7 Easy Facts About "Forex vs Stocks: Which Market is Right for You?" Described

The Impact of Economic News on Forex Markets

Forex markets, additionally recognized as international substitution markets, are incredibly sensitive to financial information. The launch of economic information and information statements may possess a notable influence on unit of currency prices, leading to dryness and chances for traders. In this blog article, we will check out the relationship between financial news and forex markets.

Economic red flags play a important task in molding the feeling of currency investors. These clues give knowledge into the health and performance of an economic situation, which in turn impacts the market value of its currency. Investors carefully check economic updates launch such as GDP (Gross Domestic Product), rising cost of living prices, work numbers, central banking company plan decisions, and field equilibriums to gauge the total strength or weakness of a nation's economic climate.

When good financial information is launched, such as higher-than-expected GDP development or lower unemployment prices, it usually leads to an increase in need for that country's currency. This boosted need induces the currency to cherish versus other currencies in the forex market. Alternatively, bad financial information can easily lead to a reduction in demand for a currency and lead in loss of value.

One of the most very closely viewed financial indicators is rate of interest prices established through main financial institutions. Main financial institutions utilize interest rates as a tool to control rising cost of living and boost or cool down their corresponding economic climates. When central banks increase interest prices or indicator that they may do thus in the future, it frequently draws in international clients appearing for higher yields on their financial investments. This increased demand for the currency leads to admiration.

On the other hand, when main banking companies lower rate of interest costs or signify that they might perform thus quickly due to fragile economic problems, it can easily lead to a decrease in demand for that money as financiers find much better profits in other places. This lowered need creates devaluation.

หุ้นForex respond promptly to these financial news releases through changing their settings appropriately. Automated investing units are scheduled with protocols developed to carry out trades located on predefined criteria activated by particular financial record factors being released.

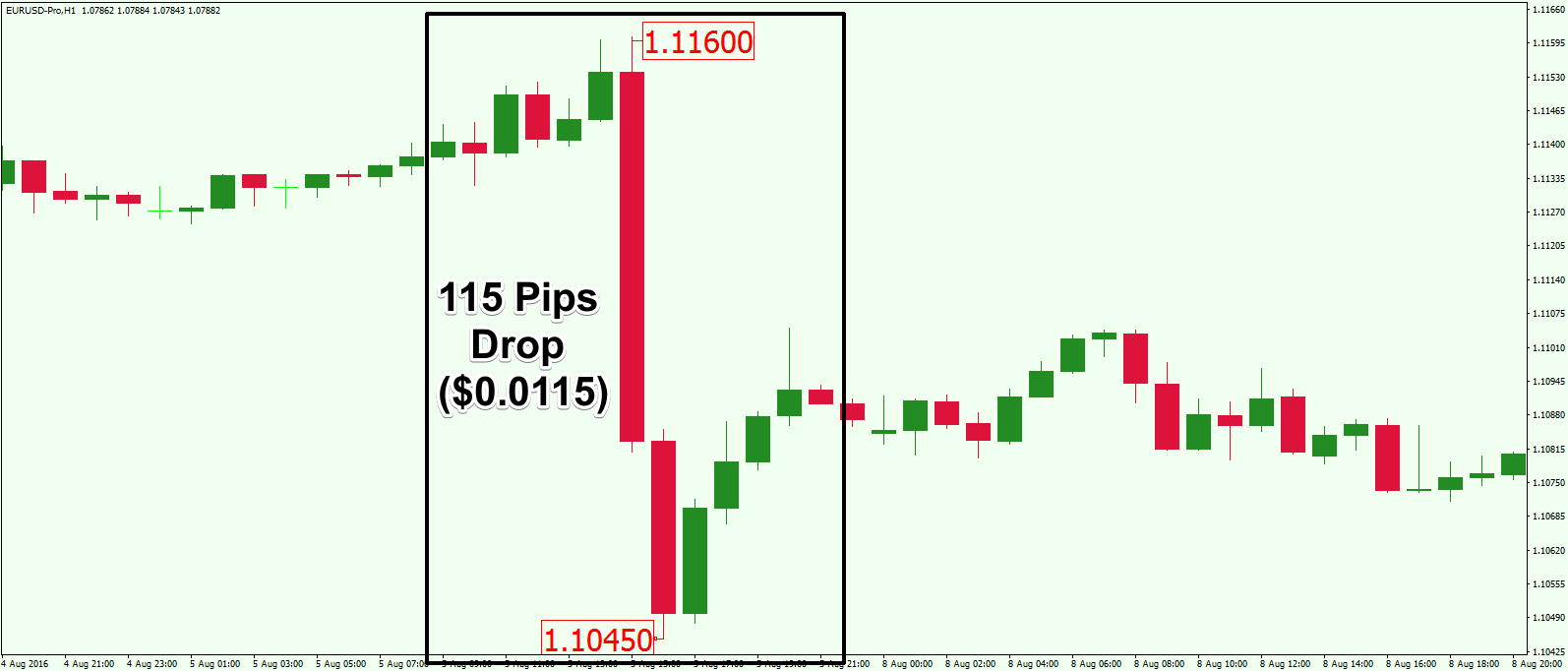

It is worth keeping in mind that not all economic information releases have the very same impact on forex markets. Major financial red flags, such as GDP and work numbers, often tend to have a even more substantial impact than minor ones. Furthermore, unanticipated end result or data that departs significantly coming from market assumptions can easily lead to elevated volatility in the currency market.

Forex traders utilize various methods to utilize on the impact of economic information on unit of currency costs. Some traders choose to hang around for major news launch and profession in the immediate consequences when dryness is at its optimal. Others take a a lot more long-term strategy by evaluating economic fads and setting up themselves as necessary.

In final thought, financial news has actually a profound influence on forex markets. Traders closely observe financial indicators and news announcements to determine the health of an economic situation and create informed investing decisions. Positive or adverse surprises in economic data may lead to significant fluctuations in money prices, showing chances for traders to benefit from these adjustments. Understanding the partnership between financial headlines and forex markets is crucial for anyone appearing to be productive in this compelling and fast-paced financial market.

800 words