6 Simple Techniques For What Is a Reverse Mortgage? - RamseySolutions.com

Steve Elman Reverse Mortgage Specialist 1611 Spring Gate Ln, Las Vegas, NV 89134 - YP.com

Steve Elman Reverse Mortgage Specialist 1611 Spring Gate Ln, Las Vegas, NV 89134 - YP.comReverse Mortgage Advisor - Las Vegas - Alignable Fundamentals Explained

In 2017, the nationwide average for house equity gain per household meaning just how much the equity had actually risen from the previous year was $15,000. In Nevada, the average equity gain per household was $27,000, or nearly twice the nationwide average. Only California and Washington saw sharper increases. Nevada is flourishing once again, specifically in urban locations such as Las Vegas.

Get to know Jesse Brewer! A Certified Reverse Mortgage Professional here at the Fairway Moore-Wilson branch in Las VegasJesse… - Reverse mortgage, Mortgage, Moore

Get to know Jesse Brewer! A Certified Reverse Mortgage Professional here at the Fairway Moore-Wilson branch in Las VegasJesse… - Reverse mortgage, Mortgage, MooreThere are lots of elements to consider when deciding if a reverse home loan is the very best choice for you, consisting of: Eligibility. Not everyone qualifies for a reverse mortgage. You must be 62 or older and own your home. Even then, Learn More Here might use. Financial need. If you have medical or other financial obligations to settle, tapping into your home equity can be beneficial.

House owners who intend on moving or offering their house quickly are not excellent candidates for reverse mortgages. For a reverse mortgage, you must reside in the home. Inheritance. People who want a house to remain in the household after their death might want to think about other alternatives, as the individual who inherits the home would need to repay the reverse home mortgage.

There are closing expenses and additional costs related to reverse mortgages. Senior Citizens in Las Vegas, particularly those who currently own realty, have a range of retirement living alternatives. Practically all master-planned communities including Providence, Summerlin, Mountain's Edge and Anthem have low-maintenance, age-restricted areas for individuals older than 55. Numerous locals acquired homes in these neighborhoods after selling larger familial homes.

The smart Trick of Reverse Mortgages Las Vegas That Nobody is DiscussingCertified financial professionals can help even more explain the advantages and disadvantages of looking for a reverse mortgage in Las Vegas. It is essential for elders to completely understand the regards to reverse home mortgages. Nevada's Consumer Affairs Department has actually provided warnings about reverse mortgage scams. They state seniors and their households must watch for the following red flags, which might recommend a scam: Charging free of charge reverse mortgage information Minimizing preloan therapy or not supplying it Forgery.

Mann Mortgage Las Vegas – Las Vegas Home Loans -

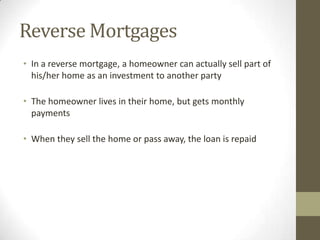

Mann Mortgage Las Vegas – Las Vegas Home Loans -What are reverse mortgages? A reverse home loan, or Home Equity Conversion Mortgage (HECM), is a type of mortgage readily available to house owners 62 or older who have considerable equity (normally a minimum of 50%) in their home. This financial tool can benefit individuals who require additional money circulation for other costs, as the worth of their home's equity can be converted to money, getting rid of monthly mortgage payments.