AMA with SOLV protocol

口丂匚卂尺๛ツ

Danil |Dubai Community

Nice to meet you here

Okay, let's start

Q1. Could you briefly introduce yourselves as well as Solv?

Ryan C

Hello everyone, I'm Ryan, co-founder of Solv Protocol and head of Solv’s marketing and research teams.

Solv Protocol is a decentralized platform for creating, managing, and the on-chain transaction of NFTs that broadly represent financial ownerships and rights. We call such NFTs, Vouchers. As NFT containers for digital assets, the Voucher can significantly enhance liquidity for locked assets and has proved extremely useful in numerous use cases across DeFi. Our token standard, ERC-3525, allows individuals to split or merge Voucher containers in whatever way they see fit.

We recently closed our Series A round led by Blockchain Capital, Sfermion, and Gumi Cryptos, with DeFi Alliance, The Lao, CMT Digital, CMSholdings, Apollo co-investing. And got Binance labs several before. We have so far partnered with 25 DeFi projects, all of whom have minted their Vesting Vouchers here at Solv. And to this day, over 7000 addresses have interacted with Solv, and the TVL has reached an all-time high of $260M on January 10, 2022.

These numbers signal the tremendous market potential that comes with utilizing NFTs which express and execute sophisticated financial contracts or financial NFTs. Soon, trillions of dollars of assets will pour into the DeFi space, where customers and institutions can enjoy the leading on-chain, permissionless marketplace for the financial NFTs in DeFi, provided by Solv Protocol.

@Daniewar Done:))

Danil |Dubai Community

Q2. What problem is Voucher trying to resolve? What is a Voucher?

Ryan C

The most pressing problem in the emerging field of DeFi right now is the absence of an efficient and flexible tool to express complicated financial contracts.

Vesting Voucher is a splittable NFT structure that represents ownership of locked allocations. For projects and investors, it’s a low-cost and frictionless solution for trading and managing allocations. Solv’s Voucher is a splittable NFT that represents ownership of allocations. An initial Voucher offering (IVO) is a public offering in which allocations of a project’s native tokens are sold in the form of Vouchers, to individual investors. IVOs are an excellent way for projects to reward early users and to form strong project-user relationships.

As NFTs, Vouchers are highly extensible by design to meet a wide array of use cases. Solv’s upcoming product Convertible Voucher is a structured financial product that can be converted into a predetermined number of tokens or stablecoins under certain conditions. It would empower DAOs that have listed their tokens to obtain cash in the most efficient way, while it allows voucher investors to receive healthy returns on a token in a relatively unstable climate.

@Daniewar Done!

Danil |Dubai Community

Q3. IVO is a new fundraising model. What's so special about it when compared to IDO and Coinlist?

Ryan C

Vesting Vouchers might seem like a simple concept for token lockup, but as a tool in practice, it’s effective and neat. It plays as a crucial medium through which a crypto project can connect with the users in a real way.

As we all know, these days investors can invest in a project’s token mainly through IDOs. But the downside of IDOs is that they neither bring long-term user base to the project nor are they rewarding users of the project for investing. As an alternative, the IVO offers a rare opportunity for early retail investors to purchase tokens at a low price point, something they are usually not able to do.

That being said, IVOs and CoinList do share a lot of similarities. For me, it helps think of the IVO as more of a “decentralized” Coinlist, but with additional benefits as follows:

1. More inclusiveness. Anyone can purchase inexpensive, early allocations through the IVO as long as they’re Whitelist.

2. More feasibility. Vouchers are accepted on every exchange, lending, or derivatives platform that supports NFTs, and you can freely send or receive Vouchers as long as you have a crypto wallet.

3. Enhanced security. Vouchers are secured by decentralized infrastructure.

On Dec 13, 2021, we launched our IVO event. Within the first hour, trade volume soars to nearly $2M BUSDs, with the highest floor price being $1500 BUSD - up from the opening $400. The next two days after the launch saw SOLV Voucher rising to the 2nd place in the 7D Hot Series list and first in the 7D Premium Creators List on the Binance NFT platform. Safe to say our IVO was quite a hit.

@Daniewar Done.

Danil |Dubai Community

Great 🎶

Q4. Could you introduce more about Convertible Vouchers?

Ryan C

As the second member of Solv’s financial NFT family, Convertible Voucher is a structured product that can be converted into a predetermined number of tokens or stablecoins under certain conditions.

