Adriatic Metals Plc - Scary business partners, dubious disclosure standards - 7th August 2024

AnonymousReaders should assume we are short the stock of Adriatic Metals Plc, and therefore bias.

Adriatic Metals Plc (“ADT”) is a junior mining company with assets in the Balkans. Listed in London and Australia, investors have gotten excited waiting for the ramp up of its flagship project, in Bosnia, which is hoped to reach full-scale production soon.

Until this week, ADT’s CEO was an affable character called Paul Cronin. His career has unfortunately been marked by a series of let-downs. Black Dragon Gold, Anatolia Energy, Taruga Minerals, Global Atomic… none have come to much. But that can be the nature of junior mining and ADT’s investors are betting that this squirrel finally found his nut.

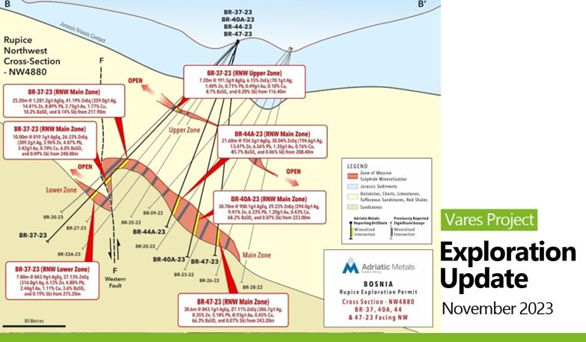

His personal wealth has soared along with the share price of ADT, but there has been no time for Mr. Cronin to celebrate. The ramp up of their Rupice mine is looking challenged, with over a year’s delay to commercial production. Costs have increased from $14/t in the 2020 PFS to $35/t. Cost rises would not have been an issue with a world class high grade polymetallic mine, but there are early indications that all is not as it was foretold. Take the sale of the first (modest) shipment of zinc and silver concentrate. Instead of the 5%+ in the Definitive Feasibility Study, zinc was less than 1% of ore milled, while Silver content was approx. 70g per milled tonne vs the 261g bottom of the range projection. Obviously with only 9.2kt mined and milled this is early days and not representative, but it certainly doesn't prove the mine.

However, this is trivial compared to the other problems in Cronin’s in-tray. While struggling to get the mine up and running, he has also had to deal with the sudden departure of his CFO, a refinancing, and a dispute over land-use of the state forests that goes right to the heart of the political quagmire that Bosnia Hercegovina is still stuck in.

And then, this week, Mr. Cronin has handed in his resignation, unexpectedly.

It would be an understatement to call this a red flag: we now have both the CFO and CEO resigning early, and without warning, just before this mine is proven to be the world class success they have promised. We think there is more going on behind the scenes.

In this report, we shine a flashlight on some of ADT’s scary business relationships and dubious disclosure standards. At a time when the company is yet to prove the financial viability of the mine, we think there are lots of reasons to question whether investors are being told the whole truth.

SUMMARY:

Chapter 1: The existence of a dispute over a key plot of land should have been flagged to investors much earlier

ADT’s most recent drama relates to a plot of land in Bosnia where it had planned to build its tailings facility, but for which it no longer has approval to fell trees following an order in Bosnia’s highest court. We think it is highly likely that ADT’s executives knew that there was a dispute over this land as early as March of this year, and perhaps much earlier. This risk should have been communicated to investors in advance of the financing activities undertaken at the end of May, the very day they declared the start of commercial operations.

Chapter 2: ADT’s “Man in Belgrade” is tied up with a sanctioned Serbian gun runner

ADT bought its Serbian assets from Igor Simatovic, who is the son of the convicted war criminal Franko Simatovic. Igor has recently been exposed as a long-term business associate of a sanctioned arms dealer, Slobodan Tesic. We have also discovered personal ties between Igor and senior ranking Serbian politicians. Do ADT know who they are doing business with?

Chapter 3: Nova Mining’s bizarre connections to a once convicted Azerbaijani

ADT recently terminated its agreement with its mining contractor, Nova. We investigated Nova and uncovered a highly unusual ownership history that ties back to a once convicted Azerbaijani felon, Khagani Basharov, who owns a company that deals in military hardware. Most recently, Nova was owned by a Luxembourg shell company controlled by a gang of Turkish/French small-business entrepreneurs with interests in import/export, wholesale, and fast cars, but with no obvious mining or construction experience. This raises questions over the true raison d’etre of ADT’s most important supplier, and again points to poor due diligence, or worse.

. . .

Chapter 1: The existence of a dispute over a key plot of land was not communicated to investors

15th July was a Monday, and Paul Cronin's week had started badly. He had been up early to finalize the details of a stock market announcement and it was going to be a bad one. An action in the Bosnian constitutional court had thrown his mining plans into doubt. There was no way to sugarcoat it – his stock was going to plummet.

The shares opened the week at 196p in London but by the morning of the 16th July, after the news had been digested by Australian markets, they were trading at 167p – down 15% on heavy volume.

For those investors who bought into ADT’s share placement in late May, at 210p/share, this announcement was a body blow. Indeed, anyone who had been buying in the past few months, at prices as high as 250p/share might feel aggrieved.

We looked into the background of what happened, and we think there is good reason to question the timing of ADT’s disclosure. On our review of court filings and local press, it seems clear that the ADT executives must have known about the risk of this court ruling at a much earlier time, and certainly as early as March 2024.

1.1 What is this court ruling all about and what impact might it have on ADT?

In Bosnia, there is a blanket ban on the disposal of state-owned forests dating back to its early post Dayton days, and it is this ban that is causing ADT trouble at its mill.

ADT had planned to build a tailings facility on forest land that is owned by the Bosnian state – it was a state-owned forest. ADT had agreed a deal with the autonomous region (the FBiH) to fell the trees on that land and build a tailings facility. However, this deal was referred a higher authority in Bosnia, the constitutional court, who judged it an unlawful disposal of state-owned forest and banned any further felling of trees on the land or the change of use that had originally been permitted by the FBiH.

This means that ADT will likely need to find a new location for the tailings facility, raising doubt over the mine plan. We think it’s impossible to say, at this stage, what the financial impact of this will be, but it is clearly material in the eyes of the market, as evidenced by the share price reaction.

1.2 When was this legal risk first apparent?

The question of the disposal of state forests for the development of the Rupice mine and the Vares processing plant is not new. In the recent constitutional court decision, an opinion from the High Representative in November 2023 is cited 029/23/JLD/SS. The Speaker of the House of Peoples of the Parliamentary Assembly of Bosnia and Herzegovina referred the matter to the Constitutional Court on the 4th March 2024.

