AI应用还能做吗 - 黄易山的AI投资逻辑

wangleineo 由知乎大巴扎搬运昨天,Reddit前CEO美籍华人黄易山(X:@yishan)发了一篇推文,浏览量达到了1600万次,也引发了巨大的争议。

先看看他说了什么:

推文

My AI investment thesis is that every AI application startup is likely to be crushed by rapid expansion of the foundational model providers.

我的人工智能投资理念是,所有人工智能应用初创公司都可能被基础模型提供商的快速扩张所扼杀。

App functionality will be added to the foundational models' offerings, because the big players aren't slow incumbents (it is wrong to apply the analogy of "fast startup, slow incumbent" here), they are just big. Far more so than with any other prior new technology, there is a massive and fast-moving wave that obsoletes every new app almost as fast as it can be invented. There is almost no time to build a company and scale it.

应用功能将被添加到基础模型的产品组合中,因为大型企业并非行动迟缓的传统企业(在这里套用“快速创业公司,行动迟缓的传统企业”的类比并不恰当),它们只是规模庞大。与其他任何新技术相比,如今的科技浪潮来势汹汹,几乎每款新应用刚问世就会被迅速淘汰。几乎没有时间去建立一家公司并扩大规模。

There are two ways AI application startup founders can make money:

人工智能应用创业公司的创始人可以通过两种方式赚钱:

The situation is highly unstable - we don't know if it's going to crash or go to the moon but both scenarios make it very unlikely that any AI application startup will independently become a generational supercompany (baseline odds are low to begin with).

情况极不稳定——我们不知道它会崩溃还是会一飞冲天,但无论哪种情况,任何人工智能应用初创公司都不太可能独立成为一代超级公司(本来概率就很低)。

The best odds are finding an application niche in a highly specialized field with extremely unique and specific data barriers, ideally ones relating to real atoms (hardware or world-related) data and not software/finance.

最好的机会是在高度专业化的领域中找到一个应用细分市场,该领域具有极其独特和具体的数据壁垒,理想情况下,该领域与真实原子(硬件或世界相关)数据有关,而不是与软件/金融有关。

在推文引发讨论后,他又发了一条来解释他的观点和立场:

Great, this is blowing up so I will offer some additional follow-up:太好了,这件事引起了广泛关注,所以我再补充一些后续内容:

This is NOT your typical prediction of "the incumbents are agile" or the old "what if Google clones your startup" midwit investor question. 这并非你通常所说的“现有企业很灵活”之类的预测,也不是老一套的“如果谷歌克隆了你的创业公司怎么办”之类的愚蠢投资者问题。

The entire novelty of this thesis is that unlike in the past, specific elements of the AI industry are likely to make it so that application companies cannot outrun the wave of obsolescence, which will rush along far, far more quickly than prior technology waves.我立论的新颖之处在于,与过去不同,人工智能行业的某些特定因素可能会导致应用公司无法逃脱技术淘汰的浪潮,而这一浪潮的到来速度将远远超过以往的技术浪潮。

The foundational technology has not stabilized in any way whatsoever, and applications require a sufficiently stable foundation for some extended period of time in order to create value and then a system for monetizing that value (i.e. "a business"). The wholesale rate of change in the nature of the foundation is the reason why I think almost all application startups will not survive to achieve any significant scale, not because the current large players are special.基础技术至今仍未趋于稳定,而应用程序需要足够稳定的基础架构才能在相当长的一段时间内创造价值,并建立相应的价值变现系统(即“商业模式”)。我认为,几乎所有应用程序初创公司都无法生存并达到显著规模,原因就在于基础架构性质的剧烈变化,而非当前的大型企业有何特殊之处。