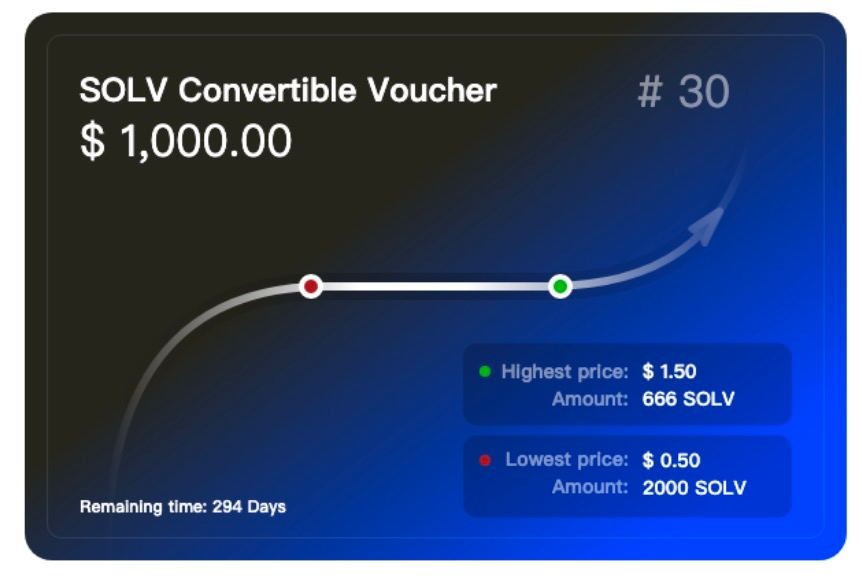

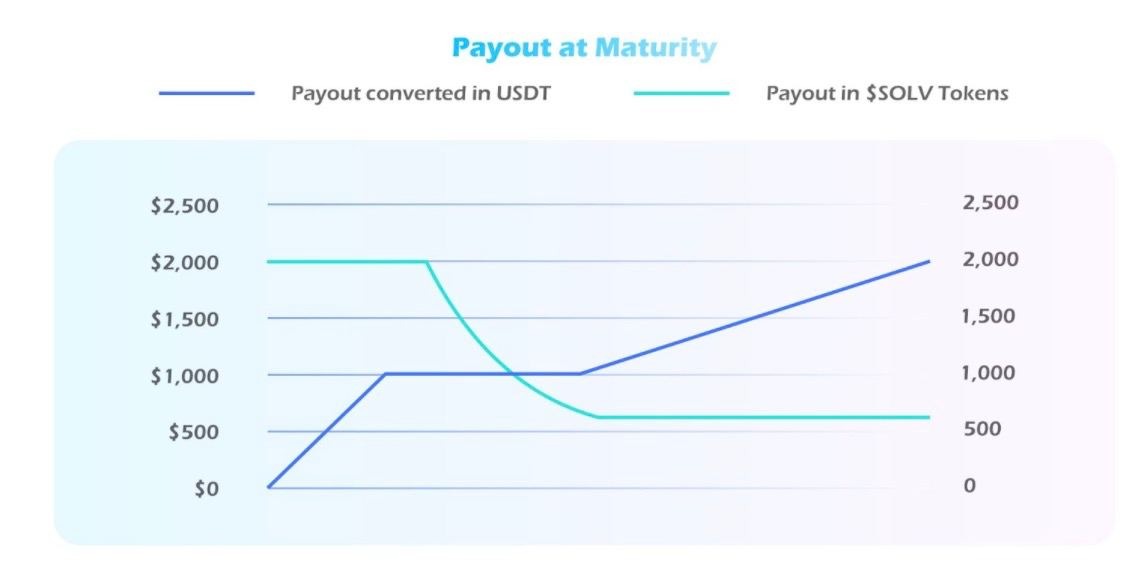

From a technical point of view, the Convertible Voucher is an NFT container for locked token assets, and it revolves around three core parameters: a maturity date, face value, and a predetermined price range, which is called the “bond range.” If the token price falls into the bond range, the Convertible Voucher will execute like a zero-coupon bond, offering full nominal value payout to the investor in stablecoin. On the other hand, if the token falls out of the bond range, the Voucher owner can redeem the tokens whose amount equals the Voucher’s nominal value divided by either limit of the bond range, depending on what the token price is.

For risk-averse investors, the Convertible Voucher is the best way to invest in tokens that have unique risk profiles. It also gives owners of the Convertible Voucher an out before the settlement, by letting them trade those Vouchers on Solv Marketplace.

@Daniewar Done:)

Danil |Dubai Community

Q5. Convertible Voucher sounds like a great tool for diversifying treasuries. How is the payout calculated?

