AMA With InsurAce

Huobi & InsurAce. Part I - Introduction.

Flying Jack Huobi Community Manager,

Rules & Format of the AMA:

1) At the start of the AMA, we will have introduction of Oliver Xie Founder of InsurAce and brief on InsurAce. (Channel will be muted)

2) After brief introduction, Community Manager would ask questions.

3) After Guest answer questions, channel will be unmuted for community members to ask questions.

4) Channel will be muted for Guest to answer questions.

5) There will be two/three rounds of questions and answers.

6) Slow mode will be activated to reduce spamming. Please avoid repeating questions, ask only 1-2 questions relevant to INSUR only. Spammers and Bounty hunters won't be considered for rewards.

7) Take part in the quiz to earn more rewards. Link to the quiz will be pinned.

For receiving rewards KYC is must

Hello everyone! Welcome to the Huobi Global Telegram AMA. We are hosting $INSUR today. I am sure everyone would be eager to learn more about INSUR.Hello everyone! Welcome to the Huobi Global Telegram AMA. We are hosting $INSUR today. I am sure everyone would be eager to learn more about INSUR.

It’s a great honour and privilege to welcome Oliver Xie, Founder of InsurAce.

@oliver4insur First of all congratulations on successful listing on Huobi.

Thank you Jack, it’s really an honour to be here today, and thanks for the support from Huobi team to list $INSUR, and hold this AMA for us.

Flying Jack Huobi Community Manager,

@oliver4insur Before beginning the session, could you please introduce yourself to our community?

thank you for joining us

Hello folks, how is everybody doing.

My name is Oliver, i’m the founder of InsurAce Protocol. Really happy to be here.

Maybe let me do a little bit more of introduction to myself.

I started to work on InsurAce project since Sept. last year, and prior to that, I worked as CTO in one of the three Singapore-based licensed derivative exchanges and clearing houses. I entered the crypto space back to 2017 where I led a team to research cryptos and blockchain, and gravitated towards the blockchain-based Open Finance for the past few years.

The initiation of InsurAce, the DeFi insurance 2.0 Platform, is to build a reliable, robust and carefree insurance protocol, accessible for all DeFi users. It gives me the chance to combine both my professional expertise and my personal passion perfectly.

👉 DeFi is my passion, and InsurAce is my mission.

Although I'm the Founder and project lead of InsurAce, my role in InsurAce is more like a coordinator to assemble the suitable team members in order to deliver the best project.

We have a very dedicated and professional team composed of blockchain experts from IBM, very experienced insurance experts from tier-1 insurance institutions, top legal & compliance veteran and cyber security experts as our advisors, together with professional marketing members to work together on this exciting journey.

Besides daily management as the founder, I myself is also a coder too, so I work with my developer team shoulder by shoulder on the product delivery.

@FlyingJack over.

Flying Jack Huobi Community Manager,

thanks for the introduction, I would request you to present a brief introduction about InsurAce

sure, thanks Jack.

Believe many of our folks have seen or traded $INSUR on huobi from last Thursday, which is the governance token of this project.

Flying Jack Huobi Community Manager,

I missed the pump 🙈

to be brief, InsurAce is:

1. a DeFi insurance protocol;

2. main features: portfolio-based insurance + investment products;

3. what you can get as an user => you pay less, earn more, and get safer.

4. our mission: provide reliable, robust and carefree DeFi insurance services to the crypto users.

@FlyingJack over sir.

Flying Jack Huobi Community Manager,

Thanks for the brief.

Shall we start the AMA now?

sure, let’s go.

Flying Jack Huobi Community Manager,

Can you share a little bit of what InsurAce has achieved in 2020 and what exciting milestones are to be delivered in 2021?

sure, it’s been an exciting journey for InsurAce since the inception.

2020 is the year of genesis, whereas 2021 is the year to survive, live and thrive.

in year 2020, InsurAce started, some of the major events:

- assembled the InsurAce founding team and kicked off the project.

- product initial design and development was successful and recognized by many DeFi savvy users.