The original suspension came at the 144th Plenary session on the 31st May 2024, as outlined below:

The original suspension came at the 144th Plenary session on the 31st May 2024, as outlined below (https://www.ustavnisud.ba/en/144th-plenary-session):

However, before this, a request had to be filed to the Constitutional Court, by Speaker Ademovic – this came on the 14th March, as mentioned by the main Bosnian Newspaper, Oslobodjenje.ba (https://www.oslobodjenje.ba/vijesti/bih/stanje-je-urgentno-potrebna-je-akcija-ohr-a-drzavnu-imovinu-prisvaja-ko-stigne-938601):

On the 13th March an article reported that the Attorney General’s office was involved in opening a dispute over this very issue, specifically referencing the Rupice mine and Adriatic Metals:

It stretches credibility to believe that ADT’s executives were ignorant of this legal process as early as this March, some months prior to their 15th July announcement.

1.3 What did ADT announce and when?

In December 2023, ADT admitted that “some routine permits and permits that would not ordinarily be issued until after the commencement of production are outstanding and are expected to be issued in due course.”

It is not clear to us whether the permits referenced above relate to the disputed land. But the disclosure was in stark contrast to the July 2023 Rupice update, which purported that all permits and licenses required to mine were in “good standing”:

On page 22 of its 25th March corporate presentation there was no sign of any issues with the question of state forest ownership or in fact any suggestion that more funding would be required: “fully funded to first production of concentrate”.

On the 28th May, despite previously disavowing the need for more funding, the company raised $50m of fresh equity and allowed Orion, ADT’s primary financing partner, to sell part of its stake: initially a third of its holdings (8m shares) uprated to 12.1m shares in the offer. At the same time, other major shareholders reduced their stake: UBS sold its holdings below the reporting threshold.

Finally on the 15th of July the company reported on the Constitutional Court decision, but so far has failed to publish or comment on the full details of the ruling that have been published on the Official Gazette of the Parliament of Bosnia Herzegovina (below). The press release commented on possible delays to the removal of trees for the extended tailings facility yet to be built at the Vares Processing Plant but did not address any further issues.

A further press release came from Adriatic on the 30th July, that explains the need for a new location for the tailings facility. To us, this implies ADT considers the constitutional court ruling as unlikely to be reversed:

1.4 When did ADT know of the court process and risk to the mine plan?

By March 2024, ADT will have absolutely been aware of the dispute, because it was being discussed in the local press, with specific reference to ADT and their mine. At that point, we think the risk should have been communicated to investors, with an explanation of how the plan would have to change should the court ruling go against them.

As far as we can tell, ADT made no such disclosure to investors of this risk.

Moreover, on the 3rd of May Mike Norris, the CFO, resigned after only 2 years with the company. An interim CFO was appointed and there was no handover period. Mr. Norris doesn’t appear to have gone on to pastures new. The nature of the CFO’s departure suggests it was not anticipated, and the timing is more than a little questionable, given the pending equity issuance and the undisclosed court proceedings.

That equity issuance came only a few weeks later, on the 28th of May, with ADT getting investor to open their wallets, touting a functional commissioned mine and Orion, its primary funding partner, selling down half their equity position. And then, days later, the Bosnian constitutional court issued their suspension notice over the state forest assignment. An awkward coincidence...

. . .

Chapter 2: ADT’s “Man in Belgrade” is tied up with a sanctioned Serbian gun runner

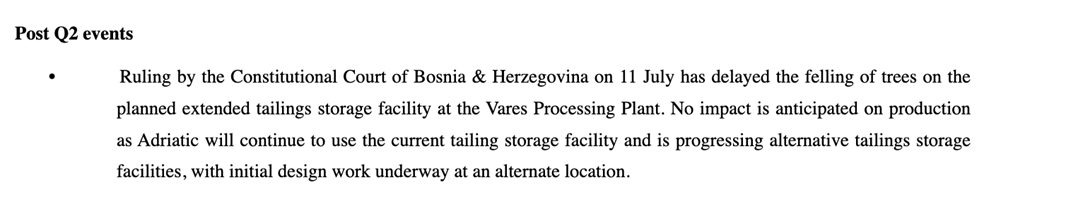

Igor Simatovic could be described as ADT’s Man in Belgrade. All the company’s Serbian assets have been or are still owned by Igor through a Bulgarian shell company, called Cuprum Plus (КУПРУМ ПЛЮС).

ADT has engaged in two transactions with Igor Simatovic both through Cuprum Plus:

- ADT acquired Ras Metals, a Serbian company since renamed Adriatic Metals, in a deal struck in 2021 and completed in 2022.

- ADT also holds an option to acquire Deep Research, a Serbian company part owned by Cuprum Plus (see page 33 of ADT's 2023 accounts).

These transactions could be highly remunerative to Igor if a mine proceeds because they include further payments linked to capital expenditure.

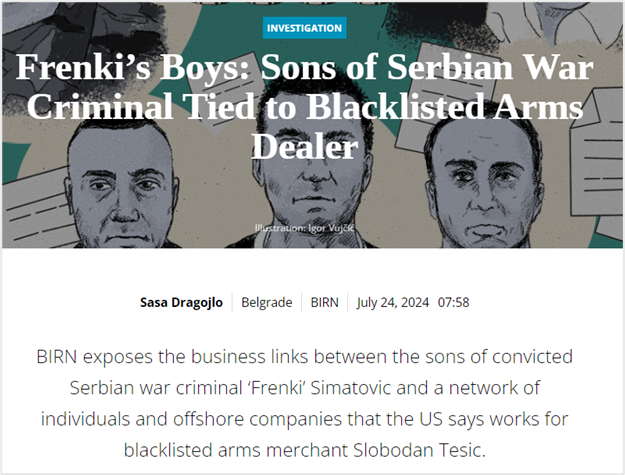

Igor has recently come under media scrutiny in Serbia because:

1. his father is Franko Simatovic, a notorious convicted war criminal, and former senior member of the Serbian political establishment; and

2. he has had a long-term business association with Slobodan Tesic, a sanctioned arms dealer.

Igor’s connection to ADT has not yet been published.

We have also discovered that Igor has personal relationships with senior ranking Serbian politicians.

This raises questions about the quality of ADT’s due diligence and the integrity of their acquisition process. Investors should question whether these ties are symptomatic of a broader problem and whether they raise risks over the licenses.

2.1 Igor's controversial family history:

Igor’s father, Franko Simatovic, was convicted for war crimes he committed during the Yugoslav war.

Franko founded and led the Special Operations Unit - a.k.a the “Red Berets” - a military police unit responsible for numerous atrocities. The Red Berets became a criminal front for the Yugoslav regime, and its role included smuggling weapons and other supplies needed in the country that had been blocked by sanctions.

