BTC\USDT

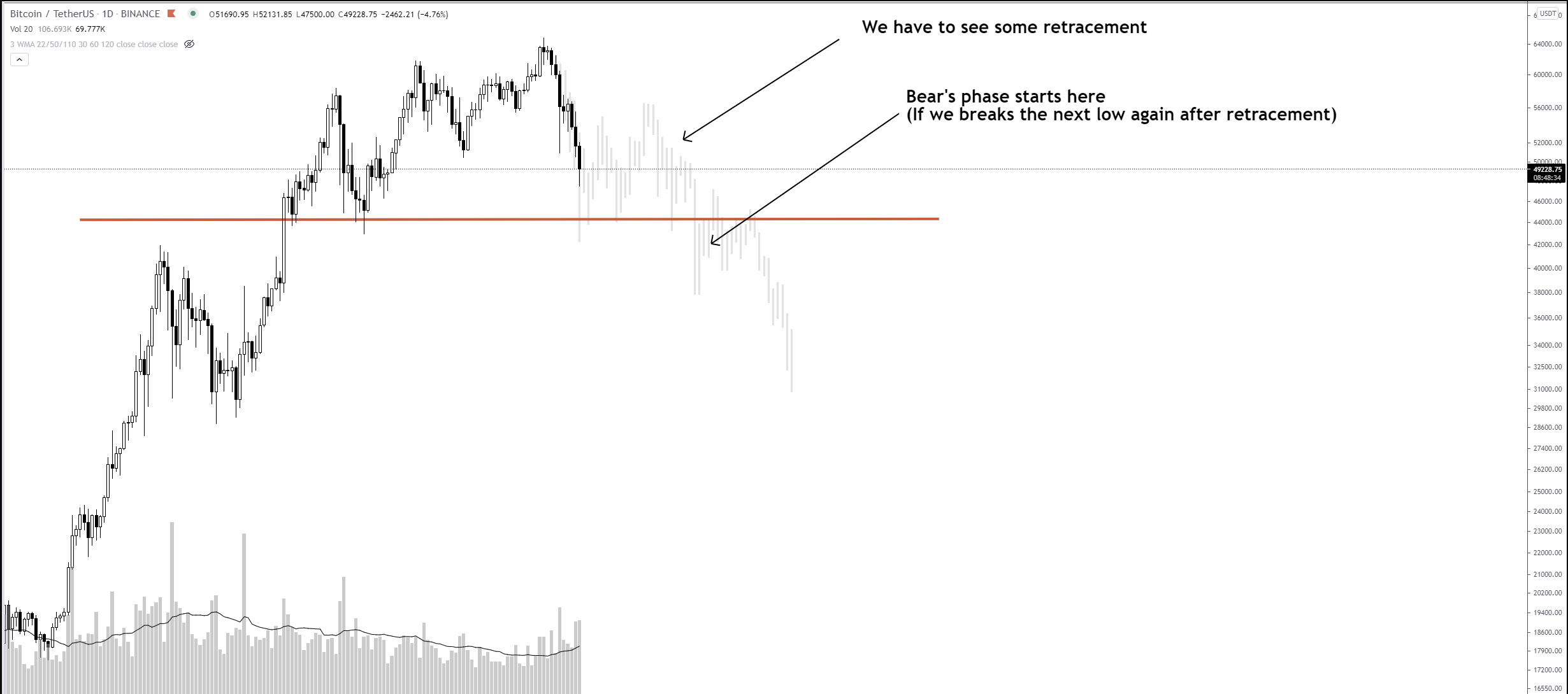

Let's take a look at what's going on with bitcoin. Many people were frightened by yesterday's fall...But if you read the previous analysis carefully, you should remember that Bitcoin is now in a flat phase, where the market is moving in a slightly different way.

In addition to the flat, we see very high volatility, on some coins you can see more than 80% growth, but overnight all the growth is leveled out.

Many projects of one candle gave shadows of 40% correlated with bitcoin,

and other projects on the contrary with a similar picture on the chart went against Bitcoin.

What does all this tell us?

- Flat phase - this is already a difficult market phase, where you need to reduce the risks (we mentioned this earlier)

- Many people panic and sell their cryptocurrency via the market orders, plus in the flat phase very often update the local minimums, where stop-losses of many participants are concentrated, which gives us increased volatility.