Ryan C

When the settlement price falls inside the bond range( $0.5 to $1.5), the amount paid to the Voucher holder would just be the Voucher’s face value. As figure shows, #30’s value (the blue curve) keeps a steady $1,000 as the settlement price traverses across the $0.50-$1.50 bond range. Assuming the Voucher was purchased at a discount for $800, in 294 days the holder will be offered a full face value profit of $1,000, generating a ROI of 25%.

If the settlement price ends up anywhere over $1.50 (upper bound), the holder receives a fixed payout 666.67 SOLV, generating a ROI of at least 25%. If the settlement price drops below $0.50 (lower bound), the holder receives a fixed payout of 2000 SOLV and a negative ROI.

@Daniewar Done:)

Danil |Dubai Community

Q6. How does it attract retail investors and why should they buy it?

Ryan C

Convertible Voucher is a new digital asset that allows crypto investors to receive healthy returns on a token.

Its unique payout mechanism takes into account the volatility that currently characterizes DeFi and makes it safe to invest in promising, new projects while retaining strong toleration of risk.

If you are a lender on Compound while earning 2% APY. Lending out stablecoin through Convertible Vouchers would produce a much competitive overall yield(8-12%). Not even including the Solv’s incentives yet.

If you are going to purchase $USF, buying a Convertible Voucher of $USF would give you protection even if the price dropped 50% if the settlement price is still higher than the lower limit of the bond range. All in all, Convertible Vouchers offer passive investors a rare peace of mind not found in most investment products of DeFi.

@Daniewar Done

Danil |Dubai Community

Q7. Who will be the first to issue Convertible Vouchers and how to participate in this event?

Ryan C

Any project teams who have a treasury (especially DAOs) with very limited liquid assets would be interested to issue their Convertible Vouchers. Unslashed Finance, a decentralized insurance protocol, will be the first project to launch their Convertible Vouchers on Solv’s financial NFT marketplace. On February 7, Unslashed Finance will issue Convertible Vouchers with tokens worth 1 million US dollars.

Unslashed Convertible Voucher Offering Event details:

Details of USF Convertible Voucher Offering

👑 Total value: 1 million USDT

⏰Offering start date: Feb 07th, 2022

💰 APR: 8%

💰 Bond range: 1/4 average price ~ 6X average price (the average price will be set up by Unslashed)

⏰ Maturity date (UTC): May 07th, 2022

Users have to get whitelisted to participate in. Solv co-host a gleam whitelist campaign with Unslashed, you could join Solv’s Telegram or Discord to learn more details.

Unslashed($USF) Convertible Voucher Offering Whitelist Campaign on Gleam

👩🏻 Total Winners: 800

👑 Each Winner can purchase: $ 1w - 100w

⏰ Whitelisting Start date: Jan 21st, 2022

⏰ Whitelisting End Date: Feb 6th, 2022

Complete more referrals and tasks to have a better chance of securing a whitelist spot

Any cheating or use of bots will be disqualified immediately

Please note securing a spot on the whitelist means you can participate in the Convertible Voucher Offering but it does not guarantee an allocation - IVO will be first come, first served.

Follow Solv Protocol

@Daniewar Done.

Danil |Dubai Community:

Then we have finished our first segment

Thanks for your cooperation ♥️

Now

let's start The second stegment

"Twitter Questions"

Are you ready?!

Ryan C

Yes, sure:)

Danil |Dubai Community

Q1 From @nabilha90188298

Now in crypto the biggest problems are security in recent days there are many project that had been hack that took the user assets,So how do you insure the security of your project do you have any insurance for this and what are you doing for security of your platform?

Ryan C

In the pursuit of higher protocol security, Solv has purchased $1million worth of insurance coverage through Tidal Finance and $3 million of insurance coverage through Unslashed. This allows the Solv users to get insured over SC risk. The current plan covers smart contract vulnerabilities deployed on Ethereum and Binance Smart Chain. Needless to say, this is quite momentous as this is the FIRST time Defi insurance is being applied to the NFT sector!

Besides, we are offering a $50,000 bug bounty to incentivize developers and white hats to help us secure our protocol by uncovering its vulnerabilities and shortcomings. And we are pleased to be able to launch this undertaking with Immunefi, which is a leading bug bounty platform experienced in the testing and securing of Defi protocols.

Danil |Dubai Community

Q2. From @0JeanWayne

The fact that Solv Protocol's main products includes NFTs, do you have plans to optimize and scale your NFTs and support other networks aside from Ethereum, which has ridiculous high gas fees?