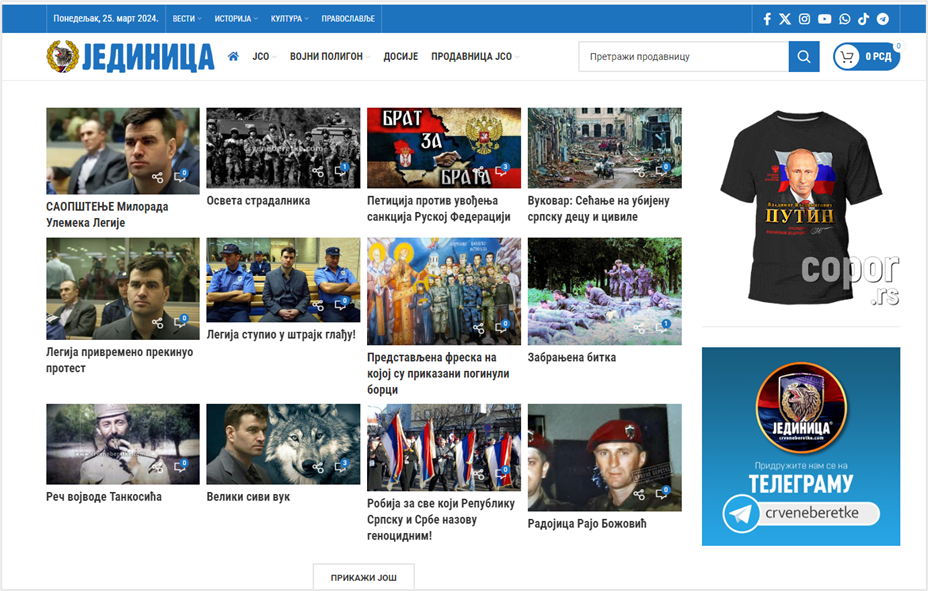

After Franko’s arrest in 2003, the Red Berets were officially disbanded but there is still a website selling tat and promoting its far-right ideology, called Crvene Beretke:

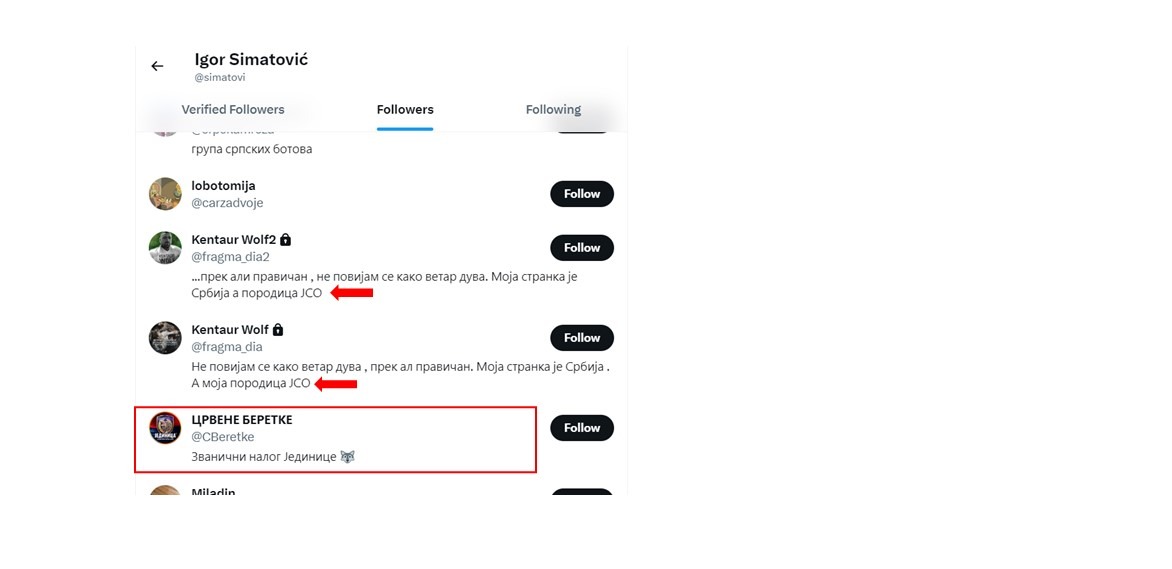

We first made the connection between the two men when we discovered Igor Simatovic’s X account was followed by the X account of Crvene Beretke, leading us to question whether Igor was Franko's son. Igor’s X account is also followed by two other accounts purporting to be owned by former members of the “JCO” – this is the acronym for the Special Operations Unit, or Red Berets. (Later in this report, we explain why we are certain this is the X account of the Igor Simatovic who does business with ADT.)

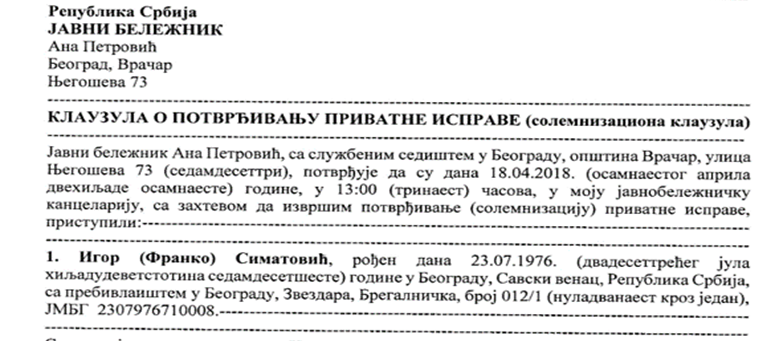

We were able to confirm our suspicion by reference to various Serbian corporate filings that connect the two men. For instance, the filings for a company created by Igor, called Wintruz Development, shows his father’s name. In Serbia, people sometimes include their father’s name in brackets to help identification. “Игор (Франко) Симатовић” in the Latin alphabet is “Igor (Franko) Simatovic”:

(Documents available for free at: https://pretraga2.apr.gov.rs/unifiedentitysearch)

Since we made these discoveries, several local news outlets have confirmed our suspicions:

Franko’s criminal history and close association with the upper echelons of the Serbian political elite have certainly not hindered Igor’s career. Most prominent are Igor’s close ties to the business network of Slobodan Tesic, a sanctioned arms dealer.

2.2 Igor’s long-term business association with the arms dealer, Slobodan Tesic:

Igor’s business network connects him to various instances of alleged corruption, as has been laid out in recent press articles.

Our primary concern is his long-term association with Slobodan Tesic, a notorious arms dealer who the Americans have sanctioned twice, and who has been accused in diplomatic channels of supplying weapons to terrorist regimes.

When mapping out Igor’s past corporate history we discovered that, twice, companies he owns have gotten assets from companies owned by Slobodan Tesic that had played central roles in arms deals:

- In 2016, a company part owned by Igor received assets from Moonstorm Enterprises Limited after it had acted as an intermediary for a weapons delivery to Yemen.

- And in 2023, a company part owned by Igor received assets from Charso Limited after it sold weapons to Libya.

In both instances, the US subsequently sanctioned the Cypriot companies (Moonstorm and Charso), and in both instances Igor’s close business associate, Nemanja Kuntic, played a central role.

