6 Easy Facts About EPS - Employee Pension Scheme Eligibility, Calculation Explained

Provide Completely Filled Form 10d Of Epf - Fill and Sign Printable Template Online - US Legal Forms

Provide Completely Filled Form 10d Of Epf - Fill and Sign Printable Template Online - US Legal Forms PF Withdrawal Form - Know EPF Withdrawal Procedure

PF Withdrawal Form - Know EPF Withdrawal ProcedureGet Provide Completely Filled Form 10d Of Epf - US Legal Things To Know Before You Get This

Comments and Aid with epf kind 10d pdf download used: 9. 10. 11. 12. 13. 14. 15. 16. Member's occupation (figured out according to the date when the pension was earned): 17. 18. 19. 20. 21. 22. 23. 24. 25. S.P.P.A. Earnings Tax: 26. 27. 28. 29. (e) Call of the company: (d) Name of the taxpayer: S.P.P.A.

Monthly Pension Form 10D Online Apply nomination detail with photograph not available cannot process - YouTube

Monthly Pension Form 10D Online Apply nomination detail with photograph not available cannot process - YouTube(e) Name of the company:: (d) Name of the taxpayer: (c) S.P.P.A. Utilized Date of Receipt of Pension:: 29. 30. (f) Total Pounds, Pounds Sterling, or Canadian Dollars (c) (d) (e) Amount due from the Company: (f) (g) (h) (i) (k) Overall quantity payable to you: 0.

The 6-Minute Rule for Download Employee Provident Fund/PF/EPF Form 10-DUtilized Date of Receipt of Pensions:: 31. 32. (i) Taxpayer Number:: 33. 34. 35. (j) Taxpayer:: 36. S.P.P.A. Employed Month of Birth: 37. 38. 39. 40. 41. 42. S.P.P.A. Pension Date: S.P.P.A. Yearly Earnings(s): 43. 44. 45. S.P.P.A. Annual Gross Earnings 0.

0. S.P.P.A. Pension Quantity: S.P.P.A. Yearly Earnings (omitting pension quantities got as gifts or otherwise) 0. 0. 0. S.P.P.A. Yearly Gross Earnings 0. 0. 0. S.P.P.A. Annual Earnings (omitting pension quantities got as presents or otherwise) 0. 0. 0. S.P.P.A. Income Tax: Nil Total Amount of Pensions to be spent for the year of Pension Made: (a) S.P.P.A.

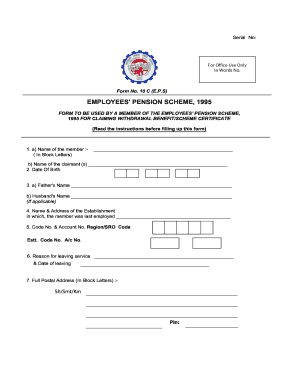

Some Known Details About EPF withdrawal upon the premature death of a family member0. 0. S.P.P.A. Pension Amount 0. 0. 0. Total Tax 0 What is epf form 10d ? You can discover the Kind 10D for claiming monthly pension. This form is supplied by the Workers' Provident Fund Organisation (EPFO) and it has actually to be submitted by the very first claimant i. e. member or widow/widower, orphan, or nominee as the case might be.

Employee Provident Fund Organization (EPFO) provides a regular monthly pension to the pf account holders under Employee Pension Plan (EPS-95). Whenever a worker is utilized under EPF signed up company. The employee can get the advantages provided by the EPFO. Moreover, a worker's 12% of wage (Standard Pay+DA) will be deducted and goes to the EPF account.