Wait

Disclaimer: This is not financial advice. I am not a financial advisor. What follows is my personal, subjective, biased opinion.

The News

On Monday and Tuesday, the ‘First Meeting of Finance Ministers and Central Bank Governors’ under Argentina’s G20 presidency will take place in Buenos Aires. It will center around new technologies, infrastructure, and cryptocurrencies.

In a letter to the Heads of Delegation, Governor of the Bank of England (BoE) and Chairman of the G20’s Financial Stability Board (FSB), Mark Carney, reiterated his stance that at present, cryptocurrencies do not pose a threat to global financial stability, due to the small overall size of the market.

Carney added that a decade after first getting on fixing the flaws that enabled the 2008 financial crisis, the FSB is pivoting away from designing new rules and towards reviewing and adapting existing ones.

The Facts

The G20 meeting of financial ministers and central bank governors on March 19th-20th will be the first of a total of five. So far, the second and third have been scheduled for April and July respectively. In these meetings, “22 finance ministers, 17 central bank governors and 10 leaders of international organizations will discuss key issues affecting the global economy, such as international financial architecture, the international tax system and financial regulation.” By putting cryptocurrencies on the agenda, the G20 thus consider them a ‘key issue affecting the global economy.’

The Financial Stability Board is an international regulatory institution, charged with overseeing the financial system on a global scale.

“The FSB promotes global financial stability by coordinating the development of regulatory, supervisory and other financial sector policies and conducts outreach to non-member countries. It achieves cooperation and consistency through a three-stage process, including monitoring implementation of agreed policies.”

