BTCCREDIT: Next-Generation Decentralized Banking Ecosystem

Odinigwe Francis O

General Overview Of Btccredit P2p Ecosystem:

Introduction:

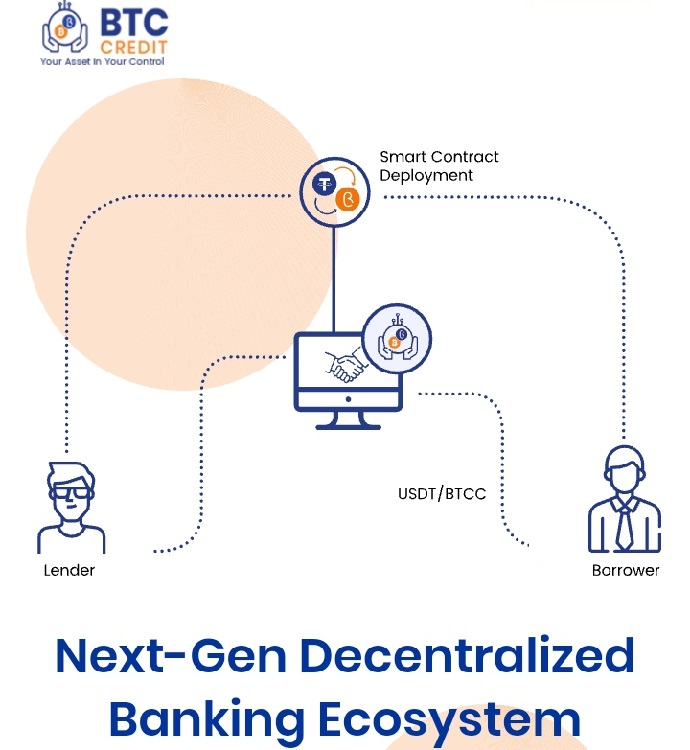

Btccredit is a very well-established loan platform that is not easy to use for users. P2P lending would be the hottest subject in the future that cryptocurrency was able to facilitate. We are building a robust infrastructure to make the P2P lending crypto worthy of all people. This platform will support Bitcoin as well as our original tokens of BTCC as guarantee. Make deposits and withdrawals, USDT to be used. The use of USDT makes it safer for users to make transactions on this platform. The first alibi for that was a very liquid USDT, appearing in almost every exchange, and another was that the subject was backed by the same amount of USD in the Bank's property. Our significant concern is the protection of customer funds and will always be the main focus. Btccredit is not just a P2P loan solution; this is a banking ecosystem. With the team's expertise and experience in the Fintech domain, they decided to make cryptographic banks that can be decentralized and provide all the facilities offered by traditional banks. Just like traditional bank functions, the BTCC will function as a bank that only supports cryptocurrency and will provide all services provided by traditional banks. These include retail and institutional loans for crypto, P2P and C2P, along with indices that act as investment instruments.

BTCC solves the problem of Global Parity of Interest rates (IRP) and has developed an ecosystem of p2p lending and borrowing. The system doesn’t restrict citizen from any country to borrow or lend funds via cryptocurrency. Btccredit will be like a crypto bank which could be decentralized and yet provide all the facilities that a traditional bank offers. Just as the traditional banks function, BTCC will function as a bank that supports only cryptocurrencies and will provide all the services provided by a traditional bank. These include retail and institutions in crypto, P2P and C2P lending, along with indexes that act as investment instruments.

HOW THE PLATFORM WORKS:

As a lender, users enter the system and fund system resulting in a USDT Wallet. The acceptable loan parameters are recorded. The loan profile creditor becomes part of the "credit market". As a borrower, users enter the system with the system generating Bitcoin wallets. Bitcoin funds entered the wallet form a guarantee of potential loans. Loan conditions are also part of the "credit market". The system's internal logic automatically matches and suggests existing loans and borrowers. The borrower or lender can also choose from borrowers' requirements. After the loan selected, both parties agree on the parameters on the book, "the borrower wallet will be funded with the requested USDT and a payment schedule will be made.

OPERATIONAL WORKFLOW:

The system will automatically connect buyers with sellers based on the conditions they like.

● The lender enters the system

● Transfer funds to the Wallet

● Post Selling Orders

● Selling orders are displayed

● Buyers check available Selling Orders range

● Suitable Buyers and Sellers

● Buyers and Sellers negotiate the most optimal prices

● Buyers fulfill requests and transfer funds

● The trade is complete

● The seller receives funds in his wallet

SOME UNIQUE FEATURES OF THE PLATFORM:

a. The Credit Marketplace:

The first unique feature will be the implementation of a loan marketplace. The borrowers and lenders that register on the platform will be prompted to declare their requirement set in terms of figures. A lender will declare parameters such as the tenure, the rate of interest sought, the maximum amount per loan from his corpus amount etc. The borrower will declare his offered rate of interest, the amount sought, tenure for which the loan is requested. The borrowers and lenders will participate in a loan matching flow much like a stock exchange with buy and sell orders.

b. Partial Bidding on Loan Offers:

The marketplace will also enable partial bidding on loan offers from borrowers

c. Crypto Collateral:

The platform would allow for collateral in multiple cryptocurrencies like Bitcoin, Ether, and Altcoins etc. There will be wallet support for each supported cryptocurrency and borrowers will deposit the collateral as per the conversion rates.

d. Collateral valuation:

The platform will manage the continuous collateral valuation and take remedial measures if collateral value fluctuates beyond certain prescribed intervals. For e.g, if Bitcoin valuation exceeds 100% from the time of pledging it as collateral, there will be a policy of releasing a certain amount of crypto back to the borrower.

e. Each Loan Agreement On Ethereum:

The platform will follow template based loan contract, which will be deployed on the Ethereum blockchain as an agreement between the lender and borrower. The platform will have a loan contract template that will be translated into an Ethereum smart contract between the borrower and the sender. The transparency of the agreement will be expressed through a publicly visible deployed contract that will calculate the loan execution parameters through a well-defined, and indisputable computation.

f. The USDT:

The platform will use USDT as a means to disburse the loans, which will make it very easy for borrowers to convert it into fiat currencies. This will make the loan feasible for any kind of need.

g. One Wallet for Everything:

The platform will be powered by a wallet that will provide all the necessary features. In this way, a wallet based ecosystem will be created that will function similar to a bank. This will also take away the need for the users to make use of multiple platforms to meet all their crypto related needs by providing them with a consolidated platform that offers all the said features at one place.

BTCCREDIT TOKEN DETAILS:

Token name: BTCC

Token Platform: Ethereum

Token amount for sale: 120,000,000

Pre-ico token price: 1 BTCC = 0.05 USD

ICO token price: 0.1000 USD

ICO token supply: 40%

Investment Info.

Personal Cap Min: 100 USD

Accept Currencies: Eth

Soft Cap: 2,500,000 USD

Hard Cap: 10,000,000 USD

ROAD-MAP:

TEAM:

ADVISORS:

For More Information On This Project, Please Kindly Visit The Links Below:

Website: http://btccredit.io/

Whitepaper: http://btccredit.io/pdf/btccredi...

Facebook: BTCCredit

Twitter: BTC Credit (@btc_credit) | Twitter

Telegram: BTCCredit.io

Instagram: Btccredit (@btccredit) • Instagram photos and videos

Author’s Details:

Bitcointalk Username: Dtotti78

Bitcointalk Profile: View the profile of Dtotti78

My Eth Wallet Address: 0xc5a639f58cb8deffff8513e2ad5f28f46d678b74