Most companies don't survive sea changes in the business-technological environment. But these sea changes happen slowly enough that one can build businesses in between. PC, desktop internet, mobile internet, etc, all took many years to play out, and were spaced out enough for application companies to grow, mature, and become incumbents themselves. As a baseline, most startups don't survive during a rapid period of change either. The small minority of incumbents who survive need extreme agility and enough of a stable footing in the last epoch (i.e. a revenue base that doesn't dissolve too quickly) to fund their evolution.大多数公司都无法在商业技术环境的巨变中生存下来。但这些巨变发生得相对缓慢,足以让企业在变革的间隙中发展壮大。个人电脑、桌面互联网、移动互联网等等,都经历了多年的发展演变,其间隔时间也足以让应用公司成长、成熟,并最终成为行业领军者。一般来说,大多数初创公司也无法在快速变革时期生存下来。少数能够生存下来的老牌企业需要极强的敏捷性,以及在上一阶段积累的足够稳固的基础(例如,不会很快流失的收入来源),才能为其未来的发展提供资金支持。

Moreover, it's usually new startups that drive the disruption that challenges incumbents. This is not the case with AI. In this case, the largest players are the ones continually causing the sea change. The environment is so continuously roiled that there is no stable foundation for application startups to become established before the next wave overtakes them. I'm not talking about incumbents outcompeting them, I'm talking about the landscape changing to make them obsolete.此外,通常是新兴创业公司推动颠覆性变革,挑战现有企业。但人工智能领域并非如此。在人工智能领域,反而是那些规模最大的企业不断引发变革。环境瞬息万变,应用型创业公司根本没有稳定的立足之地,很快就会被下一波浪潮所取代。我指的不是现有企业在竞争中胜过它们,而是整个行业格局的改变最终导致它们被淘汰。

From a practical investment lens, the way to apply this thesis to an AI application startup is to ask: are the fundamental assumptions underpinning this startup's existence going to be the same in five years? Or will they be unpredictably different? The key here is predictability - if the future will be radically different but you can predict it with confidence, you can pre-position your business. But that's not the case right now in AI. You can't skate to where the puck is going if all you know for sure is that 20 people are going to slap the puck in some crazy direction at extremely high velocity.从实际投资的角度来看,将这一理论应用于人工智能应用初创公司的方法是:支撑这家初创公司生存的基本假设五年后是否依然成立?还是会发生不可预测的变化?关键在于可预测性——如果未来会发生翻天覆地的变化,但你能自信地预测它,你就可以提前布局你的业务。但就目前的人工智能领域而言,情况并非如此。如果你只知道20个人会以极高的速度朝某个疯狂的方向击打冰球,你根本无法预判冰球的运行轨迹。

Sea changes are now happening on a 9-12 month cycle. Very few startups can turn into a mature business in that timeframe - and by mature, I mean having all the boring stuff like sales relationships and brand recognition. Yes, your engineers can make the change, but human hiring cycles and team solidification and market relations are incompressible (e.g. if you hire 100 people in a month, your organization will implode).如今,行业变革的周期已达到9-12个月。很少有初创公司能在如此短的时间内转型为成熟的企业——我所说的成熟,指的是拥有销售关系和品牌知名度等所有基础要素。没错,你的工程师可以完成转型,但人力资源的招聘周期、团队的巩固以及市场关系的建立是无法压缩的(例如,如果你在一个月内招聘100人,你的组织将会崩溃)。

Thus, application companies never quite make it to a full business threshold before the sea change happens out from under them. When I say the incumbents will take the application space, I mean that they're the only ones who can provide enough internal stability and resources to survive the sea changes they themselves will be driving, NOT that they're going to provide a superior product. They're just the ones who won't starve.因此,应用公司还没来得及真正发展壮大,行业巨变就已悄然发生。我说现有企业将占据应用市场,指的是只有它们才能提供足够的内部稳定性和资源来应对它们自身推动的巨变,而不是说它们会提供更优秀的产品。它们只是那些不会被淘汰的企业而已。

网络讨论

对于他的观点,支持和反对的声音都有。

支持的声音:

Your thesis is razor-sharp and matches what I'm seeing on the ground: the foundation model wave is a tsunami, not a tide.Every week, another "AI wrapper" startup that raised $50M at $500M valuation gets its core feature copied into Claude, Gemini, or Grok—sometimes before they even ship v1. The old playbook of "move fast, build moat, scale" is dead when the big players move faster than you can spell "prompt injection."