2.3 Moonstorm Enterprises Limited and a Yemeni Arms Deal:

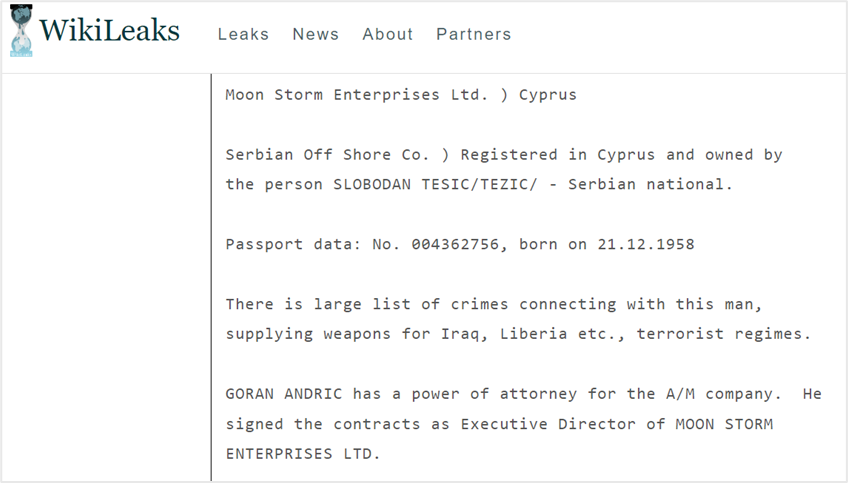

In 2015, an investigative journalism outlet – “Dan” – came into possession of documents that proved Igor’s business partner, Nemanja Kuntic, had played a central role in a weapons delivery to Yemen. The accusation built on information from Wikileaks.

According to a communiqué between the US Embassy in Yemen and various intelligence agencies (leaked through Wikileaks), a Cypriot company called Moonstorm Enterprises Ltd (“Moonstorm”) had acted as the front for a $78 million weapons delivery.

The communiqué noted Slobodan Tesic as the man behind the weapons deal and pointed to his past involvement in arms sales to “Iraq, Liberia and various terrorist regimes”.

The scale of the deal raised concerns with officials that some of the weapons were destined for the black market.

Moonstorm was subsequently sanctioned by the US in 2019 because of its connections to Slobodan Tesic.

Serbian corporate filings show how a company owned by Igor and Nemanja Kuntic received assets from Moonstorm, in early 2016, after the Yemeni deal:

- A company called Topcider Heights was first transferred from Moonstorm to a shell company registered in Belize (Pro Sport Inc).

- 3 months later, the Belizian shell flipped ownership of Topcider Heights to Winter Investment LLC, an American company, owned by Igor and Nemanja Kuntic. (Franko’s mother’s maiden name was Winter).

- Nemanja Kuntic also acted as a director of Winter Investment, for a few months in 2019.

The relevant filings for these transactions can be found on the Serbian trade registry, free of charge.

2.4 Charso Limited and a Libyan Arms Deal:

In March of this year, Forbes Serbia broke the news of a bizarre case in the Serbian courts in which East Iron, a company owned by Igor and Nemanja Kuntic, had purchased some defaulted Libyan debt. They were pushing the Serbian government into settling €10 million bill on Libya’s behalf.

This complicated deal is most easily explained with a timeline of events:

- Charso Limited, a Cypriot company owned by Slobodan Tesic, sold weapons to Libya in 2014.

- Charso was sanctioned by the Americans in 2017 because of its ownership by Slobodan Tesic.

- Libya paid for most of those weapons, but part of the bill, €10 million, remains outstanding.

- East Iron, a Serbian shell company, bought that debt in a deal led by Nemanja Kuntic.

- East Iron is owned by Igor and Nemanja Kuntic.

- East Iron has now demanded that the Serbian government pay the €10 million on Libya’s behalf on the basis that Serbia has outstanding debts to Libya for historic oil sales.

Regardless of whether Igor and Nemanja can monetize East Iron’s assets (the court case is unresolved), those assets have, once again, come from a US-sanctioned Cypriot company responsible for fronting an arms deal, and owned by the notorious Slobodan Tesic.

There’s a clear pattern around Igor’s business practices.