- completed the Seed round investment supported top VCs such as DeFiance, ParaFi, Huobi DeFi labs, Hashed, Signum etc;

- onboarded top advisors to administer compliance and cyber security of the platform;

- built up our community and PR channels.

our efforts gradually pay off, for the past few months in 2021, the major milestones we’ve achieved:

- completed development of our v1.0 in Jan, and deployed to testnet for public testing in Feb;

- closed our strategic round funding and got more support from investors and community, such as Alameda and Hashkey in Feb;

- conducted successful token initial launch via Balancer LBP in March;

- listed on Huobi Global back to a few days ago on 1 April.

Going forward, the major events upcoming are:

- launch the platform to Ethereum mainnet, and continue to develop more features, support more protocols.

- migration to other chains such as HECO, Polkadot as our key next step.

- more efforts into partnerships development and user acquisition.

@FlyingJack over ser.

Flying Jack Huobi Community Manager,

I am sure there are exciting days ahead

What made you decide to build such a project InsurAce? What potential do you see in DeFi insurance?

yes, stay tuned.

why build this project? it has something to do with an accident.

Back the DeFi summer in 2020, i was doing mining with one friend, but unfortunately his protocol got hacked, and we got nowhere to seek for help or get compensated, which is the personal trigger why we wanna build something that can help others who migh have similar sufferings.

By looking deeper into the DeFi space and especially, the existing risk management solutions, including insurance, we found there’s actually huge space to work on.

DeFi landscape continues its rapid growth and market demands have been increasing exponentially. According to DeFiPulse, as of recent, DeFi TLV reached an all-time high of 47.73 Billion in USD.

However, the industry has been witnessing challenges and threats posed by hacking, code flaws, oracle manipulation etc, causing huge losses of user assets.

Needless to say, the cyber-attacks have been posing significant threats to the whole DeFi ecosystem fundamentally. Besides the technical approaches to resolve this problem, insurance, by its nature, has been another effective means to manage this risk.

However, the existing insurance solutions have their existing issues which we think can improve a lot. therefore, we started InsurAce to build a more better DeFi insurance protocol.

As in terms of the potential DeFi insurance vertical, i think it’s still huge although there’re already a few solutions in the market.

We see DeFi Insurance still in its early-stage of development. Top insurance projects like Nexus Mutual still have relatively limited coverage and the maximum capital of the covers has not exceeded 2Billion, which only takes up less than 2% of the whole DeFi market.

I’ve talked to many crypto folks about this, basically we all agree that 8%-10% is a reasonable percentage to be covered against the TVL. Therefore, we foresee there’s still huge potential for DeFi insurance protocols, and that’s where we come about on this.

on the other hand, the overall valuation of DeFi insurances is even smaller than uniswap. but just think, the size of the largest insurance company vs the largest exchange. You’ll know what i mean.

One more thing, DeFi insurance is an area where projects can build up user loyalty and brand awareness, compared to other areas like lending, DEX etc.

overall, huge potential, huge challenges as well.

@FlyingJack over sir.

Flying Jack Huobi Community Manager,

Exponential growth always attracts bad players and we need someone like InsurAce to provide cover for common users

What are the challenges of existing DeFi insurance protocols? What are the outstanding advantages of InsurAce compared to other insurance projects such as Nexus Mutual, Cover, ArmorFi ...?

thanks Jack, i’ll take that as a compliment, but we’re definitely working hard on that.

sure. First of all, we definitely respect other insurance players in this space, i think we can work together to build DeFi a better place for all. Therefore, the comparisons made here are solely at product level, doesn’t constitute any infringements to other players.

