TRIPTERIUM T50 PLATFORM: tokenized close end index fund.

MartildaTripterium T50 is a tokenized, closed-end index fund (CEF), which passively tracks the top fifty cryptocurrency assets by market capitalisation, in order to deliver healthy returns. The fund has a Venture Capital Feeder Fund, which will invest in expertly-vetted early stage blockchain technology companies that are seeking to undertake an Initial Coin Offering (ICO), therefore benefiting from the ICO returns.

TRIPTERIUM 50 are close end index fund similar to the many traditional index funds that is offering something similar to the cryptocurrency investors. With the rise is cryptocurrency tokens and tracking the top 50 tokens in the market, to assure investors of a healthy return. There are several advantages to investing in the fund, such as there are no fees for advice, brokerage, and free founder membership. Providing something unique in the cryptocurrency market so that the confidence of the investors in the market can be renewed is the only mission of the platform. Profits from the Tripterium Venture Capital Feeder Fund will provide a constant stream of new money coming into the Tripterium T50 index fund, increasing the Net Asset Value (NAV) of the portfolio to the benefit of the T50 token holders.

OUTLINED BENEFITS

No exit fees

No broker fees

No advice fees

Benefit from the fastest growing market in the world

Free membership to the exclusive Tripterium Founders Club

Diversified exposure: Broad exposure to a diverse set of cryptocurrencies

Access great pre-ICO discounts and bonuses through the Tripterium Founders Club

Higher returns: index funds have consistently outperformed the average managed fund

Benefit from the concept of compounding interest, which increases the net asset value of the fund

Tripterium Venture Capital Fund: consistently injecting new money into the Tripterium T50 indexund

Institutional marketing: Tripterium T50 will be marketed to institutional investors, therefore increasing the T50 token price premium

Liquidation option: providing a price floor for the T50 token, ensuring that the T50 token does not fall beneath the token’s share of the net asset value of the fund

Free coins from hard fork: a cryptocurrency hard fork is when a single cryptocurrency splits in two. The value of the free coins will be put back into the Tripterium T50 index fund, increasing the net asset value of the fund

Liquidity: Tripterium T50 tokens are based on the ERC20 token standard that is secure, can be easily stored in any - Ethereum wallet, and can be easily bought or sold. The ERC20 standard is supported by all the top cryptocurrency

exchanges

UNIQUE COMPONENTS

Index Fund

Index funds aim to track the performance of a specific index. The value of the index fund will go up or down as the index goes up or down. Index funds typically have lower costs than actively managed funds because the portfolio manager doesn’t have to do as much research or make as many investment decisions. Even if two funds are of the same type, their risk and return characteristics may not be identical.

Active vs Passive Management

Active management means that the portfolio manager buys and sells investments, attempting to outperform the return of the overall market or another identified benchmark. Passive management involves buying a portfolio of securities designed to track the performance of a benchmark index. The fund’s holdings are only adjusted if there is an adjustment in the components of the index.

Exchange Traded Fund (ETF)

An ETF, or exchange-traded fund, is a marketable security that tracks an index, a commodity, bonds, or a basket of assets like an index fund. Unlike mutual funds, an ETF trades like a common stock on a stock exchange. ETFs experience price changes throughout the day as they are bought and sold. ETFs typically have higher daily liquidity and lower fees than mutual fund shares, making them an attractive alternative for individual investors.

Closed End Fund (CEF)

A closed-end fund (CEF) or closed-ended fund is a collective investment model based on issuing a fixed number of shares which are not redeemable from the fund. Unlike open-end funds, new shares in a closed-end fund are not created by managers to meet demand from investors. Instead, the shares can be purchased and sold only in the market, which is the original design of the mutual fund, which predates open-end mutual funds but offers the same actively-managed pooled investments.

Venture Capital Fund

Venture capital funds are investment funds that manage the money of investors who seek private equity stakes in start-up and small to medium-sized enterprises with strong growth potential. These investments are generally characterized as high-risk/high-return opportunities. In the past, venture capital investments were only accessible to professional venture capitalists.

