BTC vs USD

СсLet's take a look at the current situation with Bitcoin so you can navigate it.

Let's keep it as simple as possible to make it accessible to everyone, even if you are a complete beginner.

Recently we got two very sharp, maybe manipulative moves, like today's fall can be tied to the expiration of the options on BTC Futures

But that's not really the main reason at all.

Let's take a look at the current situation on the chart and understand what is really going on.

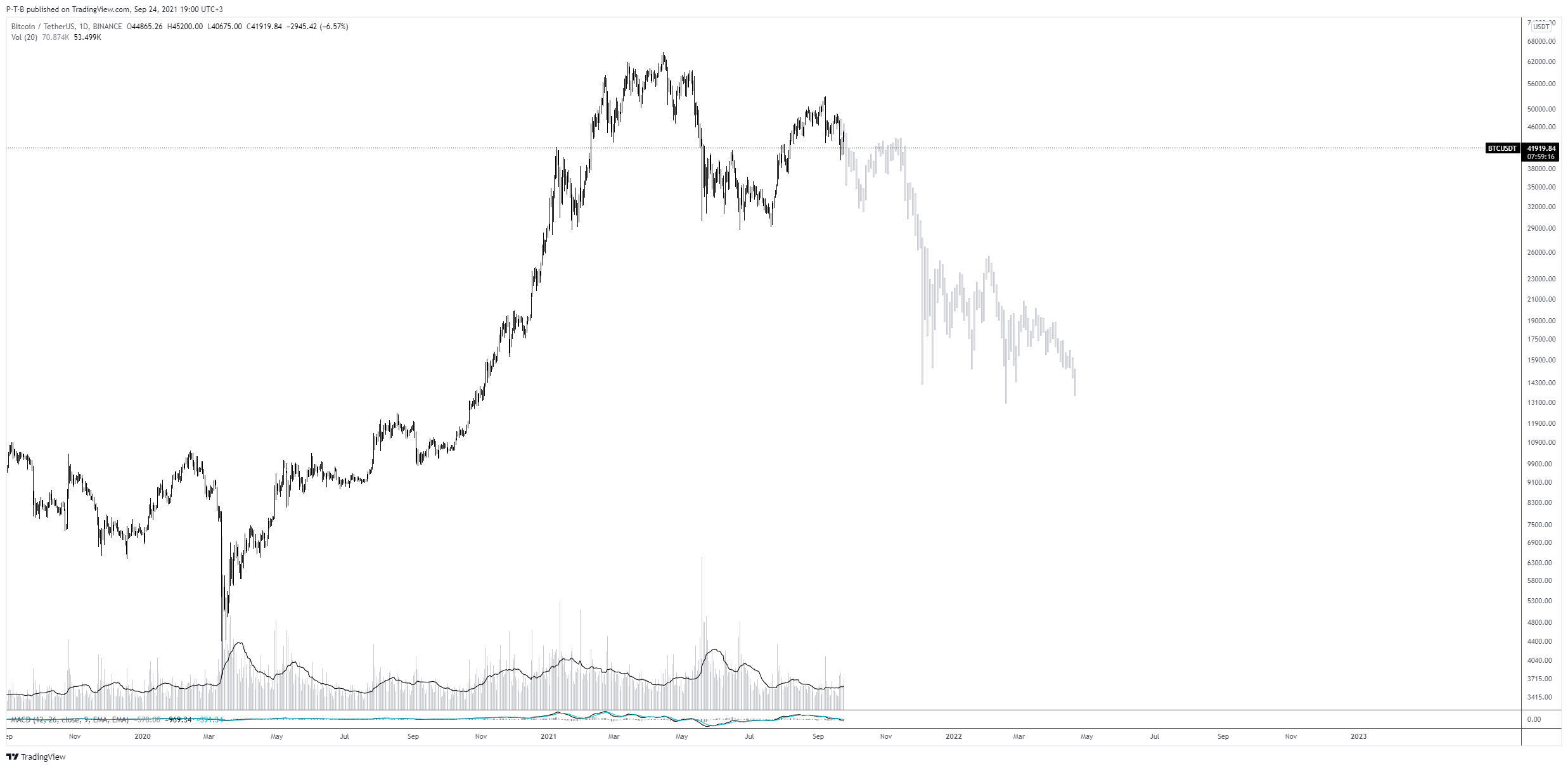

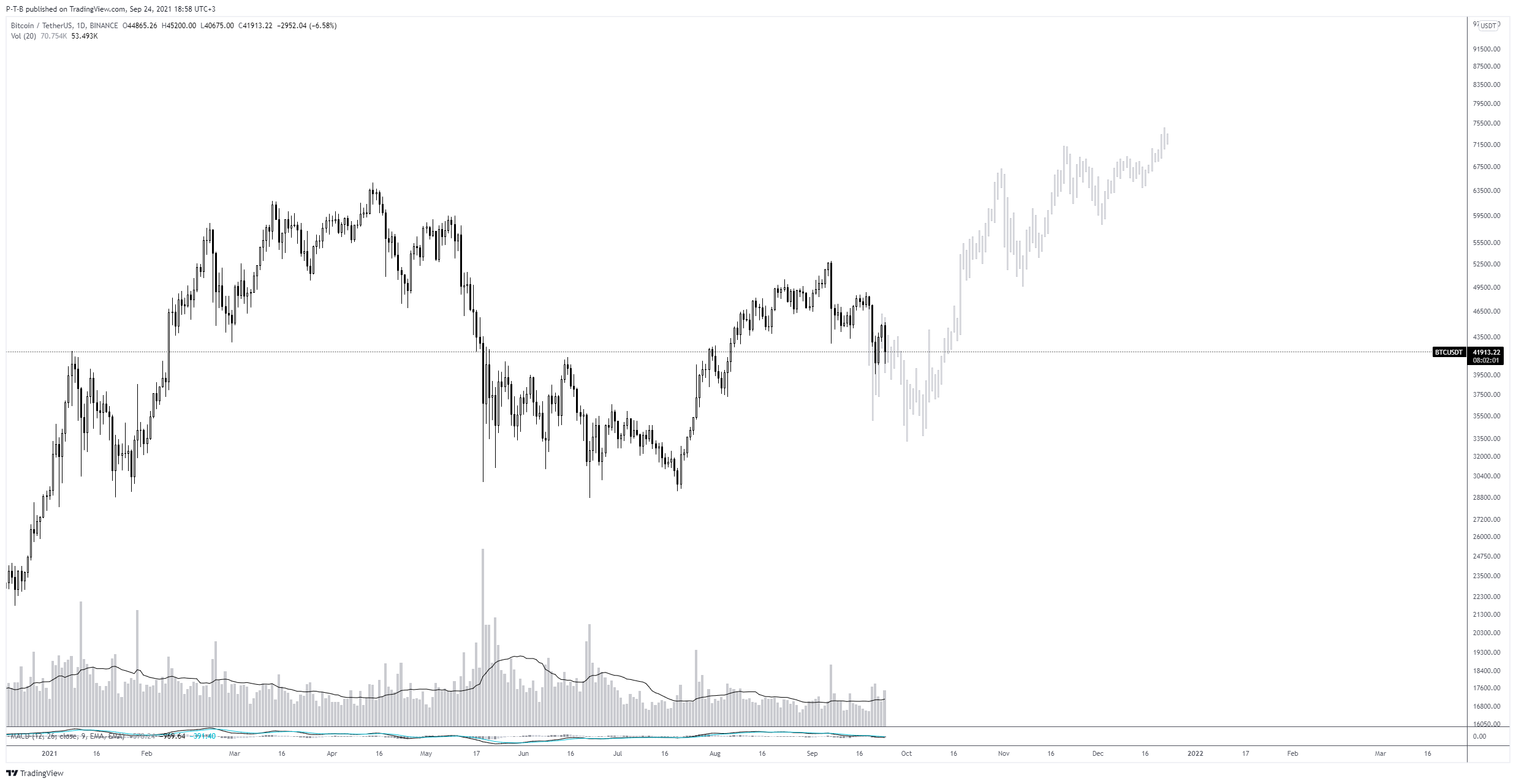

We have a historic high from where we dropped to 30k.

The 30k area was the starting point for the rise and now we have an incomplete structure relative to this location of the chart. In other words, we don't have a dominant trend.

Such trend will be formed only after the renewal of maximum or minimum (marked by green and red checkmarks), till that moment we are in a flat stage, which means that everything can happen with the price in this range (between the marked checkmarks or red square area) and actually it will not influence the general chart picture or chart structure in any way.

This is where a lot of people will lose a lot of money, and we're already seeing it... Billions of dollars worth of positions were liquidated this week.

Here's an example with Cardano, which has a capitalization of 68 billion...

It's just a roller coaster where you lose your money whichever side you take.

This is where a lot of people will lose a lot of money, and we're already seeing it... Billions of dollars worth of positions were liquidated this week.

Last time we found a way out by reducing the position to the minimum and as a result, those who took this advice were, I think, more than satisfied with the result. But now this option is inappropriate.

This time we will act differently, to avoid this volatility, as well as the carnage...

So, if possible the recommendations will be in the usual mode, but be careful and observe the recommended risks. We know that many of you, especially those who have been with us for a long time, increase the size of the position to 5%-15% instead of the recommended 3% - now it's better to minimize the risks.

But in addition to the usual recommendations, there will be those that will not work immediately (as usual), i.e. the buy/sell zone will be higher/lower In other words, we will wait for the price to reach the area we are interested in and try to catch it there.

So if the recommendation does not fill the order immediately, that's okay.

And let's estimate which scenario for Bitcoin will be positive and which will be negative.

the positive scenario at the moment

the negative scenario at the moment