Ryan C

Aside from Ethereum, we support BSC and Polygon now which could solve the problem brought by the high gas fees and we’ll definetely support chains in the near future. But I’m looking forward to the revolution of Ethereum more.

@Daniewar Done

Danil |Dubai Community

Q3 Form @Akbor_ali_9

. Almost 3/4 of investors are focused purely on the price of token in short term instead of understanding the real value and health of the project. Could you tell us on motivations and benefits for investors to hold your token in long term?

Ryan C

We connect high-quality investment firms in the crypto world, wealth advisory platforms, and investors.

And there is no token that will be claimable by the investor and the team in the first year starting from the first issuance date. Those tokens will be released in the second and the third year.

The vesting period for the private investors is 3 years and it’s even longer for team members thus the dumping pressure will be very low even in a long period. And we will continue developing innovative products in the future and actually, we already have several backup products on the way which are highly admired by investors and partners. We are pretty confident with the capacity of subsequent growth.

@Daniewar Done

Danil |Dubai Community

Q4 From @Sabit50679515

Smart contracts are prone to failure and many projects fall victim to this, costing users money and the project discrediting. How reliable and secure is your smart contract? Have you audit it through any of the parties?

Ryan C

Solv Protocol is designed to protect users’ assets. We work closely with top-notch blockchain security solutions to protect our users’ assets from external and internal risk factors. We are proud to say that our source code has successfully passed the audits by both SlowMist and CertiK, key blockchain security organizations, and is on schedule to be audited by a third security network.

Danil |Dubai Community

Q5. From @ILoveYouSinthi

One of the potential development directions of a cryptocurrency is NFT. How do you rate the NFT? Which features do you consider important and look forward to in the NFT?

Ryan C

There’s no doubt that NFT is an asset with a great capability to carry infomations and it’s well awared by the public and getting popular. But actually it just a differenttype of asset like ERC20 tokens, the difference is the token stadndard. NFT is not feasible to anything, for example, it can not be used as a financial instrument because it’s a Non-fungible asset which can not be splitted. Thus we designed and created a new ERC token standard known as a versatile non-fungible token (ERC3525) that is flexible like the ERC-20, but also non-fungible like the ERC-721, making it a semi-fungible asset. The first ERC3525 token product was created in the form of a Solv Voucher, designed to be used in the form of allocations to grant broader access to private sales while generating much-needed liquidity for projects or investors.

@Daniewar Done.

Danil |Dubai Community

Thanks for your great Answers

Now we will open the chat and the audience will send their questions

And you will choose 5 questions from them

Are you ready?!

Ryan C

Yes!

Danil |Dubai Community

Prepare your questions guys 😊

Q1 From

Janny Jordana

Do the token holders have right to participate in the governance of the project? On what kind of decisions can they vote on about the project?

Ryan C

Sure they will definitely be part of the governors and that’s one of the utility of $SOLV, they will be able to participate in other quality project’s IVOs according to the number of $SOLV they hold. For example, they may could vote to decide whether the projects coming for applying an IVO on SOlV are qua

Q2 From

Lavera Guffey

On your website you don't mention that you have done any internal or external audit of your smart contract, so can you give us details if you have done any audit before? And in case you haven't, would you plan to perform any review of your smart contract in the near future?

Ryan C

Q3 From

পাট খেত

PARTNERSHIP & COLLABORATIONS are the backbone in making every project more widespread. Can you list some of ur partners with us?

Ryan C

Q4 From

Florencia Connor

Can you tell me more details on the IDO? The schedule and contribution for each?

Ryan C

We have now issued two IVOs till now, one is for Solv and the other one is for Izumi Finance, which all brings great marketing effect to both project teams!

Q5 from

Jolie XXX

How do users participate in #Solv Protocol?I think this is the most important. 🙏🙏🙏

Ryan C

Now you could buy Solv Vouchers and other projects lockup tokens as well. Here’s the link: https://app.solv.finance/marketplace?network=mainnet

@o_s_4 @Daniewar Done

Mahmoud |Dubai Community

5/5

we are done now

Please, do you want to explain anything else that has not been explained?

Ryan C

Thanks guys for your help, really appreciate for the communities!

Just my pleasure to be here and share my thoughts! Great experience.

Mahmoud |Dubai Community

You're welcome

Danil |Dubai Community

Can you share some useful links now?

Ryan C

Sure!

I think these are enough:))

Danil |Dubai Community

It was pleasure having you here with us. Thank you for your precious time and attending this AMA.

Ryan C

Likewise:))

Danil |Dubai Community

Chat open now