5 Simple Techniques For Best Missouri Car Insurance Providers (2022) - Motor1.com

You Can Find Cheap Car Insurance in Missouri and Still Be Protected - GetJerry.com

You Can Find Cheap Car Insurance in Missouri and Still Be Protected - GetJerry.comThe Only Guide to Car Insurance in StLouis Missouri

4 best vehicle insurance provider in Missouri While you may be looking for the least expensive car insurance in Missouri, think about which suppliers use the first-rate coverage. More Details listed below perfectly combine cost-efficient policies with comprehensive protection. # 1 USAA: Low Rates for Armed force J.D. Power regional score: 897/1,000AM Best monetary strength ranking: A++Bbb (BBB) rating: A+ Those who serve in the military, in addition to veterans and instant family members, can find quality automobile insurance coverage through USAA.

Power. Keep reading: USAA insurance coverage review # 2 State Farm: A Lot Of Popular Service provider J.D. Power regional rating: 847/1,000 AM Best financial strength ranking: A++BBB rating: A+ More Americans cover their automobiles utilizing State Farm than any other company. That's most likely due to the company's competitive rates, vast network of local representatives and excellent financial health.

Keep reading: State Farm review # 3 Progressive: Low Rates for High-Risk Drivers J.D. Power local rating: 837/1,000 AM Finest financial strength score: A+BBB score: Not rated While its rates tend to be somewhat higher than some of its rivals, Progressive typically accepts motorists rejected by other providers. If you have a poor credit score or your driving record consists of a DUI or at-fault mishap, it deserves getting a quote from the insurer.

Missouri Vehicle Registration of New & Used Vehicles FAQ

Missouri Vehicle Registration of New & Used Vehicles FAQThe 6-Second Trick For Missouri Car Insurance, Non-Owners and SR-22 Coverage

Keep reading: Progressive insurance coverage evaluation # 4 Shelter Insurance Coverage: Strong Regional Coverage J.D. Power local score: 856/1,000 AM Finest monetary strength ranking: ABBB ranking: A+ Shelter isn't constantly the cheapest car insurance supplier in Missouri, but it's understood for its outstanding client service and robust regional existence. The Columbia, Mo.-based company has workplaces all throughout the Show-Me State, making it quickly accessible.

When Did Auto Insurance Become Mandatory In Missouri? – SLFP

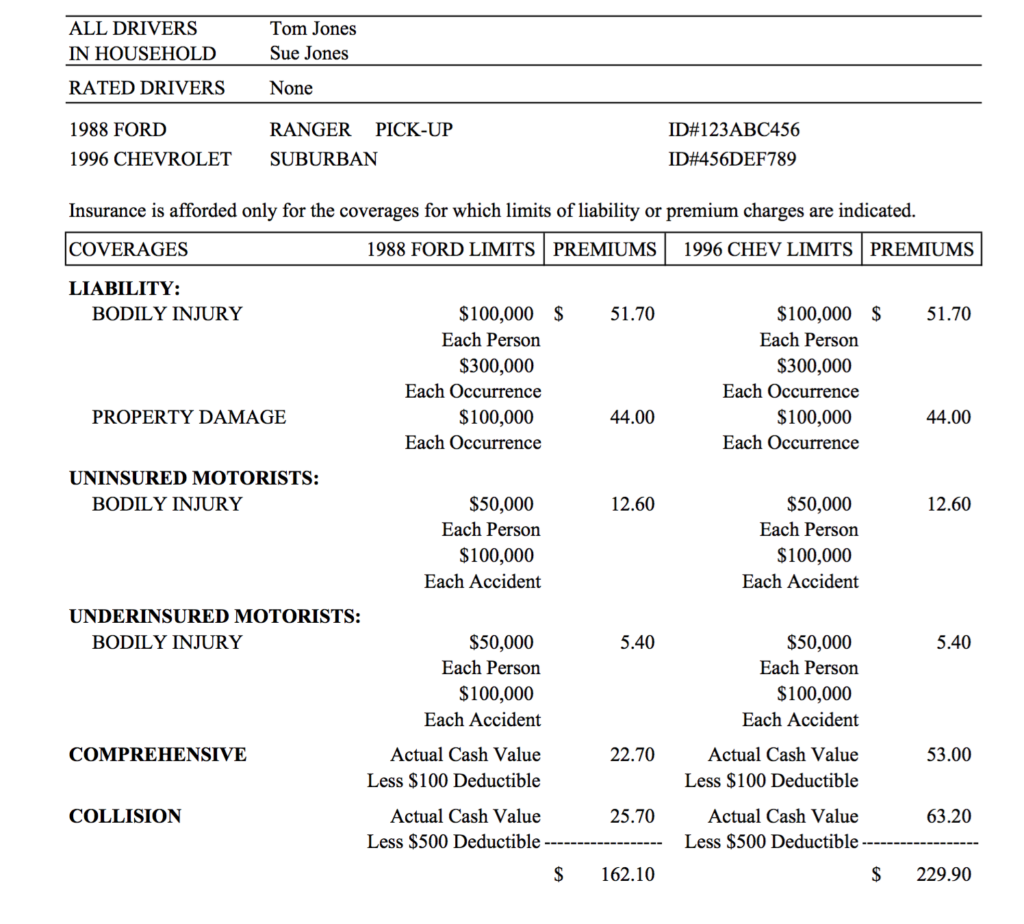

When Did Auto Insurance Become Mandatory In Missouri? – SLFPPower rankings. Missouri vehicle insurance requirements Missouri follows an at-fault system, suggesting that whoever causes a mishap is accountable for spending for all damages. States with at-fault systems typically have below-average car insurance coverage costs, but that's not the case with automobile insurance in Missouri. Missouri minimum coverage requirements According to state law, Missouri chauffeurs must fulfill the following state minimum coverage requirements: Bodily injury liability insurance coverage: $25,000 per person and $50,000 per accident Residential or commercial property damage liability protection: $20,000 per mishap Uninsured motorist physical injury coverage: $25,000 per individual and $50,000 per mishap If you desire greater protection beyond Missouri's minimum protection limits, consider adding detailed protection and collision insurance to your vehicle insurance policy.