7 Simple Techniques For FHA Mortgage Loan Program by Peoples Bank

What Does What is an FHA loan? - Pros and Cons - Better Mortgage Mean?

Getting an FHA loan needs a few key steps: Prior to you send an application for an FHA loan, you'll wish to know just how much you can afford to invest in a house. Consider your existing income, expenditures and cost savings, and utilize Bankrate's home mortgage calculator to estimate your monthly payments based upon various home prices and various sizes of down payment.

Prior to you request an FHA loan, have all these files prepared to go: 2 years of income tax return; two current pay stubs; your driver's license; and full statements of your assets (checking account, cost savings account, 401(k) and any other locations where you hold cash). Getting preapproved with numerous lenders is helpful so you can compare different rates and terms to make certain you're getting the very best deal.

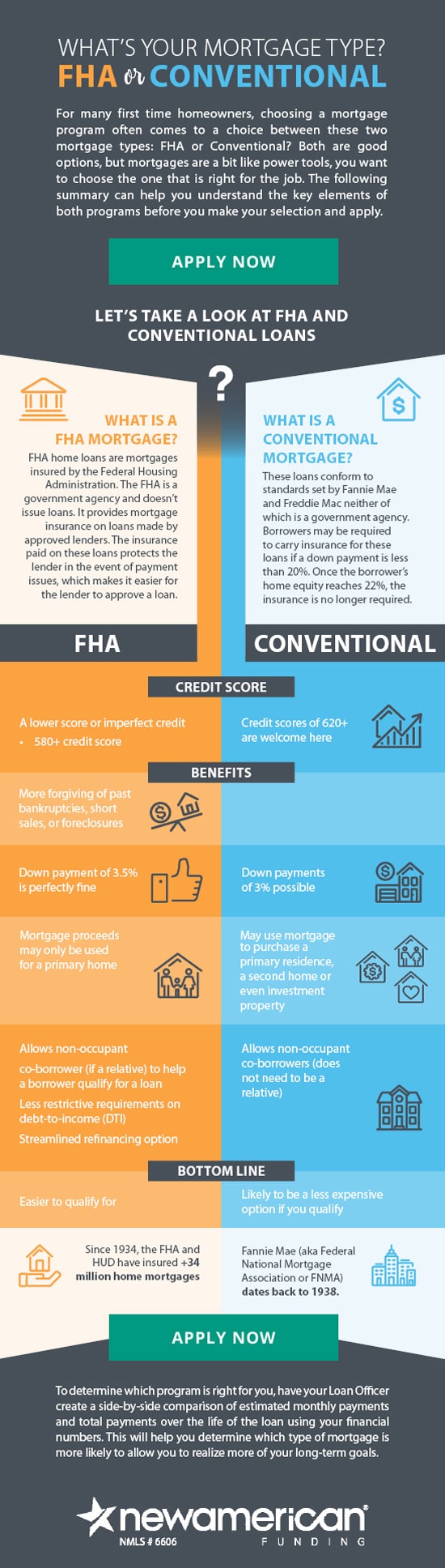

10 Easy Facts About FHA Loans in Greater Chicago Showntraditional loans, Unlike FHA loans, traditional loans are not guaranteed by the government. Certifying for a traditional home mortgage requires a greater credit history, solid earnings and a deposit of a minimum of 3 percent for particular loan programs. Here's a side-by-side contrast of the 2 kinds of loans. FHA loans vs.

5% for credit history of 580+; 10% for credit scores of 500-579 Loan terms 8- to 30-year terms 15- or 30-year terms Home mortgage insurance coverage premiums PMI (if less than 20% down): 0. 58% to 1. 86% of loan quantity Upfront premium: 1. 75% of loan quantity; yearly premium: 0. 45% to 1.

