Neural Networks

A Dying Industry

“We’re all high-frequency traders now.” The statement made by a Credit Suisse analyst indirectly highlights the inherent issues in present day high-frequency trading (HFT).¹ High-frequency trading is a type of algorithmic trading characterized by complex computer algorithms that trade in and out of positions in fractions of seconds, leveraging arbitrage strategies in order to profit from the public markets. Commonly, traders take advantage of the penny spread between the bid-ask on equities. For the typical retail trader, this would seem redundant and the pay-off would be minuscule. For HFTs, the profit from the spread accumulates and as thousands of trades are executed, there are millions of dollars to be made.

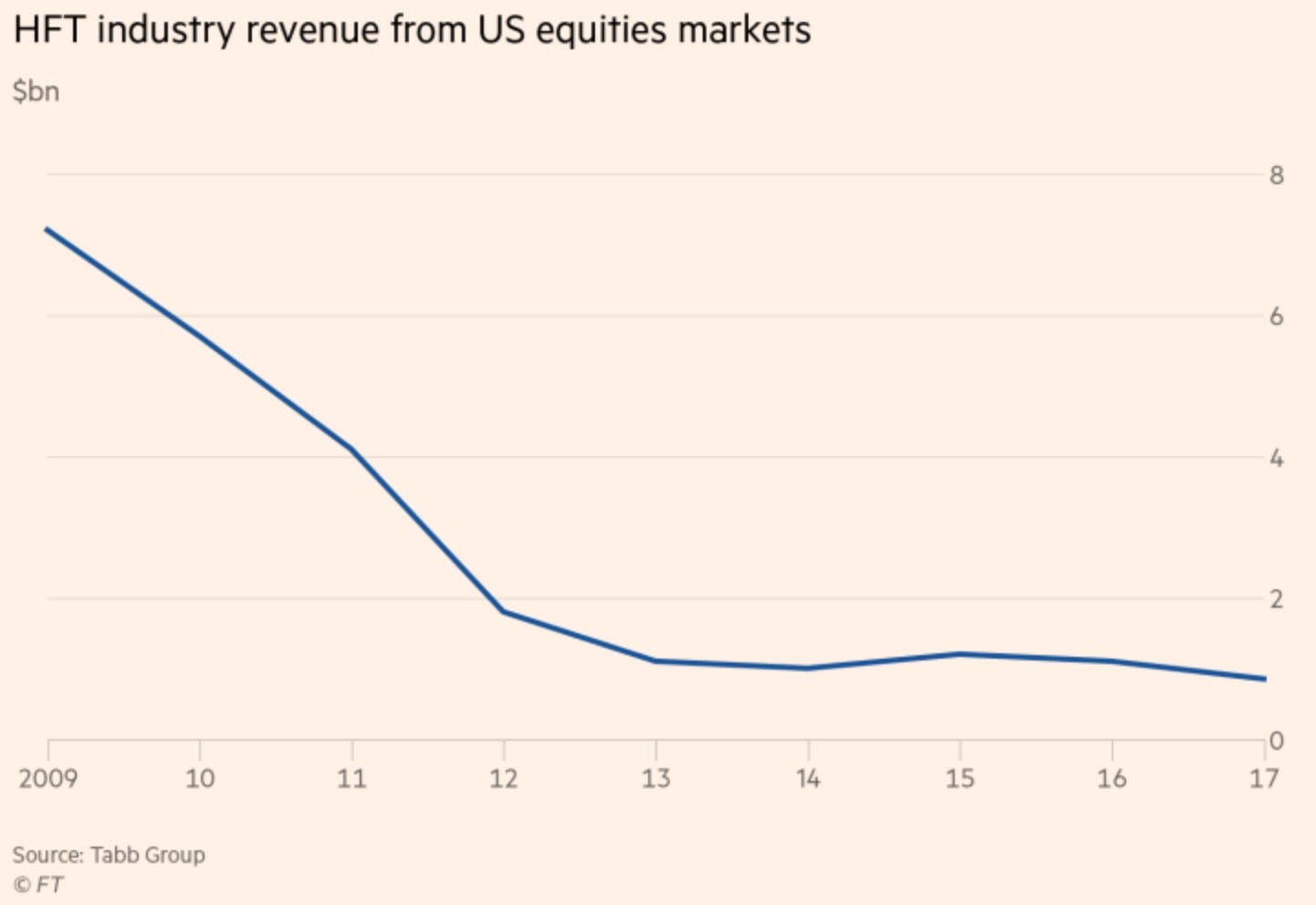

Once an incredibly profitable business, the death of HFT has been called by financiers for years. According to Tabb Group, US market makers reported $1.1 billion in revenue in 2016 compared to $7.2 billion in 2009 — a substantial and progressive decline.² When all is said and done, technology could easily be identified as the key difference between success and failure in the industry since a firm’s competitive edge is maintained by investments in superior hardware, exceptional and exclusive trading strategy design, as well as highly efficient algorithms.³