你的论点非常精辟,与我亲眼所见完全吻合:基础模型的浪潮不是平缓的,而是海啸。每周都有新的“AI套壳”初创公司,以 5 亿美元的估值融资 5000 万美元,其核心功能被复制到 Claude、Gemini 或 Grok 中——有时甚至在它们发布第一个版本之前就被复制了。当大公司行动的速度比你拼写“prompt injection”(快速注入)还要快时,“快速行动、构筑护城河、规模化”的传统策略就彻底失效了。12–18 month cash-out window? Spot on.I've watched three consumer AI apps this year go from 1M MAU to acquisition offers in under 14 months. The founders who banked $20M–$80M each are laughing. The ones who tried to "build a generational company" are now fighting for survival against a free checkbox in ChatGPT.

12-18个月的套现期?完全正确。 今年我亲眼目睹了三款面向消费者的 AI 应用在不到 14 个月的时间里,从月活跃用户 100 万到收到收购邀约。那些每人融资 2000 万到 8000 万美元的创始人,如今都在暗自窃喜。而那些曾经试图“打造一家划时代公司”的人,如今却在与 ChatGPT 里一个免费的复选框竞争,挣扎求生。 Acquisition or flash-in-the-pan are indeed the only two exits. The data backs you: CB Insights shows 2024–2025 AI M&A is up 180 % YoY, almost all by the six foundation giants. Independent IPOs? Zero. The gravitational pull is too strong.

要么成功收购,要么昙花一现,的确只有两条出路。 数据支持你的观点:CB Insights 的数据显示,2024-2025 年人工智能并购交易同比增长 180%,几乎全部由六大基础架构巨头完成。独立 IPO?零。并购的吸引力实在太强了。

But here's where I push back—just a little. Your “atoms > bits” escape hatch is the **only real moat left**, and it's bigger than people think. The niches that survive won't just be “specialized”—they'll be **impossible to simulate without owning the physical loop**: - Robotics (Figure, 1X) — proprioception data from real actuators. - Energy (oil-field AI, grid optimization) — sensor streams no LLM can hallucinate. - Manufacturing (Path Robotics, Machina Labs) — weld-path data from actual metal. - Biotech wet-lab automation — pipette trajectories + assay results. - Defense (Anduril, Shield AI) — classified sensor feeds + real kill-chain latency.

但在这里,我略有异议。 你的“原子 > 比特”逃生通道是**唯一真正的护城河**,而且它比人们想象的要大。能够生存下来的细分市场不仅仅是“专业化”的——它们**如果不拥有物理循环,就**根本无法模拟**: - 机器人(图 1X)— 来自真实执行器的本体感觉数据。 - 能源(油田人工智能、电网优化)— 传感器流,LLM 无法产生幻觉。 - 制造(Path Robotics、Machina Labs)— 来自实际金属的焊接路径数据。 - 生物技术湿实验室自动化——移液器轨迹+检测结果。 - 防御(Anduril、Shield AI)— 机密传感器数据 + 真实杀伤链延迟。

These aren't “apps.” They're **data flywheels locked to reality.** The foundation models will *happily* rent their inference, but they can't steal the proprietary physical dataset that took years and millions of real-world cycles to collect. **Bottom line:** 99 % of AI startups die or get acquired. The 1% that become generational? They're the ones that own the atoms and feed the bits to the giants on *their* terms. Flash cash or physical moat. Everything else is speedrunning obsolescence.

这些不是“应用程序”。它们是**与现实紧密相连的数据飞轮**。基础模型*乐于*租用它们的推理能力,但它们无法窃取耗费数年时间和数百万个现实世界循环才收集到的专有物理数据集。 **结论:** 99%的人工智能创业公司要么倒闭,要么被收购。 能成为世代传承者的那1%? 他们拥有原子,并按照*他们*自己的方式将原子碎片输送给巨头。 闪现现金还是实体护城河? 其他一切都是为了快速淘汰而牺牲的。

反对的声音:

This is like saying Apple would build every app when the iPhone launched. Foundational model providers will power the infrastructure, not own every use case. The real value comes from domain expertise, integrations, distribution, and customer trust. If anything, we’re entering the “App Store” era of AI, not the death of it.