- Finding a good entry point on the chart now will be very difficult, in fact, with the same pattern, something correlates with bitcoin, something does not and all in a random way

Let's now look at bitcoin directly and try to understand what is actually happening.

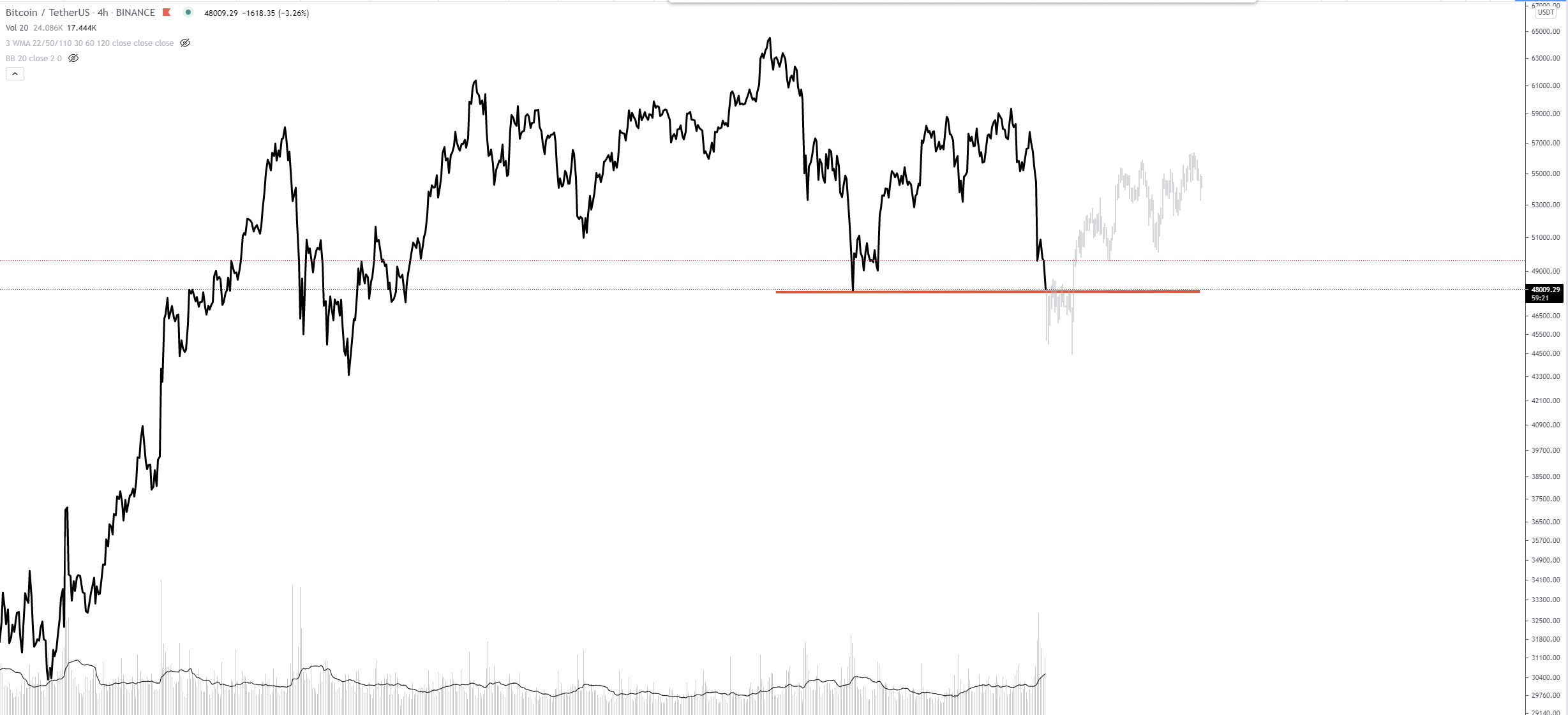

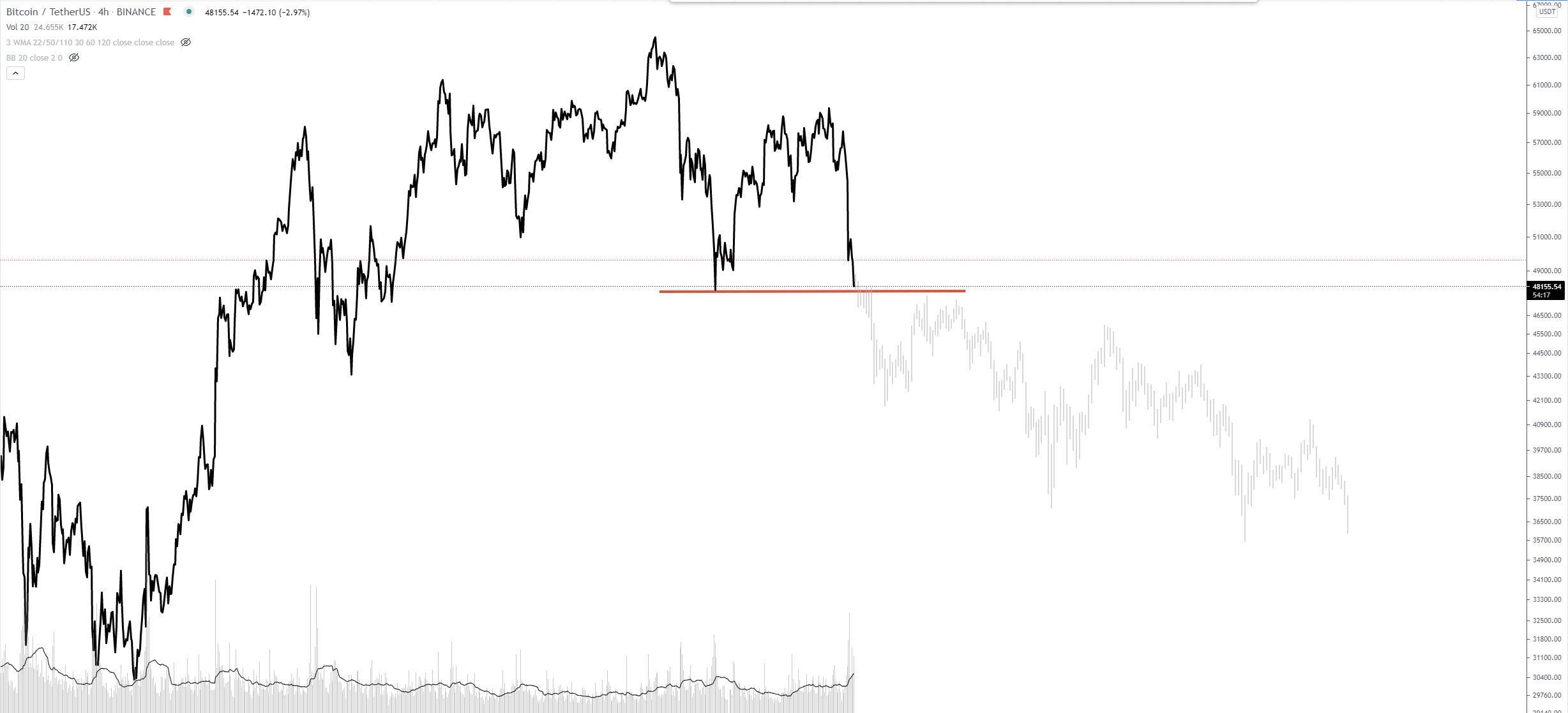

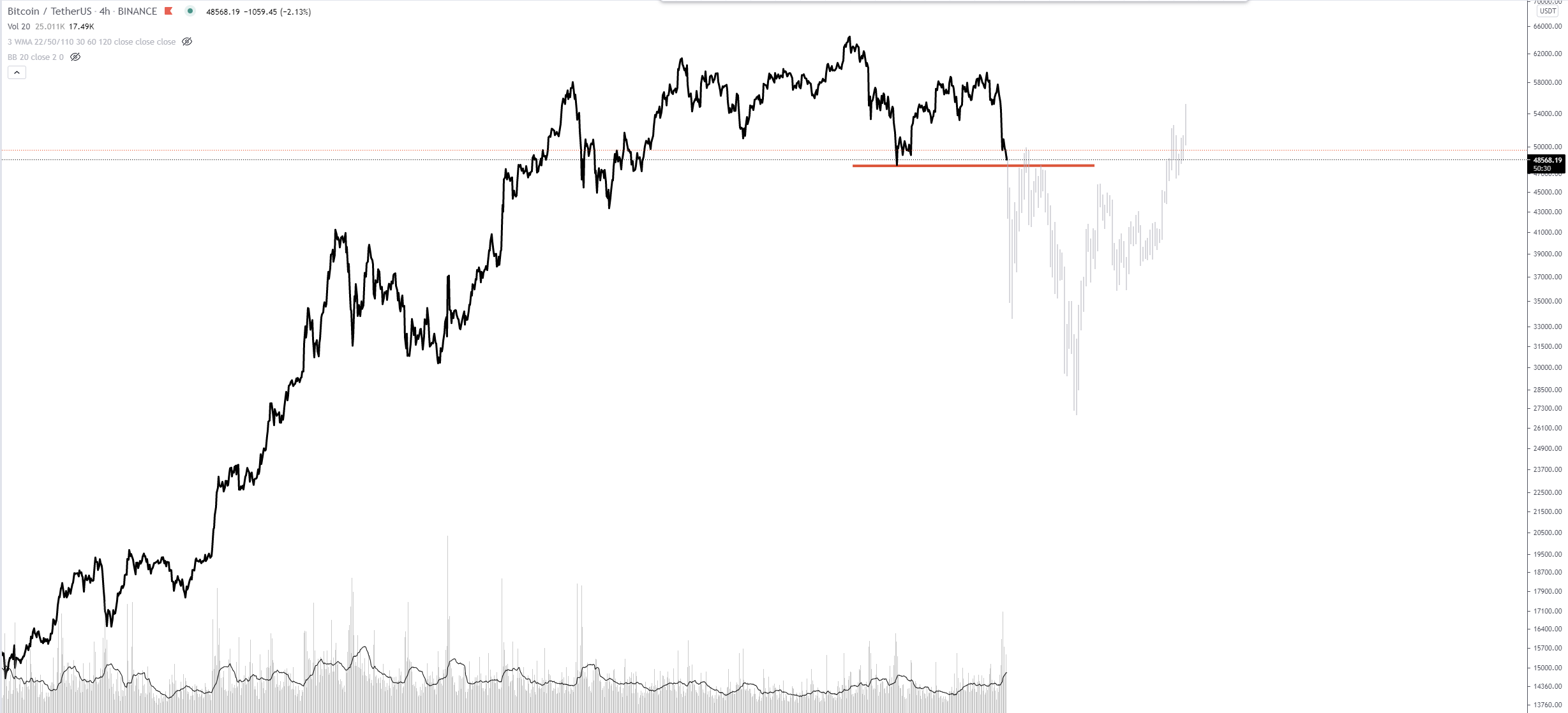

As you can see, if you remove the noise Bitcoin is only trying to update the local low, and on higher volumes, if you remember, in the flat stage it is more of a signal to buy than to sell. So to see a return, at least to $53000 is more likely, than a free fall

But if Bitcoin starts to hold under the level indicated on the chart - it will not be very good and then we will see a deeper plunge with a higher probability.

Even if a bloodbath starts now, which will be the beginning of the bear phase, for example, Bitcoin will now shed another 40% More likely we will see a return to the current values. This has always happened to Bitcoin, as long as there is no reason for it to free-fall to $1000

Bottom line...Friends, nothing has fundamentally changed since the last review. At least until Bitcoin has settled below about 47K, as was shown a few weeks ago...

One problem left to solve is the volatility problem. No stop-losses will save us now when one 40% candlestick altcoins go in random directions.

The solution here will be solely our risk management. What I propose, only the top projects will be selected for trades, which can be held for a long time. I.e., the risks of entering the position will be calculated based on the fact that your stop-loss, this is if the project is worth $0

Until we have entered the stage of a downtrend, we will select projects that are more likely to still grow.

We are also going to change our approach to buying a little bit.

You will receive recommendations in the usual mode, ie the form of the signal will not change for you, but you probably will not be able to enter the trade immediately, because the range of interest to us will be below the current one.