Averaging at Squeeze/Pump

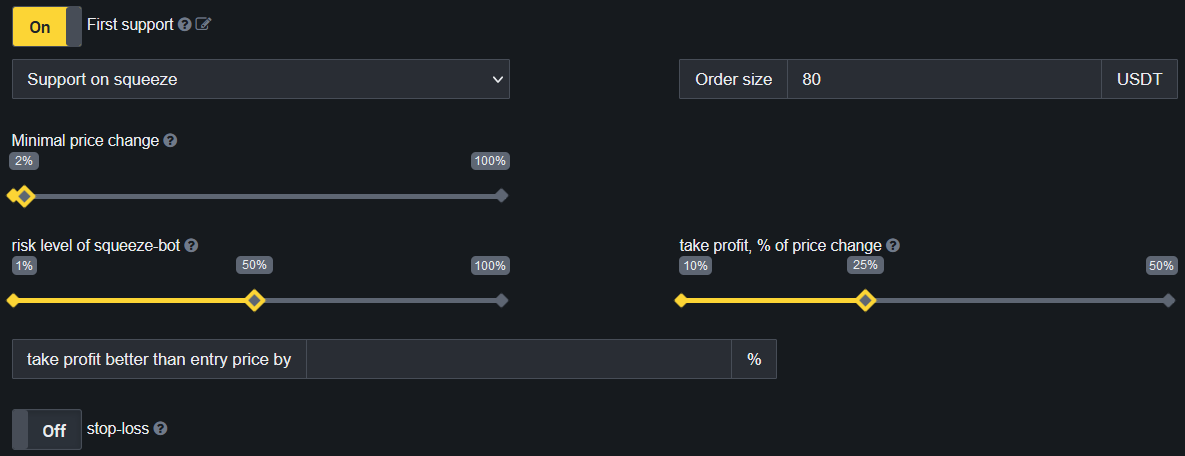

ApitradeThe function "Average at squeeze" in the futures grid-bot "Hurricane" allows you to automatically average current position in case of a squeeze (a sharp drop in price) (for long bots) or a pump (for short bots) of the selected coin against USD in order to improve the average entry price.

The algorithm automatically detects when a squeeze/pump occurs, depending on the speed of price decline/rise across different time-frames.

For different coins, a squeeze is considered to be different in terms of falling speed, depending on the liquidity of the coin and the history of previous sharp drops of the price of this coin (for top coins, a small drop of 5-10% is enough, for volatile coins with small capitalization, a sharp drop of 10-20% is needed).

When a squeeze is detected, an averaging order will be bought using a market order (by market) and grid trading will continue as usual, while a large limit take profit order will be placed at the selected distance. If you select 100% distance for take-profit, then it will be placed at an increased distance equal to the entire price change during the squeeze / pump (for example, if the sharp price drop was 10%, then take-profit will be placed at a distance of 10% from the price at which averaging order was filled).

If you wish, you can choose different risks for averaging (squeeze-bot sensitivity), for example, with a risk of 100%, averaging will occur much more often, because they will need half the squeeze (fall) on the coin.

At 1% risk, averaging will happen very rarely. You can also choose the minimum percentage drop from the average entry price, at which the system will start to detect whether there is a squeeze and, if it was detected, send an averaging market order.

We remind you that at any time you can independently increase the position using an order in the trading terminal in order to improve the average entry price, the bot will automatically pick up the increased position and sell it using the take-profit order grid.

It is recommended to use the Liquidation Calculator before setting up the averaging to calculate the new liquidation price with the increased position.