7 Easy Facts About Employee retention credit receives clarification from new IRS Described

Some Of 12 Commonly Asked Questions on the Employee Retention

The internal revenue service does have guardrails in location to prevent wage increases that would count towards the credit once the company is qualified for the staff member retention credit. Are Tipped Wages Consisted Of in Qualified Salaries? visit this YouTube channel -49 clarified that ideas would be included in qualified salaries if these wages went through FICA.

Form 941 Worksheet 2 for Q2 2021 - New Worksheet for 2nd quarter

Form 941 Worksheet 2 for Q2 2021 - New Worksheet for 2nd quarterTips that total up to less than $20 in a month are not subject FICA incomes and would not qualify for the retention credit. Are Owner/Spouse Earnings Consisted Of in Qualified Salaries? It was well understood from a previous statute and previous internal revenue service guidance that related individuals to a bulk owner were not consisted of in certified earnings (see INTERNAL REVENUE SERVICE FAQ # 59 for specifics).

Employee Retention Tax Credit on 941

Employee Retention Tax Credit on 941Associated people are: Child or a descendant of a child Brother, sis, stepbrother or stepsister Father or mom, or an ancestor of either Stepfather or stepmother Niece or nephew Aunt or uncle Son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law or sister-in-law Notification 2021-49 clarified that attribution guidelines need to be applied to assess whether the owner or spouse's earnings can be included for the ERTC.

The Basic Principles Of Step-by-Step How to Guide to Filing Your 941-X ERTCIf they are considered a majority owner, then their earnings are not qualified salaries for ERTC. Bear in mind, these guidelines the internal revenue service clarified apply to all quarters for ERTC. Consequently, if wages were previously miss-categorized as qualified earnings for ERTC, then changes to the 941 would be essential to remedy any inadvertent mistakes.

IRS Updated Form 941 for COVID-19 Related Employment Tax Credits

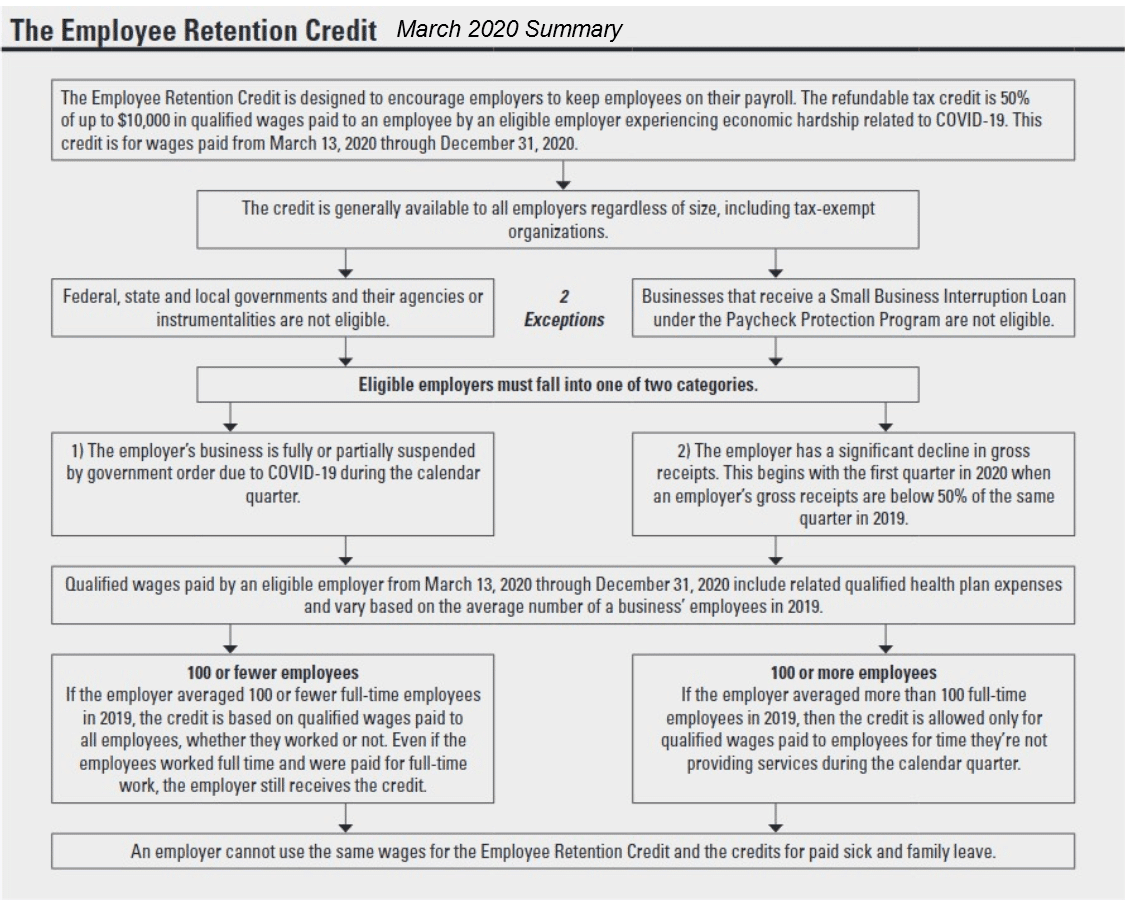

IRS Updated Form 941 for COVID-19 Related Employment Tax CreditsEmployers who take the employee retention credit can not take credit on those same competent salaries for paid household medical leave. If a staff member is included for the Work Opportunity Tax Credit, they may not be consisted of for the employee retention credit. Remember, the credit can only be handled incomes that are not forgiven or expected to be forgiven under PPP.

Keep in mind, an eligible employer receiving these grants should keep records justifying where the funds were utilized. The funds need to be used for eligible uses no behind March 11, 2023 for RRF while the SVOG dates vary (June 30, 2022 is the most recent). So, employer's considering which credits or moneying source to take ought to examine the interaction of these lorries to identify what is economically best for their business.