10 Simple Techniques For San Juan Forest approves land swap with billionaire

Explore the World For Yourself

Explore the World For Yourself The Swap (TV Movie 2016) - IMDb

The Swap (TV Movie 2016) - IMDbThe Main Principles Of Sheriff's Work Alternative Program (SWAP)

4 112. 1 13. 0 18. 9 23. 7 33. 4 44. 8 74. 4 97. 6 11. 1 10. 1 12. 8 17. 4 21. 5 25. 6 38. 0 4. 0 5. 0 6. 2 7. 9 11. 6 15. 1 22. 3 1. 1 1. 2 1.

Swop Vs Swap: Which Spelling Is The Correct One?

Swop Vs Swap: Which Spelling Is The Correct One?0 2. 7 3. 3 3. 5 Source : "The Global OTC Derivatives Market at end-December 2004", BIS, , "OTC Derivatives Market Activity in the Second Half of 2006", BIS, Major Swap Participant [edit] A Major Swap Participant (MSP, or sometimes Swap Bank) is a generic term to explain a banks that helps with swaps between counterparties.

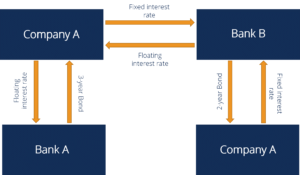

A swap bank can be a worldwide business bank, an investment bank, a merchant bank, or an independent operator. A swap bank works as either a swap broker or swap dealer. As a broker, the swap bank matches counterparties but does not assume any risk of the swap. The swap broker receives a commission for this service.

How What are currency swap lines? - European Central Bank can Save You Time, Stress, and Money.

As a market maker, a swap bank is willing to accept either side of a currency swap, and then later on on-sell it, or match it with a counterparty. In this capacity, the swap bank assumes a position in the swap and therefore assumes some risks. The dealer capacity is obviously more dangerous, and the swap bank would receive a portion of the money streams gone through it to compensate it for bearing this danger.

These factors seem simple and challenging to argue with, specifically to the degree that name acknowledgment is genuinely crucial in raising funds in the worldwide bond market. Companies using currency swaps have statistically higher levels of long-term foreign-denominated debt than firms that use no currency derivatives. Alternatively, the main users of currency swaps are non-financial, worldwide firms with long-lasting foreign-currency funding needs.

Financing foreign-currency financial obligation using domestic currency and a currency swap is for that reason superior to funding directly with foreign-currency financial obligation. The two primary factors for switching rates of interest are to better match maturities of assets and liabilities and/or to acquire a cost savings by means of the quality spread differential (QSD). Empirical evidence suggests that the spread in between AAA-rated commercial paper (drifting) and A-rated commercial is slightly less than the spread between AAA-rated five-year responsibility (repaired) and an A-rated obligation of the very same tenor.