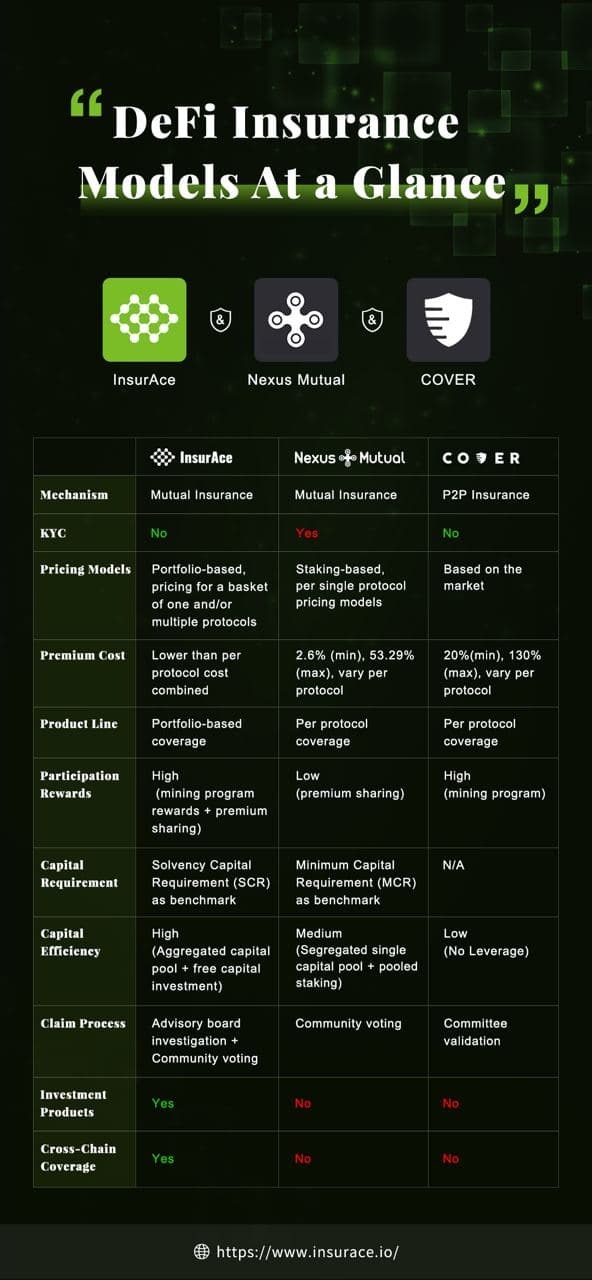

Speaking of the challenges of existing DeFi insurance protocols, basically we'll refer to 2 major protocols, Nexus Mutual (nxm) and COVER, but COVER unfortunately suffered from a hack in last Dec, so i guess it will take quite some time for them to recover, but anyway, that doesn't affect us to respect and take it as a good case study. NXM is built as an mutual insurance, whereas COVER is a peer-to-peer model, quite different.

let me share a picture for your quick glance.

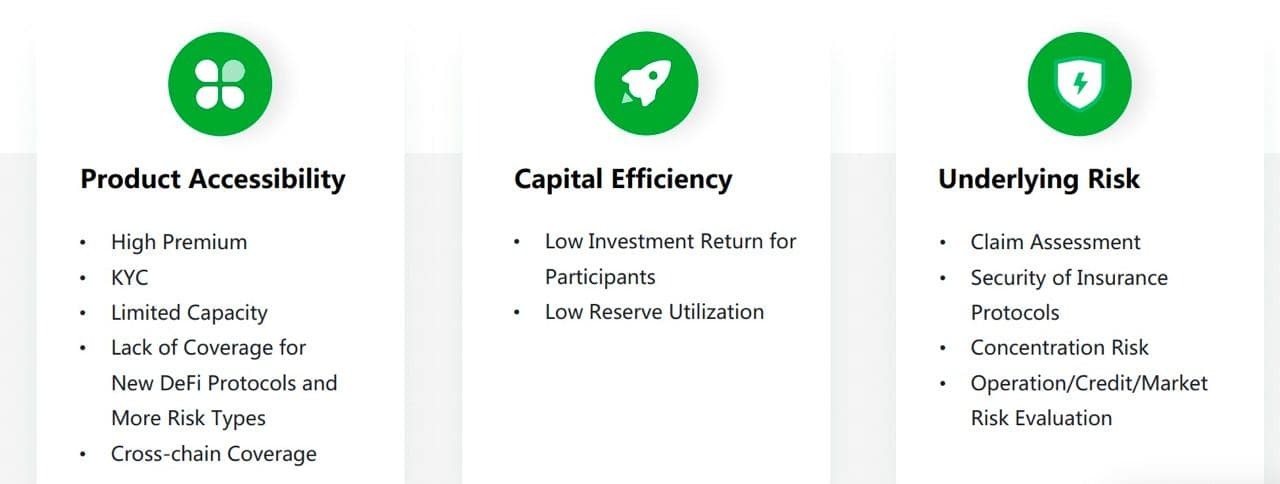

to be more specific, some of the restrictions for existing solutions are (mostly can be found in our whitepaper).

