK and Ireland residents. Their own platform Marketsx is one of the most advanced platforms that offers over 200 different assets ranging from forex currency pairs to blended stock baskets.

Marketsx is your all-in-one trading platform offering a multitude of features. Trading has been made easy with Markets.com’s range of tools including technical, sentimental, and fundamental analysis to help you make the most informed decision. Marketsx includes advanced charting features as well including indicators, multiple time periods, and oscillators to give a better view of the financial markets.

If you want a platform that is used by most traders around the world, then the MetaTrader platforms are the best option. Some of their main features are listed below:

Markets.com offers one of the best knowledge centers for anyone to enjoy even if you are not a client with them. Whether you are just starting your trading journey or have been doing it for many years, there is always something new to learn about when trading in the financial markets.

Some of the great features of Markets.com knowledge center are:

For Traders that are unfamiliar trading with Markets.com on their Marketsx or the MetaTrader 4 & 5 platforms, there is a demo account that can be used for 3 months with unlimited virtual money available. If you have not traded the financial markets before then it is recommended to start with a demo account before risking your own personal money. For all UK and Ireland residents, the minimum deposit amount to start trading on a live account is £100.

City Index is one of the best UK forex brokers with spread betting on a range of asset classes with 4,000 different financial products to bet on. These global markets can be accessed through the broker’s web trader platform or via the trading apps they offer designed for mobiles and tablet devices.

When spread betting with City Index, customers can bet on a range of financial instruments that are competitively priced. As with all spread betting in the UK, profits are tax-free and exempt from stamp duty and Capital Gains Tax (CGT).

As shown above, the UK broker offers tight spreads, starting as low as 0.5 pips for major currency pairs. For instance, spreads for the Euro/United States Dollar (EUR/USD) fx pair can be as low as 0.5 pips, with average spreads of 0.8 pips. City Index’s full forex product range consists of 65 different currency pairs, along with a solid selection of indices, shares, commodities, metals, bonds and interest rates.

Although no commission fees are incurred when spread betting with City Index, traders do face overnight financing fees, inactivity fees for dormant accounts, and premiums for Guaranteed Stop Loss Orders (GSLOs).

To manage the high risk of spread betting, stop-loss orders and limit orders are available to lock in profits and minimise losses.

As well as free order types, spread betters can pay a premium to place GSLOs. GSLOs ensure positions are closed at the exact price selected by the trader, whereas stop loss and limit orders do not provide guarantees that the pre-selected prices will be matched.

City Index’s proprietary online trading platform is powered by HTML 5 technology and accessible from any browser. Although the web trader platform may lack MT4’s Expert Advisor and automated trading features, a comprehensive suite of inbuilt technical analysis tools are provided.

City Index’s Web Trader platform features include:

City Index offers two forex trading apps specifically designed for iOS and Android devices. Many of City Index’s web trader features are available on the mobile apps, including different order types such as GSLOs, one-click trading, Reuters news and custom indicators.

The fully functional and customisable apps provide most of the online platforms charting tools with 60 inbuilt technical indicators and multiple timeframes included. A major benefit to City Index’s trading apps is that traders can easily and instantly contact customer support via the apps live chat function.

When spread betting with IG Markets, customers gain access to a range of CFDs along with a choice of trading platforms. It should be noted that trading CFDs is not purchasing the underlying asset rather than focusing on the price movements of that asset.

The broker’s proprietary trading platform for beginners is offered as a desktop or web trader. The beginner trading platform also offers trading apps designed for tablets and mobiles. For those wanting to use a third party spread betting platform, ProRealTime and MetaTrader 4 are other options.

When spread betting with IG Markets, customers can gain access to global markets and various asset classes. Available asset classes to spread bet include:

IG Markets proprietary software for beginners is a user-friendly, customisable platform suitable for all levels of trading experience. The web trader platform can be accessed from any browser, while mobile trading apps are compatible with Android and iOS devices.

An advantage to using IG Markets online trading platform is that users can utilise different order types such as Guaranteed Stop Loss Orders (GSLOs) to manage the high risk of spread betting. Platform features available on both the web trader platform and trading apps include:

Many traders prefer MetaTrader 4 due to the platform’s Expert Advisor (EAs) functionality. EAs allow users to automate trading, reducing the time spent conducting analysis and placing orders. As well as MT4’s inbuilt technical indicators, IG Markets offers an add-on package that provides an additional 12 MT4 add-ons.

Overall, IG is the best spread betting broker for beginners based on the provider’s trading platform, customer service and range of markets. IG Group is the largest retail foreign exchange broker, and so the training facilities are also ideally tailored for novice traders.

CMC Markets is an FCA (Financial Conduct Authority, United Kingdom) regulated broker offering spread betting via its proprietary trading platform.

The Next Generation platform offers an intuitive, user-friendly trading environment that is available in a standard or advanced format.

A range of trading tools is provided via the platform to assist traders with developing spread betting strategies and managing the high risk of forex trading, such as:

As a CMC Markets customer, traders can spread bet on over 9,500 financial instruments from forex, indices, commodity, share and treasury asset classes.

Although no commission is charged on top of competitive spreads, traders incur fees for overnight financing, premium order types, and inactive trading accounts. Spread betting costs include:

As well as an award-winning platform and impressive market access, CMC Markets provides an excellent range of educational resources to assist both novice and experienced spread betters.

In addition to webinars, trading platform tutorials and spread betting guides, customers can contact CMC Markets via phone, email or live chat 24/5 with any questions they may have about the broker and spread betting.

ETX Capital is an FCA regulated broker offering spread betting services on their proprietary trading platform, TraderPro and MetaTrader 4 (MT4).

ETX Capital’s MT4 trading platform includes all the tools needed to effective spread betting trading strategies, including wide market access, technical analysis tools and automated trading features.

ETX Capital customers spread betting via MetaTrader 4 enjoy access to 7 different asset classes. When spread betting on currency pairs, competitive spreads can be as low as 0.8 pips on major currency pairs such as the Euro/United States Dollar (EUR/USD). ETX Capital’s full spread betting product range accessible on MT4 includes:

ETX Capital offers MT4 as a desktop trading platform for Windows and Mac computers. The trading platform can easily be downloaded from the broker’s website and includes detailed installation and set setup instructions.

An advantage to spread betting through MetaTrader 4 and ETX Capital is the ability to create or download Expert Advisors (EAs or trading robots) to automate trading. EAs save traders time by automatically analysing markets and entering and exiting bets, eliminating the need for lengthy and complex technical analysis.

Additional MT4 features and trading tools include:

Although the broker’s MT4 mobile app is fully functional, it is not available on Android devices and restricted to iOS mobiles and tab

Dr Martens Sex Pistols

Sensual Adventures 3 The Exhibition

Retro Rus Sex

Sex 720 2021

Mama Incest Skachat

Top 10 Spread Betting Platforms With Low Spreads for UK ...

Top 10 Spread Betting Brokers | ADVFN

The Best Spread Betting Sites 2021: Our Top Picks Reviewed ...

Compare the top Spread Betting Companies for 2020

Best Spread Betting Companies | Compare Spred Bet Brokers

UK’s Best Sports Spread Betting Sites of 2021 Revealed

Best Spread Betting Companies Uk