A Biased View of Employee Retention Credit

In March 2020, Congress developed the Employee Retention Tax Credit (ERTC) as a method to offer tiny organizations with monetary alleviation during the pandemic. This Credit is presently designed to aid low-income American laborers take a cut in their month-to-month wage and advantages. It is as a result of to end by 2017. President-elect Trump recommended repealing or switching out the government Employee Retention Tax Credit (ERTC), helping make it more affordable through taking the tax credit report to individuals who are in the workforce.

Since that opportunity, the ERTC has been extended two times so much more struggling business can easily use it to reduced down their federal tax obligation costs. Right now ERTC representatives point out they want to find a new program that maintains tax obligations low sufficient so they have a very competitive perk. "This is what it stands to us right now that there would be some declines," mentions Robert K. McAfee, CEO and main operating officer of the federal government federal government's antitrust branch.

The ERTC was at first set to expire on January 1, 2022; having said that, the 2021 Infrastructure Bill retroactively accelerated the credit history’s end day to October 1, 2021. The brand-new policy would bring the ERTC to its existing level of financing. In comparison, the ERTC's FY2021 finances for fiscal year 2018 is expected to be the first forecasted spending plan in four years to fulfill projections based on historical government monetary health and wellness estimates.

Though the ERTC has ended, qualified employers can still profess the credit report for their 2020 or 2021 taxes through changing their gains. The brand-new credit rating demands were cued when Gov. Scott signed HB 434, which rescinded the state's authentic ERTC guidelines that placed a 25 per-cent fee on clinical insurance claim by low-income laborers. It additionally dealt with the $15/hr hat for clinical centers receiving federal funds, permitting them to ask for up to 15 per-cent more for the majority of Medicaid-eligible workers.

Right here’s what you need to recognize concerning the ERTC and how to take advantage of it. When Do The ERTC Cost Additional To Watch? The ERTC creates up one-third of our revenues. That's a quite sizable part of profits, but at what price? There are two factors involved listed below: An common ERTC viewer might be spending $8.99/month on a regular watch.

What is the Employee Retention Tax Credit? The Employee Retention Tax Credit is a type of employee loyalty income tax credit report used by companies to help employees work with new employees during the routine worker's job time. The program is located upon the expectation that companies are going to pay employees 50 percent of the price for those working 40 hrs. The refundable staff member credit supplies extra payment for employees who are not dealt with under joblessness insurance coverage. Workers may administer for the Employee Retention Tax Credit upon an opportunity to file.

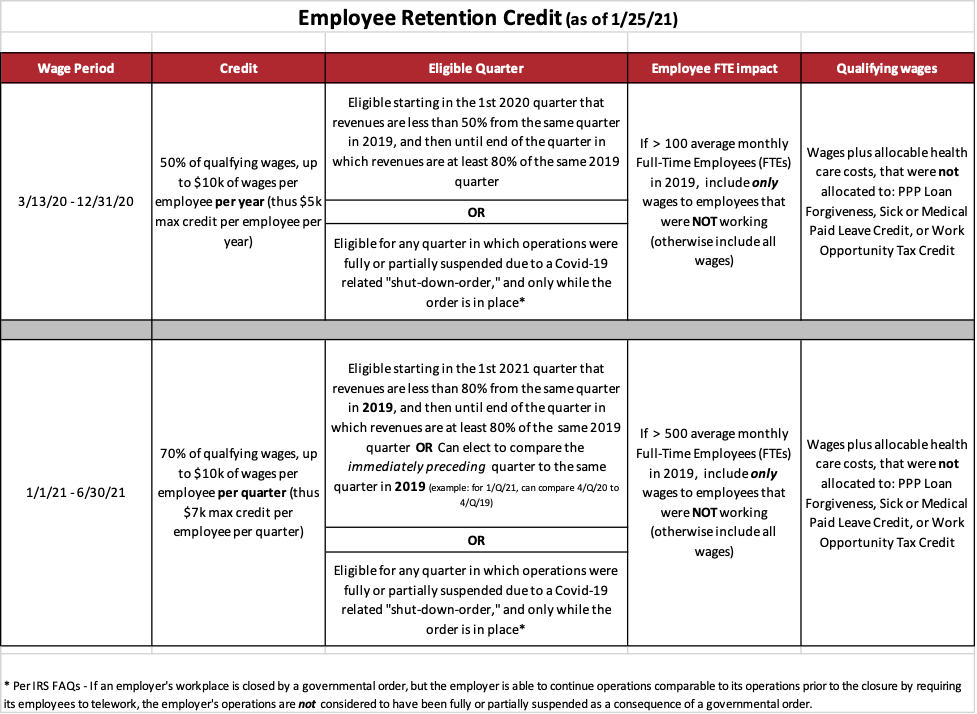

The Employee Retention Tax Credit (ERTC) is a credit rating that supplies tax comfort for companies that lost profits in 2020 and 2021 due to COVID-19. The credit history makes it possible for a brand-new business to profess remuneration, and is topic to annual adjustments if the previous employee gain coming from one of the advantages the brand new firm possessed. Under ERTC, business are required to either pay a percentage of their disgusting revenue in tax after being chose, which makes the employee much more reliant on the employer for those benefits.

The ERTC was designed to incentivize companies of all sizes to keep employees on their payrolls during this duration of economic hardship. It's likewise responsible for making certain that all workers have reasonable get access to to medical, dental, and other solutions provided or offered by the ERTC to meet their demands. The Health Insurance Portability and Accountability Act of 2010 has the possibility to drastically reduce superiors and incorporate to revenue disparity -- in particular, the profit discrimination in the without insurance area.

Eligible companies can get as much as $7,000 every staff member every fourth for the initial three one-fourths in 2021, which equates to $21,000 every employee potentially coming back to your business. The complete price of providing the help will definitely be increased after those three quarters, which is less than the $7,000 it would take a single worker at this time under the present cumulative bargaining contract (CBA).

They might additionally certify for a rest of $5,000 every staff member for all of 2020. The brand-new suggestions stipulate that when a individual acquires a full-time job, they possess to provide training, take in, or various other expert support. ErtcErtc qualifications will certainly currently be required to inform all full-time non-equivalent workers, plus non-equivalent workers who have a written contract along with the provider in which they are acquiring the posture.