American Outdoor Brands

⚡ ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

American Outdoor Brands

Add to/Remove from a Portfolio

Add to Portfolio

19.52

-0.07

-0.36%

15:59:43 - Closed. Currency in USD ( Disclaimer )

Volume: 95,499

Bid/Ask: 18.81 / 21.00

Day's Range: 19.28 - 19.71

Market is currently closed. Voting is open during market hours.

Write your thoughts about American Outdoor Brands Inc

Disclaimer: Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. All CFDs (stocks, indexes, futures), cryptocurrencies, and Forex prices are not provided by exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price, meaning prices are indicative and not appropriate for trading purposes. Therefore Fusion Media doesn't bear any responsibility for any trading losses you might incur as a result of using this data.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Indices

Commodities

ETFs

Stocks

More Categories

Created with Highcharts 4.0.4 /Highstock 2.0.4 30,592.5 08:00 16:00 00:00 30,000.0 30,500.0 29,750.0 30,250.0 30,750.0

Stocks

Indices

Commodities

Forex

More Categories

Timeframe

1 Min

5 Min

15 Min

30 Min

Hourly

5 Hours

Daily

Weekly

Alvexo - Live Trading Event: the NFP Report on 05 Feb 2021

Friday, February 5, 2021 | 08:00AM EST

Alvexo - Mastering the MACD Forex Indicator

Tuesday, February 9, 2021 | 08:00AM EST

Alvexo - Oil Geoeconomics

Friday, February 12, 2021 | 08:00AM EST

Alvexo - Making Moving Averages Work For You

Tuesday, February 16, 2021 | 08:00AM EST

© 2007-2021 Fusion Media Limited. All Rights Reserved

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

This is a Real-time headline. These are breaking news, delivered the minute it happens, delivered ticker-tape style. Visit www.marketwatch.com or the quote page for more...

American Outdoor Brands Inc. is a manufacturer of outdoor sporting accessories, firearms and other recreational products. It is a provider of shooting, reloading, gunsmithing and gun cleaning supplies, specialty tools and cutlery, and electro-optics products and technology for firearms. It designs, produces or sources, and sell products and accessories, including shooting supplies, rests, vaults, and other related accessories; sportsman knives and tools for fishing and hunting; land management tools for hunting preparedness; harvesting products for post-hunt or post-fishing activities; and survival, camping, and emergency preparedness products The company produces its products under the brands Caldwell, Crimson Trace, Wheeler, Tipton, Frankford Arsenal, Lockdown, BOG, Hooyman, Smith & Wesson Accessories; M&P Accessories, Thompson/Center Arms Accessories, Performance Center Accessories, Schrade, Old Timer, Uncle Henry, Imperial, BUBBA, and LaserLyte.

Cyprus Securities and Exchange Commission (Cyprus), The Financial Conduct Authority (United Kingdom), Australian Securities and Investments Commission (Australia), Financial Industry Regulatory Authority (United States)

Cyprus Securities and Exchange Commission (Cyprus), Australian Securities and Investments Commission (Australia), International Financial Services Commission (Belize)

American Outdoor Brands , Inc. - Wikipedia

American Outdoor Brands Inc Stock Price (AOUT) - Investing.com

American Outdoor Brands , Inc. (AOUT) Stock Price, News... - Yahoo Finance

AOUT Stock Price | American Outdoor Brands Inc. Stock... | MarketWatch

American Outdoor Brands Corporation — Wikipedia Republished // WIKI 2

American Outdoor Brands, Inc. (AOUT)

NasdaqGS - NasdaqGS Real Time Price. Currency in USD

Trade prices are not sourced from all markets

© 2021 Verizon Media. All rights reserved.

