Area code Forex: Your Best Beginner's Playbook to Trading Success

Forex trading can seem daunting to beginners, using its complex terminology and rapidly changing markets. However, along with the right understanding and strategies, anyone can navigate this particular exciting financial scenery. Whether you're looking to trade as a new hobby or searching for to build the substantial income, understanding the fundamentals of forex is the 1st step towards trading success.

In this guidebook, we are going to break decrease essential concepts in addition to provide you using practical insights that will help you start your forex trading journey. Coming from choosing the best broker to being familiar with market analysis and even risk management, we will explore everything an individual need to find out. With https://www.forexcracked.com/ and strategies, you'll be well-equipped for making informed decisions in addition to develop a back again trading approach. Let's unlock the planet of forex with each other and embark upon your path to steady profits and eco friendly trading practices.

Top Forex Trading Strategies

For starters venturing to the entire world of Forex, implementing effective trading strategies is crucial with regard to navigating the complexity with the market. One particular popular approach is definitely trend trading, in which traders identify and even follow the direction associated with the market pattern. By analyzing value movements and using tools for example moving averages, traders may make informed selections about entry and exit points. Knowing the market momentum through trend ranges and charts may significantly increase the probability of effective trades.

Another effective strategy is range trading, which focuses about identifying key help and levels of resistance. Traders using this strategy look to get with the support stage then sell at the particular resistance level, capitalizing on price changes. A solid understanding of market conduct as well as the ability in order to analyze price styles are essential intended for range trading. This process can be specifically within a non-trending market where the particular price oscillates inside specific bounds.

Additionally, breakout trading supplies a variable approach for a lot of dealers. This strategy consists of entering a location once the price movements outside a defined support or level of resistance level with additional quantity. Breakouts can sign the start involving a fresh trend, plus traders aim in order to capture profits while the price proceeds in the large direction. Employing stop-loss orders and thoroughly monitoring market conditions can enhance the particular effectiveness on this approach while minimizing dangers.

Chance Management Essentials

Effective risikomanagement is vital for productive forex trading. That allows traders to protect their capital when navigating the unstable nature of currency markets. One foundational principle in risk supervision is determining the appropriate position sized for each trade. This involves assessing how much of the trading capital you are willing to risk on a single trade, commonly suggested as no more than one to a couple of percent. By setting up strict position sizing, you can lessen losses during bound to happen market fluctuations.

