9 Simple Techniques For Investment Calculator - Austin Bank

Excitement About Investment Calculator - The Home Depot

Calculate the future value of a property with our interactive future value calculator. To utilize the calculator, either manually go into numbers in spaces supplied below or utilize the slider to change worths. Strike the determine button to compute the future worth of the possession. Suggests the hypothetical development rate for the investment.

g. months, years, and so on) the investment will grow, or the frequency of intensifying growth. The amount of deposits made during each time period. The existing worth of your financial investment. Read This of a financial investment after compounding for a specific time, interest rate, addition quantity and beginning value.

Return on Investment Calculator - logikfx

Return on Investment Calculator - logikfxUtilize our complimentary Amortization Calculator to see your interest payments and benefit worth for an amortized loan. Enter your beginning principal, rate of interest, the start.

Part I: Create a Simple Investment Calculator (20 - Chegg.com

Part I: Create a Simple Investment Calculator (20 - Chegg.comExcitement About Investment Calculator - Danaher Investor Relations

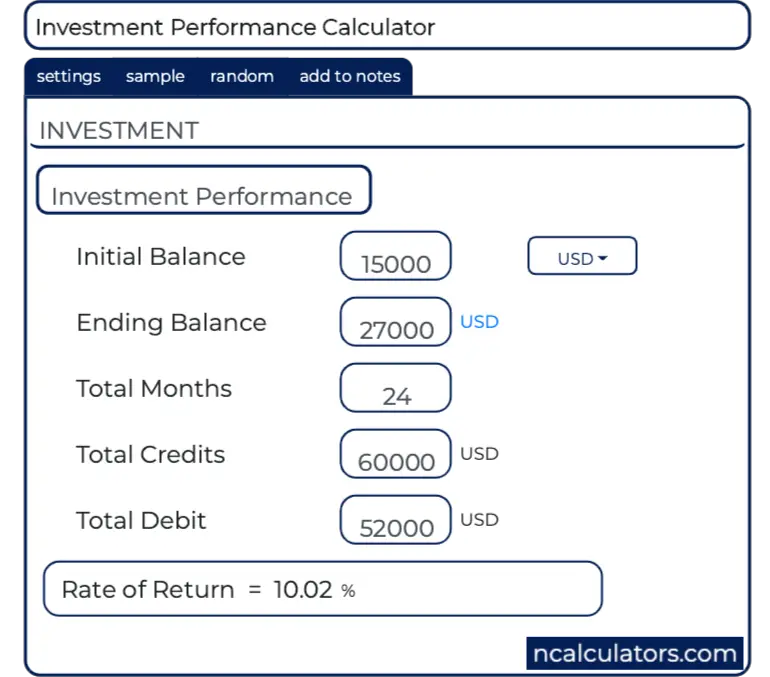

Roi (ROI) is a monetary metric that is widely used to measure the likelihood of acquiring a return from a financial investment. It is a ratio that compares the gain or loss from a financial investment relative to its cost. It is as helpful in examining the prospective return from a stand-alone financial investment as it remains in comparing returns from a number of financial investments.

Although ROI is a ratio, it is generally revealed as a percentage instead of as a ratio. Secret Takeaways Return on financial investment (ROI) is an approximate step of a financial investment's success. ROI has a large range of applications; it can be used to determine the success of a stock financial investment, when choosing whether or not to purchase the purchase of an organization, or assess the results of a real estate transaction.

ROI is reasonably easy to compute and comprehend, and its simplicity means that it is a standardized, universal measure of profitability. One drawback of ROI is that it does not represent for how long an investment is held; so, a profitability measure that incorporates the holding duration might be better for an investor that wants to compare potential investments.