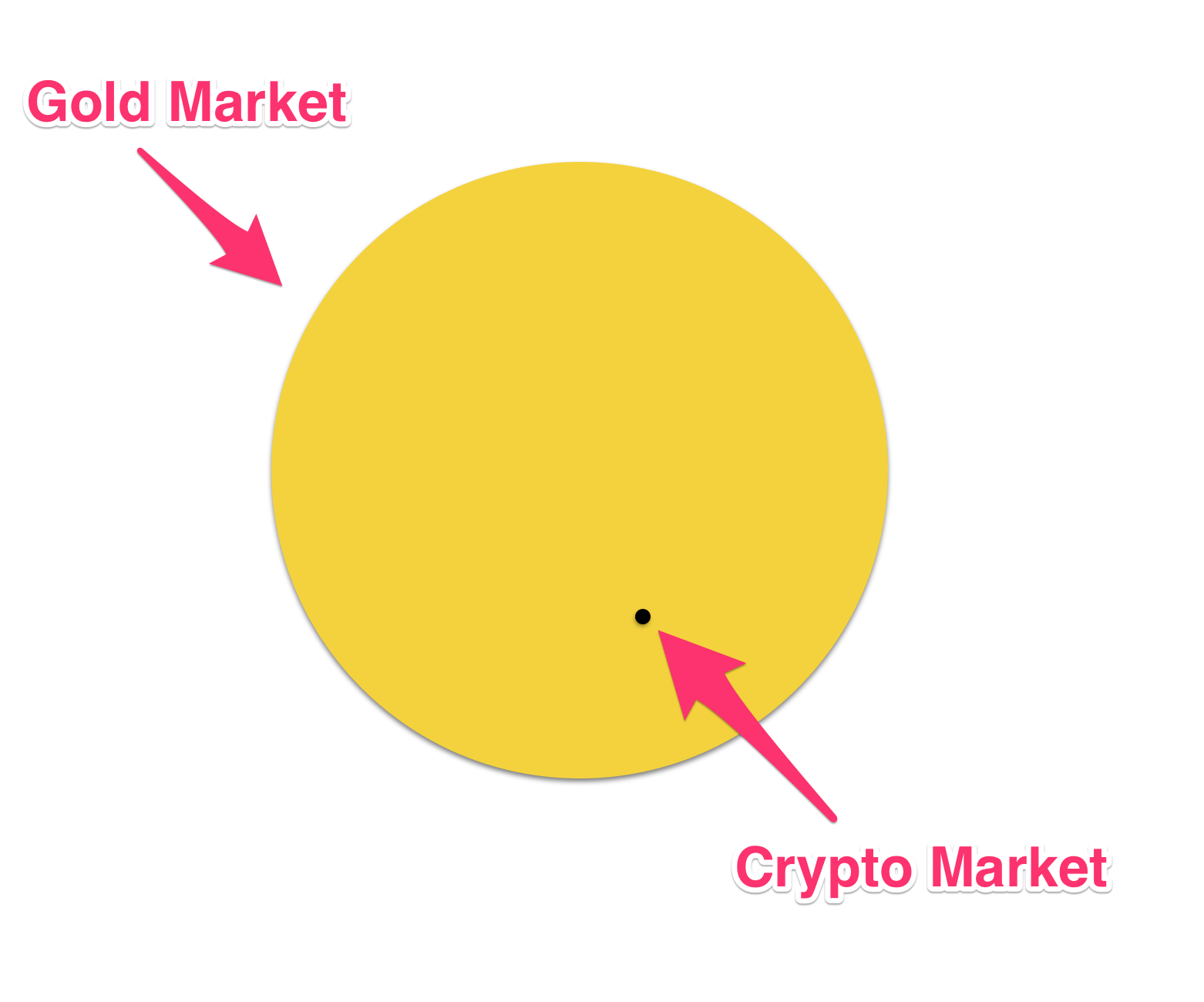

In the letter, Carney reinforced a previously shared view that “crypto-assets do not pose risks to global financial stability at this time.” In a speech on March 2nd, he had backed this stance with the argument that “they are still small relative to the financial system. Even at their recent peak, their combined global market capitalization was less than 1 percent of global GDP. In comparison, at the height of the dot-com mania, the valuation of technology stocks were a third of global GDP.”

According to World Bank data, global GDP was $33.568 trillion in 2000, which would put the dot-com bubble at about $11 trillion, according to Carney. News reported its value to be around $6-$8 trillion, but even considering the gap, the current crypto market valuation of around $300 billion is a lot smaller.

In the meantime, global GDP at the end of 2017 has reached about $86.37 trillion, placing the current crypto market at 0.3% of its size or roughly 1% at its $800 billion peak respectively.

The Commentary

As the popular saying goes “history does not repeat itself, but it often rhymes.” Hence, speculators often contrast the total size of the crypto market with previous bubbles and other factors, to show there is lots of room for growth. The numbers back this.

The global market for gold alone is at least $7 trillion, depending on how much we can still dig up. Bitcoin alone could, in theory, march to $100,000 a piece and still be at less than a quarter of that.

Global GDP has almost tripled since the dot-com bust, and cryptocurrencies are still nowhere near even the size of the old bubble at the time. However, if regulation is put in place too strictly, too early, market growth will stifle and potentially never reach similar, or even lesser, but healthier heights.

Given that recently, policy makers’ attention has shifted towards the crypto space, we can expect more information week by week, and right now, the stance most regulators take is a very open and laid back ‘wait and see’ approach. To me, this seems to be rooted in the decade of economic prosperity that’s behind us, and if it means the blockchain ecosystem is free to innovate, that’s a good thing.

2017 global GDP grew more than it had in the past 6 years at 3.6%, stock markets are close to all-time highs, despite recent declines, and the US is looking to roll back some of the Dodd-Frank act, which contributed to stable post-2008 growth, but might now hinder further economic prosperity.

In this context, Carney’s statement in his letter to G20 delegates makes a lot of sense:

“As its work to fix the fault lines that caused the financial crisis draws to a close, the FSB is increasingly pivoting away from design of new policy initiatives towards dynamic implementation and rigorous evaluation of the effects of the agreed G20 reforms.”

Instead of nipping growth in the bud, oversight committees can afford to sit, watch, and deliberate on how big the impact of blockchain is for economic growth, before rushing to decisions. This would not have been the case 10 years ago.

As another saying goes, especially with regard to investor uncertainty:

“Better the devil you know than the devil you don’t.”

It also really helps that the Chairman of the FSB is excited about reducing fees on peer-to-peer financial transactions.

Keep it crypto,

Nik