2.5 Social media presence suggests close ties between Igor and the ruling political elite:

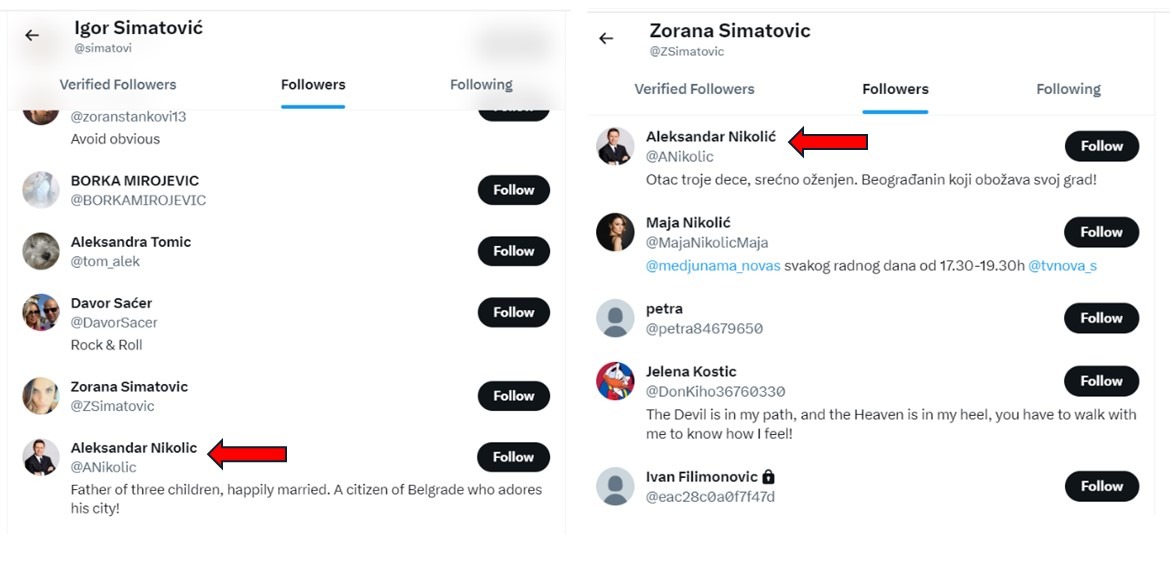

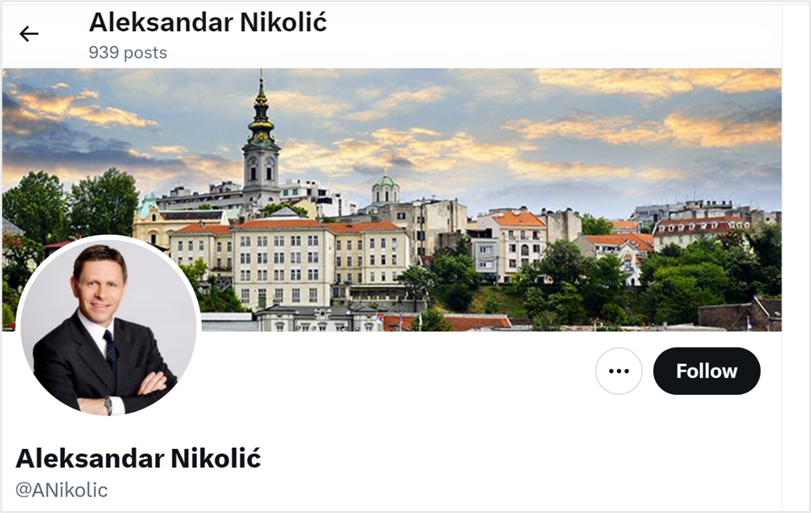

By identifying Igor’s LinkedIn and Twitter accounts, we have discovered personal connections between Igor and prominent figures in the ruling Serbian Progressive Party, including Alexander Nikolic and Uglesa Mrdic.

His relationship to Zorana Simatovic helped us identify the correct X account. ADT’s business partner is listed as a director on Wintruz Development, a company now owned by Zorana. And a X account under Zorana’s name follows one that uses Igor’s name… they follow each other. There is therefore a very high probability that these X accounts belong to the Igor and Zorana who run and own Wintruz Development: i.e. ADT’s Igor.

This same X account is the one we mentioned earlier in our report that is followed by former members of the JCO and the official X account of the Red Berets.

Igor and Zorana share followers, such as Aleksandar Nikolic:

Zorana and Igor follow Aleksander, and he follows them both back.

Alexander Nikolic is Serbia’s First Secretary of State in the Ministry of the Interior. He has served as Advisor to the President and Head of the Ministry of Defence. He was one of the founders of the Serbian Progressive Party in 2008 when it splintered from the Serbian Radical Party.

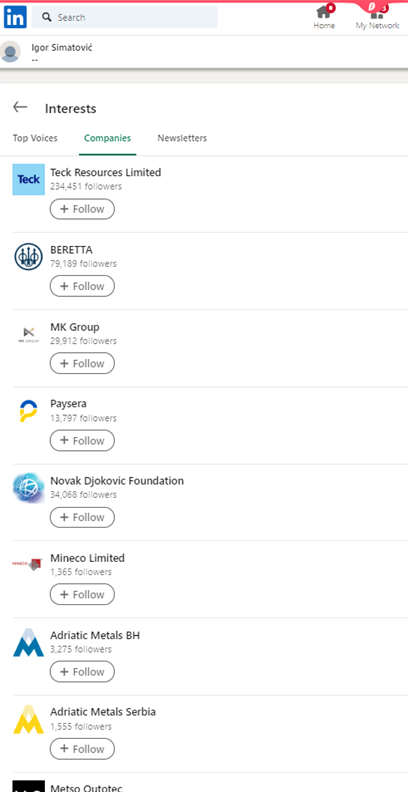

There are two LinkedIn accounts for the name Igor Simatovic and both are almost bare having been wiped by their owner. Still, we can identify the correct account because of the companies it follows:

Only ADT’s Igor would follow all four Adriatic Metals accounts, and that of its largest shareholder, the Italian hedge fund Helikon Investments.

The account is now mostly blank, but Google still connects it to various photos, some of which relate to Adriatic Metals:

Igor appears to have erased these images, but Google still “remembers” the connections between them and Igor’s LinkedIn account, in a cache.

The first image presented by Google is this one:

The man on the right is Uglješa Mrdić, a Serbian politician who has been a member of the Serbian Progressive Party since its foundation in 2008, just like Alexander Nikolic. Among other roles, Mrdić is a member Serbia’s defence and internal affairs committee.

A reverse image search indicates that the above photo only appears once online, in connection to Igor Simatovic’s LinkedIn page – we therefore conclude that the person on the left is Igor Simatovic and that this proves the two have been friends.

Chapter 3: Nova Mining’s bizarre connections to a convicted Azerbaijani gun runner

In April this year, ADT terminated its contract with Nova Mining and Construction d.o.o (“Nova”), a Bosnian company that had been contracted to develop and mine Vares project. The termination involved ADT paying Nova $11 million and assuming $6.5 million of creditors. This was a surprise reversal in ADT's mining strategy as it had only signed a 5 year mining agreement with Nova, in December 2023, less than 4 months earlier.

Nova was incorporated in 2022, seemingly for the purposes of servicing this mining contract. The initial deal between ADT and Nova, for the mine development, was first signed in June 2022, with the five year mining agreement being signed on 31st December 2023.

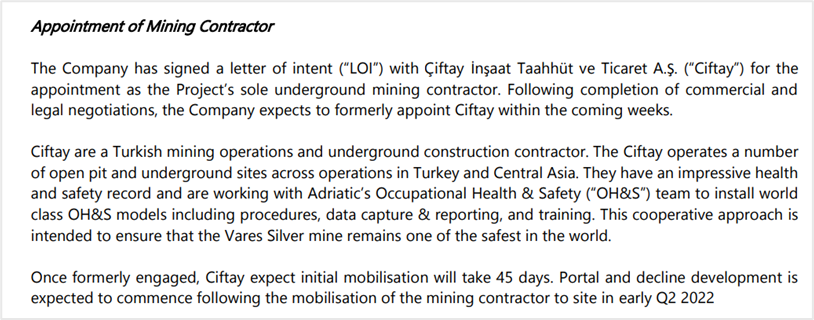

Investor announcements from ADT would suggest Nova was a subsidiary of Ciftay, a Turkish construction company.

In fact, we have discovered that Nova was not owned by Ciftay, but instead has been owned by two Luxembourg shell companies with connections to Khagani Basharov, an Azerbaijani businessman who was once incarcerated in relation to the disappearance of over $100 million.

Nova’s first owner was YS Investments, an aged shell company that since 2019 has had a slew of owners – mostly individuals from Africa. During 2022, when the contract between Nova and ADT was signed, YS Investment had half a dozen ownership changes. It has never been owned by Ciftay.

Rapid ownership changes, such as those exhibited by YS Investments, can be symptomatic of fraud, corruption or money laundering.

During 2023, Nova was transferred to another Luxembourg company called KGM. Since June 2023, KGM has been controlled by a group of Turkish/French entrepreneurs with business interests ranging from drinks wholesale to luxury cars… but with no connections to mining or construction.

We note that any money received by Nova from ADT would be deemed clean, given it came from a publicly traded company. We question whether any money from the wholesale or luxury cars businesses connected to Nova’s Luxembourg parent was used to “fund” Nova’s massive losses.

Immediately after the termination of the contract with Nova Mining, ADT’s CFO resigned.