1. Product Accessibility => such as high premium (the premium on COVER is 20% annually at its minimum, and on nexus mutual, it could be as high as 70% too), KYC-based membership (specifically to nexus mutual) which poses lots of restrictions to users, lack of support for new DeFi protocols which are actually the ones that need to be covered most, lack of risk diversity to cover other potential types of risks.

2. Capacity Issue => on nxm, the capacity is a big problem as it's highly relying on staking but the staking rewards is quite low (1% annually, can you imagine that? ), so sometimes when you wanna to buy insurance there, it just doesn't have the capacity.

3. Capital Inefficiency => Insurance, similar as any other financial product, the capital efficiency is one of the core considerations. The capital injected into the insurance platform is often not well managed, leading to the low utilization of the reserved fund which can be employed in a more delicate way. Meanwhile, per our experience in the traditional insurance industry, customers are always expecting to gain sustainable investment return on the money they place into the insurance company, therefore, investment is also important for users, not just for the short term (staking rewards by tokens might be very high), but also for the long run (after the mining is done, investment yields will be become the main sources of user returns).

4. Risk Mangement => As mentioned above, insurance, by its essence, is a tool to help people manage their risks, therefore, the risk management of the insurance business per se, is even more critical. However, the risk management for existing insurance products still need to be enhanced. Let me give you a few examples:

+cyber security risk -> what if the protocol itself got hacked? => cover is a bloody example.

+concentration risk -> will the coverages be concentrated on a few protocols only?

+claim assessment -> how to ensure a rational and impartial claim process? => nxm is solely dependent on community voting, and only claim 3 cases in the past 2 years.

+operational / credit risk -> how to ensure the operations of the platform are well managed?

insurances are designed to protect people, it should be built and run in the hands of the right team and community.

sorry guys, for thise long reply, but you can just refer to a brief summary below.

Flying Jack Huobi Community Manager,

What is InsurAce’s business design? Can you introduce the mechanism?

its ok, its always good to learn new tech

yes, sure, let me make if brief.

