LEND

PhindangLEND is a blockchain-based peer-to-peer lending platform focused on transparency and security.

LEND is a new and innovative multi-chain crypto lending protocol. Users can use LEND to lend any assets supported in our market for others to borrow and earn interest, and also use the capital provided as collateral to borrow other supporting assets. LEND opens up the possibility to lend and borrow crypto assets without the need to negotiate maturity terms, interest rates, or collateral with any counterparty or counterparty.

LEND is a subsidiary of the TEN FINANCE Ecosystem. It is a decentralized lending protocol for personnel and a protocol for logging into financial services. To understand the concept of LEND is not complicated. LEND operates much like the traditional banks we all benefit from. It only requires investors to supply the assets they own and earn interest from the protocol.

How LEND works:

LEND works by creating a Loan pool from stored crypto assets. This lending pool is a collective token of all users who wish to deposit assets and is used to facilitate loan requests from other LEND users. Loan pools are derived algorithmically and have variable floating, but competitive interest rate models, based on the current supply and demand of each asset. If supply exceeds demand, it will have lower rates for both borrowers and lenders.

The $LEND token is a decentralized cryptocurrency. The $LEND token can be used to trade, lend, pay for goods and services, and much more. The $LEND platform is an easy-to-use lending platform built on the Bsc network. The $LEND platform provides a fair, fast and transparent decentralized lending process. Lenders can make money by lending their $LEND Tokens to borrowers who pay them back at interest rates.

The purpose of $LEND?

The main goal of the $LEND token is to create 'real results' by rewarding users with a real share of the revenue generated by the protocol. $LEND will also be used to incentivize the provision of assets on the LEND platform and will allow us to involve as many users as possible in the governance of the protocol. Currently $LEND has three main uses: staking, locking, and voting. All three of these will require you to provide your $LEND and get $tLEND.

LEND Benefits and Features

The power of LEND

Every investor or participant who owns Digital LEND assets can use LEND to lend any leading asset on the official LEND market to other investors who wish to borrow and then be rewarded with interest in the process. Again, LEND owners can present their LEND digital assets as collateral to borrow other assets displayed on the LEND market. With this cycle, it is safe to say that LEND opens up opportunities to lend and borrow crypto assets while completely eliminating the need to consider maturity, interest rate, or collateral requirements with fellow investors or third party personnel.

LEND Market Diversity

The LEND money Market is filled with a series of board tokens and many more tokens that promise to be added over time. The core team has also stated that they will always present the market for the most liquid assets available.

Affordable Cost

The Binance Smart Chain network, Ethereum and Ploygon Blockchains will be the main LEND Blockchains to be launched. In the near future, more exchanges will be added. The core team is also working hard to include LEND in the Aptos ecosystem and the fees for the LEND platform will be much cheaper than other decentralized Lending platforms.

LOAN application

Lend will have its own unique app available for download on Apple and Google Playstore. At LEND, you are in full control of your crypto assets. Because the core team does not hold the assets of any of the participants. This creates a sense of comfort and confidence in the hearts of investors. Unlike other companies that present a central authority which then withdraws investors' funds.

How LENDs Operate

Within the LEND ecosystem, each asset supported by the Protocol has a tToken version of that particular asset. So when an investor supplies an asset, they will receive a tokenized version of it. Using USDT as a case study, if an investor provides USDT for a Loan, he will receive $tUSDT. Investors can earn interest automatically because the tToken they own is used to create loan balances by other participants in the protocol. It is also important to note that when supplying tTokens, the base amount of tTokens supplied will increase in value over time much like a savings account. Proprietary tokens are required when dividing collateral to create loan balances.

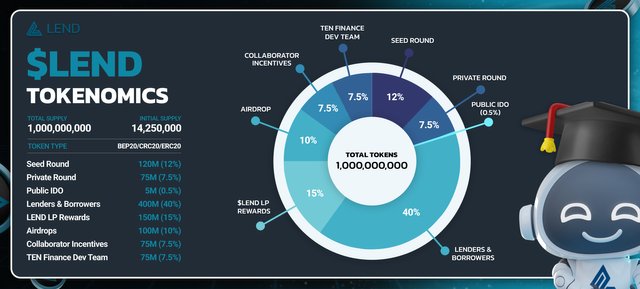

Tokenomics

- TOKEN SYMBOL: LOAN

- TOKEN TYPE: BEP20/ERC20

- TOTAL SUPPLY: 1,000,000,000

- INITIAL SUPPLY: 14,250,000

- INITIAL MARKET CAP: TBA

ROAD MAP

For More Information:

Website: https://www.lend.finance/

Whitepaper: http://lend.gitbook.io/

Telegram: http://t.me/lendfinance

Twitter: http://twitter.com /lend_finance

Github: https://github.com/tenfinance

Media: https://medium.com/lendfinance

Forum Username: Phindang

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=3357684