What Is An FHA Loan? 2021 Complete Guide - Bankrate

What Is An FHA Loan? 2021 Complete Guide - BankrateUnderstanding FHA Loans - MoneyGeek Things To Know Before You Get This

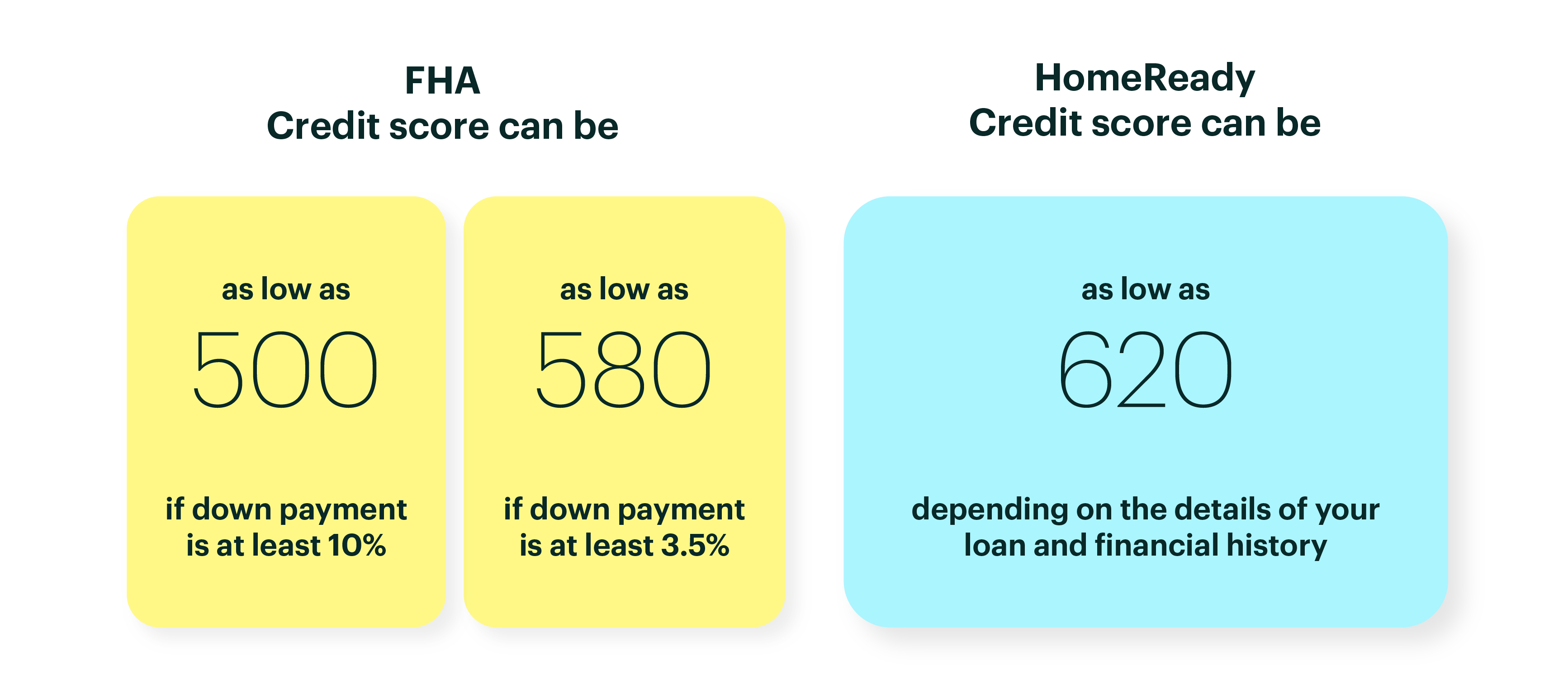

If your credit rating is 580, you're in great standing with many FHA-approved loan providers. FHA loans also give the option for a smaller sized deposit. With More Discussion Posted Here of a minimum of 580, you can make a down payment of as low as 3. 5 percent. If your credit rating is between 500 and 579, you may still have the ability to get approved for an FHA-backed loan, but you will need to make a 10 percent down payment.

Update on FHA Mortgage Insurance Premiums for Washington Home Buyers

Update on FHA Mortgage Insurance Premiums for Washington Home Buyers FHA Mortgage Wisconsin: Meeting The Debt to Income Ratio

FHA Mortgage Wisconsin: Meeting The Debt to Income RatioRather of continuing to lease while trying to conserve more money or enhance your credit history, FHA loans make the imagine being a homeowner possible quicker. Cons Since your credit report is lower, you're a larger danger of default. To protect the lender, you need to pay home mortgage insurance coverage.