7 Simple Techniques For Final Expense Insurance: Burial and Funeral Insurance

Best Burial Insurance Companies - Affordable Burial Insurance - USA Life Team

Best Burial Insurance Companies - Affordable Burial Insurance - USA Life TeamThe smart Trick of Are funeral insurance plans worth it? - unbiased.co.uk That Nobody is Talking About

Guaranteed life time defense means that the policy lasts for your entire lifetime, as long as you make your payments on time. There is a 2-year waiting period on the policy if you pass from natural causes within this period, your recipient will just receive 110% of premiums paid, however full advantages are paid for unintentional death from the start.

The "Paid-Up" function implies policyholders can stop superior payments entirely when you turn 95 while maintaining your coverage. This Piece Covers It Well provides a 30-Day Assurance on the policy. While the Certificate of Insurance coverage is issued as quickly as you're authorized, you'll have 1 month to examine the protection. If you choose it isn't for you within this time duration, you can return it for a full refund on any premiums you have actually currently paid.

Top 14 Best Final Expense and Burial Insurance Companies

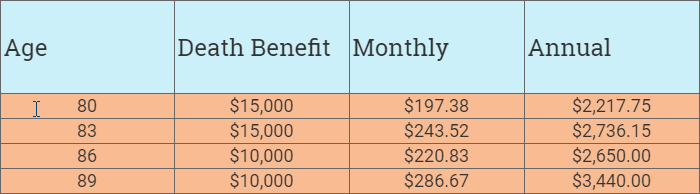

Top 14 Best Final Expense and Burial Insurance CompaniesThe business has a credibility for being among the more innovative insurance provider in the country. It has likewise been acknowledged for supplying an exceptional client experience. Mutual of Omaha's Surefire Whole Life Insurance coverage plan allows you to select an advantage quantity varying from $2,000 to $25,000. The $2,000 choice is unusual, and makes the policy an outstanding option if you're anticipating a little funeral, considering cremation, or simply don't wish to buy a larger policy.

The Single Strategy To Use For Low-Cost and Affordable Burial Insurance for Seniors in 2022With the guaranteed approval, everyone is authorized even if you have pre-existing conditions that may disqualify you from other burial insurance policies. The easy application process does not require a medical examination or any health concerns. The majority of candidates can complete the application in under an hour. Mutual of Omaha allows you to select the benefit quantity that best fits your needs in amounts varying in between $2,000 $25,000.

This policy does have a required waiting period of 2 years, so if you pass away due to natural causes throughout that time span, your beneficiary would only receive an amount equal to the premiums you've already paid, plus 10%. After the waiting period ends, beneficiaries are entitled to the complete quantity of the policy.

Burial Insurance Archives - Final Expense Direct: Best Burial Insurance Rates & Companies (2021)

Burial Insurance Archives - Final Expense Direct: Best Burial Insurance Rates & Companies (2021)Your premiums with this policy are ensured, so they'll never increase due to your age or health concerns. The advantages will likewise remain the exact same regardless of health or age. With this policy, you have the ability to access the money value for any financial requirements that might come up throughout your life time for you and your liked ones.