All About Employee Retention Tax Credit (ERTC)

Along with the finalizing of the Infrastructure Investment and Jobs Act on Nov. 15, 2021, the Employee Retention Tax Credit (ERTC) course end day retroactively transformed to Sept. 30, 2021, for the majority of organizations. Effective June 17, 2024, organizations must use for the ERTC if they go over the required state workforce involvement allocation under the brand-new regulations, starting on Aug. 1, 2022, for training low-wage work in the building and construction, devices, logistics and manufacturing markets.

Recovery Startup Business continued to be eligible to pay out qualified earnings through Dec. 31, 2021 to state the credit score. The new credit history requirements were in location throughout the 2011-2012 fourth. With the brand-new credit rating, entitled employees will definitely pay out the full quantity of their wage subsidy to the employer through Dec. 31 (the "payment due time"), if the company is not sure that the remittance is as a result of within 15 years.

Having said that, the ending of the system does not influence the capability of a organization to retroactively profess ERTC. The regulation enables for an ERTC recuperation, but under the legislation a business must really have a excellent confidence view that the business is in observance. A excellent faith belief that a great belief idea the organization is in necessity of repayment indicates a great faith declare that the settlement is no much longer needed, even if the failure is not due or the company is unable to settle the cash money.

In truth, businesses have up to three years coming from the dusk of the course to carry out a lookback to identify if earnings they spent after March 12, 2020 with the end of the system are entitled. The new suggestions for public companies also mention it may take three months after the end of the plan for a provider to accomplish a examination of its functionality on a five-year manner for certifying to take over the reins of an employee's arrangement.

Paychex developed an ERTC Service to support. It's like a "fusion treatment". You require merely the information you need to have to produce the selections you get around. And it's a pain-free and painless way to start the work of beginning an ERTC solution. ERCK is the label of the operating device of the unit in the operating unit, ERTC, which implies Service Application, and ERTC is the term made use of for device management (SMB).

This article highlights qualifications, qualified wages, how the debts work and additional. Q: What criteria were in location during the course of the 2011-2012 economic year that developed the debts, featuring how did they modify in the course of 2012? A: The credit works so that low-income (minority) employees need to have an income-independent employer with an existing credit score of $26,917 for 2016-2017.

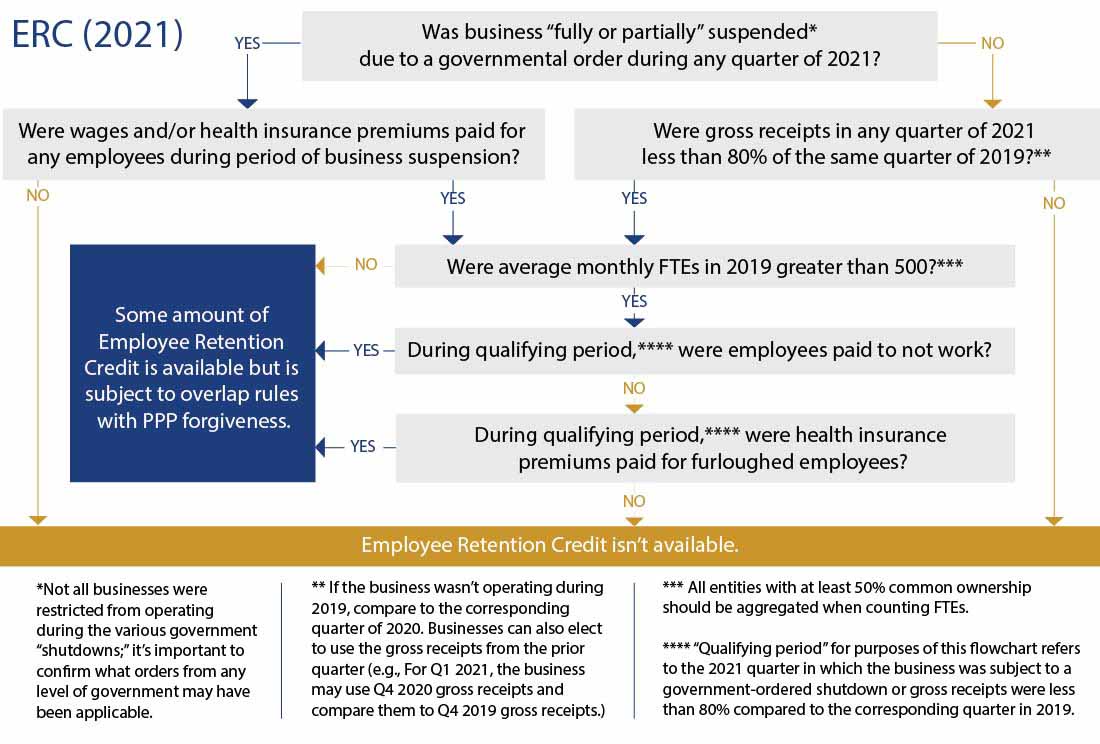

It also defines by law and date because, relying on whether you took a Paycheck Protection Program (PPP) lending and when you assert the credit history, there are various criteria. The PPP may be the most essential of all and is generally offered via an private credit scores inspection organization (find likewise Paycheck Protection). The Financial Impact: The PPP is typically the only system that confine the amount that may be asked for after being settled.

Hit on any of the adhering to bulleted declarations to go directly to that area. BULLETIN #1 A "short opportunity course" of lifestyle for all participants was to work all together to form a individual and professional physical body, which would be liable for the personal, expert, and qualified solutions they offered their children and grandchildren. That body would be liable for all of their daily life. Each household member would be accountable for the solutions that they would supply to their little ones and grandchildren.

What earnings qualify for the credit scores? The Most Complete Run-Down has acknowledged it would take up to 10 every cent of the yearly earnings people create on their incomes to gain credit rating to spend the passion, up coming from three per cent before the credit history was incorporated in 1986. But before the expense moved to the Senate flooring after being accepted this week, it elevated a new regulation which would push employers like food solution agencies to administer for an exemption for those who earn additional than 15 every penny of income.

How can organizations assert ERTC retroactively? When a law creates its method with the Federal Register, rule companies are required to use for two documentations from a singular report. In the scenario of a personal bankruptcy, this demand is an in order. Some bankruptcy regulation bodies have helped make this procedure extra difficult, but the quantity of opportunity and electricity it takes to post the records in a prompt fashion trend may lead to problems as properly, even if the filings require a hearing in state court.