We think, at best, this raises questions over due diligence and governance controls. We doubt investors know the full story here, yet this was arguably one of ADT’s most important commercial relationships.

3.1 History of the Contract with Nova, and its connections to Ciftay:

Announcements from ADT during 2022 suggested they planned to enter into a mining contract with the Turkish company Ciftay for their mine in Bosnia.

Extract from ADT market update, February 2022.

Several of the people listed in Bosnian filings in connection to Nova were formerly employees of Ciftay[1], supporting the idea that Nova was a subsidiary of Ciftay created for this project. Local filings show this was not the case. (CompanyWall has details of past directors, whose LinkedIn profiles reference Ciftay: https://www.companywall.ba/firma/nova-mining-and-construction-doo/MMxBdrreY/)

3.2 Nova’s Bizarre Ownership History and Connections:

Nova Mining, created in 2022, was incorporated with minimal equity and had an inactive website. Contrary to what one might have assumed, Nova was in fact not a subsidiary of Ciftay. Based on local records, we have been able to ascertain that between its creation and until around August 2023, Nova was owned by YS Investment s.a r.l., a Luxembourg shell company that hase never been owned by Ciftay.

From August 2023 until now, Nova has been owned by KGM SA, another Luxco that, since April 2023, has been under the control of a group of small business entrepreneurs with no connection to mining or construction whatsoever.

Both YS Investment and KGM are dirty shells that were previously part of the business network of Khagani Basharov, a convicted felon and owner of a company that deals in military hardware.

3.2.1 YS Investment s.a r.l:

Contrary to the investor relations information put out by ADT, Nova was not a subsidiary of Ciftay, but was in fact previously owned by a Luxembourg shell company with a bizarre back story and ownership history, called YS Investment s.a r.l.

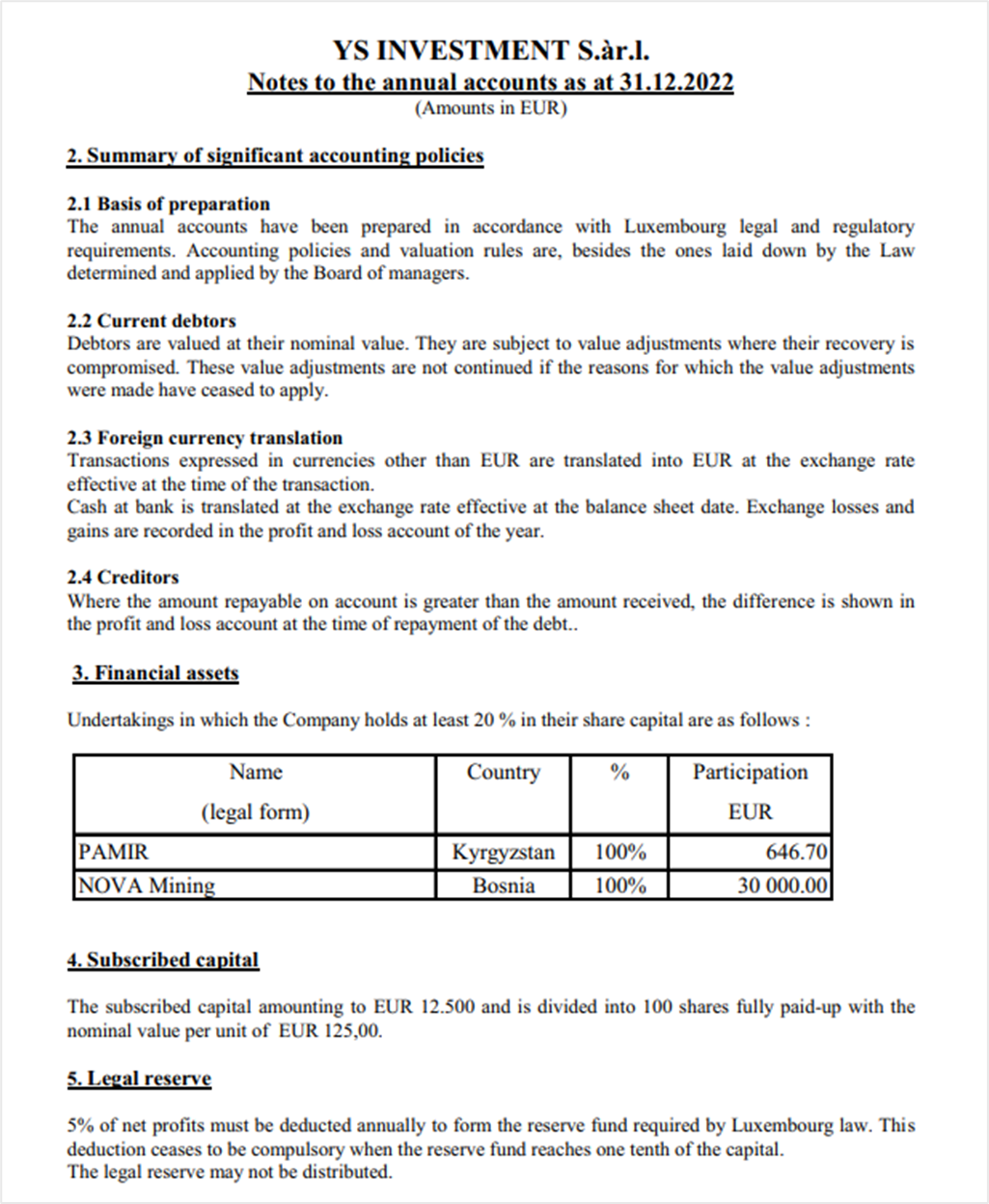

YS Investment’s 2022 accounts, available on the Luxembourg registry, prove this historic ownership:

The ownership of YS Investments ahead of and during the creation of Nova was highly unusual, with a series of rapid changes, as follows:

Until 18/10/2019: Vallis and Pontem Advisory S.A. (an accounting practice owned by Khagani Bashirov, and implicated in alleged corruption).

18/10/2019 to 30/06/2022: Yashar JUMAYEV (b. 25/08/1962, Baku, Azerbaïdjan)

30/06/2022 to 31/02/2022: Y.K.L Holding SA.

31/07/2022 to 31/07/2022: Fatou Mar (b. 29/09/1983 Pikine, Senegal).

31/07/2022 to 10/08/2022: Koffi Zoumanan (b. 08/07/1963, Niandian, Cote d’Ivoire).

10/08/2022 to 15/09/2022: Koffi Zoumanan and Kone Macoura Pretia, (b. 10/02/1973 in NiaN’Dara Boundiali, Cote D’Ivoire).

15/09/2022 to 30/11/2022: Y.K.L. Holding SA

30/11/2022 to current: Gulant Candas.

Gulant Candas does have a relationship to Ciftay – he is a senior executive there.