Speed continues to be paramount in successful high-frequency trading. The Go West network is a development of wireless towers and fibre optic lines that stretch from Chicago to Tokyo. Backed by firms such as Jump Trading, DRW Holdings, and IMC Financial Markets, Go West is the latest attempt to push the network speeds available to top traders closer to that of light.⁴ The primary issue facing the high-frequency trading industry has been maintaining a competitive edge. The advantages a firm possesses are somewhat limited by advancements in modern day technology, and resultantly, trading speeds will eventually be capped at the speed of light as time progresses. Trading volume has fallen, and markets are in a state of low volatility. Consequently, some firms are turning to crypto assets, such as bitcoin, to drive profits where prices once swung as much as 30% intraday.⁵ The statistical arbitrage strategies and linear regression models used may be in need of an overhaul, and it is starkly evident that the stagnant industry requires a spur of innovation.

The Need for Innovation: Deep Learning

Now what exactly is deep learning, and what are neural networks?

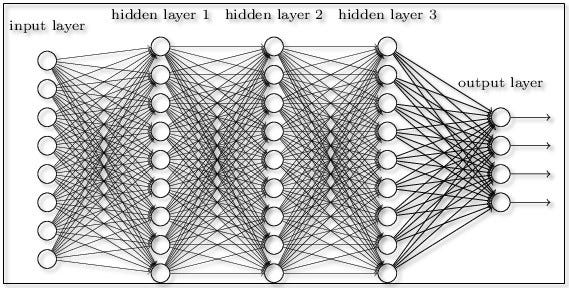

Deep learning strives for accuracy. It is a specialized form of machine learning (ML), in artificial intelligence, which exhibits self-teaching capabilities. Given raw data and a task to perform, such as classifying an object, deep learning neural networks learn how to carry out said task effectively. Improving upon regular machine learning algorithms, deep learning scales with data. Typically, the accuracy of ML algorithms plateau at some point, regardless of the amount of data the algorithm is exposed to. Conversely, deep learning algorithms take advantage of deep neural networks whose prediction, classification, or clustering accuracy continues to increase as it is exposed to more data. Neural networks are loosely modelled after the human brain’s neurons, “designed to mimic our own decision-making…solving just about any problem which requires ‘thought’”.⁶ These networks are layers of logically constructed interconnected nodes. By asking binary true or false questions, or extracting numerical values, they are able to collectively classify objects or predict outcomes through pattern recognition.⁶ Currently, an increasing number of nodes can be included in a neural network, leveraging powerful computers and algorithms, alongside mathematical formulas, to produce more accurate results.⁷

So, how does deep learning relate to high-frequency trading?

Most investors would agree that the financial markets are unpredictable. Benjamin Graham once wrote, “hindsight is forever 20/20, but foresight is legally blind. And thus, for most investors, market timing is a practical and emotional impossibility”.⁸ There are too many factors that come into play for humans to consistently predict the stock market. The possibility for someone, or something, to get close to achieving this is unfathomable. Yet, deep learning could yield a scenario where investors become extremely close to doing so. Trained by massive amounts of market data, ranging from nano-cap to large-cap stocks and local or global equities, deep learning algorithms could theoretically achieve the unthinkable. In a relatively short span of time, the precise forecasting of stock prices and market movements could be a reality. For quantitative hedge funds, investment banks, and proprietary trading firms, deep learning may be the competitive edge needed in order to revive their HFT profits. Moreover, the inclusion of real-time economic and political data could result in insights that even the most astute economists and investors could not produce, despite the complexities of the global economy.

Risks & Future Outlook

The risks attached to deep learning in finance may currently be too large for wide-spread industry adoption. Neural networks and deep learning methods are defined by their underlying algorithms, and unfortunately these algorithms are not infallible, yet. This is evident in Knight Capital’s threatened stability in 2012, where Knight netted losses of over US$440M in a matter of 45 minutes due to a rogue trading algorithm.⁹

