9 Easy Facts About "Checks vs. Electronic Payments: Which Method Is Right for You?" Explained

A Step-by-Step Guide to Writing and Depositing Examinations

In this electronic age, along with the majority of transactions being performed electronically, the fine art of writing checks might seem outdated. Having said that, there are still occasions where checks are important or preferred, such as paying rental fee or delivering a present. If you're brand new to check-writing or just need a refresher course, this step-by-step guide will definitely stroll you via the process of writing and transferring checks.

Action 1: Collect the Necessary Materials

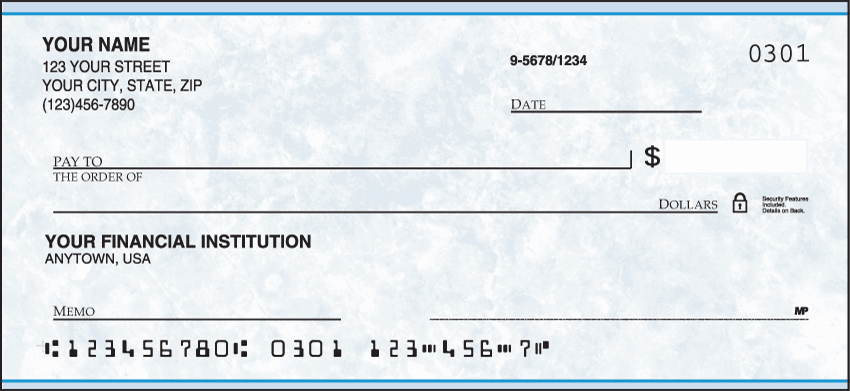

Before you start writing a examination, make sure you have all the required products useful. You are going to need a check book, which normally has pre-printed inspections with your individual details and financial institution information. In addition, possess a pen prepared for writing on the inspection.

Measure 2: Pack in the Time

Begin through loading in the date on the assigned collection in the best ideal corner of the inspection. Be sure to make use of today's time or any kind of future time if you wish to post-date the examination.

Action 3: Write Out the Payee's Title

Next, write out who you really want to pay for on the "Income to" or "Payee" series. This can be an specific individual or an company. Guarantee that you spell their label properly and efficiently so that there is no complication.

Step 4: Fill in the Amount in Numerical Form

On the series preceded by a buck indicator ($), write down the quantity of loan you desire to pay out making use of numbers. Create certain to clearly separate dollars and pennies through using a decimal factor.

Measure 5: Write out The Amount in Phrases

Listed below where you wrote down your repayment amount numerically, write it out in phrases on another collection beginning with "dollars." Be specific and prevent any sort of uncertainty; consist of both dollars and pennies if applicable.

Step 6: Memo Line (Optional)

If intended, utilize this area at the bottom left section of your inspection to write a memorandum suggesting the reason of the remittance. This may help you keep keep track of of your expenses or supply additional details to the recipient.

Measure 7: Authorize the Check

Your inspection will definitely not be authentic without your signature. Authorize Order Blank Checks using your common trademark on the line located at the lower correct corner of the examination. Guarantee that it matches the signature you possess on file with your banking company.

Step 8: Videotape the Transaction

Many chequebooks happen along with a sign up where you can videotape each examination you write. Make use of this to take note down vital information such as date, payee, and volume so that you can track your investing and harmonize your check book eventually.

Currently that you have loaded out your check correctly, it's time to discover how to transfer it in to your banking company profile:

Step 1: Promote Your Examination

Flip over your examination and locate an location contacted "Endorse Listed here." Indication on this product line specifically as it seems on the front of your inspection.

Action 2: Choose a Deposit Procedure

There are different methods to place a check, featuring seeing a physical financial institution branch or making use of mobile financial apps used through the majority of banks. Select the method that is very most handy for you.

Action 3: Go to a Bank Branch (If Applicable)

If you like standard financial procedures, take your recommended check along with correct identification (such as a chauffeur's license) to a local area bank division. Hand over the inspection to a bank employee who will definitely refine it in to your account.

Step 4: Deposit via Mobile Banking App

For those who take pleasure in convenience and rate, depositing checks with mobile financial apps is ending up being more and more prominent. Merely open your bank's application, choose "Deposit," take photos of both sides of the backed examination, confirm all information are proper, and send for deposit.

Action 5: Maintain Track of Deposited Checks

Regardless of how you select to place examinations, regularly preserve precise documents in purchase to reconcile purchases with your financial institution declarations. This will certainly help you keep organized and identify any sort of disparities or inaccuracies.

Writing and depositing inspections might not be as popular as in the past, but it stays an vital capability to possess. Through complying with this step-by-step overview, you may with certainty write checks when required and properly deposit them right into your bank profile. Always remember to maintain track of your purchases and consistently work out vigilance when dealing with economic tools.

Word Count: 800