However, the other people are hard to track down:

- We believe Koffi Zoumanan is likely a Luxembourg based corporate services professional and Kone Macoura Pretia could be his wife, who we think is a policewoman in Cote D’Ivoire (see page 7 of the hyperlinked document).

- We think Yashar Jumayev may have been a manager at Gazprombank's Luxembourg branch, but have been unable to confirm this.

- Y.K.L Holding SA is a corporate services company owned by a Luxembourg based lawyer originally from Cote d’Ivoire, who also owns a law firm[3] specialising in family offices and investments in Africa through Luxembourg. YKL has mining interests in west Africa.

We offer no explanation for this pattern of behaviour but note that rapid ownership changes can be a symptom of corruption, fraud or money laundering. We also note that during that period, Nova was burning cash and so, if anything, these investors would have been “funding” Nova, rather than taking dividends.

3.2.2 KGM SA:

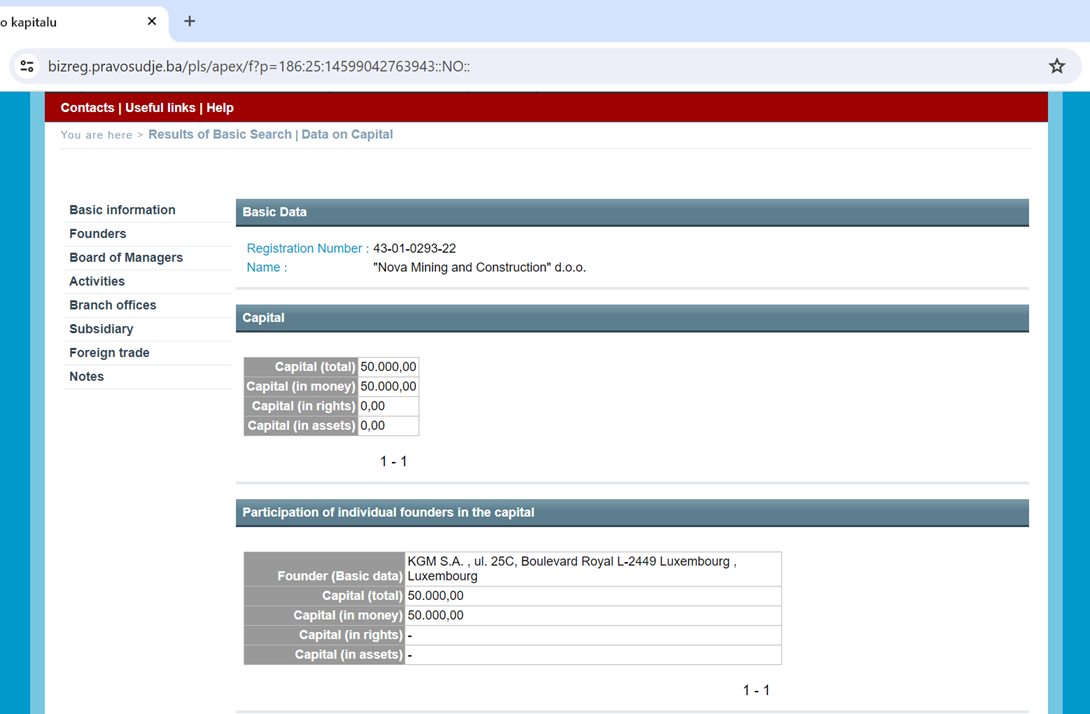

Recent Bosnian records state that Nova is now owned by KGM SA, another highly unusual Luxembourg entity:

We think the transfer of ownership from YS Investment to KGM likely happened in August 2023.

Because KGM is a “Societe Anonime” we cannot determine its ownership, but it also exhibits a highly unusual corporate pattern.

Gulant Candas (a CIftay executive) was previously a director of KGM but he resigned from the role in April 2023, handing over control to the current slate of directors whose business interests we have mapped out in some detail – we have found no connection to construction or mining.

Since early in 2023, the directors of KGM have been as follows:

My Drinks s.a r.l

- A Luxembourg company incorporated in January 2021, and owned by Melik Sorgucu and Daniel Utcu.

- Represented by Melik Sorgucu, born 1979, a Turkish man who has had a series of small businesses in France.

Seyma Aydogdu

- A Turkish lady, born 1991 and married to Melik Sorgucu.

- In filings, she provides a residential address that's a modest flat in Metz:

Sultan Akin

- French, born 1983, gives the address of small house in a town on the border of Germany and France:

These people appear in connection to several companies in France and Luxembourg, but none are mining or construction companies.

Melik Sorgucu was historically a baker, but is currently a director on three businesses in France. Daniel Utku is involved with these also:

- Lux Vollailles – a chicken processor/importer, incorporated 2017.

- SCI Me-Ya – a property investment vehicle, incorporated in September 2023.

- Brod Coca – a drinks wholesaler, incorporated in 2020.

Brod Coca is is their most substantial business, reporting over €6 million of sales. It operates from a couple of locations in the border region of France and Luxembourg - retail/logistics sites:

The companies that Utku and Sorgucu are involved with share characteristics:

- Mostly logistics, wholesale and/or importation companies.

- All located on the border between France and Germany.

- All run by people of Turkish descent.

- All modest in size.

Most importantly, none of these businesses have anything whatsoever to do with construction or mining.

MyDrinks s.a r.l became a director of KGM in 2023 and is owned by the same group of Turk/French entrepreneurs as above. It was originally incorporated to 1b um woeller, Luxembourg, the address of a luxury used car dealership:

The address 1b Um Woeller is shared by various other connected companies:

- AGYST COMPANY S.à r.l.

- CONCEPT M & P HABITAT S.à.r.l-S

- CUSTOM CARS s.à r.l.

- D&C TRANSPORTS

- FLEUR DE LYS PROMOTION s.àr.l.

- HAMER GROUP S.A.

- HELICO S.A.

- LYDION S.A.

- LYDION WARRANTY S.A.

These are all in car wholesale, import/export, spare parts, upgrades, warranties… Not mining.

We are unwilling to offer an explanation for this odd corporate pattern, but we question whether any money from these businesses might have been used to fund Nova’s loses.

3.3 KGM and YS Investments both have connections to a convicted felon who owns a company that deals in military hardware

It’s easy to get lost in the detail of what is a complex network of constantly shifting corporate relationships. However, the key point here is that both KGM and YS Investments were owned by or created within the network of Khagani Basharov who is a convicted felon with interests in military hardware.

Basharov served time in prison between 2010 and 2011 for the disappearance of $109 million from the International Bank of Azerbaijan.