19.56 0.00 (0.00%) After hours: 4:01PM EST

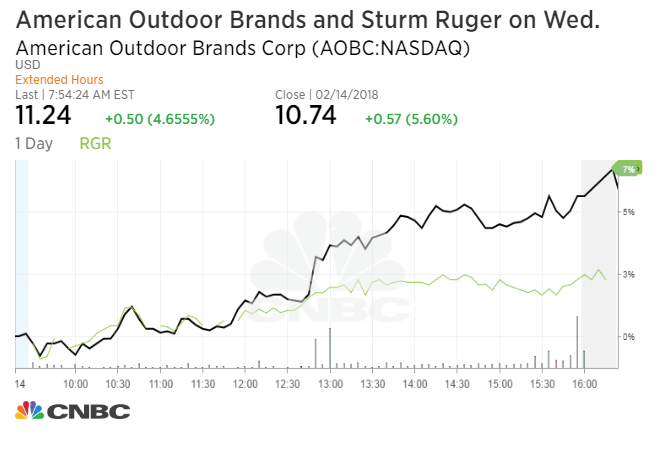

With President Joe Biden in the White House, there’s concern he could enact legislation to potentially curb the Second Amendment. That will have an impact on gun stocks. In fact, he’s already said he would ban “assault weapons, ban high-capacity magazines and introduce universal background checks in a bid to confront what he called America’s ‘gun violence epidemic,’” as reported by Newsweek contributor David Brennan. In addition, according to Daily Mail, the new administration could repeal the Protection of Lawful Commerce in Arms Act, which was passed in 2005. It was set up to shield gun makers from wrongful death lawsuits. If that were to be successfully repealed, it could do quite a bit of damage to the industry and to gun stocks.InvestorPlace - Stock Market News, Stock Advice & Trading Tips 8 Cheap Stocks to Buy With Your Next Stimulus Check Fear of gun control is part of the reason for record-breaking gun background checks in 2020. In fact, the year finished with 21 million checks. Nearly 8.4 million people bought a gun for the first time. In addition, “wave upon wave of uncertainty and concern [are] driving firearm demand,” said Jurgen Brauer, chief economist at Small Arms Analytics and Forecasting. With that, it’s come as no surprise gun stocks have been on fire, including: Smith & Wesson Brands (NASDAQ:SWBI) Sturm, Ruger & Co. (NYSE:RGR) Vista Outdoor (NYSE:VSTO) American Outdoor Brands (NASDAQ:AOUT) Ammo Inc. (NASDAQ:POWW) Gun Stocks to Buy: Smith & Wesson Brands (SWBI) Source: Supakorn Pe / Shutterstock.com Since bottoming out at $4.42 in March 2020, the SWBI stock exploded to a high of $23.57 in early 2021. In recent days, On a recent pullback to $16.50, I’d use the weakness as opportunity, especially with guns flying off the shelves. The company’s second quarter earnings showed that gun sales more than doubled year over year, with expanding margins. In fact, net sales were $248.7 million, as compared to $113.7 million year over year. Gross margins were up to 40.6%, as compared to 28.4% year over year, as well. Quarterly GAAP income was $49.1 million, or 87 cents per diluted share from $343,000, or a penny per diluted share year over year. It doesn’t hurt that SWBI authorized a $50 million stock buyback plan. Sturm, Ruger & Co. (RGR) Source: Susan Law Cain / Shutterstock.com Investors have been just as fired up over Sturm, Ruger. Since bottoming out at $35.54, it ran to a high of $84.41. The stock has since pulled back to $62.80 and could soon be a buy on weakness. I’d wait to see if RGR can hold current support before taking a position. Sturm, Ruger also had impressive earnings. In late October, it reported net sales of $145.7 million and diluted EPS of $1.39, as compared with net sales of $95 million, and diluted EPS of 27 cents year over year. For the nine months ending in September, net sales were $399.6 million diluted EPS of $3.31, as compared to $305.4 million and diluted EPS of $1.37 year over year. “As a result of this unprecedented demand, inventories remained significantly reduced at all levels in the channel during the third quarter,” CEO Christopher J. Kilroy said. Vista Outdoor (VSTO) Source: IgorGolovniov / Shutterstock.com Vista Outdoor roared from a low of about $6 to $29.43 and could see $35 soon. In late 2020, Cowen analyst Gautam Khanna upgraded the VSTO stock to an “outperform” rating with a price target of $33. He noted at the time the stock is being driven by outdoor recreation, the pandemic and Biden’s presidency. Earnings were also impressive here, too. While we’ll hear more about third quarter earnings on Feb. 4, we do know second quarter earnings were solid. Sales were up 29% to $575 million. Gross profits were up 79% to $162 million. Operating expenses were 15% of sales and improved by 483 basis points. American Outdoor Brands (AOUT) Source: Shutterstock Locked and loaded American Outdoor Brands could have another solid year ahead of it. Since late 2020, the AOUT stock ran from about $14 to $20.68. If it can break above double top resistance, it could test $23 in the near term. That’s a strong possibility with gun sales likely to improve. In its second quarter, net sales were up 65.7% year over year to $79.1 million. Gross margins improved by 690 basis points to 46.9%. Ammo Inc. (POWW) Source: ThomasLENNE / Shutterstock.com Ammunition stock Ammo rocketed from a low of about $2.02 to a recent high of $8.98. At the moment, the stock is technically overbought. Let it come down a bit and find support before taking a position here. Growth has been solid here, too. The company just provided Q4 guidance which reflects 317% year over year revenue growth. This is now the fourth straight quarter of year-over-year, triple-digit growth, according to a recent press release. Ammo expects for demand to only grow with the recent outcome of U.S. Senate elections, and political uncertainty. Ammo also agreed to buy back 1 million shares for $1.5 million in early January. On the date of publication, Ian Cooper did not have (either directly or indirectly) any positions in the securities mentioned in this article. Ian Cooper, an InvestorPlace.com contributor, has been analyzing stocks and options for web-based advisories since 1999. As of this writing, Ian Cooper did not hold a position in any of the aforementioned securities. More From InvestorPlace Why Everyone Is Investing in 5G All WRONG Top Stock Picker Reveals His Next 1,000% Winner It doesn’t matter if you have $500 in savings or $5 million. Do this now. The post 5 Gun Stocks Rising on Current Events appeared first on InvestorPlace.

SeaFloat: a pioneering hybrid solution that ensures a very efficient supply of power

Curreen Capital, an investment management firm, published its fourth-quarter 2020 Investor Letter – a copy of which can be downloaded here. A return of 49.70% was recorded by the fund for the Q4 of 2020, above both its S&P 500 benchmark that returned 12.15% and the MSCI World Index that returned 14.05%. You can view […]

Hotwife Telegram

Naked Models

Homemade Fuck Xxx

Crfxfnm C Xhamster

Teen Nudist Img Jpg Jpg

h_1200" width="550" alt="American Outdoor Brands" title="American Outdoor Brands">q_75" width="550" alt="American Outdoor Brands" title="American Outdoor Brands">w_1200/

h_1200" width="550" alt="American Outdoor Brands" title="American Outdoor Brands">q_75" width="550" alt="American Outdoor Brands" title="American Outdoor Brands">w_1200/