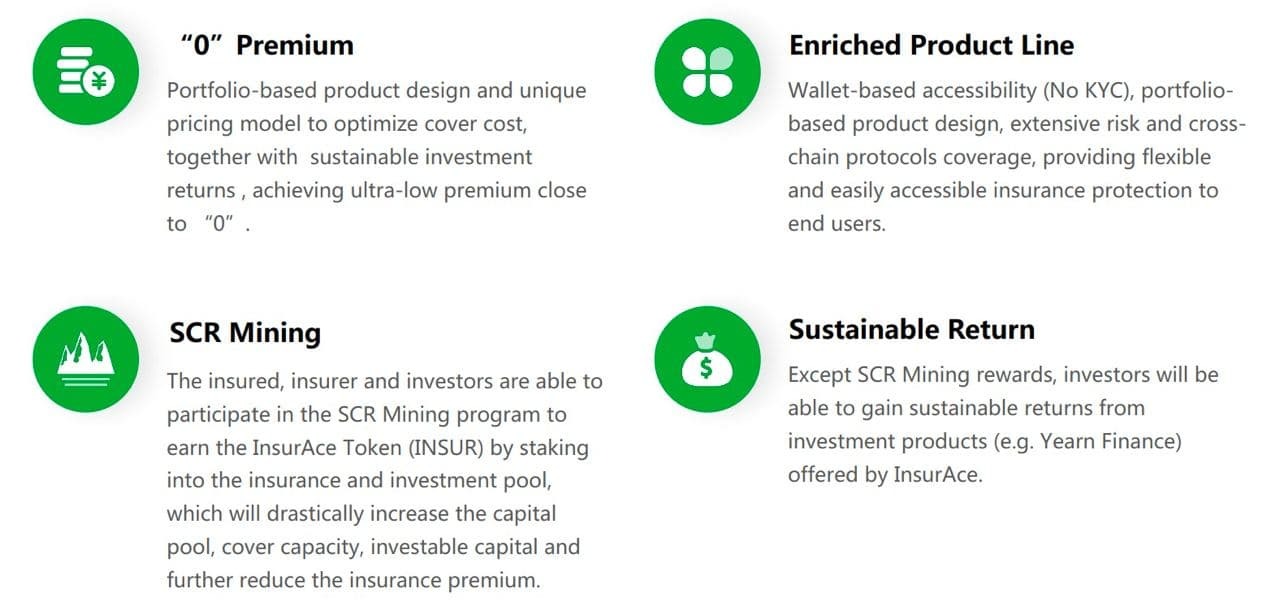

As an insurance protocol, InsurAce will provide two function arms similar as the traditional insurance company, i.e., the insurance arm and investment arm.

While insurance capabilities are our cornerstone, the investment is also an essential component to enhance the business.

you can refer to below high-level diagram for a quick view.

so basically, the 2 arms work in a synergy.

The free capital in the insurance capital pool can be placed into the investment pool to gain higher yield, while the insurance arm will provide protection to the investment activities. Meanwhile, the yield at the investment side will in turn complement the premium at the insurance side, and further reduce the cover cost for customers. These two parts will in such a synergetic manner to provide “0” premium insurance as well as considerable investment return, forming a sustainable business model.

In this model, InsurAce as a platform, will generate revenues from the insurance premium as well as a minor portion of carry from the investment returns. Those revenues will be used in areas such as operation / development costs, tokens buybacks, community incentives, ecosystem collaborations and etc.

@FlyingJack over sir.

Flying Jack Huobi Community Manager,

There are quite many alike products in the market now. Compared to the other insurance protocols, what advantages does InsurAce have?

sure, i think we’ve covered some of this in previous question, so i’ll quickly summarize this in below pic:

to sum up, the core advantages are:

1. porfolio based coverage => cover one or multiple protocols in one transaction, save your cost, save your gas, and save your time.

2. investment functions => make better use of the funds, and help you earn more.

3. no KYC => accessible for more users.

4. enriched product line => more risk types to be covered.

from a user’s perspective.

@FlyingJack over sir.

Flying Jack Huobi Community Manager,

What is the end goal for InsurAce — do you want to compete with the giants like Allianz? Or be a bridge between insurance and cryptocurrencies with coverage provided for Defi insurance?

nice description

haha, I wouldn’t say we’re going to compete with those traditional giants at this time of the project, but I guess the trend for crypto and blockchain to reshape the industry has started, and it’s going stronger and stronger. Just take a look at how internet reshaped the whole financial industry, and Web3.0 is coming over while DeFi is the first stop. So, who knows?

meanwhile, I would say that we are not pure competitors of the traditional giants, but also their collaborators. We can be a healthy supplementary role to the insurance landscape, whereas they can provide us support as well. Actually, we have talked with a few traditional insurance giants on providing insurance to us, which will benefit the whole DeFi space.

@FlyingJack over sir.

Flying Jack Huobi Community Manager,

Yes, we are just in the beginning of a great change

Can you share the INSUR token use cases and incentive mechanism? We know that InsurAce will be holding Intial Token Launch via Balancer LBP, what can we expect?

sure. INSUR token is the governance token of InsurAce protocol, so it’s is supposed to be valueless.

By saying so, the current uses for the token are:

- Mining incentives for capital provisions to the insurance pool and investment products;

- Representation of voting rights in community governance scenarios such claim assessment, proposal voting and etc.;

- Community incentives;

With the continuous growth of InsurAce’s user base and development of our ecosystem, we will seeing more values added to INSUR token as the basis of powering the whole system, such as, the token holder will be - Eligible for fees generated by InsurAce protocol through governance participation, which can be a big value capture for the token.

@FlyingJack over sir.

Flying Jack Huobi Community Manager,

Thank you for answering my questions, shall we now take questions from the Telegram Community?

sure sure. let’s go.

Continuation: Huobi & InsurAce. Part II - Community questions.