LENDINGBLOCK

Thejohnmatch

Lendingblock ICO is an open trade for obtaining and loaning cryptographic forms of money and computerized resources. It enables borrowers and loan specialists to go into completely collateralised crypto versus crypto loaning assentions. Loan specialists can procure incremental premium salary on their long haul interest in advanced resources, while borrowers can utilize their computerized resources as guarantee to empower getting to help shorter term exchanging, supporting and working capital needs. Lendingblock is making a parallel money related administration for the crypto economy to securities loaning in conventional capital markets, a market that has $2trn of advantages on advance and produced $4bn of income in 2017. This white paper will be discharged and broadened incrementally ahead of time of the declaration of the token deal on 9 March, 2018.

Mission

Lendingblock ICO is a convention and stage intended to empower and support acquiring and loaning inside the crypto budgetary framework, bringing the financial advantages of loaning (expanded spending and development, interfacing capital free market activity) to the appropriated blockchain economy, yet limiting the requirement for wasteful delegates that are pointless in the cryptographic resource condition.

Lendingblock is making the market and money related foundation for securities loaning in the crypto-economy. The estimation of securities on credit in the securities loaning commercial center has come to $2trn in 20171, this makes up 12% of all stocks and bonds available for use. It is normal that the market of cryptographic forms of money and computerized resources will take after a comparable advancement in the acknowledge markets for respects to financing yet with a quicker rate of appropriation given the straightforwardness and smoothness of the market.

Lendingblock will be the primary trade for crypto resource sponsored advances that addresses the issues of institutional and individual borrowers and loan specialists in the crypto-economy.

Lendingblock is making an open trade for obtaining and loaning crypto-resources. Holders of advanced resources will have the capacity to produce steady and secure returns without giving up the advantages of possession, and borrowers who hold computerized resources will have the capacity to utilize these computerized resources as guarantee to get at advertise rates to help subsidizing, supporting or contributing strategies.

API Access for institutional traders

For institutional and professional traders, we will also make our API tools available. Our API will offer public data on loan order books, rate tables across different currencies, user account information and the ability to place lending/borrowing requests. Users will also have access to payment terminals for interest and principle repayments.

The Lender process has five stages:

1. Registration, in which prospective lenders create an account and complete identity verification.

2. Specification,inwhich the first complete profiles specifying what they are looking for, e.g. how much they wish to lend, for what duration, desired minimum interest rate, and acceptable collateral. After verifying that the principal is available to prevent spurious offers, this lending offer is then automatically matched to loan profiles that meet their requirements;

3.Initiation in which once borrowers have submitted collateral, lenders place loan principal into the Lendingblock smart contract, at which point the principal is sent to the borrower;

4. Operations,in which the lender receives scheduled interest payments from the LND smart contract;

5. Finalisation, in which the lender receives repayment of their principal, or in the case of default by the borrower receives the collateral to cover their investment.

How Lendingblock Works

Lendingblock breaks platform users down into either lender or borrower, regardless of whether users are retail or institutional in nature. Lenders using the Lendingblock platform will be able to capitalize on incremental interest income from their asset portfolio without sacrificing the benefits of long-term ownership and will be supported by full collateralization alongside smart contract-executed lending terms.

Borrowers using the Lendingblock platform will access the previously-outlined benefits of asset lending within the cryptocurrency market, but will be able to do so via a platform that offers a transparent pricing and fee structure based on market supply and demand.

Both borrowers and lenders using the Lendingblock platform will be subject to KYC and AML verification and screening in order to ensure the platform remains compliant, and will be able to complete profiles that allow them to specify the nature of the lending or borrowing arrangement they are seeking.

Lendingblock Benefits

Some of the core benefits of Lendingblock include:

Cross-Blockchain Value Transfer.

Users can collateralize assets across different blockchains and accept any digital assets on existing protocols.

Borrow And Lend Cryptocurrencies.

Lend your cryptocurrencies to receive interest on your holdings. Or, use them as collateral to secure a loan.

Track Payments And Portfolio.

Lendingblock has simple and intuitive tools to track your portfolio of loans and monitor your payments via the app, wallet integration, or API.

The entire lending process is secured by personalized smart contracts. Those smart contracts make sure the terms of your loan are fully protected.

Token Sale

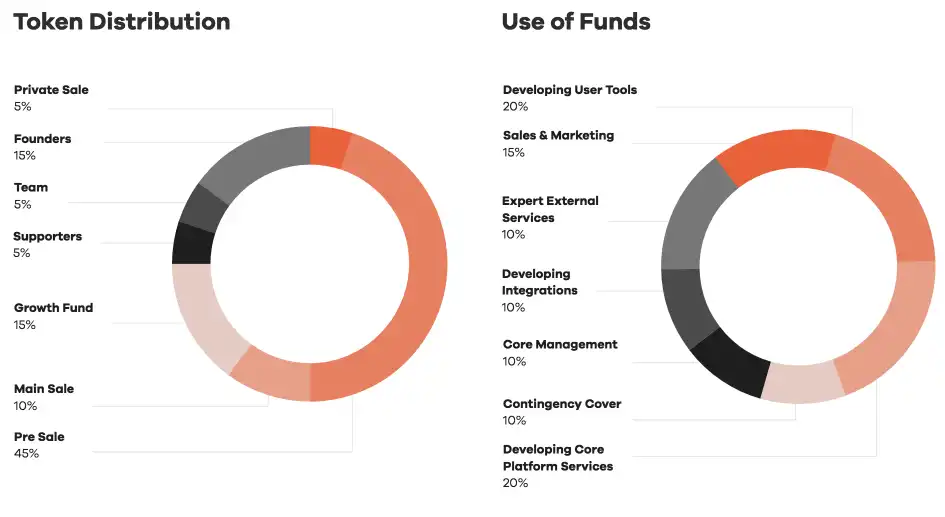

Lendingblock will be issuing 1,000,000,000 LND over the course of their token sale period, with a hard cap of $10 million USD. Each LND will carry an effective value of $0.016667 USD. In a move becoming more prevalent with high-level ICOs, Lendingblock has also set a floor of $5 million USD that, if not achieved, will result in the return of all investor capital. 60% of the total LND supply will be available for purchase during the token sale, split over a private sale, pre-sale, and public sale.

Roadmap

Team

For more information, please visit:

WEBSITE: http://lendingblock.com

WHITEPAPER: https://whitepaper.lendingblock.com/#abstract

TELEGRAM: t.me/lendingblock

TWITTER: https://twitter.com/lendingblock

FACEBOOK: https://www.facebook.com/lendingblock/

REDDIT: https://www.reddit.com/r/Lendingblock/

Author TheJohnMatch

Mybitcoinprofile:https://bitcointalk.org/index.php?action=profile;u=1673694