Deep learning is often a black box — it is given an input and provides an output, with no explanation as to why it gave that output. The interpretability of most deep learning models produced by neural networks are low, and as a result not even the programmers who created the algorithms may truly understand or be able to explain how the neural network came to predict specific outcomes. This may not be a large problem when the predictions are accurate, though, reproducibility for further applications in other contexts may prove to be a challenge. However, in the odd case that a prediction is incorrect, programmers and investors alike may be unable to identify the node or piece of information that resulted in millions or billions of dollars in losses. The last time a trader decided to abuse the capabilities of advanced software, the Flash Crash of 2010 was sparked, and about one trillion dollars in value was erased from the markets.¹⁰ In this case, the margin for error would be even smaller. Although investors have often neglect to support increased regulation on the financial markets, this paradigm continues to shift after each financial crisis. While firms could obtain an immense advantage by incorporating deep learning in their HFT strategies, they may also attract an abundance of unwanted attention, much of which would likely harm the already scrutinized and under-performing industry. A single incident with deep learning in the financial markets could be the tipping point for financial regulators, resulting in fierce repercussions. Accompanying this would be the large principal investment required to research and develop these deep learning algorithms. It seems nonsensical for a firm to spend capital on systems that may not work and hold the potential to cause their bankruptcy after just a few minutes of mis-trades. Though, there is the possibility that the firms who will eventually lead these developments will be those whose balance sheet would go virtually unaffected by these losses — the renowned bulge bracket banks.

Yet, machine learning and deep learning are playing an increasingly important role in real-time trading decisions for market participants,¹¹ so perhaps implementation has already begun. Mentioned previously, traditional linear regression models are gradually becoming outdated, and the opportunity for artificial intelligence to revolutionize this industry cannot be overstated. Academic researchers have already begun assessing the potential implementation of deep learning in high-frequency trading,¹² so it is likely industry front-runners such as Citadel Securities, Two Sigma Investments, and Virtu Financial are doing the same. If a machine’s output can be effectively paired with superior investment strategy through algorithms, the impact of deep learning throughout the financial services industry beyond HFT may be unprecedented. As firms continue to seek increased profitability, deep learning will likely be their next transition, and despite the potential downside, it may just be a matter of time before deep learning algorithms and neural networks are seen on Bloomberg Terminals.

Sources:

¹ Vlastelica, Ryan. “High-Frequency Trading Has Reshaped Wall Street in Its Image.” MarketWatch, MarketWatch, 17 Mar. 2017, www.marketwatch.com/story/high-frequency-trading-has-reshaped-wall-street-in-its-image-2017-03-15?link=sfmw_fb.

² Osipovich, Alexander. “High-Frequency Traders Fall on Hard Times.” The Wall Street Journal, Dow Jones & Company, 21 Mar. 2017, www.wsj.com/articles/high-frequency-traders-fall-on-hard-times-1490092200.

³ “Is The Success Of A High-Frequency Trading Operation Driven By Math Prowess Or Tech Infrastructure?” Forbes, Forbes Magazine, 25 Apr. 2017, www.forbes.com/sites/quora/2017/04/25/is-the-success-of-a-high-frequency-trading-operation driven-by-math-prowess-or-tech-infrastructure/#38ea4b2318d7.

⁴ Bullock, Nicole. “Financial Times ICE to ‘Go West’ with Chicago-to-Tokyo Network.” Financial Times, Financial Times, 7 Sept. 2017, www.ft.com/content/412f229d-cd38-30ee-a4b5-19ef6eafadeb.

⁵ Meyer, Gregory, et al. “How High-Frequency Trading Hit a Speed Bump.” Financial Times, Financial Times, 1 Jan. 2018, www.ft.com/content/d81f96ea-d43c-11e7-a303-9060cb1e5f44.

⁶ Marr, Bernard. “What Is The Difference Between Deep Learning, Machine Learning and AI?” Forbes, Forbes Magazine, 8 Dec. 2016, www.forbes.com/sites/bernardmarr/2016/12/08/what-is-the-difference-between-deep-learning-machine-learning-and-ai/#1339c6a026cf.

⁷ Hof, Robert D. “Is Artificial Intelligence Finally Coming into Its Own?” MIT Technology Review, MIT Technology Review, 29 Mar. 2016, www.technologyreview.com/s/513696/deep-learning/.

⁸ Graham, Benjamin. The Intelligent Investor: A Book of Practical Counsel. 3rd ed., Harper & Row, 1965.

⁹ Popper, Nathaniel. “Knight Capital Says Trading Glitch Cost It $440 Million.” The New York Times, The New York Times, 2 Aug. 2012, dealbook.nytimes.com/2012/08/02/knight-capital-says-trading-mishap-cost-it-440-million/.

¹⁰ Levine, Matt. “Guy Trading at Home Caused the Flash Crash.” Bloomberg.com, Bloomberg, 21 Apr. 2015, www.bloomberg.com/view/articles/2015-04-21/guy-trading-at-home-caused-the-flash-crash.

¹¹ Faggella, Daniel. “Machine Learning in Finance — Present and Future Applications.” TechEmergence, 1 June 2018, www.techemergence.com/machine-learning-in-finance/.

¹² Arévalo, Andrés & Nino, Jaime & Hernandez, German & Sandoval, Javier. (2016). High-Frequency Trading Strategy Based on Deep Neural Networks. 9773. 424–436. 10.1007/978–3–319–42297–8_40.