这就像说苹果会在 iPhone 发布时开发所有应用一样。基础模型提供商将支撑基础设施,而不是掌控所有应用场景。真正的价值来自于领域专业知识、集成、分发和客户信任。如果说有什么变化,那就是我们正在进入人工智能的“应用商店”时代,而不是它的消亡。

They've tried this many times before. custom gpts, custom assistants. but nothing beats small startups focused on one goal. now openai tries to compete with everyone but underperforms in every direction. chats+enterprise? anthropic wins. video? google wins. code? cursor is way ahead. they tried doing an n8n alternative with agent builder but n8n hasn't even noticed and no one talks about it anymore

他们以前也尝试过很多次,比如定制 GPT、定制助手等等。但没有什么能比得上专注于单一目标的小型创业公司。 现在 OpenAI 试图与所有公司竞争,但在各个方面都表现不佳。聊天和企业应用?Anthropic 胜出。视频?谷歌胜出。代码?Cursor 遥遥领先。他们尝试用 Agent Builder 开发 N8N 的替代方案,但 N8N 甚至都没注意到它,现在也没人再提起这件事了。

False. Tell me why Cursor is not crushed rapidly, even if it is a forked open-source IDE using popular LLMs. Big players can do it in a day for sure, where are they? Some alternatives already exist, so why can't they become the leader? Don't underestimate AI wrappers! It is the new value and UX you provide, not necessarily the foundational tech.

错误的。 请告诉我为什么 Cursor 没有迅速被摧毁,即使它是一个使用流行 LLM 的开源 IDE 分支。 大型企业一天之内肯定能做到,它们在哪儿呢?一些替代方案已经存在,为什么它们不能成为领导者? 不要低估人工智能封装!重要的是你提供的新价值和用户体验,而不是基础技术本身。