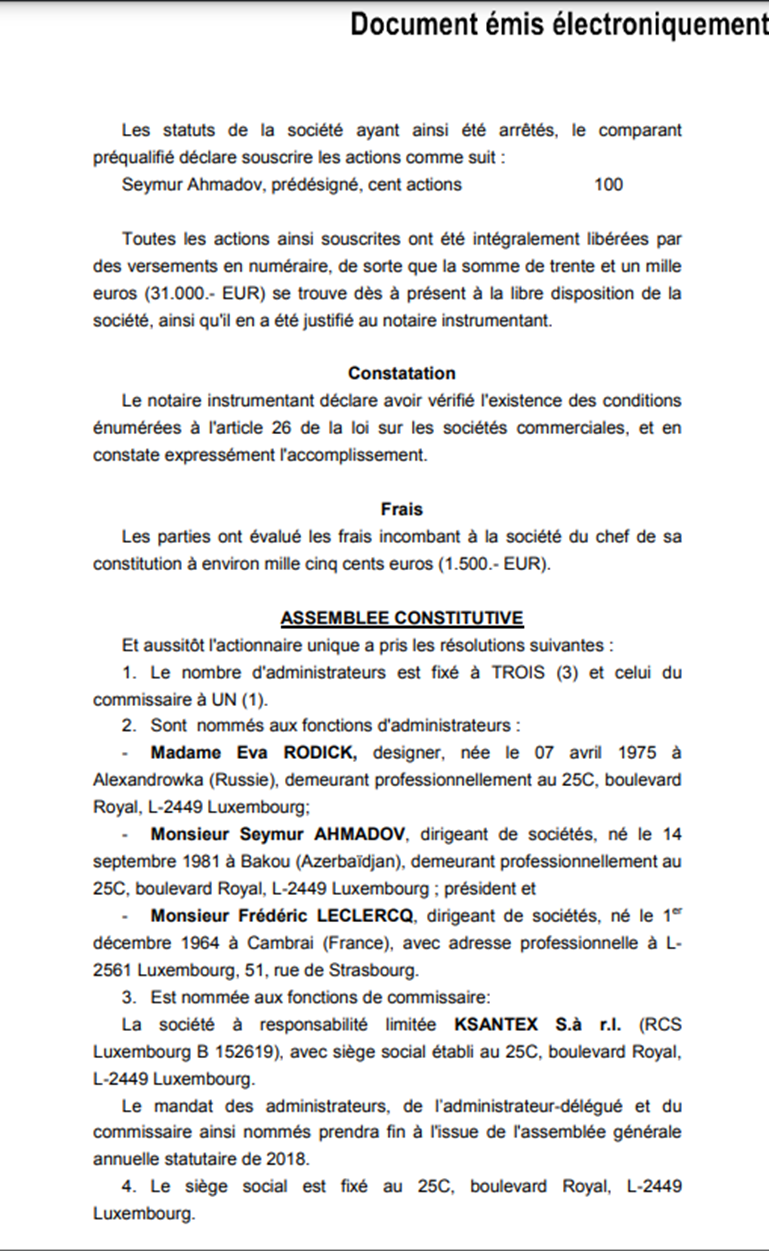

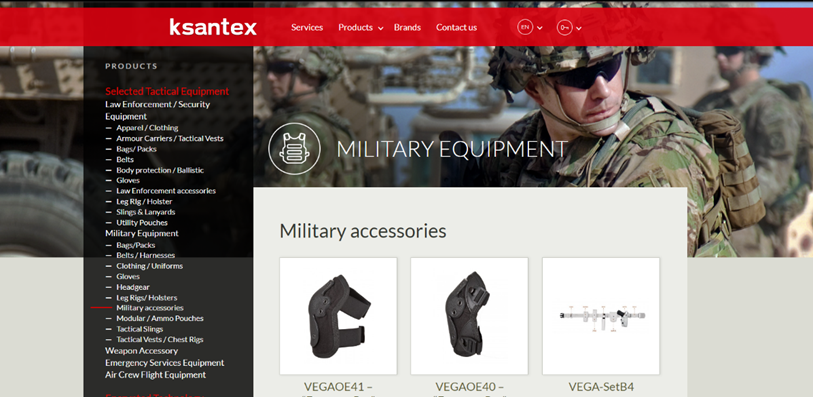

The second of Nova’s two owners, KGM, was first incorporated in 2013 and was originally called Petroleum Development SA. Its original shareholder was an Azeri called Seymur Ahmedov, who was also a founding director. Responsibility for KGM’s accounts was given to a company called Ksantex s.a r.l:

Ksantex now describes itself as a “boutique consultancy involved in the civil aviation industry”. However, archived versions of its website, such as the one below from 2016, show a different picture. It deals in military equipment:

KGM’s original accountant deals in military hardware. ¯\_(ツ)_/¯

In the archived instances of its site, Ksantex lists offices in Kazakhstan, Moldova, Belarus, Russia and Georgia. We note from historic financial accounts that Ksantex also had a branch office in Kosovo.

In 2023, Bashirov admitted that he owned and controlled Ksantex. This admission helps us to map out some of the shell companies and proxies Bashirov uses to hide his ownership. For instance, in the UK, one of the PSC’s (a beneficial owner in this case) for Ksantex’s UK subsidiary has been Taryel Ahmadov since 2020. This means Taryel is likely acting as a proxy for Bashirov. Taryel is the father of Seymur Ahmedov who, in turn, is director on various entities in Luxembourg and the UK that form part of Bashirov’s corporate network.

Seymur Ahmedov, who was the original shareholder and director of KGM, continues to act as director of Ksantex today.

YS Investments also has strong links to Bashirov. When originally incorporated, it was a subsidiary of Immo Property, a Luxembourg company in turn owned by Taryel Ahmadov and Java Investments BV, a Dutch shell company owned by Khagani Basharov. Through various ownership changes, YS Investments was owned in whole or in part by entities owned by Bashirov at least until 2019. Luxembourg filings show its ownership by companies such as Java Newtech Ltd (Cyprus), Goalsbridge (Lux), and Vallis and Pontem, all of which are owned by Bashirov or operated by his associates.

3.5 Financial Concerns:

Nova reported massive losses in 2023, with expenses twice the size of its revenues. Once again, we question whether these losses might have been funded by the wholesale or luxury car businesses in France and Luxembourg connected to KGM, or through money received from the various people who owned YS Investments during 2022.

The termination agreement between ADT and Nova included a payment of $11 million and the assumption of $6.5 million in liabilities.

3.6 Impact on ADT:

We recognize that there is insufficient evidence here to accuse Nova or any of the related parties of wrongdoing, but we are deeply concerned by the pattern of behaviour and speculate that Nova’s losses may have been funded by money from the import/export businesses in Luxembourg connected to KGM or received by the gang of shareholders of YS Investments, with its revenues funded by money from ADT.

We think ADT’s investors should be asking the following questions:

- What due diligence process was undertaken relating to Nova’s ownership at the point of the contract agreement?

- Did any of ADT’s executives ever discover Nova’s unusual background?

- If so, when was this discovery made?

- Do ADT’s executives consider it appropriate to have paid Nova such a large termination fee, given its unusual ownership?