Tokenized Index Fund

A tokenized index fund is a new type of investment fund. The Ethereum blockchain provides a trust-less and transparent platform that allows tokens to be easily transferred. This removes the need for a third party to keep track of investment accounts and their investors. Using the Ethereum network, a token holder can trade their token with no entry or exit fee bar the transfer fee charged by the Ethereum network. The T50 tokens represent their share of the underlying assets within the fund.

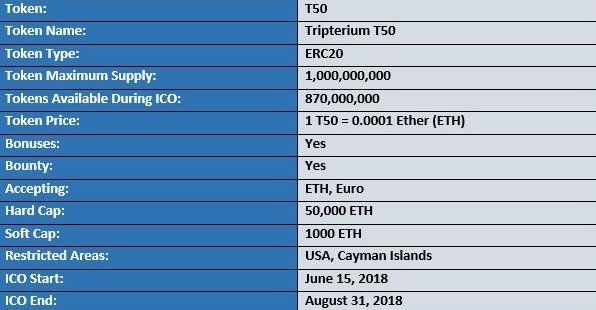

TOKEN DETAILS

The Tripterium T50 token is an Ethereum ERC20 standard token that represents the holder’s ownership in the fund. The value of the T50 token is always backed by the Net Asset Value of the fund. A liquidation option that can be exercised via the smart contract, guarantees a minimum value for each T50 token based on its proportion of the NAV.

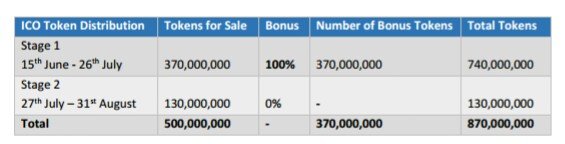

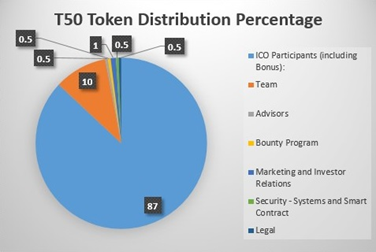

TOKEN DISTRIBUTION

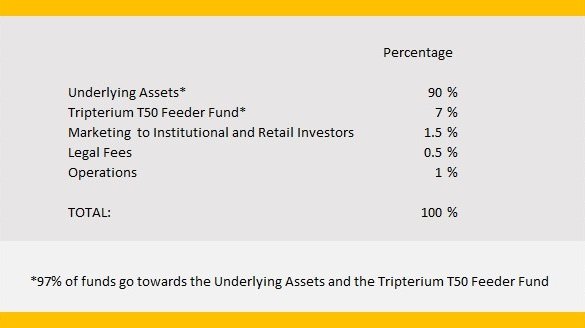

FUNDS UTILIZATION

MEET THE KNOWLEDGEABLE TEAM

ROADMAP TO SUCCESS

From development to a next generation cryptocurrency index fund.

August – December 2017

Research

Testing the proof of concept for a hybrid cryptocurrency index fund that has a venture capital feeder fund

January – February 2018

Development

The team is put together

Created the portfolio hyper-parameters and criteria for the venture capital feeder fund

February – March 2018

Smart Contracts Develope

The Tripterium smart contracts developed along with back end functions

March – June 2018

Test Systems and Smart Contracts

Testing of autonomous trading system

Testing of smart contracts and back end systems

Perform security audit and consulting with industry experts and advisors

White paper released: May 18, 2018

June – August 2018

Public Token Sale

Stage One: (100% bonus)

June 15, 2018 to July 26, 2018

Stage Two:

July 27, 2018 to August 31, 2018

After the End of the ICO

Exchange Listing and Regular Fund Operation.

Kind Regards, ensure to join this incredible project.

FOR MORE DETAILS, CLICK/FOLLOW THE LINKS BELOW:

website - https://www.tripterium.com/

whitepaper - https://s3.amazonaws.com/tripteriumt50/Tripterium+T50+White+Paper.pdf

facebook - https://www.facebook.com/tripterium/

twitter - https://twitter.com/tripterium

Author: Martilda

Profile link: https://bitcointalk.org/index.php?action=profile;u=1887582

Eth address: 0xd0D5d98857192B3931c831b7B809D47CD830da32