Back to the basics. Why PX is launched TON-first.

by Sasharu version

Price is the point at which supply and demand meet at a given point in time.

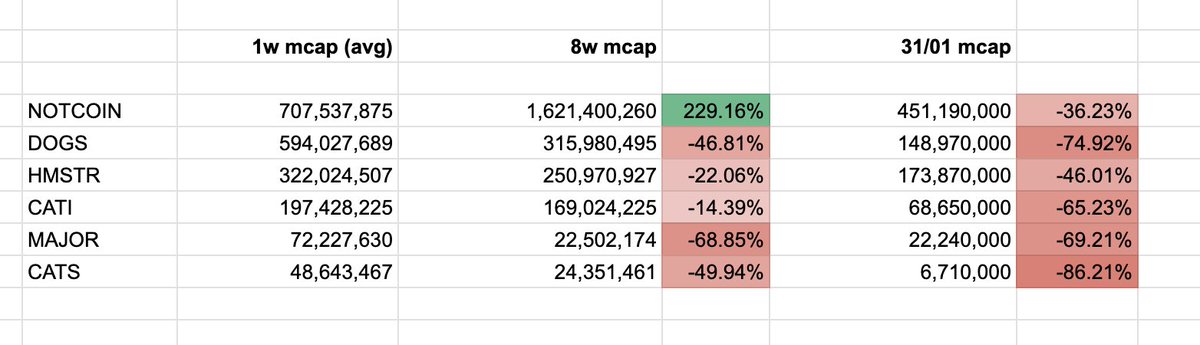

Every airdrop that distributes a significant percentage of its supply to users creates a long-tail of selling pressure. While we were optimistic about the Notcoin launch back to the May last year, the math suggested it might have been wiser to start with a smaller market cap — in that case, we would have better chances to avoid a pump-and-dump scenario and give Notcoin more space for growth.

But Notcoin was a pioneer making a historic mass adoption event that had never happened before in crypto. All this made demand high enough to drive the market cap into the billions, making people happy with their huge airdrops.

But the math is still here.

As more projects sought to replicate this success, they launched more mini-apps with tokens. Many shifted from a "play to earn" to a "pay to earn" model. These projects began prioritizing donors over players, essentially turning apps into pre-sale phase.

So, what defines the value of the dropped tokens? Who absorbs all these these airdropped tokens when users sell them?

Investors and traders, those who buy from the market, believing in the project's potential for good ROI. It feels so obvious but needs to be stated clearly: without traders and investors buying tokens, the price is not going up.

While with Notcoin, traders enjoyed gains of up to +400% in its early weeks, subsequent drops haven't been as lucrative. The ROI from most Telegram mini-app tokens post-Notcoin has often been negative.

Each launch of a mini-app token with declining performance has made the narrative less bullish, leading to investor disappointment and reduced demand for subsequent launches.

Reduced demand made lowered market caps, causing prices to drop more quickly, further disappointing investors and reducing demand in a self-perpetuating loop.

Every new launch has thus made the conditions tougher for the next.

Until now 🔳

Better chances.

Well, to break this cycle we need to make tokens on TON cool for investors and traders. What makes tokens cool? Price growth.

Rather than getting pumped on TGE with a subsequent decline, it makes more sense to start with organic price discovery following utility-based growth, potential listings on exchanges and Telegram Wallet.

Good green candles work better for traders than any words or marketing.

Especially onchain, where you have all the data.

Even a single success story with a token on TON might bring a wave of traders and investors, as seen in many examples on Solana, Ethereum and other chains. And it might happen anytime.

Following the recent onchain launches, we are seeing the development of new tools, which is cool. Onchain services are getting better and traders are getting smarter. And we want to see more analytics tools, trading bots, DEX aggregators, more mature DeFi and eventually more onchain liquidity.

The current CEX -> DROP -> DEATH pattern is just bad.

For traders, for projects, for the ecosystem.

So yeah, the time has come.

🏴