我的观点

这个话题在AI圈子里面已经是老生常谈了。

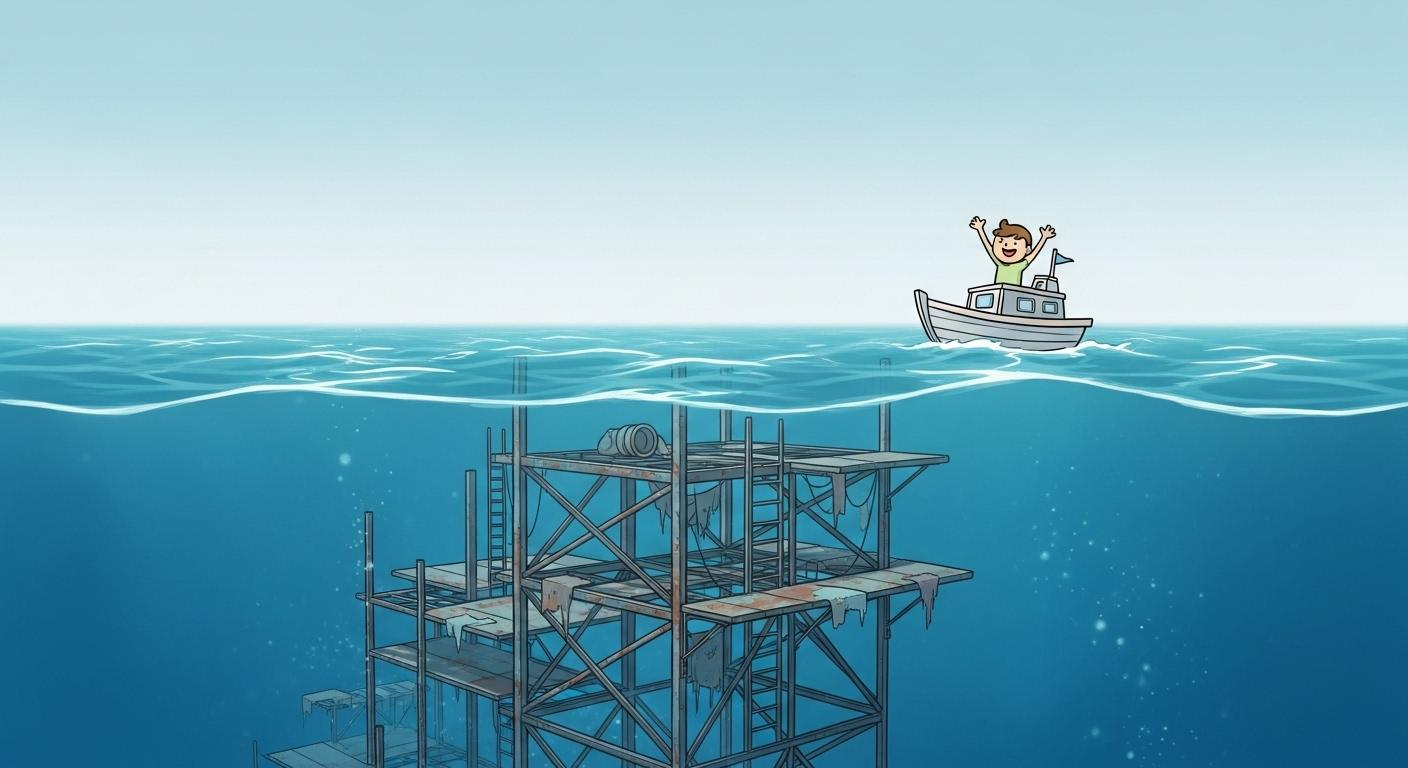

我把AI模型的智能比作不断上升的水平面,而AI应用:要么是固定的脚手架,最终被水面所淹没;要么是浮在水面上的船,能随水面同步上升而保持安全。

关于这个争论我没有绝对的立场,但是更倾向于同意黄易山的观点:AI应用很难有长期稳定的商业模式。

第一个反对者把当前AI模型:AI应用和苹果的平台:App开发者作类比,我认为是不合理的。首先苹果系统的更新速度和AI模型的更新速度是完全不能比的。其次,App/AI应用提供的价值是在平台的基础上开发了一套业务逻辑(workflow),而这套workflow完全可以由智能化(Agentic)的模型所代替。你可以认为AI在运行时即时生成了App所实现的逻辑。也就是说,OpenAI不需要故意去开发一个面向某个行业的应用,它只要提升模型的智能就够了,模型可以自行完成业务逻辑。旧平台和新平台的核心区别是:旧平台没有智能而新平台有,所以这种类比是不成立的。

用Cursor当成反例很有说服力。Cursor公司的确是AI应用中最成功的,占尽天时地利。但是它未来会如何还不好说,我认为它最好的归宿就是被某个大公司收购。因为AI编程的模式也会演进,一年以后人们还需要用IDE做开发吗?如果有一种新的模式被广泛接受,Cursor的产品没有及时跟进,也许就会被用户遗忘。更何况他们现在的盈利模式还有很大的不确定性。

开发AI应用的另一个问题是,门槛太低。因为有AI编程的辅助,现在做一套Agent系统简直如同儿戏一般。比如,最近Github上有个叫做“微舆”的项目很受欢迎,已经有25K星,它是一套舆情监测分析的AI Agent系统,流程看起来也相当复杂,但是这只是一个开发者的个人项目而已,大部分代码应该都是AI生成的。做一个AI应用,技术已经不是瓶颈,关键在于分发(distribution)。没有资源没有经验的个体和小公司想要破局,实在太难,即使花了很大力气(资金)在网络上引起一个热潮,但热度转瞬即逝,因为每天都有无数个VibeCoding出来的AI应用在做同样的事情-争抢用户的注意力,用户应接不暇,回头就把你的AI应用抛在脑后了。

开发AI应用,选择什么样的方向才是安全的呢?怎样才能占领用户的心智?说说你的想法吧。