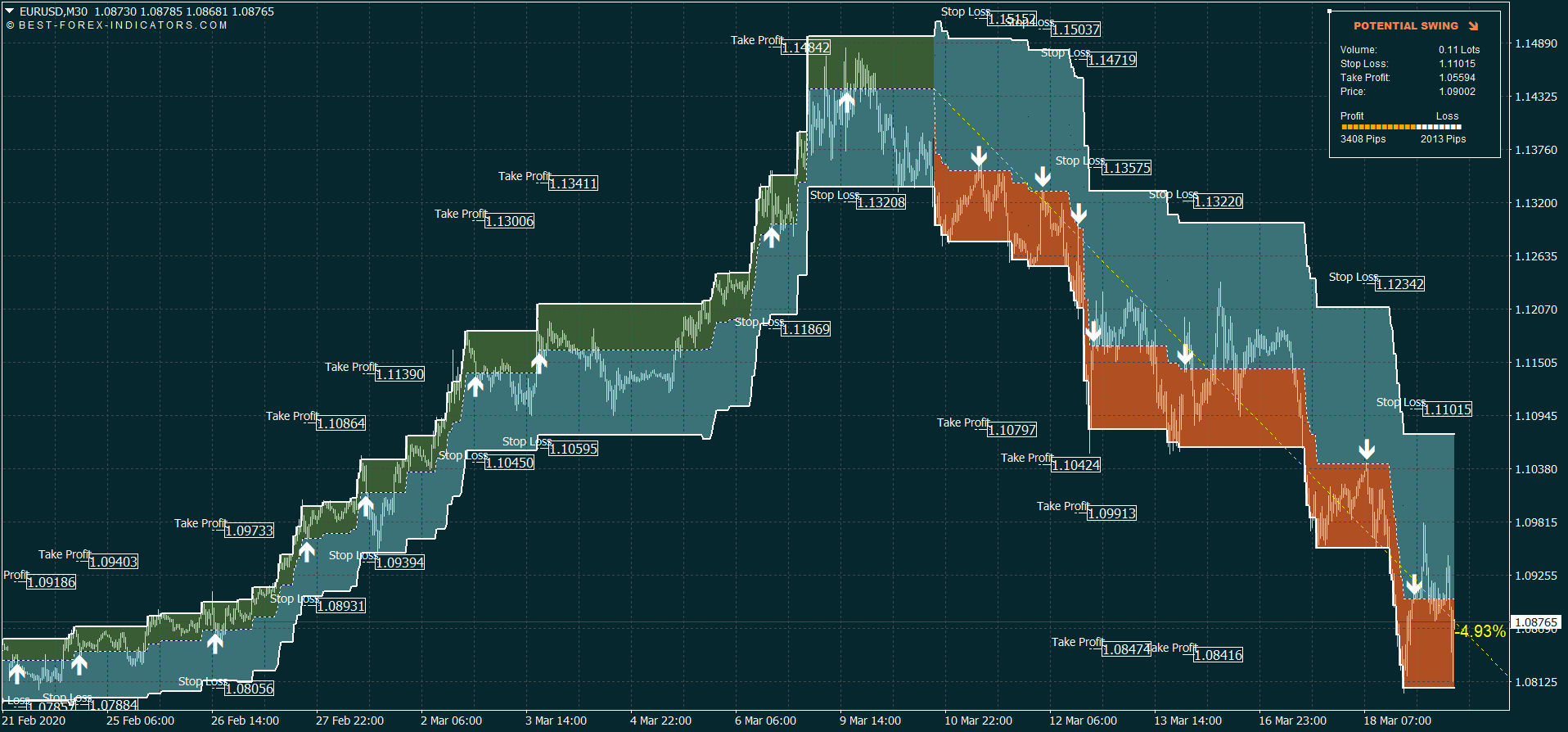

Another major aspect of chance management is implementing stop-loss and take-profit orders. A stop-loss order automatically closes your trade from a predetermined value to prevent more losses. Conversely, a new take-profit order guard your profits any time the market extends to a specific stage. Together, these equipment allow you to maintain command over your trading, ensuring that emotions do not effect decision-making under pressure.

Last but not least, maintaining a well-structured trading plan is essential for taking care of risks effectively. The trading plan outlines your strategy, including entry and exit points in addition to defined risk parameters. This kind of framework keeps a person disciplined, letting you keep to your approach even during periods of heightened industry noise. By keeping to your trading plan and continually reviewing its effectiveness, you can adapt to changing market problems while protecting the capital.

Understanding Market Mechanics

Throughout the world associated with Forex trading, understanding market dynamics is usually crucial for making knowledgeable decisions. The Forex market is inspired by a selection of factors, including economic indicators, personal events, and industry sentiment. Economic reviews such as job data, GDP growth, and inflation costs can have a new significant effect on money values. Traders must stay informed concerning these reports and even understand their implications for the currencies they may be trading.

Additionally, investors should know about the emotional aspects that drive market dynamics. Market sentiment can move rapidly, leading to volatility and sudden price movements. Emotions such as worry and greed can cause traders to help make impulsive decisions that deviate from their trading strategies. Creating a disciplined mentality and relying upon analysis rather than emotions will help traders navigate these mechanics effectively.

Lastly, the role of banks are unable to be overlooked in Forex trading. Banks influence currency worth through monetary plans, interest rates, plus interventions in the particular foreign exchange market. Focusing on how central banking companies operate and the impact on the overall economy provides traders together with valuable insights into market trends. By considering these components, traders can far better anticipate movements throughout the Forex industry and enhance their very own trading strategies.