A Biased View of Securities Finance - BNY Mellon

Securities Finance Q2 2021 - IHS Markit

Securities Finance Q2 2021 - IHS MarkitSecurities Finance Solutions & Software - Finastra Fundamentals Explained

Tradable financial asset A security is a tradable financial property. The term commonly refers to any kind of financial instrument, however its legal meaning varies by jurisdiction. In some countries and languages individuals commonly utilize the term "security" to describe any form of financial instrument, even though the hidden legal and regulatory program might not have such a broad meaning.

In some jurisdictions it consists of some instruments that are close to equities and set earnings, e. g., equity warrants. Securities may be represented by a certificate or, more generally, they may be "non-certificated", that is in electronic (dematerialized) or "book entry only" type. Certificates might be bearer, implying they entitle the holder to rights under the security simply by holding the security, or registered, meaning they entitle the holder to rights only if she or he appears on a security register kept by the issuer or an intermediary.

UK and United States [modify] In the United Kingdom, the Financial Conduct Authority functions as the national skilled authority for the policy of financial markets; the meaning in its Handbook of the term "security" applies only to equities, debentures, alternative debentures, government and public securities, warrants, certificates representing specific securities, systems, stakeholder pension plans, personal pension plans, rights to or interests in investments, and anything that might be confessed to the Official List.

Securities can be broadly categorized into: The business or other entity providing the security is called the issuer. A country's regulatory structure determines what certifies as a security. For example, personal financial investment pools might have some features of securities, but they may not be registered or managed as such if they satisfy numerous limitations.

HQLAᵡ - News

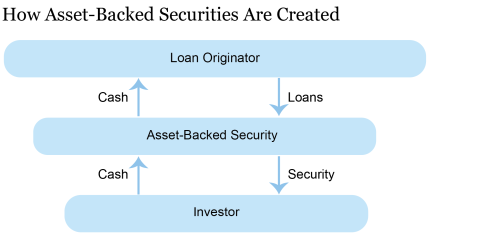

HQLAᵡ - NewsThey may offer an attractive alternative to bank loans - depending upon their prices and market need for specific qualities. A drawback of bank loans as a source of funding is that the bank might look for a procedure of protection against default by the customer by means of substantial monetary covenants. Through Find More Details On This Page , capital is provided by financiers who acquire the securities upon their preliminary issuance.